China's Export Dumping, Distorted Capitalism, and AI Bubble Risks

TL;DR

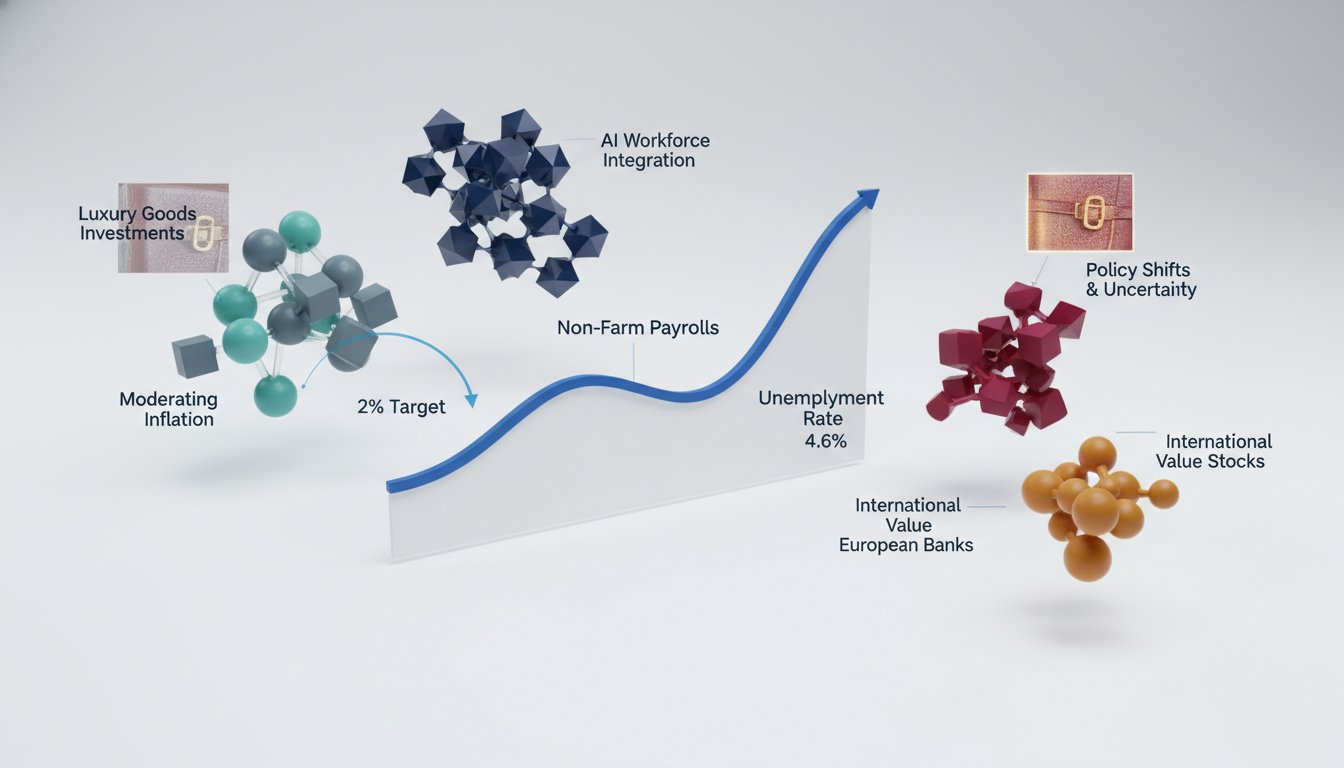

- China's export strategy of surging volumes with declining prices is creating a global backlash, intensifying in 2026 as countries shift focus from US trade battles to this "dumping" phenomenon.

- Distorted capitalism, characterized by wealth concentration and socialized losses, will continue producing perverse outcomes like unaffordability and entrenched incumbents, necessitating a return to pro-churn principles.

- Globalization outside the US continues in trade, with countries forming new agreements, even as immigration faces a Western Hemisphere backlash, leading to collapsed immigration rates.

