US Jobs Report, Inflation, AI, Tariffs, and Investment Outlook

TL;DR

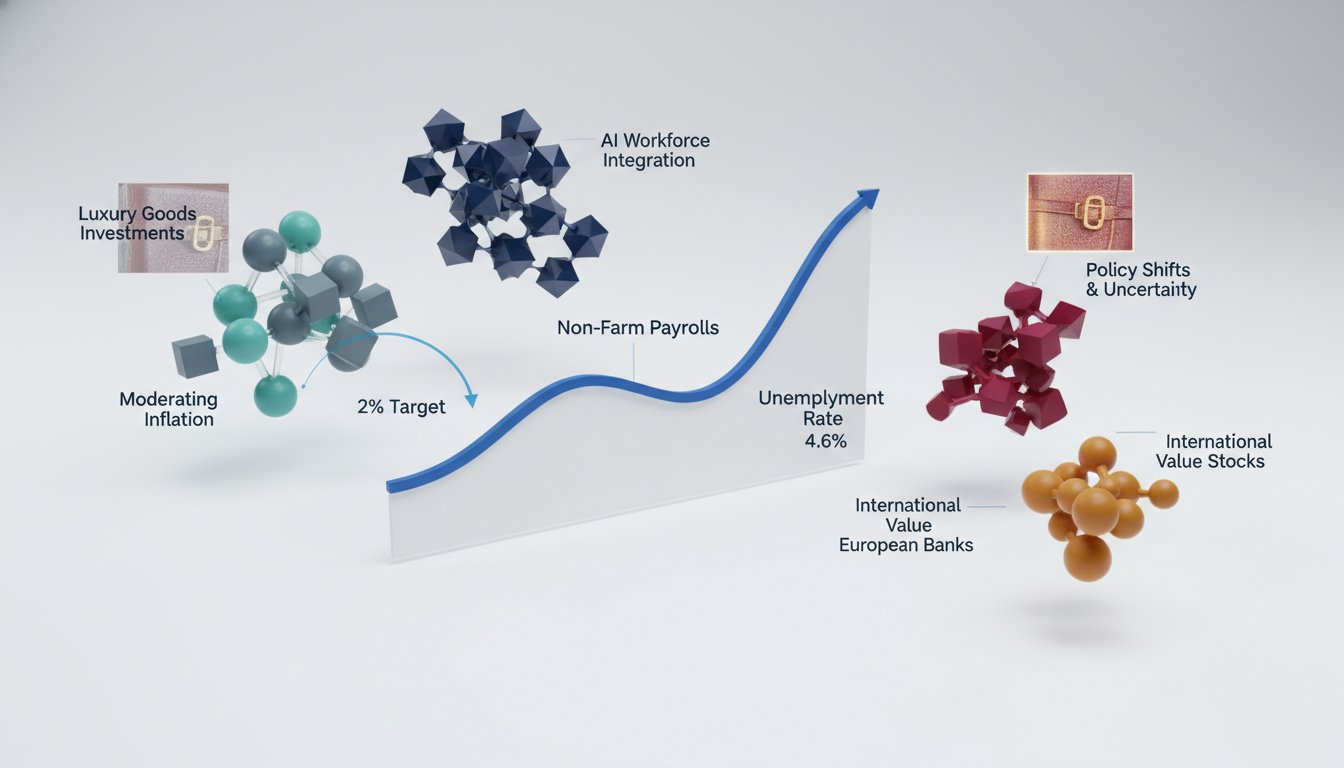

- The November US jobs report shows a rise in non-farm payrolls to 75,000 private sector jobs, a figure considered politically unpalatable and indicative of slow job growth that could lead to a higher unemployment rate.

- The unemployment rate ticking up to 4.6% is a key indicator that will attract attention from policymakers and investors, potentially influencing bond market reactions and future Federal Reserve decisions.

- Core inflation is projected to trend back towards 2% in 2026, driven by cooling goods prices, moderating non-housing services, and expected relief in the housing component of CPI.

- AI is not yet a significant factor in current US employment trends, with substantial labor market disruption from this technology likely to take decades, similar to past technological shifts like electricity.

- Tariffs have had less economic impact than anticipated due to a significant increase in exceptions filed under USMCA, shifting from 50% to 90% of goods entering the US duty-free.

