In this conversation, Dominic Konstam of Mizuho Americas offers a nuanced perspective on the interplay of AI, fiscal policy, and inflation, challenging conventional wisdom. The hidden consequence revealed is that the very technological advancements promising productivity gains may necessitate a fundamental shift in economic policy, potentially leading to structurally lower inflation but also demanding new approaches to debt management and social welfare. This discussion is crucial for investors, policymakers, and business leaders seeking to anticipate the long-term economic landscape beyond immediate market fluctuations, providing an advantage by highlighting durable trends that others might overlook.

The Unseen Currents: How AI and Fiscal Realities Will Reshape Inflation and Our Economy

The prevailing narrative often presents technological progress, particularly in artificial intelligence, as a straightforward engine for economic growth and margin improvement. We hear that AI will boost productivity, cut costs, and ultimately lead to more robust corporate earnings. However, in a recent conversation on Bloomberg Surveillance, Dominic Konstam, Head of Macro Strategy at Mizuho Americas, introduced a counterintuitive insight: the very forces driving these productivity gains might also be paving the way for structurally lower inflation, fundamentally altering the economic landscape in ways that conventional monetary policy is ill-equipped to handle. This isn't just about predicting the next quarter's inflation rate; it's about understanding how a confluence of AI-driven disinflation and escalating fiscal demands could create a new economic paradigm, one where traditional policy tools become increasingly blunt instruments.

The immediate benefit of AI is often framed as cost reduction and efficiency gains. Companies can automate tasks, optimize processes, and derive more output from existing inputs. This appears to be a direct path to improved margins. However, Konstam’s analysis suggests a deeper, more systemic effect. He posits that the widespread adoption of AI will lead to "structurally lower inflation" beyond 2026. This isn't a temporary dip but a fundamental shift in the economy's inflationary dynamics. The obvious answer -- that AI makes things cheaper and more efficient -- is insufficient because it fails to account for the downstream consequences when this efficiency is applied across the entire economy, and when juxtaposed with the growing burden of national debt.

The core of Konstam's argument lies in understanding the interplay between technological disinflation and fiscal imperatives. While AI drives down the cost of goods and services, governments are grappling with increasing debt service costs, particularly in a geopolitical climate that demands significant spending. This creates a complex system where opposing forces are at play. The conversation reveals that the obvious solutions to economic challenges often miss the more significant, albeit delayed, consequences that emerge when these solutions interact with broader systemic pressures. This requires a shift from thinking about isolated economic events to mapping the intricate webs of cause and effect that define our modern economy.

Why the Obvious Fixes Lead to Unforeseen Complications

In the immediate aftermath of economic shocks or policy decisions, the focus naturally gravitates towards the most apparent outcomes. For instance, when discussing stimulus packages, the initial thought is about boosting consumer spending. Konstam, however, draws attention to the critical element of sequencing. He notes that stimulus intended to offset the impact of tariffs was delivered after the tariffs had already dampened consumer spending. This delayed injection of funds, while providing some recovery, did not accelerate the economy in the way it might have if timed differently. The immediate benefit of the stimulus was partially diluted by its suboptimal timing, a consequence of a lack of foresight regarding the economic flow.

This emphasis on sequencing extends to how companies are expected to leverage AI. The question arises: will companies cut costs first and then invest in AI, or invest in AI and then reap the benefits? Konstam suggests that unit labor costs were already near zero or negative in the latter half of the previous year, indicating that companies had already achieved a form of cost-cutting by not overworking their existing labor force and, in some cases, by managing incomes. This implies that the AI investment is less about further immediate cost reduction and more about maintaining margins in an environment where final consumer demand might become more challenged. The system, in this case, has already adapted to a certain level of efficiency, and AI represents the next frontier, not necessarily a radical departure from current cost structures but an evolution.

The conversation also touches upon the Federal Reserve's policy stance. While some anticipate no rate cuts in the current year, Konstam's view, shared by others at Mizuho, suggests that rate cuts are likely, even if inflation risks are present. The reasoning is that a new Fed leadership might be inclined to look past temporary inflation spikes, especially if the long-term disinflationary trend driven by AI becomes more pronounced. This highlights a critical downstream effect: if the Fed prioritizes managing debt service costs or anticipates AI-driven disinflation, its policy will be more accommodative towards risk assets, a stark contrast to a scenario where inflation is the primary concern. The immediate policy decision (or indecision) has profound implications for market valuations and investment strategies.

