All Episodes

AI's Hidden Costs and Shifting Software Value Proposition

AI's true value lies in navigating complex trade-offs, not just spending big. Discover how sustainable growth and long-term plays create durable advantage beyond the hype.

View Episode Notes →

Fed's Policy Pause Masks AI-Driven Wealth Inequality Risks

The Fed's pause signals a complex economic landscape, where AI and wealth effects create unseen consequences and challenge traditional indicators for future growth and stability.

View Episode Notes →

Fed's Subtle Labor Market Signals Drive Inflation and Policy Debate

Subtle dissent reveals the Fed may be overlooking labor market weakness and AI's inflationary impact, creating a hidden risk for future policy decisions.

View Episode Notes →

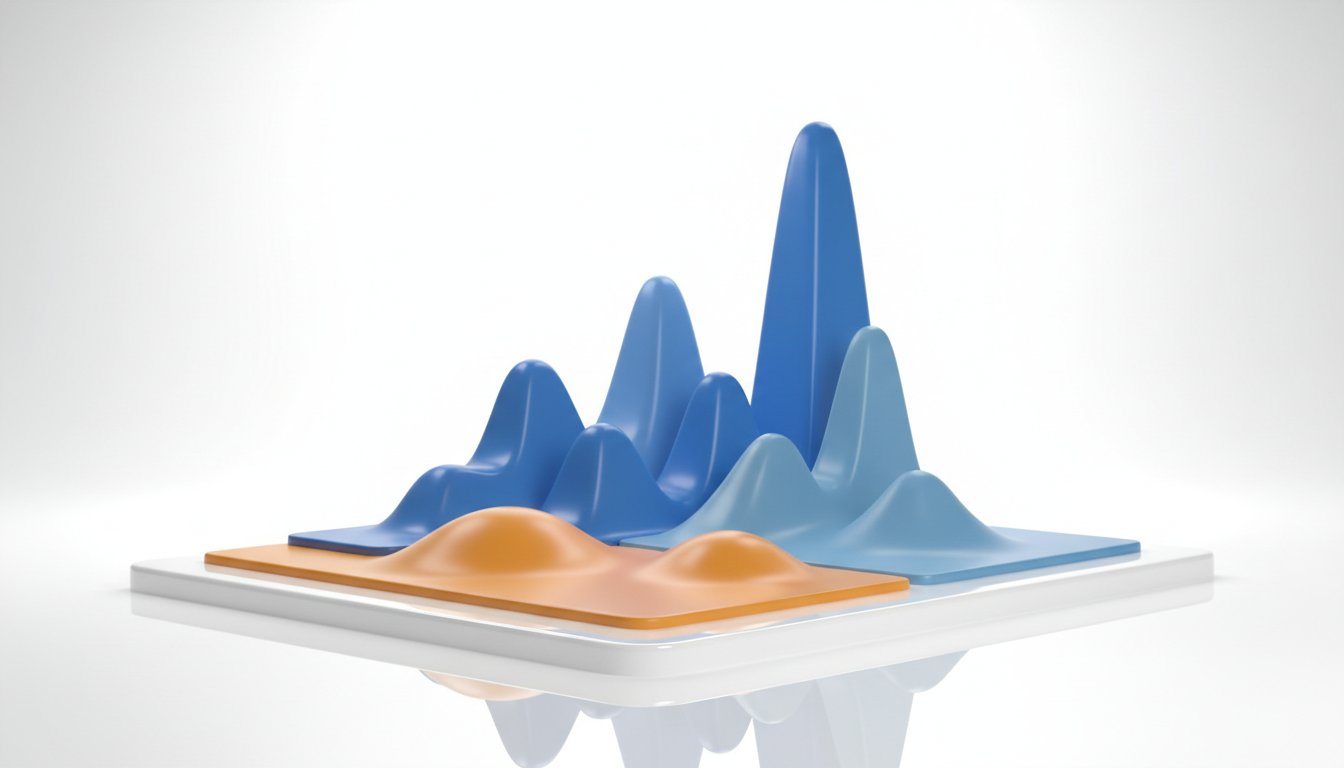

Systemic Risk: Standard Deviation, Currency Stress, and Delayed Payoffs

Understand how minor currency shifts trigger cascading consequences, revealing that conventional wisdom on inflation and market strength often fails. Gain an advantage by identifying non-obvious, compounding rewards from immediate discomfort.