- European banks have restructured and returned to core businesses, making them a potentially attractive investment as their profitability increases with rising interest rates after years of recovery from the GFC.

- Hermès Birkin and Kelly handbags are outperforming gold and the S&P 500 as investments, with ultra-rare Birkins potentially doubling in value within five years on the secondary market.

Deep Dive

The US jobs report indicates a cooling labor market, with the unemployment rate ticking up to 4.6% and a subdued three-month average for nonfarm payrolls at 22,000. This data suggests a potential shift in monetary policy, as the Federal Reserve may be prompted to consider additional rate cuts in 2026, with current market pricing potentially underestimating this likelihood.

The implications of this jobs report extend to inflation expectations and investment strategies. While goods prices and non-housing services are expected to cool, housing has been a persistent driver of inflation. However, there is anticipation for relief in the housing component of CPI, potentially bringing core inflation back towards the Fed's 2% target next year. This economic backdrop supports a more cautious outlook on equity markets, with valuations at 23 times next year's earnings. While earnings growth is expected, driven in part by large-cap technology stocks, a more diversified approach across geographies and styles, including international value stocks and European banks, is recommended to navigate current market conditions. Separately, AI is not yet a significant factor in US employment trends, with historical technological disruptions taking decades to fully manifest. Companies are expected to adopt AI more broadly during economic downturns, which will provide a clearer picture of its labor market impact. Furthermore, analysis of tariffs has revealed that exceptions and changing company strategies have lessened their anticipated economic impact, though potential Supreme Court rulings introduce further uncertainty.

Action Items

- Audit AI employment impact: Analyze 3-5 sectors for AI's current and projected labor market influence (ref: Yale Budget Lab study).

- Evaluate tariff exception utilization: Track the percentage of goods exempt under USMCA to assess actual tariff impact (ref: Martha Gimbel's tariff analysis).

- Measure value stock performance: Compare returns of value stocks against growth stocks over a 1-2 year period (ref: JPMorgan Asset Management outlook).

- Analyze handbag resale market: Track the annual appreciation of Hermès Birkin and Kelly bags against S&P 500 and gold over 5-10 years.

Key Quotes

"I think tom for me the unemployment rate ticking up to 4 6 as we said in the preamble I think that's going to get attention of investors and policymakers I think you see that move in the bond market already after that I quickly looked at your your non farm payroll I mean I guess on a positive note if you want the west coast optimistic spin you did have a negative October but total private if you exclude the government payrolls didn't look too bad tom you're talking about 52 000 in October you're talking about 69 000 in November you mentioned the three month average we do like to look at that as well and the Bloomberg economics team absolutely right that 22 000 you know that's total non farm if you look at just private it looks a bit better it's 75 000 so I would still characterize that as soggy to steal your your phrase your reference for retail sales and I still think the risk here is a higher unemployment rate and so I think this brings the fed already back into play"

Jeffrey Cleveland highlights that the uptick in the unemployment rate to 4.6% is a significant factor that will capture the attention of both investors and policymakers. Cleveland notes that while the overall non-farm payroll numbers might appear weak, the private sector payroll growth of 75,000 in November is still characterized as "soggy," suggesting a potential for a higher unemployment rate. This economic indicator, according to Cleveland, could prompt the Federal Reserve to reconsider its monetary policy.

"I agree I don't want people I I do get messages from people friends family and they say you know it's okay if we have soft job growth you know as long as the unemployment rate stays low well bad news everyone if we have slow job growth the unemployment rate tends to tick up which is what we're seeing in the last few months and I don't think 75 000 is politically palatable I agree with you so the risk here is additional rate cuts in 2026 and the bond market will start to to sniff that out I think"

Jeffrey Cleveland addresses the public's perception of job growth, noting that while some may accept soft job growth if unemployment remains low, he points out that slow job growth often leads to an increase in the unemployment rate. Cleveland believes that the 75,000 figure for private sector job growth is not politically acceptable and suggests that the risk of additional rate cuts in 2026 is increasing, which the bond market is likely to anticipate.

