Global Economy 2026: Sturdy Growth, Stagnant Jobs, Stable Prices

TL;DR

- Increased US productivity growth, potentially accelerated by AI, will widen the gap between GDP and labor market performance, leading to higher economic speed limits but potentially sour consumer sentiment due to weaker job opportunities.

- China's projected record-breaking current account surplus, driven by its resilient export sector, will negatively impact its trading partners, posing a headwind for European growth, particularly in Germany's industrial sector.

- Elevated US equity market valuations, coupled with the market pricing in less recession risk than warranted, suggest potential for increased volatility and a shallower return profile compared to prior years.

- The risk of a US recession is heightened if the unemployment rate increases by half a percentage point, which could trigger significant negative market shifts, including lower equities and wider credit spreads.

- AI investment's current limited impact on US GDP growth stems from its reliance on imported goods and measurement issues with semiconductors, delaying significant labor market effects until future years.

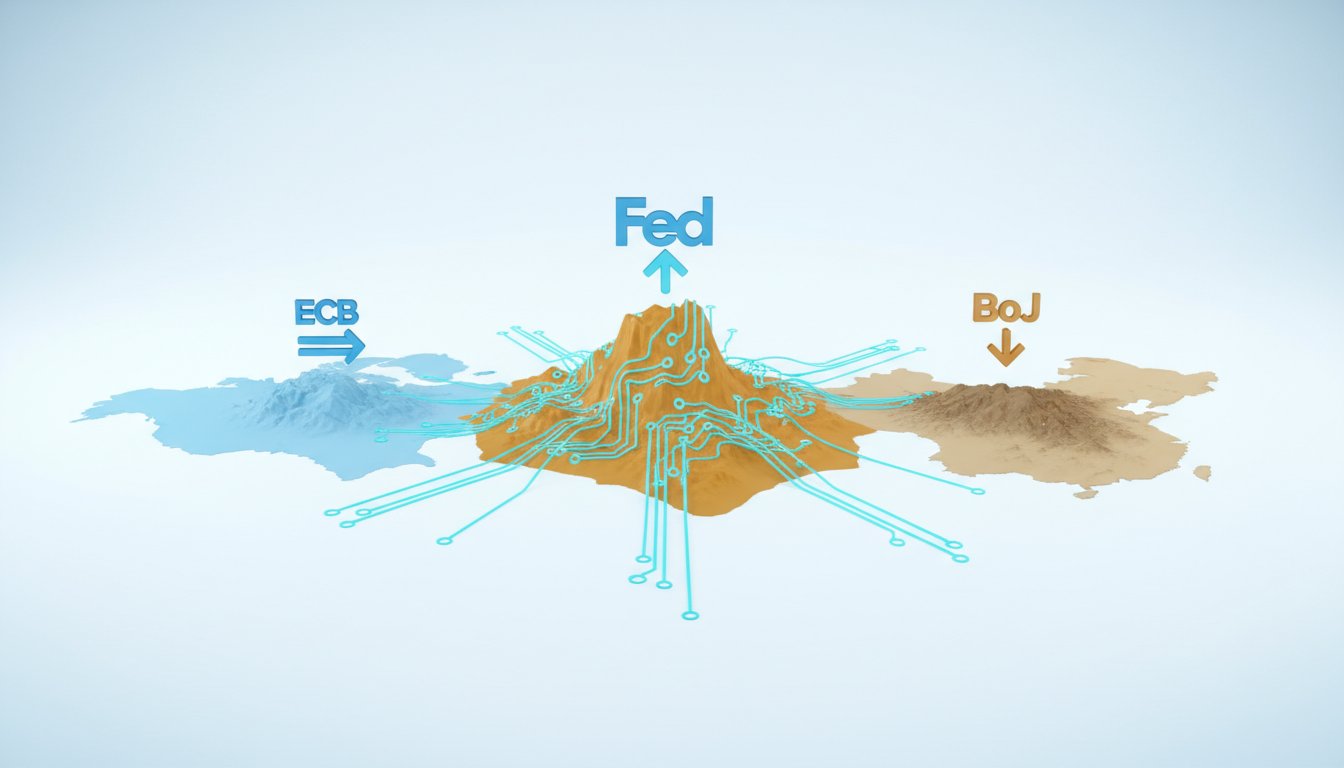

- Central banks, particularly the Fed and Bank of England, are expected to implement rate cuts as inflation fundamentals improve, driven by easing labor market pressures and declining rent inflation.

- Credit markets present a less favorable risk-reward profile than equities due to tight spreads and the increasing reliance on debt financing for AI and data center booms, risking a debt burden dynamic.