The AI Disinflationary Wave: A Structural Shift

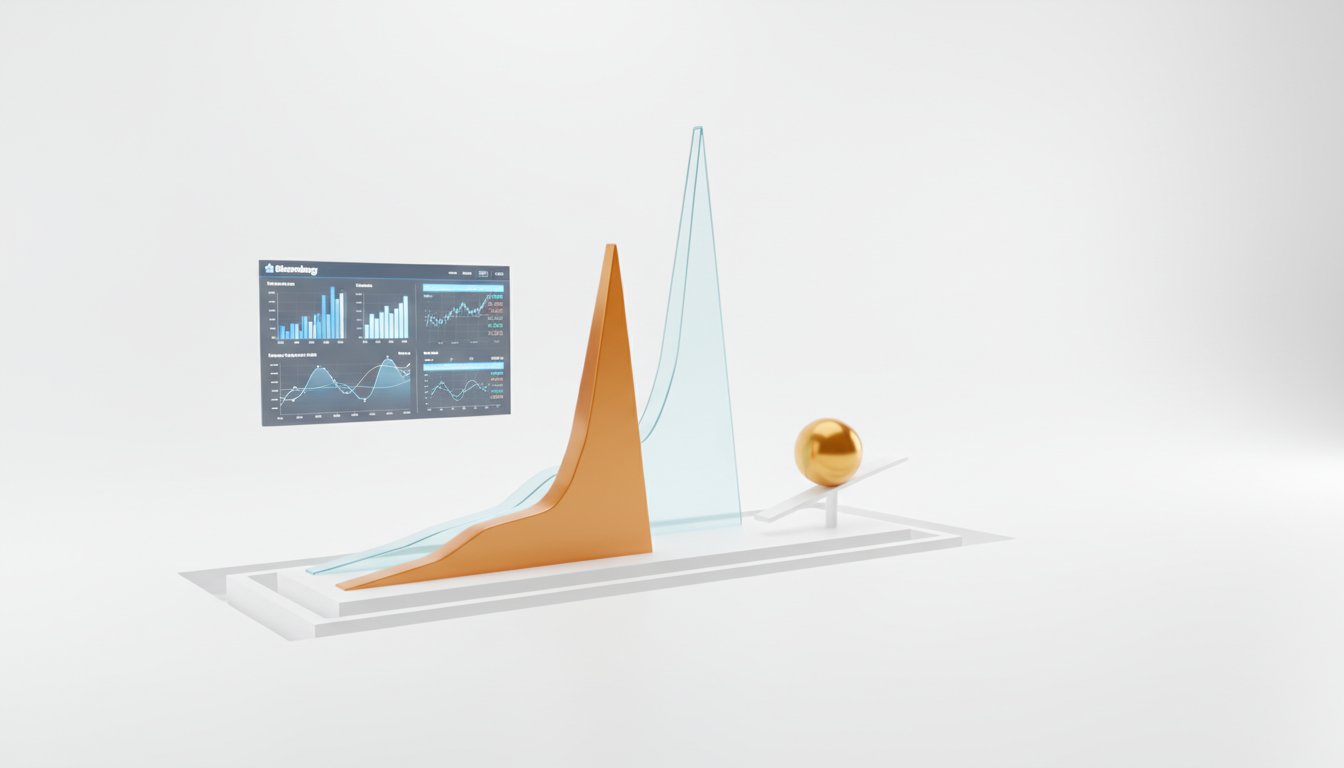

Konstam's repeated emphasis on AI as a driver of disinflation is a central thesis. He argues that AI will lead to "structurally lower inflation" in 2027. This is not merely a prediction of low inflation but an assertion that the fundamental mechanics of the economy are shifting. The lags inherent in inflation dynamics mean that past monetary growth and dollar movements are influencing current inflation. Similarly, current trends are baking in future inflation patterns. However, the AI factor introduces a significant unknown that points towards a sustained period of lower price pressures.

This perspective challenges the conventional wisdom that technological advancements invariably lead to inflationary pressures due to increased demand for new technologies or resources. Instead, Konstam suggests that AI's primary impact will be on the supply side, increasing efficiency and reducing the cost of production across a vast array of sectors. This is a powerful disinflationary force that could counteract other inflationary pressures, such as those stemming from geopolitical tensions or fiscal deficits.

