FHFA Housing Affordability Initiatives, Iran Unrest, and Muted Market Reactions

TL;DR

- The Federal Housing Finance Agency's (FHFA) $200 billion mortgage bond buyback is a significant intervention aimed at lowering mortgage rates and increasing housing affordability, potentially impacting market dynamics.

- A proposed ban on institutional single-family home buying by the FHFA aims to prioritize individual ownership and increase housing supply, despite potential Wall Street opposition.

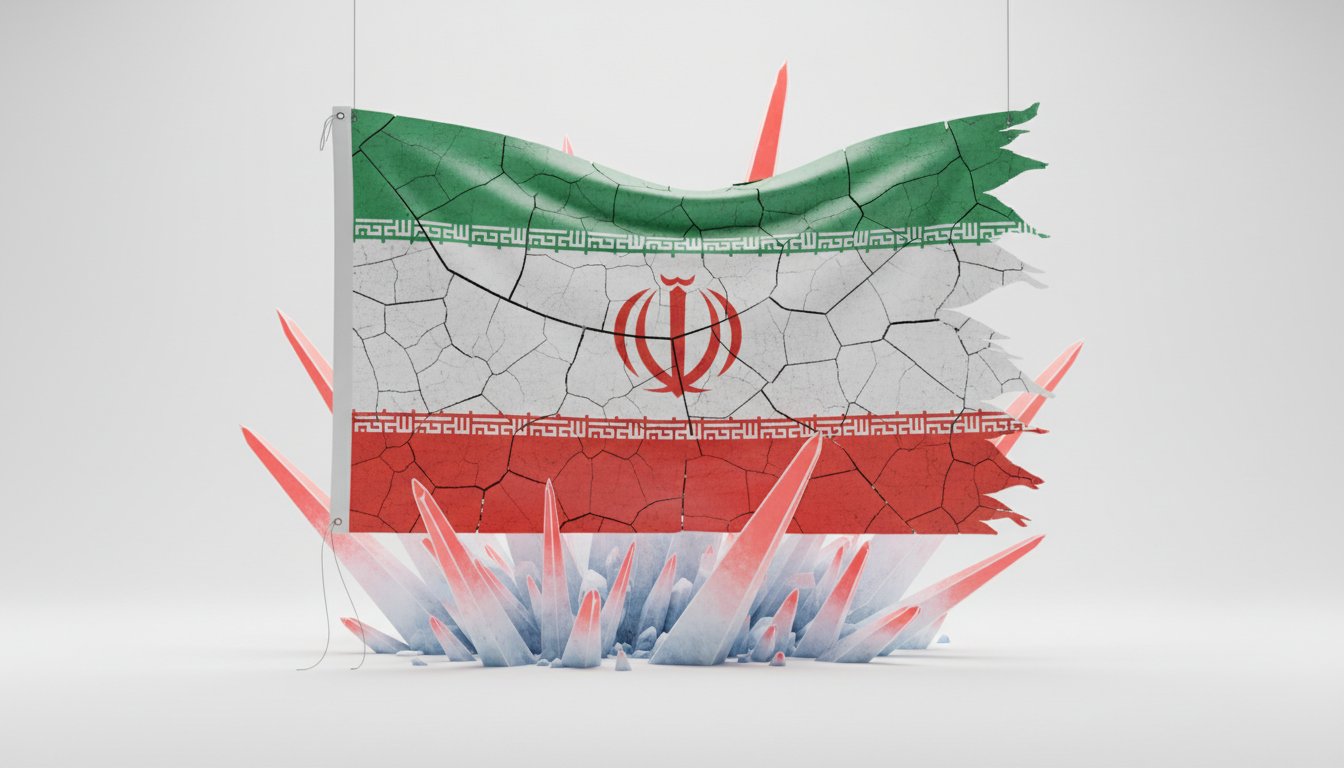

- Unprecedented nationwide protests in Iran, characterized by scale, intensity, and calls for regime change, indicate a deep societal dissatisfaction and a government struggling to deliver economic relief.