View Episode Notes →

Unseen Consequences of Dollar Policy Shifts on Inflation and Alliances

Unpacking the unseen consequences of policy shifts reveals how a strong dollar policy can fuel inflation and how geopolitical restructuring creates new economic uncertainties.

View Episode Notes →

Unseen Forces Drive U.S. Market Resilience Beyond Narratives

Discover why U.S. assets defy negative headlines. Uncover the hidden interplay of politics and markets that creates surprising resilience and strategic investment opportunities.

View Episode Notes →

Earnings Growth Deceleration Signals Potential Market Bubble

Market growth is slowing, and massive earnings beats are fading, signaling a potential bubble similar to the late 1990s. Navigate this dual opportunity and risk to avoid being disadvantaged.

View Episode Notes →

Downstream Consequences of Political and Economic Decisions

Navigate complex systemic shifts by mapping downstream effects of decisions. Anticipate policy and market reactions to gain a significant advantage in an unpredictable landscape.

View Episode Notes →

Retail Exuberance Versus Institutional Caution: Market Divergence and Unseen Consequences

Retail investors are "all in" while institutions wait, signaling potential market shifts and risks for those caught in momentum trades. Understand subtle market positioning and corporate debt impacts to anticipate future moves.

View Episode Notes →

Market Transition From Momentum To Earnings Driven Growth

The market's momentum-driven rally is unsustainable, shifting focus to earnings growth. Political narratives on immigration obscure the urgent need for legislative reform.

View Episode Notes →

Fed's Internal Division and Political Pressure Undermine Economic Stability

Internal Fed dissent and political interference undermine economic stability, creating policy paralysis and market volatility. Understand this interplay to anticipate shifts and gain an advantage.

View Episode Notes →

Fed Navigates Conflicting Data Amidst Conventional Wisdom's Hidden Costs

Conflicting economic signals create a "historic" divergence, forcing the Fed into a tightrope walk where conventional wisdom may falter, impacting markets and demanding new strategic approaches.

View Episode Notes →

US Economy's Resilience and Broadening Global Investment Opportunities

US equity markets show resilience, but true value lies in broadening global investments beyond tech. Understand AI's identity needs for secure business growth.

View Episode Notes →

Geopolitical Divergence Reshapes Global Alliances and Business Strategies

Geopolitical shifts reveal leaders using events for domestic gain, while US strategy in Greenland secures Arctic resources and minerals amid China competition.

