All Episodes

Distinguishing Immediate Disruptions from Durable Policy Drivers

Government shutdowns offer a masterclass in market distraction, revealing how focusing on immediate disruptions blinds investors to the compounding effects of executive-driven policy and legislative inertia.

View Episode Notes →

Hong Kong Property Rebound Driven By Systemic Policy and Demographic Shifts

Hong Kong's property market signals a synchronized rebound, driven by policy shifts and talent influx, positioning it as a unique nexus for China-world monetary interconnection and predicting broader Asian liquidity trends.

View Episode Notes →

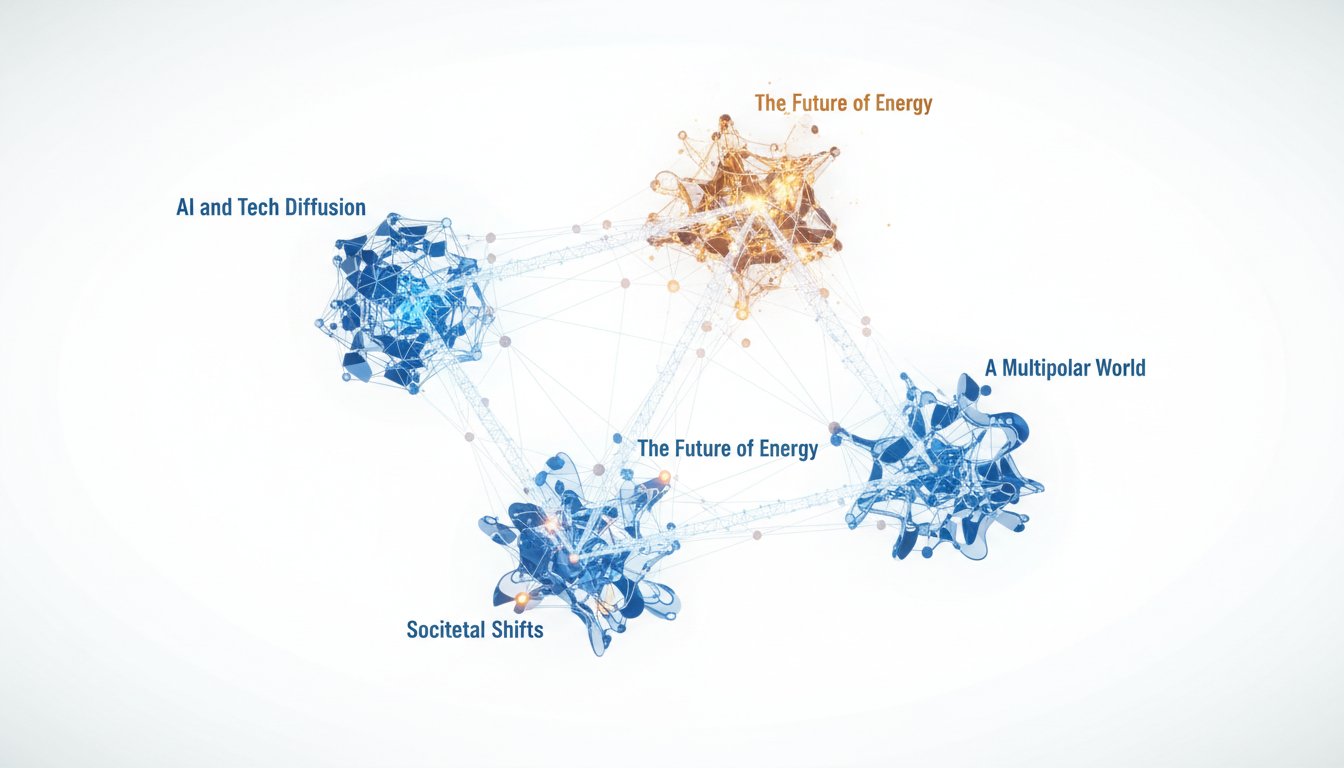

Interconnected Themes: AI Compute Bottlenecks, Energy Politics, Geopolitics, Societal Shifts

2026's landscape hinges on AI, energy, geopolitics, and society. Discover how compute limits, energy politics, and global shifts create complex challenges and unique investment advantages.

View Episode Notes →

Global Economic Outlook: Broadening US Growth, AI Productivity, and China's Deflation

AI adoption could boost US productivity to 3% and enable faster real growth, potentially allowing the Fed to cut rates despite strong growth if inflation continues to fall.