- The Iranian currency's dramatic collapse, from 29,500 to 1.42 million rials per dollar since the nuclear deal, highlights systemic economic failure and fuels ongoing unrest.

- US military action against Iran is considered highly probable, driven by escalating rhetoric and diplomatic outreach, with the US possessing vast capabilities to deliver a punishing blow.

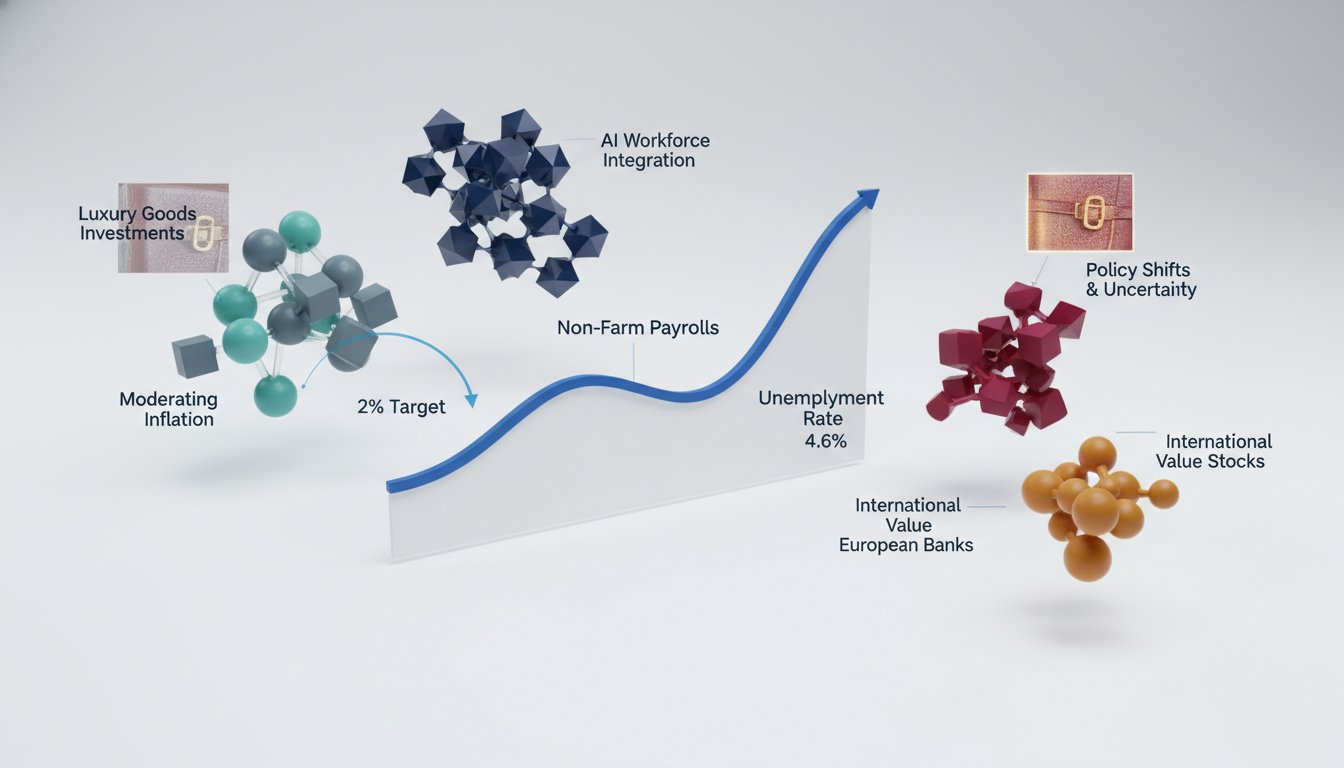

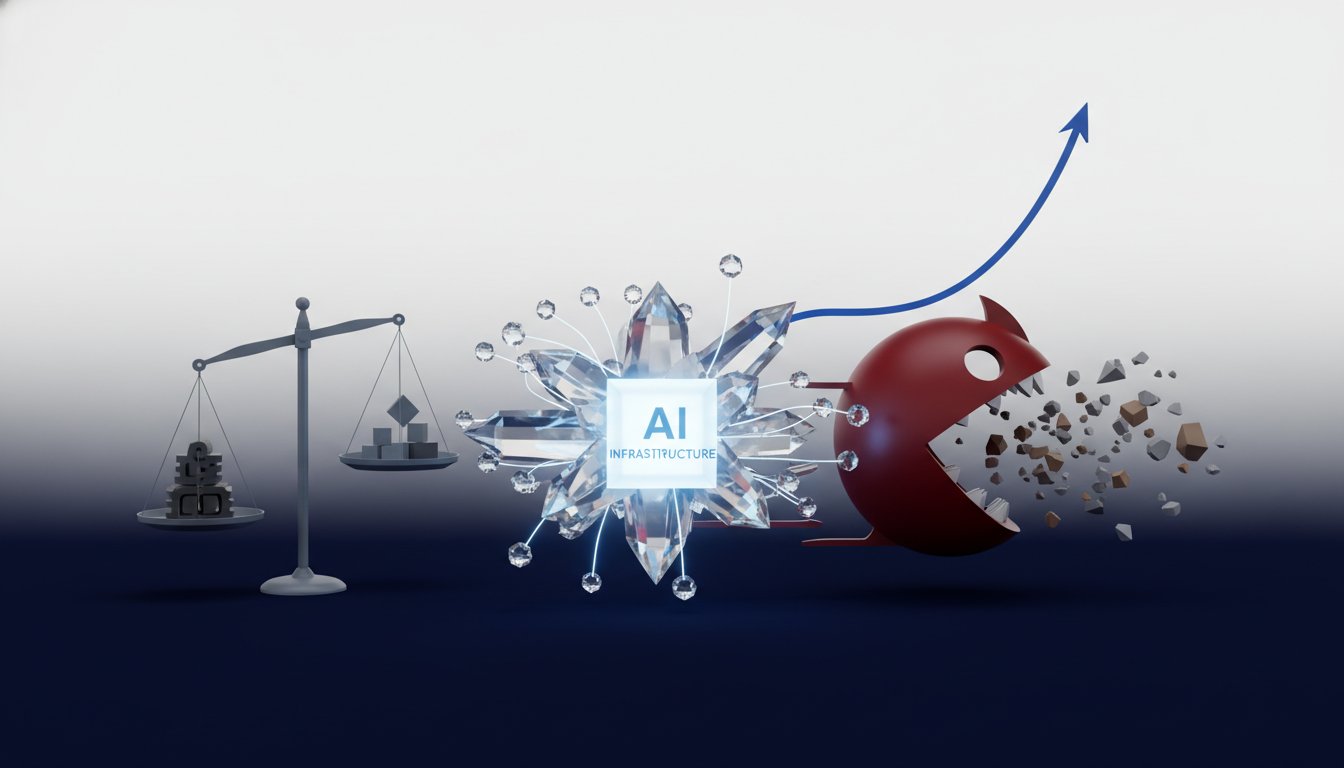

- Muted market reactions to geopolitical events suggest investors are prioritizing incoming economic data, with AI and higher US yields continuing to attract foreign investment despite global uncertainty.

- The US economy exhibits a "K-shaped" recovery, with strong performance in AI-driven sectors and among high-end consumers contrasting with struggles for others, influenced by significant immigration shifts.

Deep Dive

The Federal Housing Finance Agency (FHFA) Director, Bill Pulte, is driving initiatives aimed at reducing mortgage rates and increasing housing affordability, including a proposed ban on institutional investors purchasing single-family homes. This policy, supported by President Trump, aims to prioritize individuals over corporations in home ownership, with the FHFA actively purchasing mortgage-backed securities to lower rates. Pulte asserts that institutional buying exacerbates housing shortages and inflates prices, a view he believes is grounded in economic reality despite criticism from some market analysts.