View Episode Notes →

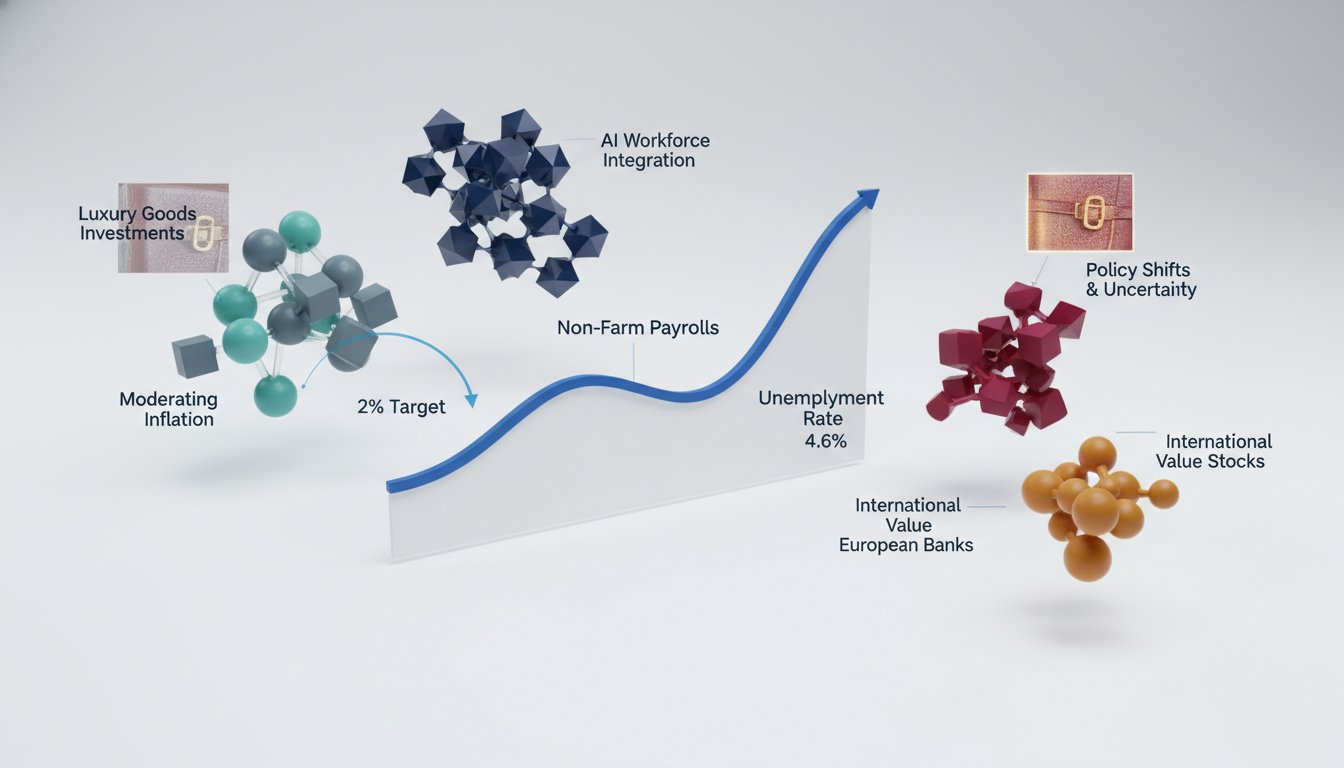

Diversified Investment Strategies for 2026 Amidst Shifting Global Dynamics

Investment shifts beyond US tech to international markets, defense, and alternatives, driven by AI, supply chain pivots, and fiscal policy.

View Episode Notes →

Intel's Strategic Foundry Expansion Fueled by Government Investment

Intel leverages U.S. government investment and AI demand to challenge TSMC, driving a strategic transformation in semiconductor manufacturing and positioning for significant future growth.

View Episode Notes →

Dollar Asset Confidence Erodes Over Years, Not Days

Dollar-based assets face a slow, years-long erosion of confidence, a fundamental shift impacting long-term economic stability and inflation perceptions beyond short-term market reactions.

View Episode Notes →

US Transactional Diplomacy Drives Global Re-industrialization and Economic Growth

US policy drives global growth by lowering energy prices and re-shoring industries, securing favorable trade deals through assertive negotiation for American benefit.

View Episode Notes →

Dollar's Eroding Confidence Drives Global Asset Diversification

US dollar confidence is slowly eroding as central banks and pension funds diversify into gold and foreign markets, signaling a long-term shift away from traditional safe havens.

View Episode Notes →

Navigating Geopolitics, AI Bull Market, and Retail Shifts

AI's secular growth potential fuels a resilient, albeit volatile, bull market, demanding patient capital deployment during anticipated pullbacks.

View Episode Notes →

Contrarian AI Investment Thesis Meets Arctic Resource Competition

Skepticism around AI debt financing presents a contrarian opportunity in technology stocks, while the Arctic Ocean emerges as a new geopolitical flashpoint for resource competition.

View Episode Notes →

Global Economic Leaders Pursue Transactional Deals Amidst Geopolitical Shifts

Global leaders forge co-investment and manufacturing deals, leveraging defense spending to attract investment and diversify trade beyond traditional partners. AI IPOs promise to reshape equity markets amid a renationalization trend.

View Episode Notes →

Netflix's Content Acquisition Strategy Sacrifices Profit for Growth

Netflix pivots to content expansion, acquiring Warner Bros. assets to dominate viewing time, despite near-term profit sacrifices.

View Episode Notes →

Europe's Cohesion Tested By Divergent Interests And Global Market Volatility

Europe's unity is tested by differing national interests and external pressures, while Japan's bond markets show extreme, potentially destabilizing volatility.

View Episode Notes →

Geopolitical Risks Drive Asset Reallocation Amidst U.S. Economic Strength

Geopolitical risks and U.S. economic strength create market volatility, prompting global capital shifts and a dual "gas and brake" business environment.

View Episode Notes →

Global Bond Volatility and Stock Picking Drive Investment Strategy

Global bond markets interconnect, with Japan's yield surges subtly reinforcing US Treasury valuations. Low stock correlations demand stock-picking, as traditional hedges are suppressed.

View Episode Notes →

Monetary Policy and Data Drive Markets; Investors Need Greater Selectivity

Monetary policy and data, not geopolitics, drive markets. Investors must become more selective due to high expectations and focus on European economic reforms.