View Episode Notes →

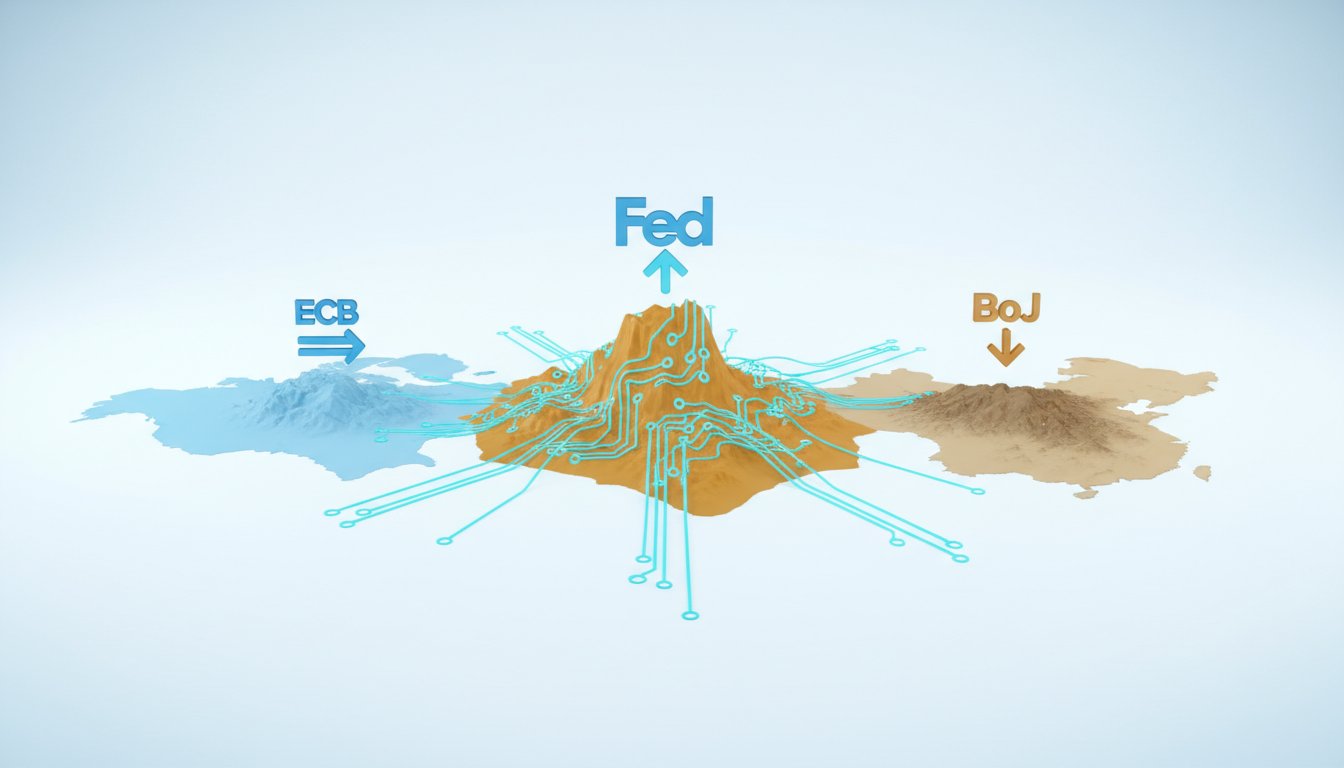

Global Central Banks Navigate Divergent Paths: US Rate Cuts, Japan's Currency Risk, European Easing

US inflation may ease post-Q1, allowing Fed rate cuts, but a strong fiscal bill could sustain inflation and delay easing. Japan faces currency depreciation risks, while Europe's disinflation supports ECB rate cuts.

View Episode Notes →

US-EU De-escalation Eases Geopolitical Risk; Domestic Affordability Faces Legislative Hurdles

Geopolitical de-escalation eases U.S.-EU trade risks, but domestic affordability plans face steep congressional hurdles, promising limited impact on housing and credit.

View Episode Notes →

GSE Mortgage Buy Program: Modest Housing Impact, Broader Credit Tailwinds

A $200 billion mortgage buy program offers a modest affordability boost and benefits credit markets, but its scale and unclear details limit significant housing market impact.

View Episode Notes →

AI Adoption Drives Structural Shift in European Equities

European equities are breaking a decade-long discount trend, offering AI-driven growth and selective stock-picking opportunities beyond US tech giants.

