European Equities: Multiple Expansion Over Earnings Growth Amidst Structural Headwinds

TL;DR

- European equities may benefit from U.S. market strength through multiple expansion, as Europe trades at a significant discount, anticipating a broadening economic recovery that could lift valuations.

- Structurally rising China competition and Europe's old economy exposure are expected to drive earnings downgrades, particularly in sectors like chemicals, autos, and luxury goods, despite optimistic consensus forecasts.

- German fiscal policy presents a mixed outlook, with slower execution on infrastructure spending potentially dampening earnings, while increased defense spending offers a more optimistic, albeit small, sector-specific opportunity.

- AI adoption could become a significant bull case for European equities if ROI becomes material, as the majority of the European index is exposed to adoption challenges and productivity gains.

- Banks are favored due to their positive exposure to yield curve steepness and consistent delivery of high earnings upgrades, offering attractive valuations with significant buyback and dividend yields.

- Utilities are poised for multi-year growth driven by high CapEx on the energy transition and increasing investor willingness to reward returns, fueled by the power demand from AI.

Deep Dive

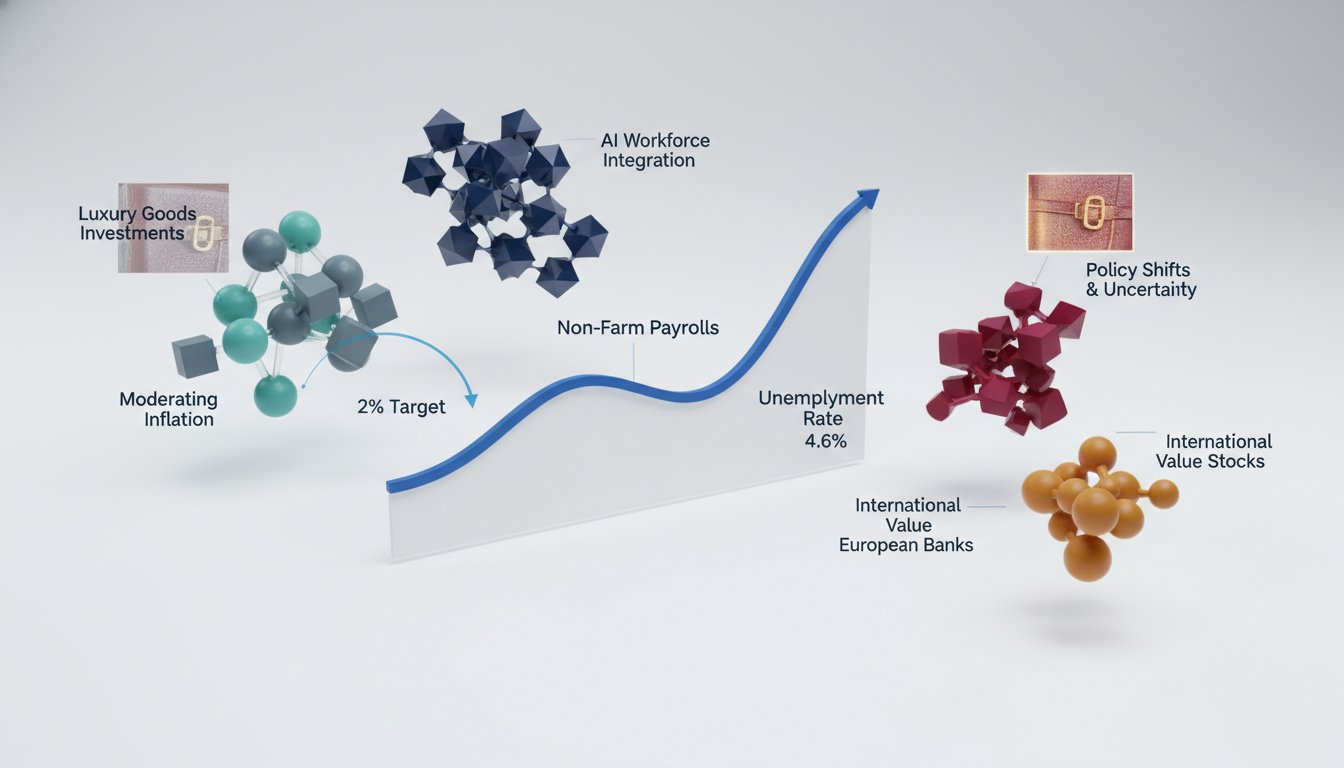

European equities in 2026 face a complex outlook, influenced by U.S. market dynamics and internal structural challenges, with potential upside driven more by multiple expansion than robust earnings growth. While the U.S. market's projected 15% upside could provide a supportive "slipstream," Europe's earnings growth is expected to lag significantly, necessitating a focus on valuation discounts and thematic opportunities to drive returns.