Deep Dive

Goldman Sachs Research forecasts a global economy in 2026 characterized by "Sturdy Growth, Stagnant Jobs, Stable Prices," driven by receding trade tensions, supportive fiscal policies, and easing monetary conditions. This outlook, while optimistic, implies significant divergence across regions and sectors, with robust GDP growth failing to translate into labor market improvements due to accelerating productivity, and presents a mixed bag for investors as market expectations lag the research team's more positive economic assessment.

The core of the 2026 outlook hinges on a shift from the headwinds of trade disputes in 2025 to tailwinds from fiscal stimulus, particularly in the US via the "One Big Beautiful Bill Act" and German fiscal easing, alongside expected central bank rate cuts. This environment supports a 2.5% growth forecast for the US, largely unhindered by tariffs and boosted by tax cuts and business depreciation allowances. However, this growth is projected to occur without significant labor market tightening, with the unemployment rate holding steady at 4.5%. This disconnect is primarily attributed to a pickup in US productivity growth, now estimated at 2% and expected to accelerate with AI integration, effectively raising the economy's "speed limit" and widening the gap between GDP performance and employment opportunities. Consequently, while the macro landscape appears favorable, consumer and worker sentiment may remain subdued due to perceived poor labor market conditions.

China's economic trajectory presents a bifurcated picture, with its export-oriented, goods-producing sector demonstrating remarkable resilience, even offsetting the negative impacts of US tariffs. This strength, however, is contrasted by ongoing weakness in domestic sectors, particularly the property market, which is expected to subtract 1.5 percentage points from growth. The consequence of this imbalance is a projected surge in China's current account surplus to 1% of global GDP, a historical record, which will negatively impact its trading partners, notably Europe. Europe's growth forecast, revised down slightly, faces headwinds from this external imbalance, especially for Germany, though short-term relief is anticipated from German fiscal expansion and positive performance in countries like Spain. Market sentiment, particularly concerning China and Europe, is seen as lagging behind these evolving realities, with potential for upgrades as the trade surplus story unfolds and its implications become clearer.

The implications for currency markets suggest a continued, albeit shallower, trend of dollar weakness, driven by the Federal Reserve's likely rate cuts compared to other developed markets and a generally supportive global growth environment for cyclical assets and currencies. However, the primary focus may shift from broad dollar movements to the outperformance of cyclical assets. In credit markets, the outlook is less enthusiastic than for equities. While the overall macro backdrop is favorable, already tight spreads, a past peak in corporate balance sheet strength, and the increasing reliance on debt financing for AI and data center booms present risks. This could lead to a gradual widening of credit spreads, even amidst positive economic and equity performance, echoing dynamics seen in the late 1990s.

The most significant risk to this optimistic outlook is a more material deterioration in the labor market. A further increase in the unemployment rate, even by a few tenths of a percentage point, could trigger historical recession indicators, potentially creating a negative feedback loop of declining confidence and spending. Such a scenario would lead to dramatic market shifts, including falling equities and widening credit spreads, and is therefore the primary concern for policymakers and investors. Less immediate, but still present, are risks associated with a less dovish central bank easing path than anticipated, and lingering fiscal risks that could resurface, particularly in the first half of the year, as growth strengthens and inflation dynamics remain under scrutiny.

Action Items

- Audit AI investment impact: Measure US GDP contribution from AI spending (ref: import/export balance, intermediate goods treatment).

- Track labor market feedback loop: Monitor unemployment rate changes (0.5% threshold) and consumer confidence surveys (ref: SAM rule).

- Analyze China's current account surplus: Quantify impact on trading partners' growth (ref: 1% global GDP target).

- Evaluate European industrial sector resilience: Assess impact of China's trade surplus and German fiscal easing (ref: 1.3% Euro area growth forecast).

- Measure correlation between productivity growth and wage growth: Identify potential divergence in GDP vs. labor market performance.

Key Quotes

"As we go into 2026, I think the story is a little bit clearer because the tariff issue is now in the rearview mirror. The increases in tariffs are behind us. Going forward, we'll probably go sideways to lower depending on what happens on the legal front, what happens with perhaps tariff reductions as we go into the midterms. But it's no longer a negative."

Jan Hatzius explains that the resolution of tariff increases provides a clearer economic outlook for 2026 compared to the previous year. He suggests that this issue will no longer be a drag on growth, potentially becoming neutral or even slightly positive depending on future policy developments.

"US growth at 2.5% fourth quarter to fourth quarter, and that is really driven by some of the forces I just talked about. Tariffs are no longer a drag. Maybe they're even going to turn into a small boost in terms of real income as the year progresses. We are getting tax cuts on the consumer side, strong tax refunds. We're getting fiscal help on the business side as firms can fully depreciate equipment and plants. And we're probably going to see a boost from the rate cuts that the Fed has already delivered."