View Episode Notes →

Simultaneous Policy Easing Fuels Market Overheating and Valuation Overshooting

Unusual simultaneous monetary, fiscal, and regulatory easing fuels overheated markets, potentially driving valuations beyond fundamentals and unlocking trillions in bank capacity.

View Episode Notes →

India's Market Comeback: Reflationary Policies Drive Re-rating

India's markets are set for a comeback, driven by reflationary policies, structural economic shifts, and a household move to equities, promising sustained growth and higher valuations.

View Episode Notes →

Tariffs Drive US Manufacturing Reshoring and Decade-High Growth

Tariffs are making U.S. production more viable, driving decade-high industrial growth and positioning the U.S. to capture future factory construction by 2027.

View Episode Notes →

Venezuela's Oil Revival: Medium-Term Supply Risks and Refiner Benefits

Reviving Venezuela's oil industry offers bearish price risks medium-term but benefits US refiners and energy stocks, while its debt shows a strong recovery outlook.

View Episode Notes →

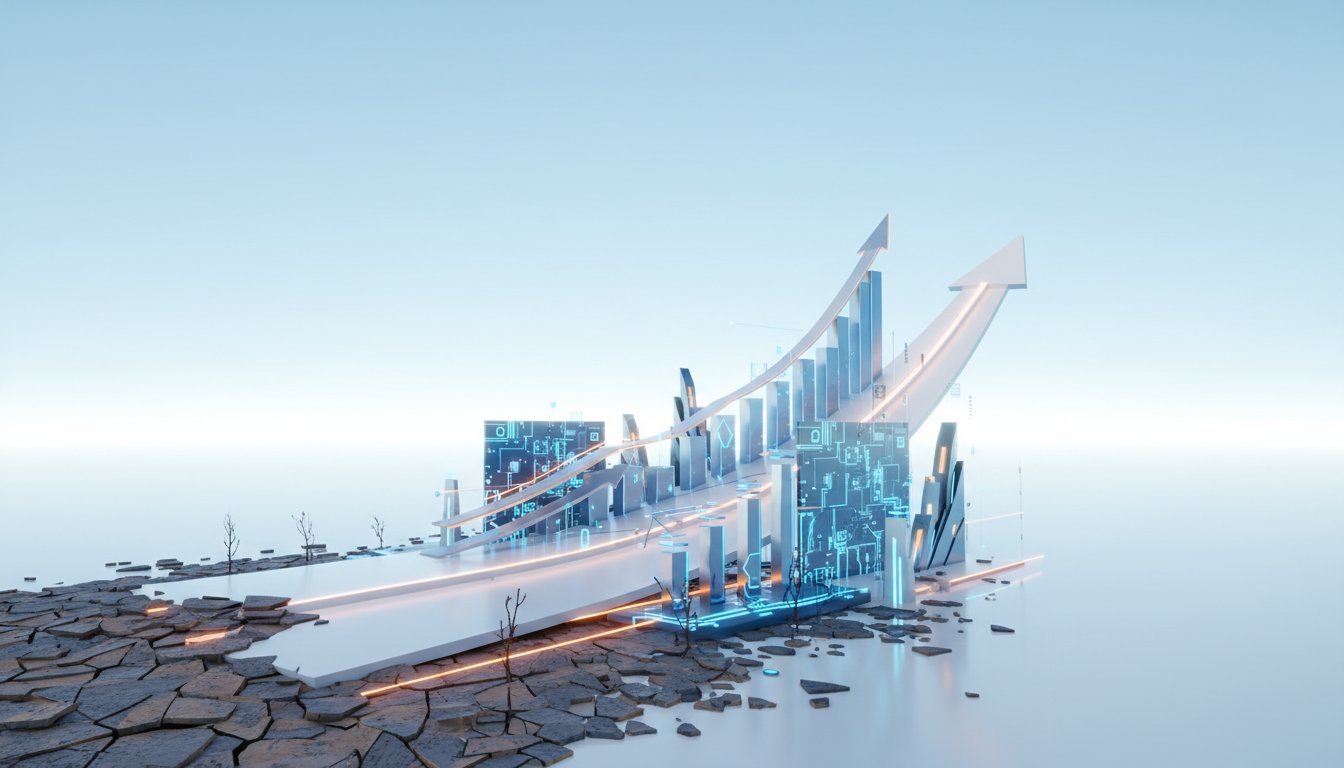

Leading Cyclical Indicators Signal Substantive Global Growth Acceleration

Leading indicators across commodities and equities signal a robust global growth acceleration, suggesting stronger earnings and challenging rate cut expectations.