View Episode Notes →

2026 Economic Outlook: Diversified Equities, Steady Rates, Interventionist Policy

Capture steady economic growth and accelerating earnings in 2026 with a diversified equity portfolio, as the Fed holds rates steady amid persistent inflation and broadening business investment.

View Episode Notes →

Strategic Diversification Amidst Global Fragmentation and AI Augmentation

Diversify beyond the US into gold and emerging markets as geopolitical fragmentation and AI's impact reshape global investment. Europe must close its pensions gap, while monetary policy, not politics, now drives market volatility.

View Episode Notes →

AI's Broad Labor Impact Outpaces Modest Consumer Spending Recovery

AI is displacing new hires across sectors beyond tech, while consumer spending recovery prevents recession but won't accelerate job growth. Corporate leaders will reshape employment by mid-2025.

View Episode Notes →

US Economy: Macro Strength Masks Micro Disparities and Policy Challenges

AI integration and widening income inequality are creating a disconnect between strong economic data and public perception, challenging the Federal Reserve's data-driven decision-making.

View Episode Notes →

AI-Driven Disinflation Reshapes Central Banking and Investment Strategies

AI-driven productivity promises structurally lower inflation, enabling lower interest rates and reshaping investment strategies, but also introduces complexities in fiscal policy and job automation.

View Episode Notes →

Market Trends and Geopolitical Shifts Driven by Tech Innovations

AI agent identity security transforms risk into opportunity, while personalized investment and optimized expenses reshape market dynamics.

View Episode Notes →

Proposed Credit Caps Risk Credit Availability; Delta Bets on Premium International Travel

Delta projects 20% EPS growth fueled by premium cabin demand and international expansion, navigating regulatory risks and industry shifts.

View Episode Notes →

Bank Consolidation, Credit Caps, and Europe's Geopolitical Autonomy

Bank consolidation yields efficiency and profitability, but a 10% credit card rate cap risks cutting off credit for lower-FICO customers. Europe must redefine its global role beyond US influence.

View Episode Notes →

Tariffs Drive Hawkish Fed Policy Amid Assertive Geopolitics

Tariffs will drive more inflation and a hawkish Fed than expected, while U.S. foreign policy asserts regional dominance, contradicting neo-isolationist predictions.

View Episode Notes →

Technology-Driven Growth Outpaces Inflation Amidst Fed Policy Pause

US growth could double to 4% by 2030, driven by a technology shock. Real revenue per worker is up 15%, signaling a productivity revolution already boosting corporate profits.

View Episode Notes →

US Faces Volatile Economy, Foreign Policy, and Fed Independence Challenges

Political pressure on the Fed and a disruptive foreign policy risk global trust and stability, while AI and longevity tourism signal new market frontiers.

View Episode Notes →

FHFA Housing Affordability Initiatives, Iran Unrest, and Muted Market Reactions

FHFA initiatives aim to lower mortgage rates and boost housing affordability by banning institutional home buying, prioritizing individual ownership.

View Episode Notes →

Federal Reserve Independence Crucial Amidst Political Interference and Economic Headwinds

Political interference threatens the Fed's independence, risking higher inflation and market instability. Shift investments to industrials and mid-caps as tech leadership broadens.

View Episode Notes →

Tightening Labor Market, Declining Income Share, and AI's Amplifying Impact

The labor share of income is at a post-WWII low before AI's full impact, signaling a challenging economic environment for workers.

View Episode Notes →

US Energy Policy Leverages Venezuela for Inflation Control and Economic Growth

Rebuilding Venezuela's oil infrastructure offers a significant economic opportunity for US companies and a path to lower domestic energy prices, directly combating inflation.

View Episode Notes →

Cooling US Labor Market Validates Fed Cuts, Signals Cautious Outlook

US labor demand is cooling, validating Fed rate cuts but signaling caution for immediate further easing. Persistent productivity gains are now crucial for growth to avoid inflation.

View Episode Notes →

Presidential Focus Shifts to Foreign Policy Amidst Unreliable Market Outlooks

Presidential focus shifts to foreign policy, mirroring historical territorial acquisitions, while predictable January market consensus trades often fail within weeks due to declining volatility.

View Episode Notes →

Fed Governor Proposes Dovish Policy Amidst Inflation and Investment Concerns

Measured inflation is artificially high; underlying inflation is near target, justifying accommodative policy and proactive rate cuts for future growth.