The FHFA's actions, such as the $200 billion mortgage bond buyback, are intended to directly impact mortgage rates, with an initial observed 25 basis point decrease. Pulte emphasizes that these measures are part of a broader strategy to reverse what he characterizes as the negative housing affordability impacts of the Biden administration. He also highlights the transformation of Fannie and Freddie under President Trump, moving them from remote work environments to active operations and significantly increasing their perceived valuation, while remaining prepared for potential public offerings.

The situation in Iran represents an unprecedented scale and intensity of nationwide protests, driven by deep dissatisfaction with the government's inability to deliver economic relief amidst currency collapse and failed policies, rather than specific economic complaints. This has resulted in significant loss of life among both protesters and security forces, alongside thousands of arrests, all occurring within a compressed timeframe. Despite government efforts to contain unrest through promises of reform and coercive measures, the protests persist, fueled by a broken government prioritizing military spending and its nuclear program over the needs of its population.

President Trump's comments regarding potential military action against Iran, coupled with diplomatic outreach and increased social media rhetoric, suggest a high likelihood of targeted strikes. This approach, characterized by a pattern of public pronouncements followed by decisive action, is aimed at responding to violence against peaceful protesters. While detailed plans for military strikes are not disclosed, the US possesses vast military capabilities to deliver significant punitive blows to relevant Iranian units and personnel. The potential succession of leadership in Iran, should the current regime be imperiled, is uncertain, but likely to emerge from within the existing Revolutionary Guard network, potentially leading to a governing body willing to engage with the West.

The muted market reaction to recent events indicates that investors are primarily focused on incoming economic data rather than political actions. Despite geopolitical tensions, foreign investors continue to favor U.S. assets due to the AI boom and higher yields offered by U.S. debt compared to other global markets. This sustained appetite for U.S. assets, reflected in a strong dollar, suggests underlying economic confidence, though a significant dollar depreciation would signal a reversal. The "one big beautiful bill," AI and data center investments, and energy booms are significant tailwinds supporting U.S. GDP growth, projected to remain robust.

Gold's record highs are attributed to central banks shifting away from dollars due to sanctions, coupled with strong retail demand in China and persistent U.S. inflation above the Federal Reserve's 2% target. Despite high GDP growth projections of 4-5%, consumer sentiment remains subdued, reflecting a "K-shaped" economic outlook where high-end consumers and AI-focused sectors thrive, while others struggle. This divergence is exacerbated by significant declines in net immigration, which has altered the equilibrium for job growth. While equity markets remain optimistic due to strong corporate earnings, bond and credit investors are more attuned to risks, though their reactions have also been notably subdued. The administration's focus on affordability, particularly in housing, suggests an acknowledgment of consumer sentiment that does not align with aggregate economic indicators.

Action Items

- Audit institutional home buying: Analyze impact on housing supply and affordability across 5 key regions.

- Track currency devaluation: Monitor Iranian Rial against USD for 3-month period to assess economic stability.

- Measure GDP growth drivers: Quantify contribution of AI data centers and energy boom to US GDP over 2 quarters.

- Analyze consumer sentiment drivers: Correlate high-end consumer spending with AI sector growth across 3 income brackets.

- Evaluate Fed policy impact: Assess correlation between Fed rate changes and yield curve steepness for foreign investors.

Key Quotes

"My main focus, John, has been on reducing mortgage rates to the extent that we can do it and increasing housing affordability. President Trump announced a huge thing last week when he decided that he was going to ban institutions from buying homes. Basically, the concept is that people should be living in homes, not corporations. We have a supply problem in this country, and obviously, we're working on the demand side of things because in some cases, affordability has gotten so tough that people don't even want to buy a home because of what Joe Biden did. And so we're reversing that. That's what we're focused on."

Federal Housing Finance Agency Director Bill Pulte states his primary objective is to lower mortgage rates and improve housing affordability. Pulte explains the rationale behind banning institutional home buying, emphasizing the principle that homes should be for people, not corporations, and that this action addresses a supply problem exacerbated by current affordability issues.