View Episode Notes →

Tesla's Camera-Only Approach Drives Autonomous Vehicle Market Disruption

Autonomous vehicle availability doubles to over 30% of the U.S. urban population by 2026, driven by fleet expansion and new city rollouts.

View Episode Notes →

Private Credit 2.0 Fuels Digital Infrastructure Amidst Evolving Lending Guidelines

Credit markets are transforming, fueling digital infrastructure with trillions in capital. Banks now participate across the full credit spectrum, blurring public and private lines as new risks emerge in massive buildouts.

View Episode Notes →

U.S. Intervention in Venezuela Signals Multipolarity, Unilateral Policy, and Market Uncertainty

U.S. intervention in Venezuela signals a unilateral foreign policy shift, increasing market uncertainty and potentially reshaping trade dynamics with Mexico, while influencing Venezuelan bond valuations.

View Episode Notes →

Bullish U.S. Equity Outlook For 2026 Driven By Converging Catalysts

An early-cycle recovery is underway, driven by deregulation and accommodative policy, creating an optimal environment for equity gains in 2026.

View Episode Notes →

One Big Beautiful Bill Act: Tax Refunds Boost 2026 Spending, Later Drag

Retroactive tax cuts boost 2026 refunds by 15-20%, primarily fueling savings and debt repayment, improving household finances before later economic drags.

View Episode Notes →

Fed's Rate Cuts Risk Prolonging Inflation Amidst Economic Transition

Fed rate cuts to support jobs risk prolonging inflation above 2% through 2027, demanding a careful balance between employment and price stability.