View Episode Notes →

2026 Economic Outlook: AI's Impact on Markets and Retirement Planning

AI fuels "physical AI" robotics and boosts Microsoft's underestimated cloud growth, while retirement auto-escalation and zero-waste menus offer actionable strategies for savings and sustainability.

View Episode Notes →

Immediacy of Headlines Drives Global Trade Shift Away From US

Global trade is restructuring as America withdraws, with other nations learning to trade independently, increasing overall volumes and shifting economic power.

View Episode Notes →

US Investors Face Concentration Risk Amid Global Outperformance

US investors face historic concentration risk; international markets outperformed the US last year, yet portfolios remain unexposed, creating significant downside potential.

View Episode Notes →

China's Export Dumping, Distorted Capitalism, and AI Bubble Risks

China's aggressive export strategy and distorted capitalism create global backlash and affordability crises, while AI and alcohol markets face sharp corrections.

View Episode Notes →

Venezuela's Political Illegitimacy and Infrastructure Deter Foreign Investment

Venezuela faces two futures: superficial change or dangerous fragmentation, both deterred by decades of infrastructure decay and illegitimate governance, making foreign investment unlikely.

View Episode Notes →

AI Dominance, Fiscal Stimulus, and Labor Loosening Drive 2026 Markets

AI drives mega-cap tech dominance and US growth, fueled by stimulus, while private equity offers opportunities outside stretched public valuations.

View Episode Notes →

Venezuela's Democratic Governance Essential for Oil Recovery

Venezuela's economic recovery hinges on democratic governance, not just oil fixes. Property rights and citizen empowerment are key to unlocking its vast potential.

View Episode Notes →

Venezuela's Oil Recovery Hinges on US Cooperation and Institutional Rebuilding

Venezuela's survival hinges on US cooperation due to naval control and difficult-to-extract oil reserves. Rebuilding institutions is key to reviving production and leveraging its vast, yet complex, energy assets.

View Episode Notes →

US Economy's Resilience Drives S&P 500 Growth and Sector Rebalancing

S&P 500 earnings could reach $500 per share, driving a 10,000 target by decade-end, fueled by productivity gains and a strategic sector rebalance beyond tech.

View Episode Notes →

Venezuela Oil Recovery Requires U.S. Investment and Global Strategy

Venezuela's oil sector requires $20 billion for recovery, contingent on government cooperation and energy company assurances, signaling a complex path to restoring global energy markets.

View Episode Notes →

US Direct Governance of Venezuela: Policy, Legal, and Oversight Questions

The U.S. now directly governs Venezuela, controlling its oil to fund operations and reimburse damages. This unprecedented intervention blurs lines between national security and law enforcement.

View Episode Notes →

2026 US Economic Outlook: Volatility, Recession Risk, Gold Safe Haven

2026 brings volatile US equities, a potential recession, and rising bond yields, but gold offers a safe haven as AI's impact reshapes consumer spending and employment.

View Episode Notes →

2026 Economic Outlook: AI Monetization, Consumer Spending, and Geopolitical Risks

AI's "prove it" year arrives in 2026, demanding monetization beyond big tech and a shift to broad consumer spending for economic resilience.

View Episode Notes →

2026 Equity Markets Driven by Broadening Growth and Fed Easing

Equity markets rally in 2026 on broad earnings growth and Fed rate cuts, while subdued investor sentiment acts as a surprising market buffer.

View Episode Notes →

AI Capital Expenditure Risk Threatens Market Rally, Stagflation Concerns Mount

AI capital expenditure may not yield compelling returns, posing the biggest threat to the S&P 500 by potentially causing multiple contraction in a key market segment.

View Episode Notes →

2026 US Economic Outlook: Fed Policy, Trade Risks, and Labor Market Shifts

A shift in Fed composition signals lower rates and higher inflation, but trade policy uncertainty and leveraged hedge funds pose significant risks to growth in 2026.