"I would say this, that the president is laser-focused on housing affordability and reversing what has happened these last four years. You look at the average mortgage payment under Joe Biden, it's skyrocketed compared to what it was under President Trump's first term. We are focused on bringing down not only the mortgage rates but also the day-to-day cost and upkeep of homes, which has to do with, you know, whether it be your ongoing expenses, mortgage insurance, etc. There are so many pieces to the cost puzzle that at the FHFA, us Federal Housing, we are working to reduce the cost burden that Americans have."

Director Pulte asserts that President Trump is intensely focused on housing affordability and rectifying the situation from the previous four years. Pulte highlights that the average mortgage payment has significantly increased under the current administration and details the FHFA's efforts to reduce various costs associated with homeownership, beyond just mortgage rates.

"Well, it just makes economic sense. You talk about supply. I mean, you kind of gave me a narrative there, but if you look at the economic supply of things, the fact is you have big corporations buying, using long-term paper, using their balance sheets to scoop up homes in a supply shortage, as we call it. And they're in some cases buying these homes for 20, 30, 40% less than Americans are doing it. President Trump was elected with a very, very popular mandate. Sometimes people don't remember because it was a year ago, but it was a landslide victory, and he was given a mandate to reverse these last four years of crazy inflation that happened under Joe Biden. And so I think it's very appropriate that we're doing everything that we can to reduce housing costs, and we're going to keep doing it, whether it's the institutional ban on buying, looking at all of the things that go into a home and owning a home."

Director Pulte defends the economic rationale behind banning institutional home buying, arguing that large corporations leverage financial resources to acquire homes during a shortage, often at lower prices than individuals. Pulte connects this policy to President Trump's mandate to combat inflation and reduce housing costs.

"The current nationwide protests in Iran continue to have reached a scale and intensity that is unprecedented in the history of the Islamic Republic. Virtually every major city and town is experiencing some form of political protest against the government, calling for regime change, not just complaints against a specific economic policy. And what you have is the tactical government efforts to contain these protests through promises of economic reform have not satisfied the protesters, and increasingly coercive and violent responses by the government have not ended the protests thus far."

Former senior US intelligence official Norman Roule characterizes the nationwide protests in Iran as having an unprecedented scale and intensity within the Islamic Republic's history. Roule notes that protests are occurring in most major cities and towns, with demands for regime change rather than just economic policy grievances, and that government containment efforts have been unsuccessful.

"So, in the 2022 to 2023 situation, for example, the number of the tragic number of deaths, for example, that took place were took place over a much longer period of time. The number of arrests took place over a much longer period of time. So we're watching a compression of this, and this is happening because the inflation, the collapse of the currency, the dissolution with the government, the failed policy, the impression, it's built upon itself since 2017. So you've got an extraordinarily unhappy population that feels the government, correctly so, is feeling that the government is just unable to deliver."

Norman Roule explains that the current situation in Iran is compressed compared to previous protest periods, with a higher number of deaths and arrests occurring over a shorter timeframe. Roule attributes this compression to escalating inflation, currency collapse, government policy failures, and a general sense of dissatisfaction among the population who perceive the government as incapable of delivering.

"The market reaction this morning is very muted, which is telling investors that the key issue continues to be the incoming data."

Torsten Slok, Chief Economist at Apollo, observes that the muted market reaction indicates investors are primarily focused on incoming economic data. Slok suggests this suggests that recent events, while significant, have not fundamentally altered the market's reliance on data for future direction.

Resources

External Resources

Books

- "The One Big Beautiful Bill" - Mentioned as a piece of legislation expected to add 0.9 to GDP growth in 2026.

Articles & Papers

- "The Equilibrium Rate for Non-Farm Payrolls" (Federal Reserve) - Discussed in relation to the impact of declining immigration on labor market equilibrium.

People

- Jonathan Ferro - Host of the Bloomberg Surveillance podcast.

- Lisa Abramowitz - Host of the Bloomberg Surveillance podcast.

- Amary Henderson - Host of the Bloomberg Surveillance podcast.

- Bill Politi - Federal Housing Finance Agency Director, cited in relation to the DOJ's subpoena of the Federal Reserve and housing affordability initiatives.

- President Trump - Mentioned in relation to housing affordability initiatives, institutional home buying ban, and potential actions regarding the Federal Reserve.