"I think we we you're going to get more priced in in our view the unemployment rate continues to trend up and we in our in our forecast we do have inflation moderating and I think that's important to note as well the fed we have you know in our base case the fed cutting three times in 2026 so wurp is probably underpriced at this stage and that 4 6 unemployment rate bolsters that view I think"

Jeffrey Cleveland explains that the market is likely to price in more interest rate cuts due to the upward trend in the unemployment rate. Cleveland's forecast includes moderating inflation and anticipates the Federal Reserve cutting rates three times in 2026, suggesting that current market pricing (WORP) might be underestimating this possibility. The 4.6% unemployment rate, according to Cleveland, supports this view.

"We do think when we look at the main components of cpi what what we think will drive inflation in 2026 we think goods prices will cool off we think non housing services prices will also cool given the weaker labor market and we do think housing housing has been a big thorn in the side of the the cpi the policymaker community so we we expect some relief in the housing component so when we tie that all together we do get core inflation trending back towards 2 next year so that's that's kind of how we're looking at things"

Jeffrey Cleveland discusses his outlook on inflation, predicting that goods prices and non-housing services prices will cool down due to a weaker labor market. Cleveland specifically notes that housing, a significant component of CPI, is expected to provide relief, leading to core inflation trending back towards 2% next year. This projection, according to Cleveland, is based on an analysis of the main components of the Consumer Price Index.

"I think the thing that everyone keeps forgetting right is that it takes time for technological disruption to happen it took decades for electricity to disrupt the labor market and even took a pretty long time for the internet to kick in right it wasn't like immediately in 1997 we were changing all the things and so you know ai feels so big and people are expecting to see you know impacts immediately and that's just not how companies work"

Martha Gimbel emphasizes that technological disruption, such as the impact of AI on the labor market, occurs over extended periods. Gimbel draws parallels to the adoption of electricity and the internet, noting that significant labor market changes did not happen instantaneously. Gimbel suggests that the expectation for immediate impacts from AI is unrealistic, as companies require time to integrate and adapt to new technologies.

"One of the things that we got wrong on tariffs was that we didn't realize how many exceptions there were in the law currently for companies to take advantage of that they weren't filing the paperwork for because it just wasn't worth it to them at previous tariff rates but once the tariffs were high enough companies started for instance filing the paperwork to take advantage of the usmca and so we've seen the share of goods coming into the us from canada and mexico that are exempt under the usmca go from 50 to 90 that is not something we thought about that is not something we anticipated and that is one of the reasons why tariffs have had less of an impact than many of us anticipated"

Martha Gimbel identifies an oversight in their previous analysis of tariffs, specifically regarding the numerous exceptions available to companies. Gimbel explains that previously, companies did not file for these exceptions because the tariff rates were not high enough to warrant the effort. However, with increased tariffs, companies began utilizing mechanisms like the USMCA, leading to a significant rise in exempt goods from Canada and Mexico, which was an unanticipated factor in their tariff impact assessment.

"The US on average has better companies in better businesses and that isn't going to change the reason the US market is two thirds of everything these days is it's come the right way right it's come through superior earnings growth over the last 15 years so that's where we are but you also now have higher prices and I think you can legitimately balance your US exposure these days with the rest of the world and we're not so sure investors are doing that I think a lot of investors including by the way investors in Europe and Asia have kind of become a little overfixated on the US and have forgotten you can also make money in in those markets too"

Paul Quinsee explains that while the United States generally has superior companies and business environments, leading to its market dominance

Resources

External Resources

Books

- "The World's Richest Families for 2025" (Bloomberg News) - Mentioned as a source for information on the wealth of the world's richest families, specifically the Waltons.

Articles & Papers

- "Hermès Birkin and Kelly handbags are so scarce that they're beating gold and the S&P 500" (New York Post) - Discussed as an example of luxury goods that can serve as an investment, outperforming traditional assets like gold and the S&P 500.

People

- Jeffrey Cleveland - Director & Chief Economist at Payden & Rygel, provided assessment of the November US jobs report and its implications for monetary policy.

- Paul Quinsee - Global Head of Equities at JPMorgan Asset Management, discussed the shift toward value stocks and the equity market outlook.

- Martha Gimbel - Executive Director of the Yale Budget Lab, explained why AI is not yet a major factor in US employment trends and discussed tariffs.