- The AI bubble is susceptible to a sharp correction when interest rates rise, potentially by year-end, as sticky inflation and liquidity dry up, signaling a shift in asset support.

- Declining alcohol consumption, driven by health awareness and debunked myths about its benefits, is negatively impacting alcohol stocks, mirroring the earlier shift away from cigarettes.

- The current market rally is supported by earnings growth, but this growth is concentrated in a few stocks, and a deceleration in nominal GDP growth could challenge future valuations.

- Retail investors are "all in" with record margin loan balances and high positioning, contrasting with institutional investors who are neutral or underweight due to market concentration.

Deep Dive

The current form of capitalism is a distorted model, characterized by widening income and wealth inequality, entrenched incumbents, and a decline in the pro-churn, pro-competition dynamism that defines true capitalism. This distortion is leading to widespread disillusionment, particularly among young people, who express a preference for socialism, signaling a profound disenchantment with the existing system and its inability to address affordability crises or foster upward mobility.

The crisis of affordability, especially in the housing market, is a direct consequence of excessive regulation that has severely constrained new home supply. This regulatory burden, despite population growth, has kept new home construction at levels seen decades ago. The resulting imbalance between rising demand and stagnant supply inflates home prices, making homeownership unattainable for younger generations and contributing to broader economic anxieties. This system, where the rich benefit from capitalism's upside while losses are socialized, is unsustainable and will continue to produce perverse outcomes.

Globally, while the United States withdraws from the global trade system, other nations are increasingly engaging in trade agreements and increasing their trade volumes independently. This shift indicates a recalibration of globalization, with trade continuing outside of American participation. However, globalization faces significant challenges in the realm of immigration, where a backlash against immigrants is evident across the Western hemisphere, leading to collapsed immigration rates in many parts of Europe and America.

A significant emerging trend is China's aggressive export strategy, characterized by surging export volumes coupled with declining prices. This "dumping" of goods is hurting manufacturing sectors globally, from Europe to Southeast Asia, and is expected to intensify, leading to a significant backlash against China's trade practices in the coming years.

The market faces a potential bubble driven by artificial intelligence, which could deflate rapidly if interest rates rise significantly. Sticky inflation and existing liquidity could sustain this bubble, but an increase in long-term interest rates, possibly by year-end, would dry up the money fueling these assets. This scenario suggests that higher interest rates, rather than lower ones, could be the surprise, impacting financial assets and potentially leading to an economic slowdown.

Alcohol consumption is declining globally, even in countries like Russia, due to increased awareness of its negative health consequences and the debunking of its purported health benefits. This trend is impacting alcohol stocks, which have been among the worst-performing sectors, as consumers, particularly younger generations, turn away from alcohol, similar to the shift away from cigarettes previously.

Disinflationary forces are present, but a return to widespread deflation is unlikely because the current economic landscape is supported by both fiscal and monetary policy, unlike past disinflationary periods. While equity markets have performed well, with the US leading, the currency dynamic is shifting, suggesting potential gains for investors in Asian markets due to expected dollar weakening against currencies like the yen and renminbi.

The equity market's momentum is supported by fiscal stimulus, regulatory easing, and the lagged effects of monetary stimulus, creating a favorable environment for continued market climbs. However, a significant portion of recent market returns has been driven by earnings growth, with expectations for continued double-digit earnings growth in 2026. This outlook is contingent on top-line acceleration and margin expansion, which may be challenged by a potential deceleration in nominal GDP growth.

While institutional investors are largely neutral, retail investors are heavily invested, showing maxed-out positioning and significant growth in margin loan balances, indicating a high level of risk-taking. This concentration in a few leading stocks, particularly in the tech sector, limits institutional investors' ability to participate fully, forcing them to be underweight these leaders. Fixed income performance is expected to be constrained due to lower current yields, suggesting a preference for equities over credit.

