2026 Global Economic Outlook: U.S. Drives Growth Amidst Divergent Central Bank Policies

TL;DR

- U.S. economic growth in 2026 is projected at 1.75% (Q4/Q4), driven by resilient consumer and AI-fueled business spending, with a potential upside surprise if spending accelerates beyond current forecasts.

- AI's immediate impact on 2026 growth is primarily demand-side through capital expenditures, contributing to inflation, while productivity gains are expected to materialize more significantly in subsequent years.

- The Federal Reserve is anticipated to cut rates to just above 3% by mid-2026, driven by slowing labor market data, aiming to prevent further economic deterioration.

- European Central Bank policy will likely shift towards rate cuts to approximately 1.5% as tepid growth allows disinflationary processes to continue undershooting the 2% target.

- China's economy faces continued tepid growth and a deflationary spiral in 2026, likely preventing it from reaching its 5% growth target.

- The Bank of Japan is expected to hike rates in December 2025, but inflation path uncertainty will likely lead to a pause for most of 2026.

Deep Dive

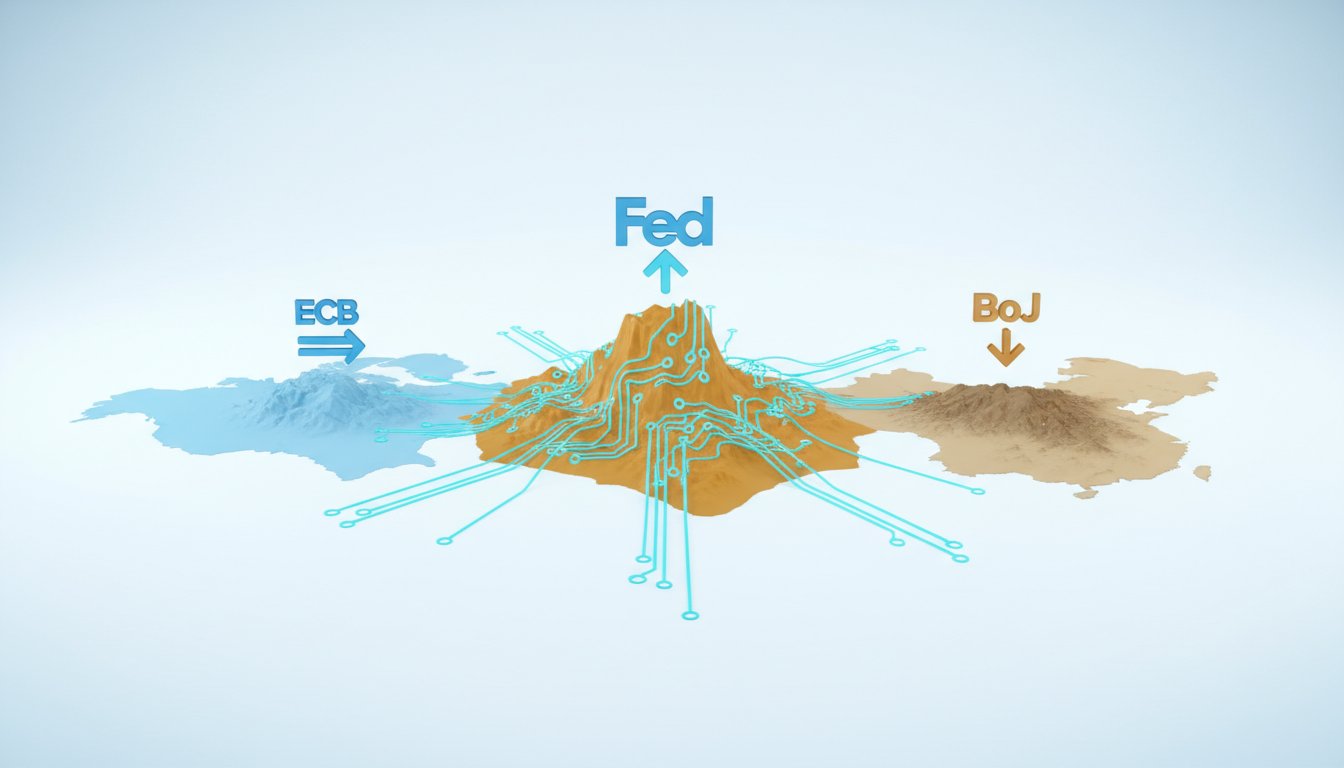

Global economic growth is projected to moderate in 2026, settling into a slower but steady pace, while inflation is expected to continue its downward trend in most regions. This outlook, however, masks significant regional variations and potential uncertainties, with the U.S. economy poised to be the primary driver of global performance and market fluctuations. Central banks will navigate these dynamics, with differing policy paths reflecting distinct economic conditions and inflation outlooks.

The U.S. economy faces a near-term slowdown driven by tariffs and monetary policy lags, but is expected to rebound in the latter half of 2026, supported by robust consumer and business spending, particularly on AI-related capital expenditures. Conversely, China is anticipated to experience continued tepid growth due to a deflationary spiral, likely falling short of its 5% target. Europe's growth is projected to remain unremarkable, just above 1%, caught between fiscal policy pushes and a central bank that believes it has tamed inflation. A key downside risk for the global economy stems from the U.S., where a recession, though likely mild given current low unemployment and business investment, could ripple outward. Conversely, stronger-than-expected U.S. spending, driven by AI investment and resilient household consumption, presents an upside scenario that would also bolster global growth.