View Episode Notes →

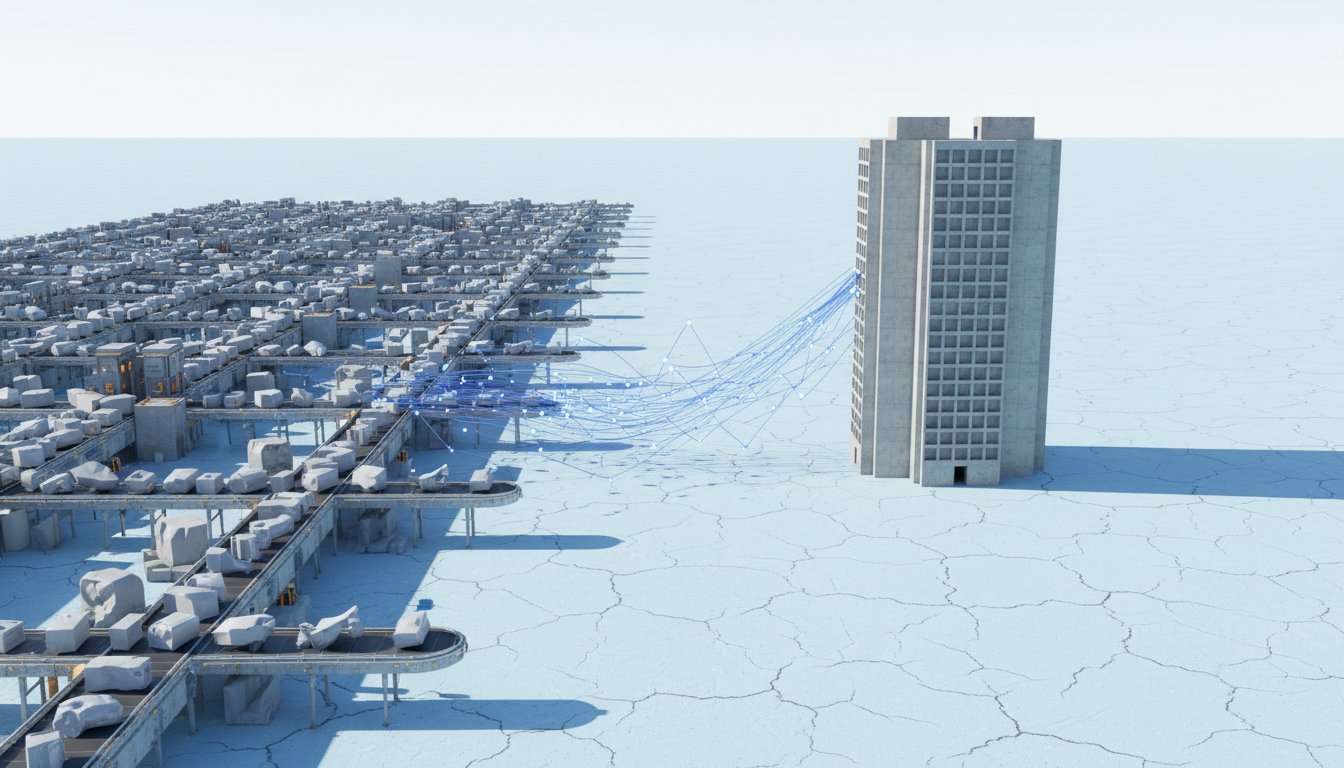

AI Revolution and Geopolitical Fragmentation Drive Market Resilience

Geopolitical shifts now price markets, increasing shipping costs 300% and driving a move from "just-in-time" to hybrid inventory for manufacturing resilience.

View Episode Notes →

2026 Market Shift: Broadening Participation, Rational AI, and Fed Policy

2026 marks a market shift beyond mega-cap tech, with equal-weight S&P 500 revenue growth accelerating to 5%. Expect a focus on profitable AI and a broadening market rally.

View Episode Notes →

Navigating AI Euphoria: Diversification Amidst Market Complacency

Sustained double-digit equity returns and low volatility may signal market complacency, suggesting a strategic shift towards international markets, value stocks, and defensive sectors like consumer staples.

View Episode Notes →

2026 Market Outlook: Moderate Returns, Increased Volatility, and Strategic Shifts

2026 brings moderate returns and increased volatility as optimism is priced in, demanding a shift from tech to healthcare and industrials amid policy and geopolitical risks.

View Episode Notes →

Navigating 2026: International Opportunities Amidst US Economic Shifts

High valuations and tight credit spreads signal market vulnerability; shift focus to international opportunities like Nordic high-yield and Japanese DIP financing for attractive risk-adjusted returns.

View Episode Notes →

Equity Bubble Risks and Rotation Strategies Amidst Economic Uncertainty

The equity market is in bubble territory with mega-cap tech trading at extreme multiples, signaling a need to rotate into undervalued blue-chip dividend stocks.

View Episode Notes →

Production for Security Thesis Drives 2026 Economic Growth and Market Shifts

AI-driven productivity allows flat headcounts and rising revenues, but consumer spending shifts to services and experiences, while housing unaffordability impacts younger generations' economic behavior.