View Episode Notes →

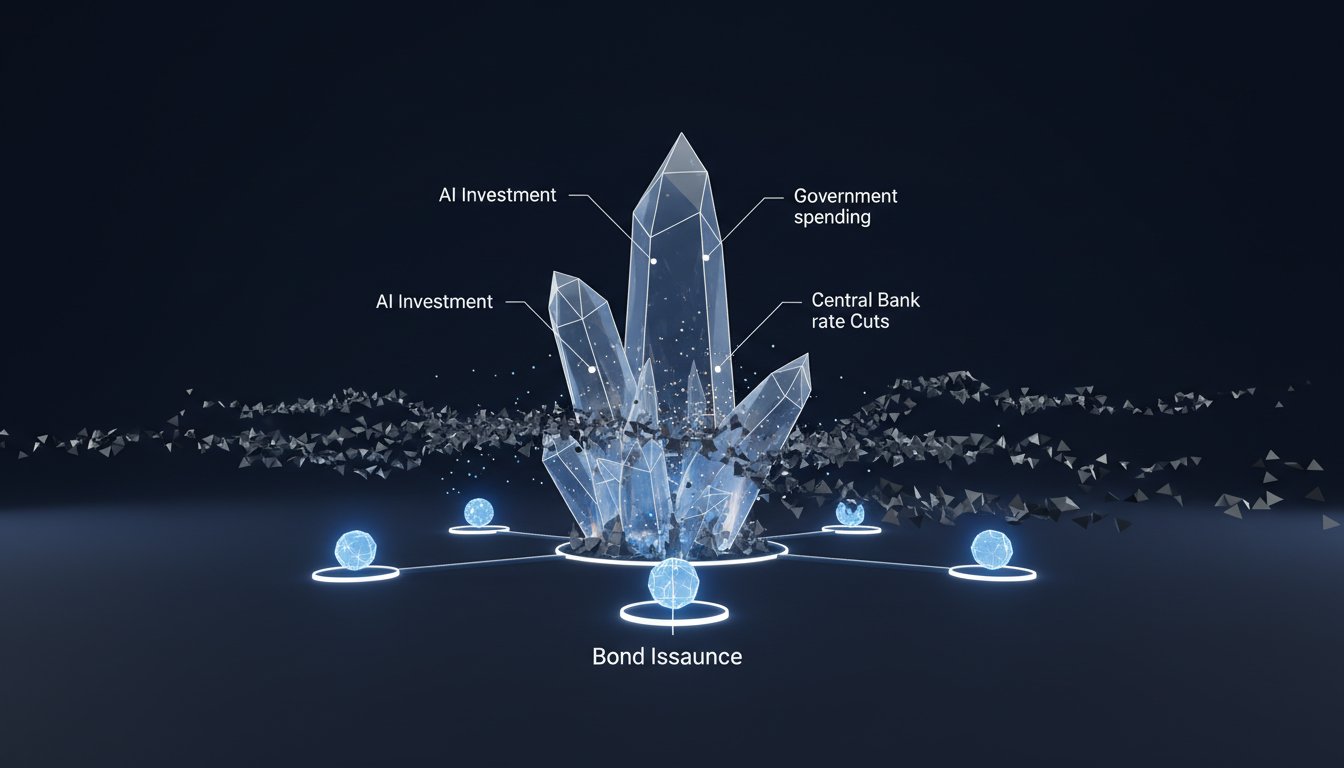

AI CapEx Drives Bond Issuance, Shifts Equity Preferences

U.S. equity valuations are justified by higher profit margins and supportive policies, while AI spending creates a $1 trillion bond issuance gap, downgrading investment-grade credit.

View Episode Notes →

AI's Disruptive Impact and Economic Implications Across Industries

AI adoption is reshaping industries, driving economic growth through data centers and semiconductors, while forcing companies to adapt or face disruption from agentic commerce and hyperscalers.

View Episode Notes →

Bull Market Recovery Driven by Policy Sequencing and Dovish Fed

A new bull market began in April, presenting significant earnings upside as policy shifts to a growth-positive stance. Markets are underappreciating this opportunity for broad economic recovery and corporate earnings growth.

View Episode Notes →

2026 Global Economic Outlook: U.S. Drives Growth Amidst Divergent Central Bank Policies

AI drives U.S. growth and inflation in 2026, with central banks diverging as global economic expansion moderates.

View Episode Notes →

Data Center Growth Strains Grid, Raises Consumer Electricity Rates

Data center electricity demand is projected to triple by 2030, straining the grid and potentially raising consumer rates, while some data centers deploy on-site power to mitigate impacts.

View Episode Notes →

Compressed Risk Premiums Require Dynamic Asset Allocation

Lower risk premiums and flatter efficient frontiers mean investors earn less for taking on risk, challenging traditional 60/40 portfolios and demanding dynamic asset allocation.

View Episode Notes →

Resilient Growth Drives Divergent Equity and Credit Performance

AI-fueled investment and fiscal policy will drive record corporate debt issuance, widening credit spreads and causing investment-grade credit to underperform equities in 2026.