Central bank policy in 2026 will be characterized by divergence. The U.S. Federal Reserve is expected to implement further rate cuts, bringing its policy rate near neutral levels by mid-2026, driven by a durable slowdown in the labor market. The European Central Bank, despite President Lagarde's view on inflation, is likely to cut rates as tepid growth suggests inflation will undershoot its 2% target. In contrast, Japan's central bank is expected to raise rates in December, signaling a shift towards reflation, though inflation's rocky path may lead to a pause for most of 2026 before potential further hikes in 2027. Artificial intelligence is a significant factor, currently boosting demand through CapEx in data centers and semiconductors, which is somewhat inflationary. While AI's productivity benefits will eventually enhance supply, for 2026, its demand-side impact will be more pronounced, contributing to continued growth but keeping inflation notably above targets. The U.S. is forecasted to grow around 1.75% in 2026, an upgrade from prior outlooks, with growth accelerating in the second half of the year due to stronger-than-anticipated business and household spending, and the Fed's earlier-than-expected easing.

The primary takeaway is that the U.S. economy's trajectory will disproportionately influence global growth and market sentiment in 2026. While AI's demand-side effects will support economic activity, its supply-side productivity gains will take time to materialize, meaning inflation will remain a concern. Central bank policies will diverge, reflecting differing economic realities, with the Fed leaning towards easing and the Bank of Japan moving towards tightening.

Action Items

- Track 3-5 key economic indicators (e.g., US employment, China growth, Europe inflation) to monitor deviations from baseline forecasts for 2026.

- Analyze AI CapEx impact: Quantify demand-side inflationary pressures from AI infrastructure spending over the next 1-2 years.

- Measure productivity gains: Estimate AI's supply-side contribution to GDP growth and disinflationary effects over a 2-3 year horizon.

- Evaluate central bank divergence: Compare projected policy rate paths for the Fed, ECB, and BoJ to identify potential market impacts.

Key Quotes

"We really think next year is going to be the global economy slowing down a little bit more just like it did this year, settling into a slower growth rate. But at the same time, we think inflation is going to keep drifting down in most of the world. Now that anodyne view, though, masks some heterogeneity around the world; and importantly, some real uncertainty about different ways things could possibly go."

Seth Carpenter explains that while the general outlook for 2026 is for slower global growth and declining inflation, this broad view conceals significant regional differences and potential uncertainties. Carpenter highlights that this "anodyne view" is a simplification that doesn't capture the nuances of diverse economic conditions worldwide.

"I really do think that the U.S. is going to be a real key driver of the story here. And in fact -- and maybe we'll talk about this later -- if we're wrong, there's some upside scenarios, there's some downside scenarios. But most of them around the world are going to come from the U.S."

Seth Carpenter identifies the U.S. economy as the primary influence on global economic performance in 2026, affecting both positive and negative potential outcomes. Carpenter emphasizes that significant global economic shifts, whether favorable or unfavorable, are likely to originate from trends within the United States.

"Our view is that the Fed's actually got a few more rate cuts to get through, and that by the time we get to the middle of next year, the middle of 2026, they're going to have their policy rate down just a little bit above 3 percent. So roughly where the committee thinks neutral is."

Seth Carpenter forecasts that the Federal Reserve will implement additional interest rate cuts throughout 2026, bringing the policy rate close to what the committee considers a neutral level. Carpenter bases this projection on the expectation of a durable slowdown in the labor market, which he believes will prompt the Fed to ease policy to prevent further economic deterioration.

"I think where we are for 2026, and it's important that we focus it on the near term, is the demand side is much more important than the supply side. So, we think growth continues. It's supported by this business investment spending. But we still think inflation ends 2026, notably above the Fed's inflation target."

Seth Carpenter explains that in the near term for 2026, the demand side of the economy, driven by business investment, will be a more significant factor than the supply side. Carpenter anticipates that while growth will continue, inflation will remain above the Federal Reserve's target by the end of the year.

"In numbers, that's about 3 percent growth. A little bit more than that for global GDP growth on like a Q4-over-Q4 basis. But for the U.S. in particular, we've got about 1.75 percent. So that's not appreciably different from what we're looking for this year in 2025."

Seth Carpenter quantifies the global GDP growth forecast for 2026 at approximately 3% on a Q4-over-Q4 basis, with the U.S. projected to grow around 1.75%. Carpenter notes that the U.S. growth figure is similar to the previous year's projection, but this number masks significant internal economic evolution throughout the year.

Resources

External Resources

Articles & Papers

- "2026 Global Outlook: Slower Growth and Inflation" (Thoughts on the Market) - Discussed as the primary topic of the episode, detailing economic forecasts for the upcoming year.

People

- Serena Tang - Chief Global Cross-Asset Strategist at Morgan Stanley, host of the podcast.

- Seth Carpenter - Global Chief Economist at Morgan Stanley, guest providing economic outlook.

- Christine Lagarde - President of the European Central Bank, mentioned in relation to ECB policy.

- Kazuo Ueda - Governor of the Bank of Japan, mentioned in relation to BoJ policy.

Organizations & Institutions

- Morgan Stanley - Mentioned as the host institution for the podcast and source of economic insights.

- Federal Reserve (Fed) - Referenced for its monetary policy and interest rate decisions.

- European Central Bank (ECB) - Discussed in relation to its inflation targets and potential policy adjustments.

- Bank of Japan (BoJ) - Mentioned for its current policy stance and potential future rate hikes.

Websites & Online Resources

- morganstanley.com/insights - Provided as a link for readers to access further insights from Morgan Stanley.

Other Resources

- Artificial Intelligence (AI) - Discussed as a driver of capital expenditure, productivity, and economic growth.

- Tariffs - Mentioned as a factor contributing to slower global growth in 2025.

- Monetary Policy - Referenced as a factor influencing economic slowdown and recovery.

- Fiscal Policy - Discussed in the context of European economic dynamics.

- Deflationary Spiral - Used to describe the economic situation in China.

- Reflation - Mentioned in relation to the economic shift in Japan.