Hong Kong Property Rebound Driven By Systemic Policy and Demographic Shifts

The Hong Kong property market is at a pivotal moment, signaling a synchronized rebound across residential, office, and retail sectors for the first time in nearly a decade. This isn't merely a cyclical uptick; it's a complex interplay of policy shifts, demographic resurgences, and evolving global capital flows that global investors often overlook. The non-obvious implication here is that Hong Kong's resilience, driven by factors like removed stamp duties and a talent influx, positions it as a unique nexus for China-world monetary interconnection, a dynamic that can predict broader Asian liquidity trends. Investors who grasp these deeper systemic drivers, rather than just the headlines, gain an advantage in anticipating regional capital movements and identifying durable opportunities overlooked by consensus.

The Unseen Currents Beneath Hong Kong's Property Surge

The narrative around Hong Kong real estate often focuses on immediate price movements. However, Praveen Choudhary's analysis reveals a more intricate system at play, one where seemingly minor policy adjustments and demographic shifts cascade into significant, synchronized market movements. The current upturn, characterized by a projected 10%+ residential price growth in 2026, a stabilizing Central office market, and an improving retail environment, is the clearest signal since 2018. This isn't just a recovery; it's a testament to how specific, often uncelebrated, systemic adjustments can unlock pent-up demand and redefine market dynamics.

Policy's Unintended Consequences: The Stamp Duty Deluge

The most striking catalyst for the residential market's turnaround is the February 2024 removal of extra stamp duties. While ostensibly a measure to simplify transactions for mainland and foreign buyers, its downstream effect has been profound. Previously, these duties acted as a significant barrier, capping the participation of a crucial buyer demographic. Post-removal, mainland buyers now account for 50% of unit sales, a dramatic surge from 10-20%. This policy shift didn't just lower transaction costs; it fundamentally altered the demand-side equation, creating a supply-demand mismatch that defies the consensus view, which attributed the initial recovery solely to lower interest rates.

"With those extra charges gone, buying and selling real estate in Hong Kong, especially for mainlanders, is a lot more straightforward and penalty-free. In fact, post the removal of the stamp duty, the percentage of units that has been sold to mainlanders have gone to 50 percent of total. Earlier it used to be 10-20 percent."

This policy decision highlights a common pitfall: focusing on the immediate benefit (simplified transactions) while underestimating the systemic impact of unlocking a vast pool of capital. The "penalty-free" aspect, combined with improved affordability and a positive wealth effect from a surging Hang Seng Index, creates a powerful feedback loop. This demonstrates how a seemingly localized policy can have far-reaching implications for capital flows and market sentiment across Asia, acting as a leading indicator for broader liquidity trends.

The Demographic Dividend: More Than Just Numbers

The narrative of Hong Kong's population decline during COVID is now being rewritten by a renewed inflow of talent. The projected 140,000 visa approvals in 2025, double pre-COVID levels, signifies a strategic re-engagement with global talent. This isn't just about filling seats; it's about fostering new household formations and injecting vitality into the economy. This demographic shift, coupled with the policy-driven influx of mainland buyers, creates a robust demand base that underpins the residential market's strength.

The key insight here is how population growth, driven by deliberate policy, directly impacts housing demand and affordability. When housing prices decline to a long-term average relative to income, and mortgage rates fall, this demographic tailwind creates a powerful pull for pent-up demand. This effect is amplified by the wealth effect from the equity market, illustrating a complex system where financial markets, policy, and demographics are inextricably linked. The non-obvious advantage lies in recognizing that population growth isn't just a statistic; it's a fundamental driver of real estate cycles, especially when it's policy-induced and aligns with improving affordability.