View Episode Notes →

Five-Thirty Year Yield Curve: Key Indicator for Economic Trends and Equity Performance

The 5-30 year Treasury yield curve reveals economic trends beyond Fed policy, offering a clearer view of market sentiment and future trajectory than shorter-term measures.

View Episode Notes →

AI-Driven Demand Disconnect Complicates Federal Reserve Policy

AI and robust demand are decoupling hiring from growth, complicating Fed policy and potentially prolonging the path to 2% inflation.

View Episode Notes →

2025 US Economy Resilience Fuels Constructive 2026 Asset Outlook

Unlock 2026's market potential: a "new 60/40" needs more equity and less bonds, as sideways rates diminish traditional hedging. Private credit surges, mirroring 2019 deal flow.

View Episode Notes →

Rate Cuts Ineffective -- Structural Issues Drive Economic Challenges

Rate cuts won't fix the economy's fundamental issues, which are unrelated to interest rates. This necessitates focusing on structural problems and potentially more aggressive Fed action later.

View Episode Notes →

Governor Miran Advocates Proactive Rate Cuts Amidst Data Lags

Excessive data dependence leads to backward-looking policy, risking an economic accident. Proactive rate cuts align policy with future needs, not outdated information.

View Episode Notes →

Navigating 2026's K-Shaped Recovery: Rebalancing Amidst Labor Shortages and AI Risks

US markets face high valuations and labor shortages, necessitating portfolio rebalancing and exploration of alternative assets for growth and risk mitigation.

View Episode Notes →

US Trade Policy Shift Protects Domestic Industry Amidst Global Realignment

US trade policy shifts to protect domestic industry, prioritizing jobs over consumer prices, while AI's growth offers investment opportunities in infrastructure and data-driven companies.

View Episode Notes →

Corporate Resilience and Labor Market Cracks Shape 2026 Outlook

Corporate earnings remain resilient, but cracking labor markets and uncertain AI impact on consumer spending signal a non-linear path forward for 2026 market gains.

View Episode Notes →

Labor Market Weakness Fuels Six-Month Disinflationary Trend

A productivity boom fuels GDP growth despite a weak labor market, driving disinflation as consumers' financial strain erodes firms' pricing power for six months.

View Episode Notes →

2026 Market Broadening Amidst Inflation and AI Evolution

Persistent inflation into 2026 may require economic contraction, while markets broaden beyond narrow AI stocks as banks prioritize scale and technology in M&A.

View Episode Notes →

November CPI Weakness Masks Resilient Economy and AI Growth

November CPI data is artificially weak; expect inflation to rebound and interest rates to hold steady as the labor market strengthens.

View Episode Notes →

AI-Driven Growth Fuels Optimistic Economic Outlook Amidst Derivative Complexities

AI-driven productivity gains will fuel S&P 500 growth to 8600, while individual stock volatility rises with price, creating complex market dynamics.

View Episode Notes →

US-China Trade Equilibrium, China's Economic Shift, and Housing/Airline Industry Pressures

A stronger yuan could boost China's consumer power and global standing, but domestic economic strains and trade overcapacity challenges persist.

View Episode Notes →

AI-Driven Secular Bull Market Broadens With Rate Cuts

AI fuels a projected 3% GDP increase and an S&P target of 8600, signaling a secular bull market driven by productivity gains. Anticipate broadening market participation in 2026.

View Episode Notes →

AI's Gradual Labor Disruption and Disinflationary Economic Signals

AI's labor market impact unfolds over decades, not years, requiring careful identity security audits for AI agents and strategic analysis of disinflationary trends.

View Episode Notes →

"Muddle Through" Economy Supports Risk Assets Amid Labor Cooling

A weakening labor market supports equities into 2026, not a broad pullback. This "muddle through" economy with slow growth and sticky inflation allows Fed rate cuts, favoring risk assets.

View Episode Notes →

US Jobs Report, Inflation, AI, Tariffs, and Investment Outlook

US jobs report shows a cooling labor market and rising unemployment, potentially prompting Fed rate cuts. Core inflation nears 2%, while AI's labor impact remains decades away.

View Episode Notes →

Investor Skepticism on AI Capex Amidst Shifting Market Narratives

Investor skepticism on AI capex spending questions funding and cash flow, demanding tangible profit margins and broader economic participation for sustained growth.