Jan Hatzius highlights that US growth is projected at 2.5% due to the absence of tariff headwinds and the presence of supportive fiscal policies, including tax cuts and accelerated depreciation for businesses. He also anticipates a positive impact from previously delivered interest rate cuts by the Federal Reserve.

"The property sector still, we think, going to subtract something like 1.5 percentage points from growth this year. And yeah, I think that is naturally going to lead to a growing external imbalance. The current account surplus, we think, is going to grow to about 1% of global GDP, which would be the biggest number for any economy in recorded history."

Jan Hatzius points out that China's property sector is expected to reduce growth by approximately 1.5 percentage points. He anticipates this weakness will contribute to a growing external imbalance, projecting China's current account surplus to reach 1% of global GDP, a historical record.

"We think that dynamic of dollar weakness probably on balance with our central case forecast is going to continue. The Fed's more likely to cut rates and more likely to cut them further than many of the other developed markets. This good global growth environment is generally supportive of and consistent with dollar weakness. But we think the gradient is likely to be much shallower than before, and the mix is probably different."

Dominic Wilson suggests that the trend of dollar weakness is likely to persist, supported by the Federal Reserve's anticipated interest rate cuts and a favorable global growth environment. However, he cautions that the pace of this weakness may be slower and the contributing factors more varied than in the past.

"And that speaks to stronger productivity growth. And we've seen in the US pick up from about 1.5% productivity trends in the 2008 to 2020 cycle to about 2% now, probably with further acceleration coming because that 2% doesn't really have any significant AI impact in it yet."

Jan Hatzius attributes the disconnect between solid GDP growth and weaker labor market performance to an increase in productivity growth. He notes that US productivity has risen from approximately 1.5% to 2% and anticipates further acceleration as the impact of Artificial Intelligence becomes more pronounced.

"I mean, at the top of the list and the most immediate is more deterioration in the labor market. We've already seen a sizable increase in the unemployment rate, and it wouldn't take that much more, a few tenths more from here, and you'd be triggering on us the SAM rule, the idea or historical regularity that if you get a half percentage point plus increase in the unemployment rate in a year's time, that's a reliable indicator of recession."

Jan Hatzius identifies a deteriorating labor market as the most immediate and significant risk to the economic outlook. He explains that a further increase in the unemployment rate could trigger the SAM rule, a historical indicator suggesting a heightened risk of recession.

Resources

External Resources

Books

- "one big beautiful bill act" - Mentioned as a source of fiscal support and tax cuts in the US.

People

- Jan Hatzius - Head of Goldman Sachs Research and Chief Economist.

- Dominic Wilson - Senior Advisor in the Global Markets Research Group.

- Allison Nathan - Host of Goldman Sachs Exchanges.

Organizations & Institutions

- Goldman Sachs - The firm producing the podcast series.

- US (United States) - Mentioned for its economic outlook, fiscal support, tax cuts, and monetary policy.

- China - Discussed for its economic outlook, export sector, and current account surplus.

- Europe - Discussed for its economic outlook, growth forecasts, and industrial challenges.

- Germany - Mentioned for its fiscal easing and industrial sector.

- Spain - Highlighted as a bright spot for growth within the Euro area.

- UK (United Kingdom) - Mentioned in relation to inflation rates and central bank policy.

- Japan - Mentioned for expected increases in its policy rate.

- Federal Reserve (Fed) - Mentioned in relation to expected rate cuts and monetary easing.

- Bank of England - Mentioned in relation to expected rate cuts.

- New York Fed - Mentioned for its survey on job loss and re-employment likelihood.

- The Conference Board - Mentioned for its numbers on consumer perception of job availability.

Websites & Online Resources

- www.gs.com/research/hedge.html - Location for disclosures applicable to research with respect to issuers.

Other Resources

- 2026 Macro Outlook - A report by Jan Hatzius and Dominic Wilson.

- Sturdy growth, stagnant jobs, stable prices - The title of the 2026 macro outlook report.

- SAM rule - A historical regularity indicating recession risk based on unemployment rate increases.

- AI (Artificial Intelligence) - Discussed as a factor potentially impacting productivity growth and labor markets.

- PCE index - Mentioned as a measure of inflation.

- CPI (Consumer Price Index) - Mentioned as a measure of inflation.

- FX (Foreign Exchange) markets - Discussed in relation to currency movements and dollar weakness.

- Euro area - Mentioned for its growth forecast and economic components.

- National Football League (NFL) - Mentioned in the context of the "one big beautiful bill act" and its potential impact on business depreciation.