Leading Cyclical Indicators Signal Substantive Global Growth Acceleration

TL;DR

- An alignment of leading cyclical indicators--copper prices, non-traded commodities, Korean equities, small-cap stocks, and financial stocks--suggests a more substantive global growth acceleration than speculative activity might imply.

- The strong performance of economically sensitive assets like Korean equities (up 80%) and financial stocks indicates a broad-based improvement in global cyclical activity, supporting positive equity market outlooks.

- Rising copper prices (up 40%) and non-traded commodity indices (up 10%) signal underlying industrial demand, acting as reliable, less investor-influenced indicators of a strengthening global economic backdrop.

- The convergence of these diverse cyclical signals supports the view that U.S. equity market performance is fundamentally linked to improving economic activity and potentially stronger-than-appreciated earnings growth.

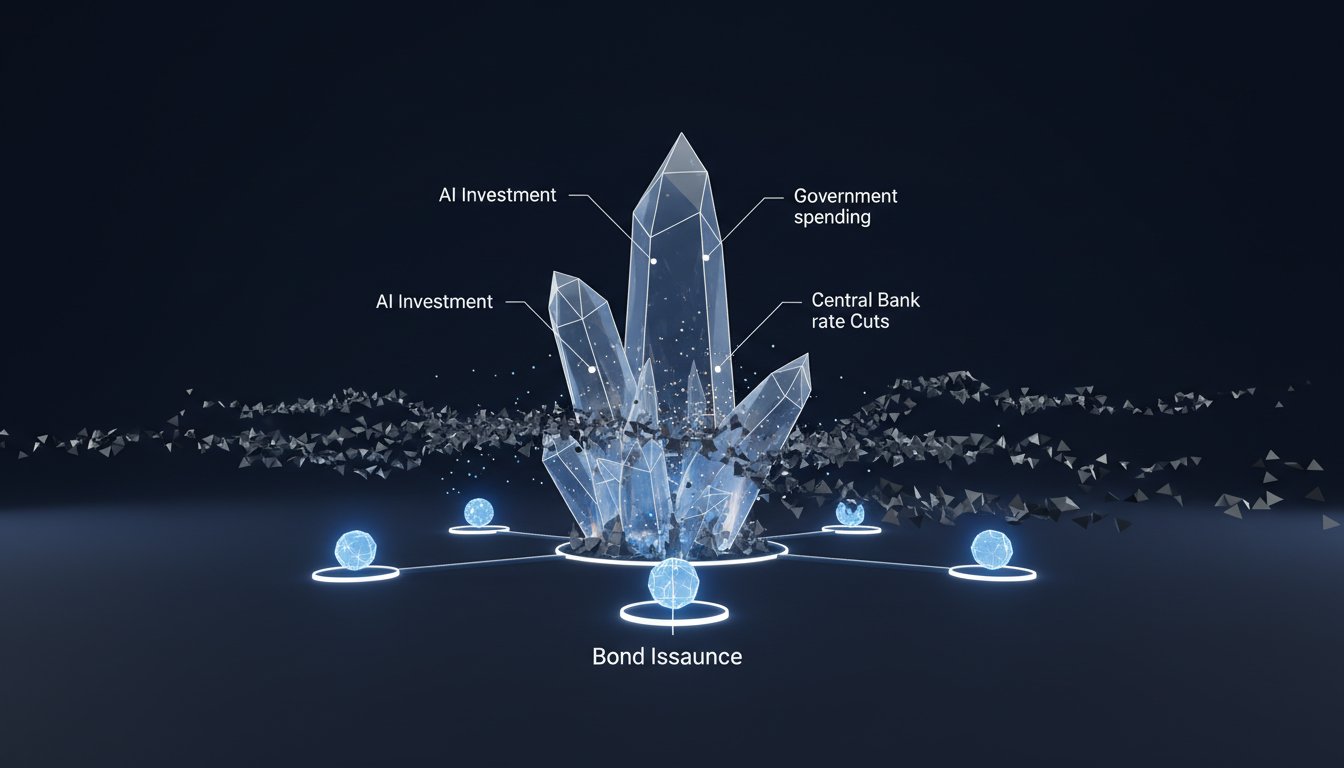

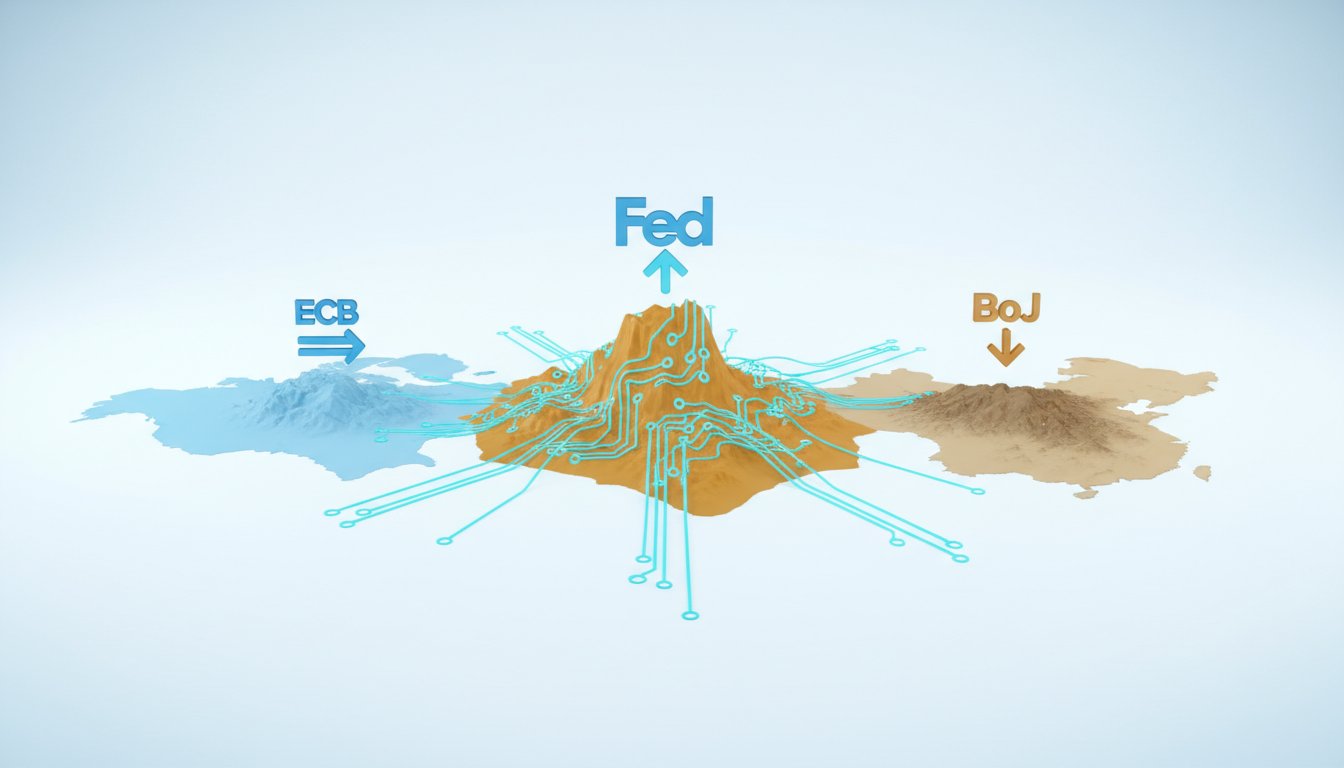

- If these positive cyclical indicators persist, they may challenge the rationale for continued central bank rate cuts, raising questions about their consistency with a robust global growth environment.

Deep Dive

Multiple leading indicators for the global economy are now simultaneously signaling a sustained period of strong cyclical growth, suggesting a more substantial underlying trend than speculative market activity alone would imply. This alignment, observed across diverse asset classes from commodities to equities, supports Morgan Stanley's forecast for a positive year in markets with higher equities and modestly lower bond yields, indicating the current market cycle may have more room to run.

This convergence of positive signals is evident in several key areas. Copper prices have surged approximately 40% over the past year, reflecting increased demand for industrial metals. A crucial index of non-traded industrial commodities, less susceptible to investor speculation, has risen 10%, further underscoring broad-based industrial strength. Korean equities, long considered a proxy for global economic optimism due to their cyclical nature, led major markets with an 80% gain last year. Additionally, smaller-cap stocks, which are typically more sensitive to economic shifts, have outperformed their larger counterparts. Financial stocks in the U.S. and Europe, also highly economically sensitive sectors, have significantly outpaced the broader market. The collective message from these disparate indicators is that the global economic outlook has been improving consistently over time.