- Lisa Mateo - Provided updates on newspaper headlines, including stories on wealthy families and luxury handbags.

Organizations & Institutions

- Payden & Rygel - Employer of Jeffrey Cleveland, who provided analysis on the jobs report.

- JPMorgan Asset Management - Employer of Paul Quinsee, who discussed equity market outlook and European banks.

- Yale Budget Lab - Institution where Martha Gimbel is Executive Director, discussed AI's impact on employment and tariff analysis.

- Bloomberg News - Source for a story on the world's richest families.

- New York Post - Source for a story on the investment value of Hermès Birkin and Kelly handbags.

- J.P. Morgan Chase & Co. - Parent company of J.P. Morgan Asset Management.

- Finra - Member organization mentioned in relation to J.P. Morgan Distribution Services, Inc.

- Supreme Court - Mentioned in relation to potential rulings on tariffs.

- Walmart - Retailer whose founding family, the Waltons, were discussed in relation to wealth.

- Hermès - Luxury brand whose Birkin and Kelly handbags were discussed as investments.

- S&P 500 - Stock market index used for comparison of investment returns.

Websites & Online Resources

- jpmorgan.com/getactive - Website mentioned for learning more about active fixed income ETFs from J.P. Morgan Asset Management.

- chase.com/reservebusiness - Website mentioned for learning more about the Chase Sapphire Reserve for Business card.

- adobe.com/dothatwithacrobat - Website mentioned for learning more about Adobe Acrobat Studio.

- omnystudio.com/listener - Website mentioned for privacy information.

- public.com/market - Website mentioned for learning more about Public's generated assets and transferring portfolios.

- mastercard.com/commercialacceptance - Website mentioned for learning more about Mastercard's B2B acceptance solutions.

- mypolicyadvocate.com - Website mentioned for learning more about policy transparency services.

- ishares.com - Website mentioned for viewing a prospectus for Volley by iShares.

Other Resources

- US Jobs Report - Discussed as a key economic indicator influencing monetary policy.

- Monetary Policy - The implications of the US jobs report for future monetary policy were discussed.

- Value Stocks - Discussed as a sector experiencing a shift in investment focus.

- AI (Artificial Intelligence) - Discussed in relation to its current and potential impact on US employment trends.

- Tariffs - Discussed in relation to their economic impact and potential Supreme Court rulings.

- USMCA (United States-Mexico-Canada Agreement) - Mentioned as a mechanism for goods to be exempt from tariffs.

- Core CPI - Mentioned as a measure of inflation, with housing being a significant component.

- Core PCE - Mentioned as the Fed's preferred inflation gauge.

- Non Farm Payrolls - A component of the US jobs report, discussed in terms of its monthly change.

- Unemployment Rate - Discussed as a key indicator of labor market health.

- Rate Cuts - Discussed in the context of potential Federal Reserve actions in 2026.

- CPI (Consumer Price Index) - Mentioned as a report to be released, impacting inflation expectations.

- Fed (Federal Reserve) - Mentioned in relation to potential interest rate decisions and inflation targets.

- FOMC (Federal Open Market Committee) - Mentioned in relation to the timing of Fed meetings.

- WURP Function - A tool or metric used to assess market expectations for rate cuts.

- Triple Crown of Swimming - A series of challenging open-water swims, which Jeffrey Cleveland has participated in.

- English Channel Swim - A specific open-water swim completed by Jeffrey Cleveland.

- Uber Eats Wrapped - A feature that compiles user activity on Uber Eats, similar to Spotify Wrapped.

- Uber Comfort - A service tier within Uber.

- GFC (Global Financial Crisis) - Mentioned in the context of the recovery of European banks.

- Mag 7 Companies - A group of seven large technology companies that have driven significant earnings growth.

- Money Market Funds - Discussed in relation to cash appreciation and investor comfort with the market.

- International Value Stocks - Identified as having strong returns on the Public platform.

- European Banks - Discussed in terms of their recent performance and restructuring.

- Investment Banking - Mentioned as a field where AI could potentially automate tasks.

- Electricity - Used as a historical example of a technology that took time to disrupt the labor market.

- Internet - Used as a historical example of a technology that took time to disrupt the labor market.

- Recessions - Mentioned as a period when employers might implement labor-saving productivity enhancements.