For individual investors, navigating market volatility requires careful positioning to avoid being forced to sell during downturns. This means avoiding overconcentration in specific factors, limiting leverage, and ensuring overall allocation is not so extended that liquidity needs during inevitable volatility force equity sales. While earnings growth is projected, its concentration in a few stocks may not be sustainable, necessitating a broadening of market participation, which has been anticipated but not yet realized. The Korean stock market (Kospi), heavily influenced by major tech companies, exhibits pronounced boom-bust cycles, indicating a high-risk, speculative environment.

LinkedIn's growth in membership and revenue is attributed to its requirement for real names, which helps mitigate toxicity, misinformation, and scams, fostering more trustworthy and careful interactions. This professional networking environment is becoming increasingly valued for its quality of discourse and curated content, even beyond job seeking.

The decline in alcohol consumption is mirrored by a reduction in corporate spending on "happy hours" and lavish parties. This shift, driven by remote work trends, a desire for early evenings, and increased health consciousness, signifies a cultural change away from traditional office schmoozing opportunities.

Action Items

- Audit China's export pricing: Analyze 20% annual price cuts against 40% volume surge to identify dumping impact on manufacturing sectors.

- Create affordability crisis framework: Define 5 key regulatory impacts on home supply to address affordability for young Americans.

- Measure capitalism distortion: Quantify income and wealth inequality trends to assess deviation from pro-churn and pro-competition principles.

- Track global trade shifts: Monitor trade volumes outside America to assess globalization's continuation despite US withdrawal.

- Evaluate AI bubble risk: Monitor interest rate movements and liquidity levels to identify potential end of AI bubble inflation.

Key Quotes

"the main reason i wrote the book is something that you teased just now in your introduction which is that so many young people today when they are polled in america say that they are disillusioned with capitalism and in fact many of them particularly progressives say that they would rather have socialism now that tells you about what is the disenchantment with the current system that we have and what i've tried to do in the book and i don't think i would change anything from what i wrote about this 18 months ago when it was published is that you've seen more of that which is that we're seeing much wider income inequality wealth inequality and we are seeing a lot of the incumbents get much more entrenched and my point is that capitalism is not supposed to work this way capitalism is supposed to be pro churn it's supposed to be pro competition and we are supposed to weed out a lot of the old players rather than have this kind of system where it gets sclerosis"

Rushir Sharma explains that the core motivation for his book was to address the widespread disillusionment with contemporary capitalism among young people, many of whom express a preference for socialism. Sharma argues that this disenchantment stems from increasing income and wealth inequality, and the entrenchment of existing players, which contradicts capitalism's intended function of promoting churn and competition.

"well the main reason for that is that the amount of regulation we've had in the system that has made home supply in very short supply in fact so the number of new homes we're building in america today is roughly the same level as it was 30 40 years ago when the population was a lot less the kind of regulation we have today makes it very difficult to build new homes so demand keeps going up but supply just doesn't come on the market"

Rushir Sharma identifies excessive regulation as the primary driver of the unaffordable home prices in America. Sharma points out that current home construction levels are stagnant compared to decades ago, despite population growth, because regulations make building new homes exceedingly difficult. This imbalance between rising demand and limited supply, Sharma contends, is a key issue within the current capitalist system.

"i think the single biggest story of 2026 which could emerge is the fact that china's dumping is causing so much pain to so many countries around the world what exactly is going on here which is that china's always known to be an export powerhouse but over the last decade or so this is beginning to shift in one very important way in the past yes china would export a lot and it would also increase prices over time last few years what's begun to happen and this has become more acute in the last couple of years that china's export volumes have surged but it has done so by cutting prices so chinese export prices are declining by 20 a year whereas export volumes are surging by 40 and that is leading to a flood of chinese goods around the world which is hurting the manufacturing sector in places from europe to southeast asia and i suspect that that backlash will really become more intense in 2026 because a lot of these countries were so focused on fighting trump's trade battle in 2025 but that seems to have peaked now i think the attention is going to turn to what china does and i think that the backlash against this china dumping is going to get pretty intense this year"

Rushir Sharma highlights China's export strategy as a potentially significant global story for 2026, noting a shift from increasing prices to surging export volumes driven by price cuts. Sharma explains that China's export prices are decreasing by 20% annually while volumes increase by 40%, leading to a global influx of Chinese goods that harms manufacturing sectors worldwide. Sharma anticipates an intensified backlash against this "China dumping" in 2026 as countries shift their focus from trade battles with the US to China's practices.