View Episode Notes →

Valuations Price In Optimism, Market Breadth Needed for Returns

Valuations already price in 2026's optimism, creating a high bar for returns. A broadening market rally depends on AI optimism's unwinding and emerging markets' growth.

View Episode Notes →

AI Hype Fades, Shifting Focus to Business Value and Economic Slowdown

AI hype fades, shifting focus to tangible business value and ROI, as economic slowdown signals may prompt faster Fed rate cuts benefiting smaller companies.

View Episode Notes →

Broadening Equity Rally Fueled by Global Fundamentals and M&A

The market rally broadens beyond big tech, fueled by strong corporate earnings and M&A activity, presenting opportunities in international equities and a sustainable, moderate bull market.

View Episode Notes →

AI-Driven Small Business Growth and Labor Data Scrutiny

Emerging AI-powered businesses are driving a "great American roll-up," prioritizing productivity for scale, even as labor data requires careful economic assessment.

View Episode Notes →

Howard Marks Warns AI's Societal Impact Risks Excessive Implementation

AI's societal disruption, particularly job displacement, demands careful investment, as excessive implementation risks capital destruction and widespread purposelessness.

View Episode Notes →

AI's Early Impact, Shifting Economy, and Market Consolidation

The US economy shifts to a "Pac-Man" pattern, with AI's immediate impact focused on infrastructure, not widespread growth, while M&A drives consolidation for tech investment.

View Episode Notes →

Fed Prioritizes Productivity-Driven Growth Amidst Data Uncertainty

The Fed signals a dovish tilt, prioritizing productivity-driven growth to enable rising incomes and sustained economic expansion without proportional job creation.

View Episode Notes →

Fed Rate Cut Divides Committee, Signals Political Influence

The Fed's rate cut reveals a divided committee, hinting at political influence over monetary policy and a potential disconnect in understanding AI's economic impact.

View Episode Notes →

Federal Reserve Policy Divergence and Streaming Industry Consolidation

The Federal Reserve's interest rate cut defies 55 months of inflation, suggesting a shift in policy priorities and potential future market volatility.

View Episode Notes →

Persistent Inflationary Pressures Challenge Dovish Fed Policy Expectations

AI's demand for energy and services fuels inflation, challenging the Federal Reserve's ability to achieve price stability and potentially leading to unexpected market volatility.

View Episode Notes →

Federal Reserve Dilemma, Media Consolidation, and Muted Market Outlook

The Fed faces a dilemma navigating inflation and a tight labor market, while media consolidation proves more complex than spreadsheets suggest, impacting future market returns.

View Episode Notes →

AI Adoption Drives Market Shift Amidst Geopolitical and Energy Challenges

AI adoption drives efficiency and growth, reshaping markets by 2026, while energy demand surges and geopolitical trade dynamics shift.

View Episode Notes →

2026 Economic Outlook: Fed Dovishness, AI Growth, and Europe's Reforms

A dovish Fed shift and AI-driven growth may boost 2026 rates, while Europe's bureaucracy hinders its economy, making cautious credit risk assessment crucial for investors.

View Episode Notes →

Media Consolidation Drives Synergy Potential and Operational Efficiency

Consolidate tech stacks to unlock $2-3 billion in streaming synergies, or integrate diverse assets for even greater savings.

View Episode Notes →

AI Productivity, Fiscal Stimulus, and Market Volatility Drive 2026 Outlook

AI fuels U.S. productivity dominance, driving market performance despite expected interest rate cuts and global economic shifts.

View Episode Notes →

Credit Markets Priced for Perfection; M&A and AI Drive 2026 Outlook

AI adoption is poised to drive significant EBITDA uplift by connecting data and improving efficiencies, while strategic M&A fuels capital markets issuance through 2026.

View Episode Notes →

US Energy Dominance, AI Demand, and Market Resilience Strategies

AI's insatiable energy demand clashes with policy-driven supply hurdles, creating price disparities and shifting investment towards pro-energy states.

View Episode Notes →

Netflix Acquires Warner Bros. Discovery for Content, Franchises, and AI Defense

Netflix secures Warner Bros. Discovery's vast content library and franchises to defend against AI disruption and expand global reach, signaling a new era of media consolidation.

View Episode Notes →

Realistic Growth Expectations and Trade Policy Drive 2026 Strategy

Temper earnings growth expectations to 10-12% and await trade policy clarity before committing to supply chain shifts.

View Episode Notes →