The implications for corporate America listening to this are significant. While AI offers the route to maintaining margins, it also signals a potential future where pricing power is diminished due to widespread cost efficiencies. Companies that rely heavily on price increases to boost profits might find themselves constrained. The system, in this AI-driven future, may reward operational excellence and cost control more than aggressive pricing strategies. This is a delayed payoff: the investment in AI today creates a competitive advantage tomorrow, not through higher prices, but through superior efficiency that allows companies to thrive even in a low-inflation environment.

The Looming Shadow of Debt and Fiscal Policy

While AI points towards disinflation, the conversation also underscores the growing importance of fiscal policy and the escalating burden of national debt. Konstam suggests that in a "K-shaped economy" with AI driving productivity, fiscal policy will become increasingly critical for managing social welfare and addressing potential unemployment. This leads to a fascinating tension: AI pushes for lower inflation, while the need to service debt and potentially fund social safety nets might necessitate policies that could, in other contexts, be inflationary.

Konstam's discussion on central bank independence is particularly insightful. He contrasts the historical dominance of fiscal policy in Europe with the post-1970s independence of the Federal Reserve. He argues that this independence is a luxury that should not be taken for granted. The increasing debt levels, coupled with geopolitical instability, could force a re-evaluation of this independence, potentially leading to a scenario where "treasury is driving central bank monetary policy."

This is a profound consequence. If debt service becomes the dominant concern, monetary policy might be geared towards keeping interest rates low, even if it means tolerating higher inflation or accepting a less independent central bank. The idea of Modern Monetary Theory (MMT) is invoked, not necessarily as a prescribed path, but as a reflection of the potential need for more creative fiscal and monetary coordination. The system responds to pressures, and the pressure of a massive national debt in a complex geopolitical world may force policy adaptations that were previously considered unthinkable.

The "creative" solutions discussed are not about simply handing out money but about targeted redistribution, potentially through basic income, especially if AI leads to significant job displacement. This is where the immediate discomfort of acknowledging these long-term fiscal challenges creates a lasting advantage. Those who prepare for a world where fiscal policy plays a more direct and coordinated role with monetary policy will be better positioned than those who cling to outdated models.

Navigating the Yield Curve in a Shifting Landscape

For bond investors, the prospect of a significantly steeper yield curve in real terms presents both challenges and opportunities. Konstam anticipates "super low" real yields at the front end and higher real yields at the long end. This suggests a strategy of "playing the curve," extending duration to capture higher yields. Markets like the US and UK are mentioned as offering relatively higher yields compared to other regions.

However, this isn't an environment for outright yield hunting in the traditional sense. The real opportunity lies in understanding the curve's shape and the forces driving it. The interaction between accommodative monetary policy (aimed at managing debt and supporting growth) and potential inflationary pressures (from fiscal spending or other factors) will shape this curve. Investors who can anticipate these dynamics and position accordingly will benefit.

The conversation also touches upon the challenges in Europe, where fiscal issues in countries like France and Italy, coupled with political uncertainty, make opportunities in fixed income riskier. While the ECB has stabilized rates, the potential for a slightly more hawkish tone later in the year or early 2027 due to fiscal spending filtering through the economy adds another layer of complexity. This underscores the importance of a global perspective, recognizing that different regions face unique combinations of inflationary, fiscal, and political pressures.

The Yen's Precarious Position: Carry Trade and Intervention

The discussion on the Japanese yen highlights another critical system dynamic: the carry trade and the potential for its unwinding. With the yen trading at an 18-month low against the dollar, the focus shifts to potential interventions by the Ministry of Finance and the Bank of Japan.

Konstam notes that the yen has moved away from fundamentals, a common trigger for intervention. The risk is not just a gradual depreciation but sharp, sudden movements associated with carry trade unwinds. These unwinds can create significant market volatility. The upcoming election in Japan adds another layer of complexity, as political considerations might influence the timing and nature of any intervention.