"well i think that the world is very sensitive to higher interest rates i know that some of the previous guests are forecasting lower interest rates this year but i think that the real surprise could be that by the end of this year we get higher interest rates particularly long term interest rates and when interest rates go up that's when money really starts to dry up so i think that what you're alluding to here tom is the fact that i wrote that we have some sort of an ai bubble but the bubble can keep inflating until interest rates go up and money dries up i think that that happens possibly by the end of the year when you end up getting higher interest rates as inflation remains sticky and the fact that we still have you know like a lot of this liquidity propping up financial assets but the moment interest rates go up particularly long term interest rates that's when money dries up"

Rushir Sharma suggests that higher interest rates, particularly long-term ones, could be a significant surprise by the end of the year, leading to a drying up of money. Sharma posits that this rise in interest rates, potentially driven by sticky inflation and existing liquidity supporting financial assets, could burst any existing bubbles, including a potential AI bubble. Sharma believes that the moment long-term interest rates increase, the flow of capital will be significantly curtailed.

"well i think pair it back to pair it back to basic fundamentals if we look from 1973 through to present day we can count the nber recessions we look at the economic data today it is not pointing to a recession in the us and we've got fiscal stimulus and monetary support in the rest of the world take a look at s p total returns over those periods in a non recession year nine times out of 10 the s p 500 gives a positive total return so the idea that one would bet against the economic momentum today when you've got everything aligned fiscal stimulus regulatory easing the lagged effect of monetary stimulus all coming together in 2026 i would be betting on equity markets continuing to climb a wall of worry and some of the investment spending from companies needing to play catch up in order to stay relevant in terms of a growing global economy"

John Bilton argues that current economic data does not indicate a recession in the U.S., especially when considering the presence of fiscal stimulus and monetary support globally. Bilton notes that historically, in non-recessionary years, the S&P 500 has delivered positive total returns approximately nine out of ten times. Bilton suggests that with aligned fiscal stimulus, regulatory easing, and the lagged effects of monetary stimulus, betting against economic momentum and expecting equity markets to continue climbing is a reasonable position.

"well i think that the key message is when we think about volatility in markets and as being an individual investor the most important thing is to make sure that you are not positioned in a way that when volatility eventually does strike that you are forced to sell positions that you shouldn't that's the only way to destroy value over the long run so what that means is not being overconcentrated to certain factors not having too much leverage and making sure that the overall allocation is not so extended that if you have liquidity needs during a time of inevitable volatility you don't have to sell your equities"

Cameron Dawson advises individual investors that the most crucial

Resources

External Resources

Books

- "What Went Wrong with Capitalism" by Rushir Sharma - Mentioned as a book that won awards in 2024 and is recommended for young people disillusioned with capitalism.

Articles & Papers

- "Top 10 Trends for 2026" (Financial Times) - Mentioned as a publication where Rushir Sharma's work is celebrated.

People

- Rushir Sharma - Author of "What Went Wrong with Capitalism" and chairman at Rockefeller International.

- Paul Sweeney - Co-host of the podcast, mentioned in relation to Rushir Sharma's book.

- John Bilton - Global Multi-Asset Strategist at JP Morgan Asset Management, discussed regarding disinflation and output.

- Cam Dawson - With New Edge Wealth, discussed market outlooks and retail investor positioning.

- Kevin Gordon - With Schwab, mentioned in relation to cookies and market insights.

- Lizanne Saunders - Mentioned in relation to Kevin Gordon and market insights.

- Dan Roth - Credited with saving LinkedIn for Microsoft.

- Shanali Bassick - Advised someone to get back on LinkedIn.

- Tina Afford him - Mentioned as a guest on LinkedIn.

- Tom Keen - Mentioned in relation to LinkedIn content.

- Lisa Matteo - Mentioned in relation to LinkedIn content.