- USMCA Exemptions - The share of goods entering the US from Canada and Mexico that are exempt under the USMCA.

- Tariff Analysis - A type of economic analysis related to the impact of tariffs.

- Bloomberg Economics Team - Mentioned for their analysis of non-farm payroll data.

- Bloomberg Business App - An application for accessing Bloomberg content.

- Bloomberg Terminal - A platform for financial data and news.

- Bloomberg Surveillance Podcast - The podcast from which this content is derived.

- Bloomberg Audio Studios - A division of Bloomberg that produces podcasts and radio content.

- Interactive Brokers - A financial brokerage firm mentioned as a sponsor.

- Investco - An investment management company.

- Public Investing - A brokerage service.

- Open to the Public Investing Inc. - A member of FINRA and SIPC.

- Public Advisors LLC - An SEC registered advisor.

- Blackrock Investments LLC - Mentioned in relation to iShares.

- iShares - A provider of exchange-traded funds (ETFs).

- Volley by iShares Large Cap Premium Income Active ETF - An ETF mentioned for its income and growth potential.

- Chase Sapphire Reserve for Business - A credit card offering premium benefits.

- Adobe Acrobat Studio - Software with AI-powered PDF features.

- Mastercard - A company offering B2B payment solutions.

- My Policy Advocate - A service that explains insurance policy vulnerabilities.

- National Football League (NFL) - Mentioned in the context of sports analytics.

- Pro Football Focus (PFF) - A data source for player grading.

- New England Patriots - An example team for performance analysis.

- Bloomberg Radio - A radio station.

- Apple CarPlay - A system for integrating iPhones with car infotainment.

- Android Auto - A system for integrating Android phones with car infotainment.

- Amazon Alexa - A voice assistant.

- iHeartRadio - A digital radio service.

- YouTube - A video-sharing platform.

- Twitter - A social media platform.

- Picasso - An artist whose work is compared to the investment value of luxury handbags.

- Spotify Wrapped - A feature that provides users with a summary of their listening habits.

- Uber - A ride-sharing and food delivery company.

- Taco Bell - A fast-food restaurant chain.

- Five Guys - A fast-food restaurant chain.

- Burger King - A fast-food restaurant chain.

- Chipotle - A fast-food restaurant chain.

- Plumber - Mentioned humorously in relation to spending on Uber Eats.

- Uber Eats - A food delivery service.

- Uber Comfort - A service tier within Uber.

- Saturday Night Live (SNL) - A sketch comedy show.

- Walmart - Retailer whose founding family, the Waltons, were discussed in relation to wealth.

- Qatar - A Middle Eastern country mentioned in relation to wealthy families.

- Saudi Arabia - A Middle Eastern country mentioned in relation to wealthy families.

- United Arab Emirates - A Middle Eastern country mentioned in relation to wealthy families.

- Gold - A precious metal used as a benchmark for investment returns.

- New Jersey Surf - Mentioned in relation to Paul Sweeney's activities.

- Catalina Channel - A body of water mentioned in relation to Jeffrey Cleveland's swimming achievements.

- Dodgers - A baseball team.

- Manhattan - A borough of New York City.

- England - A country mentioned in relation to the English Channel swim.

- France - A country mentioned in relation to the English Channel swim.

- Claremont - Mentioned in relation to Jeffrey Cleveland's study of politics.

- Washington - Mentioned in the context of political acceptability of economic data.

- Washington D.C. - Implied location of "Washington."

- New York - A state in the US.

- London - The capital city of the United Kingdom.

- Park Avenue - A street in New York City.

- Piccadilly - An area in London.

- Durham - A city in Northeast England.

- United Kingdom - A country.

- Canada - A country.

- Mexico - A country.

- Europe - A continent.

- Asia - A continent.

- Middle East - A region.

- Germany - A country.

- Ireland - A country.

- Australia - A country.

- Japan - A country.

- China - A country.

- India - A country.

- Brazil - A country.

- Argentina - A country.

- Chile - A country.

- Colombia - A country.

- Peru - A country.

- Venezuela - A country.

- Ecuador - A country.

- Bolivia - A country.

- Paraguay - A country.

- Uruguay - A country.

- South Africa - A country.

- Nigeria - A country.

- **