The primary headwinds for European earnings stem from structurally rising competition from China, particularly impacting old-economy sectors like chemicals, autos, and luxury goods, where demand is not accelerating. This competitive pressure has historically accounted for 60-90% of European earnings downgrades. Furthermore, the execution pace of Germany's fiscal initiatives, especially the reallocation of its infrastructure fund towards social spending, poses a drag on corporate earnings, though the defense sector shows strong execution and optimism. A significant potential catalyst for European stocks, however, lies in accelerating AI adoption; if the return on investment from AI becomes undeniable, Europe's broad exposure to adoption rather than just invention could drive substantial productivity gains and stock performance, particularly from the second half of the year onwards.

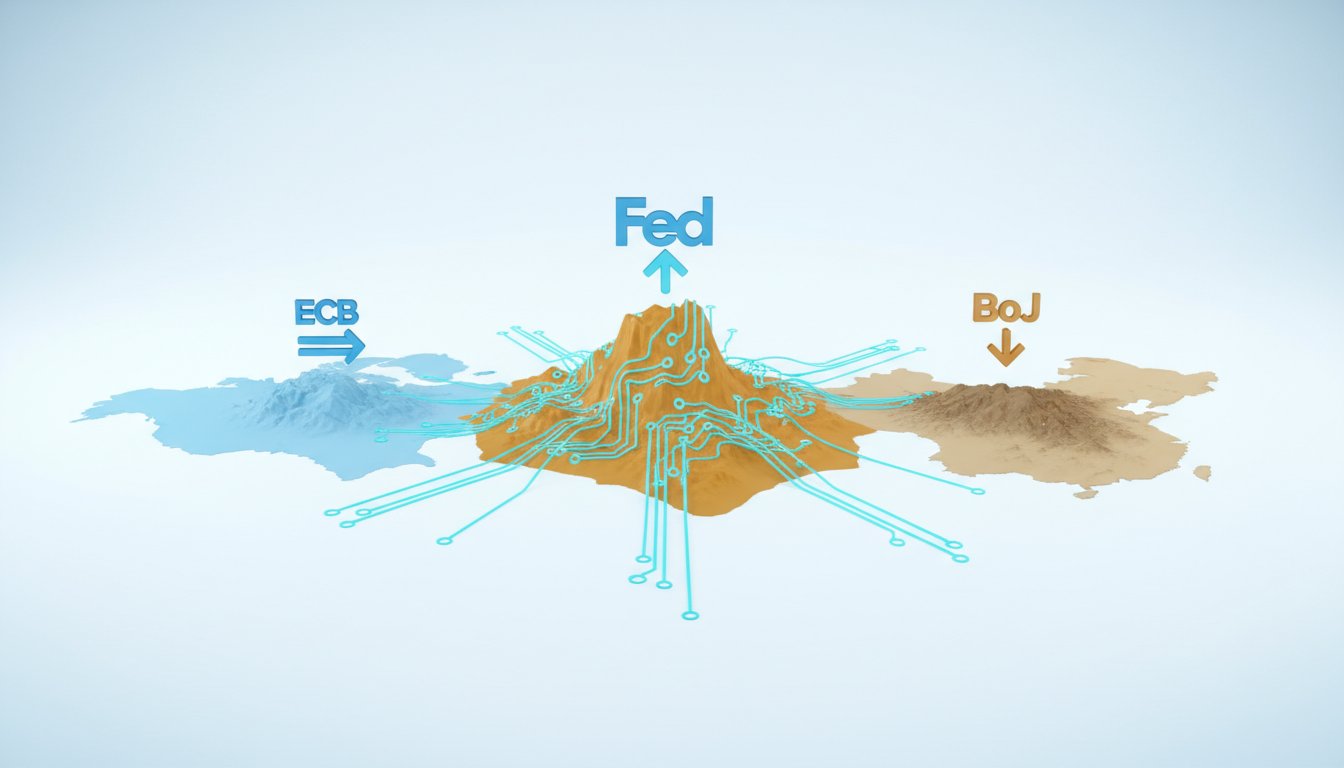

Based on a data-driven model incorporating themes, cycle views, and quant factors, the outlook favors sectors positioned to benefit from fiscal constraints and the energy transition. Banks are exceptionally favored, screening at the top of the model due to their positive exposure to a steepening yield curve and consistent delivery of earnings upgrades, while remaining attractively valued with strong buyback and dividend yields. Defense is also a preferred sector, benefiting from increased demand and execution. Utilities have recently broken out of a long-term downtrend and are seen as a multi-year play, with renewed investor willingness to reward their capital expenditure on the energy transition, especially given the burgeoning demand for power to support AI infrastructure.

Action Items

- Audit European earnings forecasts: Compare consensus 13% growth to model's 4% for 3-5 key sectors (chemicals, autos, luxury) to identify downgrade risks.

- Analyze China competition impact: Quantify historical 60-90% downgrade driver on 3-5 China-exposed sectors to assess future earnings vulnerability.

- Evaluate German fiscal execution: Track infrastructure fund reallocation (social spend vs. company earnings) and defense spending pace for 2-3 quarters.

- Measure AI adoption ROI: Monitor early adopter performance for 5-10 European companies to predict broader AI-driven productivity gains.