- Bo Bichette - Blue Jays shortstop and free agent, mentioned in relation to an offer from a Toronto steakhouse.

Organizations & Institutions

- Bloomberg Surveillance - The podcast where the discussion is taking place.

- Bloomberg Audio Studios - Mentioned as the producer of the podcast.

- Rockefeller International - Affiliation of Rushir Sharma.

- JP Morgan Asset Management - Affiliation of John Bilton.

- ECB (European Central Bank) - Mentioned in relation to monetary policy and interest rates in Europe.

- New Edge Wealth - Affiliation of Cam Dawson.

- Schwab - Affiliation of Kevin Gordon.

- Charles Schwab - Mentioned in relation to retail investors and market seminars.

- Deutsche Bank - Mentioned in relation to positioning indicators.

- Goldman Sachs - Mentioned in relation to positioning indicators.

- Aai - Mentioned in relation to retail investor positioning.

- Blue Jays - Baseball team for which Bo Bichette plays.

- Yankees - Baseball team showing interest in Bo Bichette.

- Microsoft - Owner of LinkedIn.

- The Journal (Wall Street Journal) - Mentioned for its reporting on LinkedIn and happy hour trends.

- NBER (National Bureau of Economic Research) - Mentioned in relation to counting recessions.

- Mag 7 - Group of stocks mentioned for their earnings growth.

Websites & Online Resources

- LinkedIn - Social media platform discussed for its growth and user behavior.

- Apple CarPlay - Mentioned as a way to listen to the podcast.

- Android Auto - Mentioned as a way to listen to the podcast.

- Bloomberg Business App - Mentioned as a way to access the podcast.

- YouTube - Mentioned as a platform to watch the podcast live.

Other Resources

- Capitalism - A core theme discussed throughout the episode.

- Socialism - Mentioned as an alternative system by some young people.

- Populism - Discussed in the context of post-Trump politics.

- Affordability Crisis - Discussed in relation to home prices in America.

- Regulation - Mentioned as a factor affecting home supply.

- Globalism - Discussed in relation to trade and immigration.

- Protectionism - Mentioned in relation to countries like India.

- Dumping (Chinese) - Discussed as a factor impacting global manufacturing.

- Interest Rates - Discussed in relation to economic bubbles and money drying up.

- AI Bubble - Mentioned as a potential market bubble.

- Peak Alcohol - A trend discussed regarding declining alcohol consumption.

- Cannabis - Mentioned as a potential substitute for alcohol.

- Disinflation - A key economic concept discussed by John Bilton.

- Deflation - Mentioned as a potential outcome of disinflation.

- Made in Germany Plan - Mentioned in relation to capital expenditure in Europe.

- Fiscal Stimulus - Discussed as a factor supporting equity markets.

- Monetary Support - Discussed as a factor supporting equity markets.

- Equity Markets - Discussed in terms of performance and future outlook.

- Bonds - Discussed in terms of performance and future outlook.

- Alternatives (Asset Allocation) - Mentioned as part of JP Morgan Asset Management's strategy.

- Credit - Discussed in relation to asset allocation.

- Margin Loan Balances - Mentioned in relation to retail investor activity.

- Fixed Income - Discussed in relation to asset allocation and yields.

- High Yield (Bonds) - Mentioned in relation to bond market spreads.

- Investment Grade (Bonds) - Mentioned in relation to bond market spreads.

- S&P 500 - Stock market index discussed for its returns.

- Earnings Growth - Discussed as a driver of market performance.

- Nominal GDP Growth - Mentioned in relation to sales forecasts.

- Margin Expansion - Discussed in relation to earnings forecasts.

- Kospi - Korean stock market index.

- Casino Capitalism - Mentioned in relation to the Korean index.

- Happy Hour - Discussed as a declining trend.

- Corporate Card - Mentioned in the context of past business spending.

- Work from Home - Discussed as a factor influencing social trends.

- Trading Desk - Mentioned in the context of past market practices.

- Investment Banking - Mentioned in the context of past market practices.