- Joe Biden - Mentioned in relation to housing affordability and inflation during his term.

- Elizabeth Warren - Mentioned as a figure who discussed institutional buying but did not take action, contrasted with President Trump's approach.

- Norman Roll - Former senior US intelligence official, providing analysis on protests in Iran.

- Mr. Whitcoff - Mentioned in relation to a communication channel with Iran's foreign minister.

- Secretary Turner - Mentioned as part of an effort to reduce the cost of home ownership.

- Secretary Bessen - Mentioned as part of an effort to reduce the cost of home ownership.

- Secretary Lutnick - Mentioned as part of an effort to reduce the cost of home ownership.

- Susie Whiles - Mentioned as part of an effort to reduce the cost of home ownership.

- James Blair - Mentioned as part of an effort to reduce the cost of home ownership.

- Torsten Slok - Of Apollo, providing market analysis.

- Neil Dutta - Mentioned as someone who believes the institutional home buying ban is faulty economics.

Organizations & Institutions

- Bloomberg - Mentioned as the source of the podcast and television show.

- Barkley's Investment Bank - Mentioned as the sponsor of the "Barkley's Brief" podcast.

- Public Investing - Mentioned as a platform for building multi-asset portfolios and investing in generated assets.

- Open to the Public Investing Inc. - Brokerage services provider for Public.

- Public Advisors LLC - SEC registered advisor for Public.

- JPMorgan Chase Bank N.A. - Mentioned as a provider of business banking and digital tools.

- Federal Reserve - Mentioned in relation to a DOJ subpoena and market reactions.

- DOJ (Department of Justice) - Mentioned in relation to its subpoena of the Federal Reserve.

- FHFA (Federal Housing Finance Agency) - Mentioned in relation to its director's activities and housing affordability efforts.

- Fannie Mae - Mentioned in relation to mortgage bond buybacks and its role in the housing market.

- Freddie Mac - Mentioned in relation to mortgage bond buybacks and its role in the housing market.

- The Treasury - Mentioned in relation to potential knowledge of the DOJ subpoena.

- The White House - Mentioned in relation to efforts to reduce the cost of home ownership.

- Okta - Mentioned as a provider of identity security for AI agents.

- Islamic Republic - Mentioned in the context of protests in Iran.

- Revolutionary Guard - Mentioned as a network within Iran's leadership.

- ECB (European Central Bank) - Mentioned in comparison to the Federal Reserve's interest rates.

- Atlanta Fed - Mentioned for its GDP Now tracking.

- St. Louis Fed - Mentioned for its estimate of equilibrium for non-farm payrolls.

- Redbook - Mentioned for its weekly data on same-store retail sales.

- iShares - Mentioned as the provider of the Volley ETF.

- Blackrock Investments LLC - Mentioned as the preparer of iShares ETF information.

- Mint Mobile - Mentioned as a provider of wireless service with a holiday offer.

Websites & Online Resources

- public.com/market - Mentioned as the website to go to for Public's offerings and bonuses.

- public.com/disclosures - Mentioned for complete disclosures related to Public's services.

- chase.com/business - Mentioned as the website to learn more about Chase for Business.

- www.ishares.com - Mentioned as the website to view the prospectus for the Volley ETF.

- mintmobile.com - Mentioned as the website to try Mint Mobile's services.

Podcasts & Audio

- Bloomberg Surveillance Podcast - The podcast associated with the show.

- Barkley's Brief - A podcast from Barkley's Investment Bank analyzing market themes.

Other Resources

- Generated Assets - A type of asset on Public that allows users to turn ideas into investable indexes with AI.

- AI - Mentioned in relation to generated assets, AI agents, and the AI data center boom.

- Mortgage Back Securities (MBS) - Mentioned in relation to purchases by Fannie and Freddie.

- Non-Farm Payrolls - Mentioned in relation to labor market data and immigration.

- K-shaped outlook - Mentioned as a driver of differences in consumer and corporate performance.

- Volley (Large Cap Premium Income Active ETF) - An ETF from iShares offering monthly income and growth potential.