View Episode Notes →

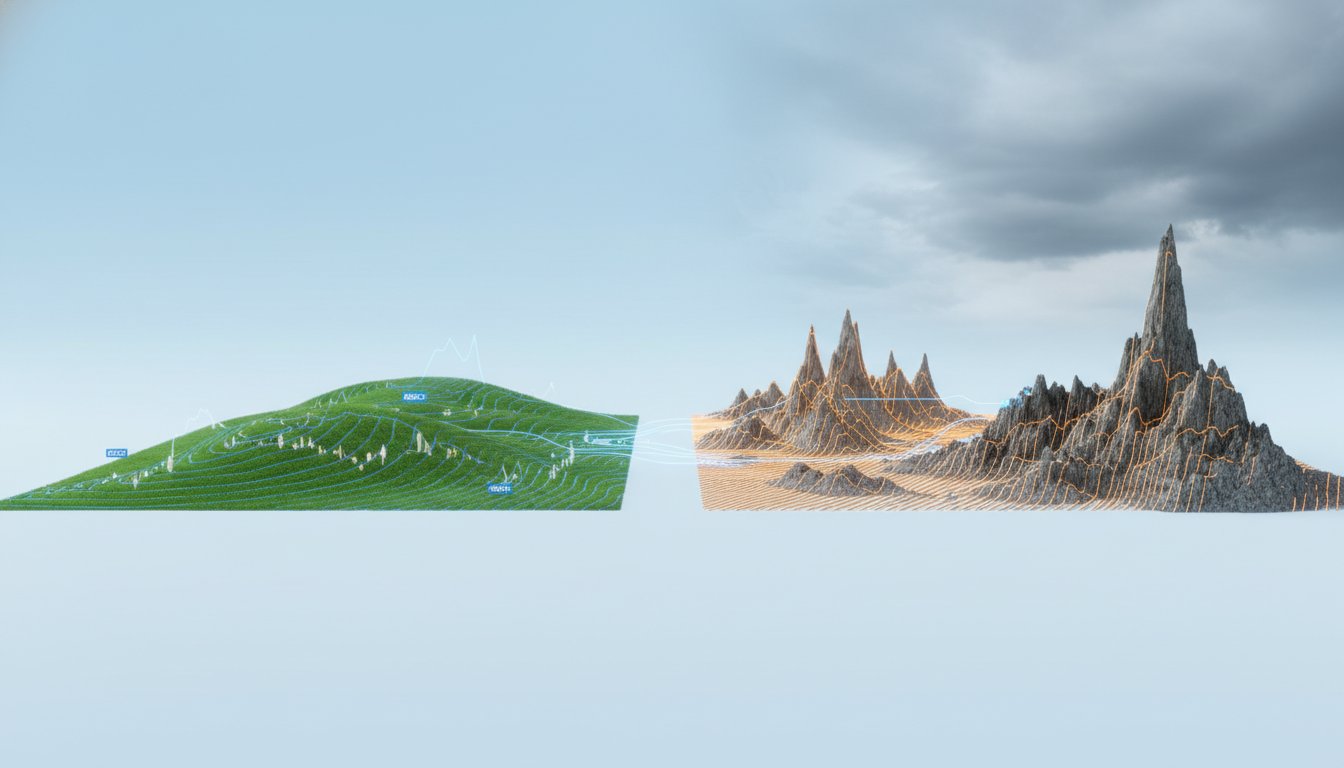

Structural Inflation Shift Requires Real Asset Portfolio Diversification

A new inflationary regime emerges, driven by AI infrastructure booms and wealth concentration, forcing a shift from traditional 60-40 portfolios to real assets for inflation hedging.

View Episode Notes →

Policy Implementation Drives Market Focus Beyond Directional Bets

Markets now adapt to established policies, not anticipate shifts. Focus on implementation, trade rulings, and executive actions for impact, as legislative changes face gridlock.

View Episode Notes →

AI CapEx Financing and IG Bond Supply Challenges Global Rates

AI CapEx financing will drive massive bond supply, yet credit spreads are expected to widen only modestly, challenging client assumptions about market capacity.

View Episode Notes →

Fed Prioritizes Market Stability Through Asset Purchases

The Fed prioritizes market stability, injecting liquidity via asset purchases to counter Treasury issuance and support asset prices, signaling a "run it hot" thesis for equities.

View Episode Notes →

2026 Credit Cycle: Stimulus, AI Fueling Issuance Before Burnout

A stimulative backdrop and AI investment will spur corporate risk-taking, causing the credit cycle to burn hotter before it burns out in 2026, necessitating wider spreads.

View Episode Notes →

Fed's Data-Dependent Policy Prioritizes Labor Amidst Lasting Inflation

Fed shifts to data-dependent rate cuts, prioritizing labor support even with inflation above target until 2027, signaling market volatility and dollar depreciation.

View Episode Notes →

Asia's 2026 Recovery Driven by Non-Tech Exports and China Equity Stability

Asia's 2026 export growth broadens beyond tech, fueling wider economic recovery through job creation and consumption, while China's equity market stabilizes with a focus on innovation sectors.

View Episode Notes →

European Equities: Multiple Expansion Over Earnings Growth Amidst Structural Headwinds

European equities may rise through multiple expansion, driven by U.S. strength and AI adoption, while facing earnings downgrades from China competition and slower German fiscal execution.

View Episode Notes →

AI-Driven Productivity and Rate Cuts Fuel Market Broadening

AI-driven productivity, Fed rate cuts, and deregulation fuel a broadening market beyond tech, favoring cyclicals and quality companies with strong pricing power.

View Episode Notes →

AI Drives Retail Transformation Through Six Key Dimensions

AI transforms retail by enhancing personalization, boosting shopper spend by 25%, and driving GDP growth, while agentic commerce introduces new risks and opportunities.

View Episode Notes →

K-Shaped Economy: Slowing Wage Growth and Divergent Consumer Spending

Slowing real wage growth to stall speed will cut consumption growth to 1% in late 2025, impacting lower- and middle-income households, while higher-income consumers benefit from wealth effects.

View Episode Notes →

U.S. Equity Valuation Justified by Profitability and Policy; AI Drives Bond Issuance

Elevated U.S. equity multiples are justified by higher profit margins and tech weighting, supported by policy tailwinds and broadening earnings growth.

View Episode Notes →