The "Positive Carry" and Hong Kong's Global Role

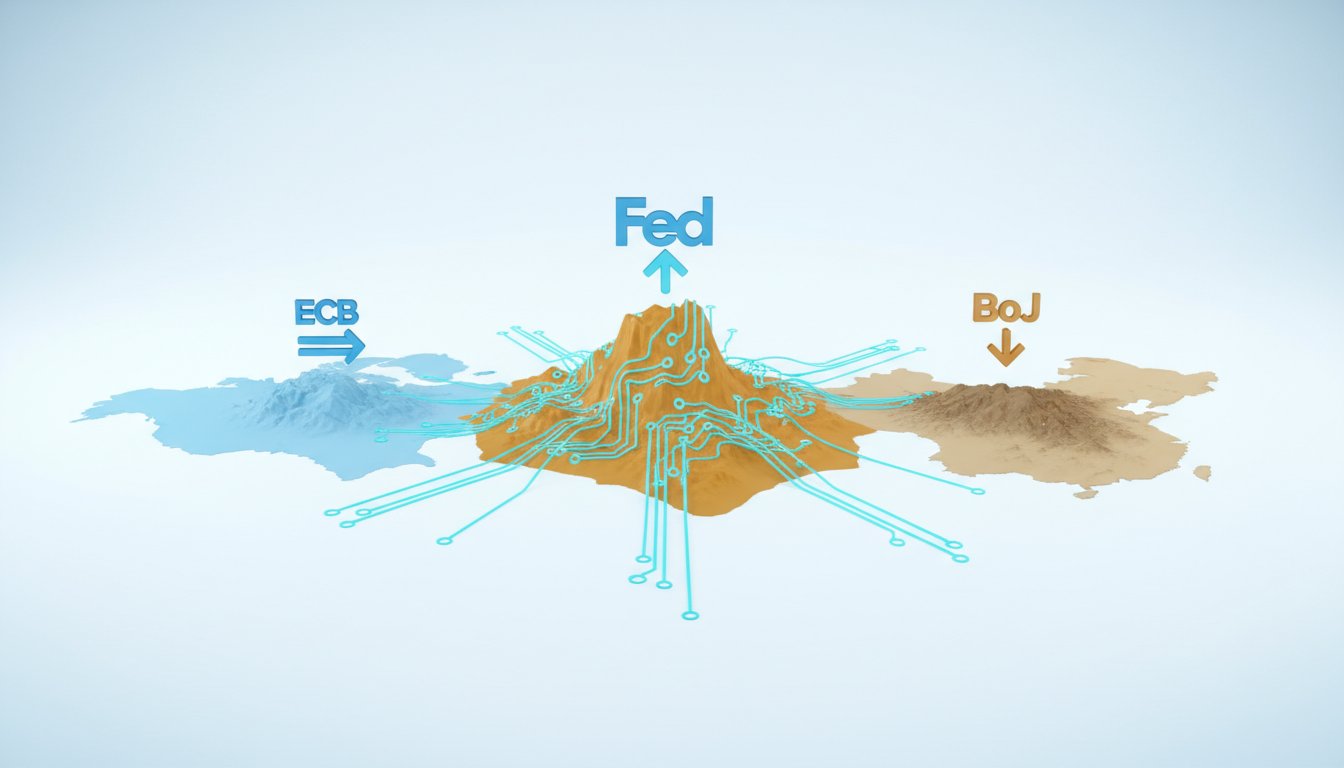

Choudhary's analysis introduces the concept of "positive carry" -- a situation where rental income outpaces mortgage interest costs -- as a critical driver, alongside the supply-demand imbalance. This is particularly relevant in a market influenced by global monetary policy, such as Federal Reserve rate cuts impacting mortgage rates. This dynamic creates a scenario where holding property becomes increasingly attractive, incentivizing investment and further bolstering prices.