The implication here is that while the yen's weakness might seem like a simple forex trend, it's deeply intertwined with global capital flows and central bank policies. The system's response to an excessively weak yen--intervention--can have ripple effects across global markets, particularly for those heavily involved in the carry trade. This is a situation where immediate discomfort (a weakening yen) could lead to delayed action (intervention) that attempts to stabilize the system.

Disrupting Russia's Shadow Fleet: A New Sanctions Enforcement

Heidi Crebo-Rediker, Senior Fellow for Geoeconomics at the Council on Foreign Relations, brings a critical perspective on the evolving nature of sanctions. She highlights a significant shift from merely sanctioning Russian oil tankers to actively disrupting them. This move from passive enforcement to active disruption is a crucial development.

The "shadow fleet" of tankers, often operating with opaque ownership and insurance, has been a way for Russia to circumvent sanctions. However, the US, followed by potential action from the UK and Baltic states, is now targeting these vessels. This maritime pressure is not just about commodity prices; it's about constraining Russia's ability to fund its war effort. Ukraine's direct kinetic pressure on Russia's Black Sea shadow fleet, through drone strikes, further amplifies this disruption.

The downstream effect of this coordinated pressure is a tightening of Russia's logistical and financial arteries. While the immediate impact on global oil prices may not be significant due to other market dynamics, the long-term consequence is a reduction in Russia's capacity to sustain its military operations. This is a prime example of how sustained, albeit initially uncomfortable, pressure can create a lasting strategic advantage by degrading an adversary's capabilities. The system--in this case, Russia's war machine--is being systematically choked off.

Weight-Loss Drugs and Airlines: An Unforeseen Efficiency Gain

In a seemingly unrelated segment, Lisa Mateo brings attention to the unexpected impact of weight-loss drugs on airline fuel efficiency. Analysts at Jeffries estimate that airlines could save up to $580 million in fuel costs annually as passengers become lighter due to the increased use of GLP-1 agonists.

This is a perfect illustration of how a societal trend, driven by health and wellness, can have significant, unforeseen economic consequences. The immediate problem airlines face is fuel cost. Their traditional solutions involve making planes lighter through material science or reducing amenities. The unexpected solution, however, comes from a change in passenger physiology.

The hidden consequence here is that a medical breakthrough can translate into substantial operational savings. This is a positive second-order effect, where a societal benefit leads to a tangible economic advantage for an industry. It highlights how interconnected systems can be, and how innovations in one area can create surprising efficiencies in another, often without direct intent.

Key Action Items

- Embrace AI for Long-Term Disinflationary Strategy: Companies should view AI not just as a cost-cutting tool but as a fundamental driver of long-term disinflation. This requires a strategic shift towards operational excellence and efficiency as primary competitive advantages, rather than relying on pricing power. This pays off in 12-18 months.

- Develop Fiscal Resilience and Scenario Planning: Policymakers and businesses must move beyond traditional economic models and actively plan for scenarios where fiscal policy plays a more dominant role, driven by debt service and social welfare needs. This includes exploring creative solutions for income support and debt management. Requires ongoing strategic review, with implications realized over years.

- Position for a Steeper Real Yield Curve: Bond investors should anticipate a steeper yield curve in real terms, focusing on opportunities at the longer end of the curve. Understand that monetary policy may be influenced by fiscal needs, leading to sustained low short-term real rates. This pays off in 6-12 months.

- Monitor Geopolitical Disruptions to Supply Chains: Be aware that active disruption of sanctioned entities, such as Russia's shadow fleet, can create localized supply chain pressures, even if broad commodity prices remain stable. This requires agile sourcing and risk management. Immediate action to assess supply chain vulnerabilities.

- Invest in Durable, Efficiency-Driven Business Models: In an era of potential structural disinflation, businesses that can demonstrate superior efficiency and operational resilience will outperform. Focus investment on technologies and processes that enhance productivity and reduce unit costs sustainably. This creates lasting advantage over 18-36 months.

- Prepare for Evolving Central Bank Mandates: Recognize that central bank independence may be challenged by fiscal imperatives. Be ready for monetary policy that balances inflation concerns with debt management and economic stability, potentially leading to more coordinated fiscal-monetary approaches. Requires long-term strategic foresight.

- Explore Diversification Beyond Tech Giants: For investors looking at themes like AI, consider broadening exposure beyond major tech companies to include infrastructure and related real assets that support the AI ecosystem. This pays off in 12-24 months.