Systemic Risk: Standard Deviation, Currency Stress, and Delayed Payoffs

The current global economic landscape is characterized by a precarious balance, where seemingly minor shifts in currency dynamics can trigger cascading, often underestimated, consequences. This conversation reveals that conventional wisdom about currency strength and inflation often fails when examined through the lens of long-term systemic effects. By understanding concepts like standard deviation in market movements and the subtle interplay between goods prices, productivity, and global supply chains, investors and policymakers can gain a significant advantage. Those who can identify and act upon these non-obvious implications, particularly where immediate discomfort leads to delayed, compounding rewards, will be best positioned to navigate future volatility.

The Stress Test: When Standard Deviation Becomes the Norm

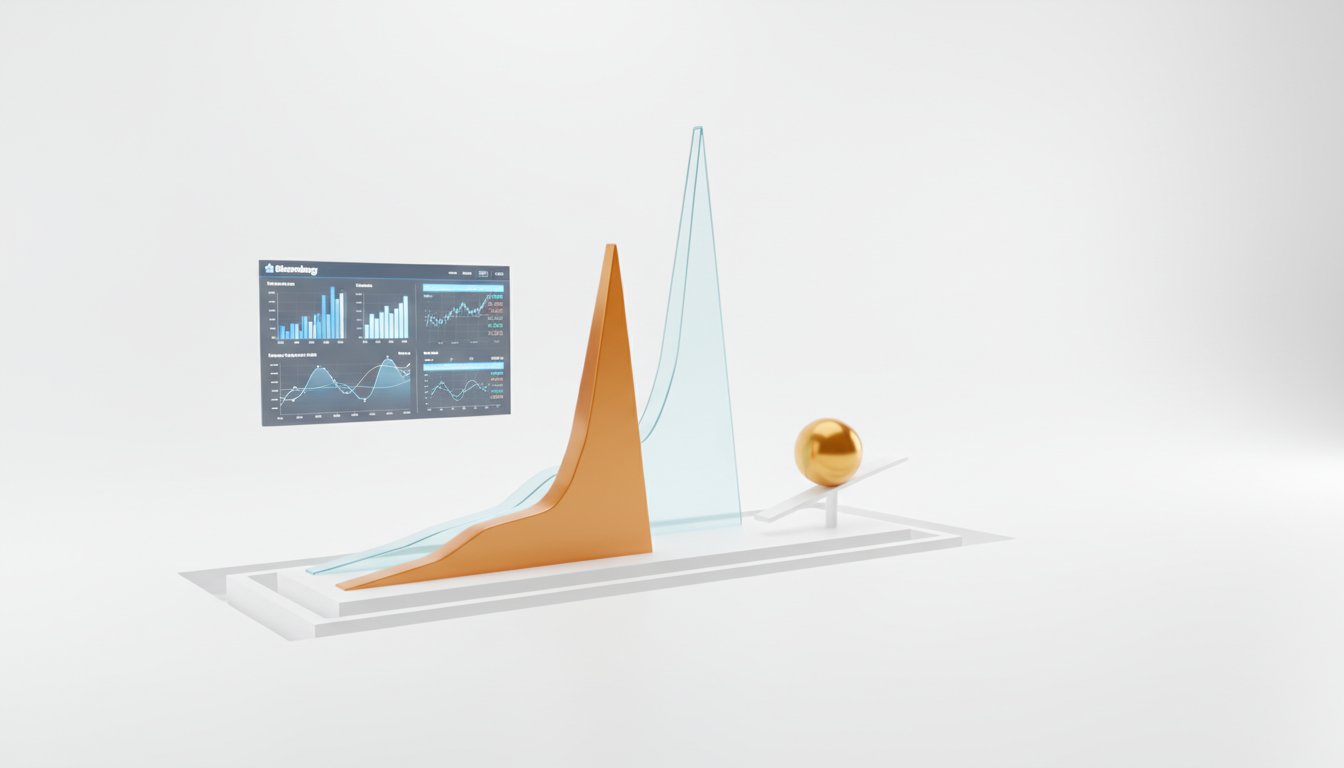

The conversation opens with a focus on market volatility, framed through the lens of standard deviation. Tom Keene, drawing on his deep understanding of market mechanics, highlights that while one or two standard deviations in asset prices might be expected, reaching three standard deviations signals genuine stress. This isn't just about numbers; it's about recognizing when market movements are deviating significantly from historical norms, indicating potential systemic strain. The example of gold, currently sitting at two standard deviations above its 20-year average, serves as a tangible illustration. The implication is that current market conditions are far from stable, and the potential for further, more extreme movements is elevated. This perspective immediately challenges the comfort of "business as usual" and forces a consideration of what happens when these deviations persist or worsen.

"And three standard deviations is a general statement, indicates stress."