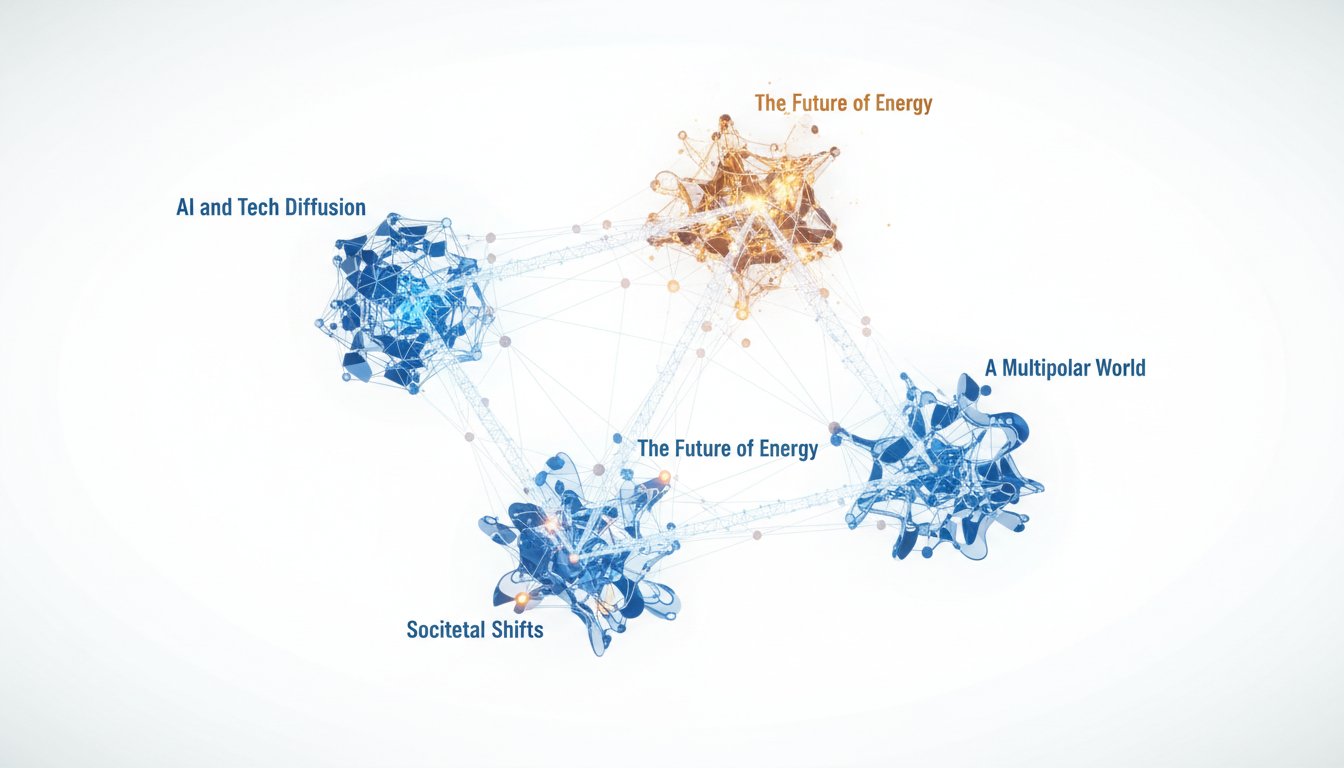

Crucially, Choudhary frames Hong Kong not just as a real estate market, but as a vital hub for "global monetary interconnection between China and the world." This perspective elevates the analysis beyond local factors, positioning Hong Kong as a bellwether for international capital flows and liquidity. The synchronized upturn across residential, office, and retail suggests that this interconnectedness is strengthening, offering a unique vantage point for investors. The delayed payoff for understanding this systemic role is the ability to anticipate broader Asian market shifts, identifying opportunities that emerge from this unique global nexus. This is where conventional wisdom, focusing only on local supply and demand, fails to capture the full picture.

The Office and Retail Echoes: A Systemic Turnaround

While residential prices lead the charge, the positive momentum is rippling through the office and retail sectors. The stabilization of Central district office rents and the improvement in retail sales indicate a broader economic confidence returning to Hong Kong. This synchronized growth across all three major segments is the clearest sign of a systemic turnaround, suggesting that the drivers identified in the residential market are having a broader economic impact.

The implication is that the policy shifts and demographic strengthening are not isolated phenomena but are contributing to a more robust and dynamic economic environment. As residential demand picks up, it fuels consumer spending, which in turn supports retail, and as economic activity increases, it bolsters demand for office space. This interconnectedness means that the positive trends are mutually reinforcing, creating a virtuous cycle that is more durable than a single-sector boom. Recognizing this systemic reinforcement provides a more accurate forecast of the market's trajectory and its potential to outperform isolated sector analyses.

Actionable Takeaways for Navigating the Hong Kong Market

- Immediate Action: Re-evaluate Hong Kong real estate exposure, particularly residential, recognizing the policy-driven shift in mainland buyer participation. This requires understanding the new demand dynamics beyond historical averages.

- Short-Term Investment (Next 6-12 months): Monitor the "positive carry" in residential properties, as declining interest rates while rents rise create an attractive holding environment. This offers a tangible benefit that compounds over the short term.

- Strategic Adjustment: Consider Hong Kong's role as a global monetary interconnection point. This insight can inform broader Asian investment strategies, anticipating shifts in liquidity and capital flows that may not be evident in other markets.

- Longer-Term Investment (12-24 months): Invest in retail and office spaces that benefit from increased household formation and economic activity spurred by residential market strength. This requires patience, as these sectors follow the residential lead.

- Contrarian Thinking: Challenge the consensus view that Hong Kong's recovery is solely tied to China's negative residential outlook. Focus on the unique drivers like policy, talent attraction, and its role as a global financial hub. This discomfort now can lead to significant advantage later.

- Diversification: While residential leads, ensure a balanced view across residential, office, and retail. The synchronized upturn suggests these sectors will offer compounding benefits over time, creating a more resilient portfolio.

- Data Monitoring: Track key indicators like population growth, visa approvals, and the Hang Seng Index. These provide early signals of the underlying systemic health and potential future shifts in the market.