- Track bank sector upgrades: Monitor earnings upgrade consistency and valuation multiples for European banks against 9x PE target.

Key Quotes

"As we look ahead to 2026, there's a lot going on in Europe stock markets. From shifting economic wins to new policies coming out of Brussels and Washington, the investment landscape is evolving quite rapidly. Interest rates, profit forecasts, and global market connections are all in play."

Paul Walsh introduces the discussion by highlighting the dynamic and rapidly evolving nature of the European stock market landscape for 2026. He points out that various factors, including economic shifts, policy changes, interest rates, and profit expectations, are all contributing to this complex environment.

"But the year 2025, I would say is a year of two halves. So, we began the year with a lot of, kind of, under performance at the end of 2024 after U.S. elections, for Europe and a decline in the euro. The start of 2025 saw really strong performance for Europe, which surprised a lot of investors. And we had kind of catalyst after catalyst, for that upside, which was Germany’s ‘whatever it takes’ fiscal moment happened early this year, in the first quarter."

Marina Zavolock summarizes 2025 as a bifurcated year for European stocks, noting an initial underperformance followed by a surprisingly strong first half driven by catalysts like Germany's fiscal policy and positive developments regarding the Russia-Ukraine conflict. She indicates that this strong start was not universally anticipated by investors.

"But our upside is more driven by multiple expansion than it is by earnings growth. Because what we continue to see in Europe and what we anticipate for next year is that consensus is too high for next year. Consensus is anticipating almost 13 percent earnings growth. We're anticipating just below 4 percent earnings growth. So, we do expect downgrades."

Marina Zavolock explains that while European equities may see upside in 2026, this is expected to be primarily due to multiple expansion rather than robust earnings growth. She contrasts the consensus forecast of nearly 13 percent earnings growth with her team's expectation of just under 4 percent, anticipating that downgrades are likely.

"And thematically, why do we see these downgrades? And I think it's something that investors probably don't focus on enough. It's structurally rising China competition and also Europe's old economy exposure, especially in regards to the China exposure where demand isn't really picking up."

Marina Zavolock identifies structurally increasing competition from China and the exposure of Europe's traditional industries to this dynamic as key thematic reasons for expected earnings downgrades. She emphasizes that this factor, which has driven significant downgrades in previous years, is often underestimated by investors.

"And this is the real bull case for me in Europe. If AI adoption, ROI starts to become material enough that it's hard to ignore, which could start, in my opinion, from the second half of next year. Then Europe could be seen as much more of a play on AI adoption because the majority of our index is exposed to adoption."

Marina Zavolock presents AI adoption as a significant potential bull case for European equities, suggesting that if the return on investment becomes substantial enough, Europe's broad exposure to AI adoption could drive market performance. She believes this trend could become more pronounced from the latter half of the following year.

"And if you look -- whether it's at our sector model or you look at our top 50 preferred stocks in Europe, the list is full of Banks. And I didn't mention this in the thematic portion, but one of the themes in Europe outside of Germany is fiscal constraints. And actually, Banks are positively exposed to that because they're exposed to the steepness -- positively to the steepness -- of the yield curve."

Marina Zavolock highlights that banks are prominently featured in their sector model and top stock picks for Europe, attributing this preference to their positive exposure to fiscal constraints and the steepness of the yield curve. She notes that this sector consistently delivers strong earnings upgrades and remains attractively valued.

Resources

External Resources

Articles & Papers

- "The Outlook for European Stocks in 2026" (Thoughts on the Market) - Discussed as the primary topic of the episode, analyzing key drivers, risks, and sector shifts for European equities.

People

- Paul Walsh - Co-host, Head of Research Product in Europe at Morgan Stanley.

- Marina Zavolock - Co-host, Chief European Equity Strategist at Morgan Stanley.

- Mike Wilson - Mentioned for his view on the outlook for U.S. equity markets, influencing the "slipstream" concept for European stocks.

Organizations & Institutions

- Morgan Stanley - The institution where Paul Walsh and Marina Zavolock are employed.

- NFL (National Football League) - Mentioned in the context of U.S. elections and their potential impact on European markets.

- European Union (Brussels) - Mentioned in relation to new policies evolving the investment landscape.

Other Resources

- AI adoption - Discussed as a potential bull case for Europe, with potential ROI becoming material from the second half of the next year.

- Germany's 'whatever it takes' fiscal moment - Referenced as a catalyst for strong European performance in the first quarter of 2025.

- Russia-Ukraine negotiations - Mentioned as a theme that emerged within the European equities market, driving upside.

- Tariffs - Discussed as a concern for investors leading into Liberation Day, prompting diversification out of U.S. equities.

- German fiscal policy - Discussed as a multi-year story with a focus on the pace of execution for 2026, including an infrastructure fund and defense spending.

- Energy transition - Mentioned as a driver for high CapEx growth in the utilities sector.

- Quantamental model - Described as a data-driven model incorporating themes, cycle views, and quant factors, used to inform sector preferences.