-- Tom Keene

This concept of stress is amplified when discussing dollar dynamics and capital flow risk. Win Thin, an expert with a background influenced by Nobel laureate Robert Mundell, points out the delicate balance the US is currently experiencing: a weaker dollar without immediate negative spillover effects. However, he cautions that this is a temporary "sweet spot." History shows that these currency shifts can become disorderly, and once the "genie is out of the bottle," it's incredibly difficult to control. The analysis of dollar-yen movements further illustrates this. While the yen has strengthened against the dollar, Keene's quick assessment suggests that the market is not yet at a point of "real strong yen stress." This implies that the current moves, while significant, might be precursors to larger, more disruptive capital flows. The danger lies in the assumption that current stability will continue, a classic failure of conventional wisdom that ignores the compounding effects of sustained currency shifts.

The Shifting Sands of Inflation: Goods vs. Services and the China Effect

Constant Hunter introduces a critical distinction in the inflation narrative: the divergence between goods and services prices. For a long time, goods prices were either stable or declining, largely due to increased productivity and, crucially, China's role in exporting disinflation through its massive supply chains. The implication of tariffs and other disruptions is that this deflationary force has diminished. What was once a consistent downward pressure on inflation has been removed, contributing to the current elevated goods prices.

This separation is not merely an academic point; it has profound systemic consequences. It means that the inflation dynamics of the past are no longer a reliable predictor of the future. The removal of China's disinflationary export power creates a vacuum that can lead to sustained price pressures, especially when combined with other inflationary forces. Hunter's observation highlights a fundamental shift in the global economic system. The ease with which goods were produced and exported at low cost is changing, and the system is now recalibrating. This recalibration, as seen with gold and currency stress, is unlikely to be smooth.

"So something that was not contributing to higher inflation was actually contributing to lower inflation has gone away."

-- Constant Hunter

The analysis here emphasizes how seemingly isolated events--like trade policy changes or shifts in productivity--can have far-reaching and interconnected effects. The removal of a deflationary input (cheap Chinese goods) doesn't just mean prices go up a little; it fundamentally alters the inflation equation, potentially requiring a complete rethinking of monetary policy and investment strategies. This is where understanding the system's response becomes paramount. The system, no longer benefiting from that external disinflationary force, will find new equilibrium points, likely involving higher price levels than previously anticipated.

The Delayed Payoff of Understanding Systemic Risk

The core insight emerging from this conversation is the immense value of understanding systemic dynamics and anticipating downstream effects, particularly those with delayed payoffs. The current market environment, characterized by currency volatility and shifting inflation drivers, is a prime example of where short-term thinking leads to disaster.

Keene’s analysis of gold and dollar-yen movements, and Thin’s caution about disorderly capital flows, point to risks that are not immediately apparent but will compound over time. Similarly, Hunter’s explanation of the changing inflation landscape underscores how removing a long-standing deflationary mechanism can create sustained upward pressure.

The "single best idea" isn't just about learning a tool like the Bloomberg Terminal; it's about developing the discipline to look beyond immediate price action and understand the underlying systemic forces. This requires patience and a willingness to confront uncomfortable truths--that current solutions might be creating future problems, or that the most beneficial strategies involve actions that don't yield immediate results.

The competitive advantage, therefore, lies not in reacting faster to market noise, but in understanding the deeper currents. It's about recognizing that the stress indicated by three standard deviations, or the potential for disorderly capital flows, or the fundamental shift in inflation drivers, are not just news headlines, but signals of a system under pressure. Those who can map these consequences, even when the payoff is months or years away, are the ones who will build true resilience and generate lasting returns. The conventional wisdom, which often prioritizes immediate gains and visible progress, fails precisely because it ignores the compounding nature of systemic effects.

- Embrace Standard Deviation as a Stress Indicator: Actively monitor market movements beyond one or two standard deviations. Recognize that sustained deviations signal systemic stress, not just temporary fluctuations.

- Anticipate Disorderly Capital Flows: Understand that current currency "sweet spots" are temporary. Prepare for potential instability as capital seeks new equilibria, especially when the dollar weakens significantly.

- Re-evaluate Inflation Drivers: Acknowledge that the deflationary impact of global supply chains is diminishing. Factor in the potential for sustained price increases, particularly in goods.

- Invest in Long-Term Understanding: Prioritize learning tools and frameworks (like those on the Bloomberg Terminal) that enable deeper analysis of systemic dynamics, not just surface-level data.

- Develop Patience for Delayed Payoffs: Recognize that true competitive advantage often comes from actions taken now that yield significant benefits over longer time horizons (12-18 months or more), even if they require immediate discomfort or lack visible progress.

- Connect Macro Trends to Micro Decisions: Understand how global shifts (e.g., trade policy, currency dynamics) directly impact the operational and strategic decisions of businesses and investors.

- Challenge Conventional Wisdom on Currency Strength: Be wary of assuming a weak dollar is always beneficial without considering the potential for disorderly capital flows and broader market instability.