The second-order implications of this synchronized bullish signal are significant. Firstly, it reinforces the fundamental case for equities, suggesting that stronger economic activity will translate into better-than-expected corporate earnings growth, a key driver for stock market performance. Secondly, sustained strong growth could challenge prevailing central bank policy expectations. If the economy is indeed accelerating, the rationale for aggressive interest rate cuts may weaken, potentially leading to adjustments in market expectations and asset pricing. The persistence of these indicators is therefore critical; a downturn in any of them could signal a weakening economic backdrop. However, as long as they remain positive, they provide strong evidence supporting the view that the current market cycle is robust and has not yet reached its peak.

Action Items

- Track 3-5 leading economic indicators (e.g., copper prices, Korean equities) to monitor global cyclical shifts.

- Analyze 5-10 non-traded industrial commodity indices to assess underlying economic activity independent of investor sentiment.

- Evaluate financial stock performance relative to broader markets across US and Europe to gauge economic sensitivity.

- Measure small-cap stock outperformance versus large-cap stocks to identify shifts in economic sensitivity.

- Correlate earnings growth forecasts with observed cyclical indicator trends to validate market outlook.

Key Quotes

"But instead of going back again to our forecasts for the year ahead, I want to focus instead on a wide variety of different assets that have long been viewed as leading indicators of the global cyclical environment. I think these are important, and what's notable is that they're all moving in the same direction, all indicating a stronger cyclical backdrop."

Andrew Sheets explains that he is shifting focus from direct forecasts to a collection of assets that historically signal economic conditions. Sheets highlights that the significance lies in these diverse indicators collectively pointing towards a strengthening global economy, suggesting a more substantial underlying trend.

"First, copper prices, which tend to be volatile but economically sensitive, have been rising sharply, up about 40% in the last year. A key index of non-traded industrial commodities, for everything from glass to tin, which is useful because it means it's less likely to be influenced by investor activity, well, it's been up 10% over the last year."

Andrew Sheets provides specific examples of these leading indicators, noting the significant rise in copper prices and industrial commodity indices. Sheets points out that non-traded commodities are particularly valuable as indicators because their price movements are less likely to be driven by speculative investment.

"Korean equities, which tend to be highly cyclical and thus have long been viewed by investors as a proxy for global economic optimism, well, they were the best performing major market last year, up 80%. Smaller cap stocks, which again, tend to be more economically sensitive, well, they've been outperforming larger ones."

Andrew Sheets continues to present evidence of a strengthening economic outlook by referencing the performance of Korean equities and smaller capitalization stocks. Sheets explains that these asset classes are considered sensitive to economic cycles, and their strong performance suggests broad investor optimism about global economic activity.

"And last but not least, financial stocks in the US and Europe. Again, a sector that tends to be quite economically sensitive, well, they've been outperforming the broader market and to a pretty significant degree. These are different assets in different regions that all appear to be saying the same thing: that the outlook for global cyclical activity has been getting better and has now actually been doing so for some time."

Andrew Sheets identifies financial stocks in the US and Europe as another key indicator of economic health, noting their significant outperformance. Sheets concludes that the convergence of these varied assets across different markets strongly suggests an improving and sustained global economic outlook.

"Now, any individual indicator can be wrong. But when multiple indicators all point in the same direction, that's pretty worthy of attention. And I think this ties in nicely with a key message from my colleague Mike Wilson from Monday's episode: that the positive case for US equities is very much linked to better fundamental activity, specifically our view that earnings growth may be stronger than appreciated."

Andrew Sheets emphasizes the importance of corroborating evidence from multiple sources, stating that a single indicator can be misleading. Sheets connects this observation to a broader theme from Morgan Stanley Research, suggesting that the positive outlook for equities is fundamentally tied to stronger-than-expected corporate earnings growth.

Resources

External Resources

People

- Andrew Sheets - Global Head of Fixed Income Research at Morgan Stanley

- Mike Wilson - Colleague

Organizations & Institutions

- Morgan Stanley - Employer of Andrew Sheets

- US - Region for financial stocks

- Europe - Region for financial stocks

Other Resources

- Thoughts on the Market - Podcast name

- Korean equities - Mentioned as a proxy for global economic optimism

- Smaller cap stocks - Mentioned as economically sensitive

- Financial stocks - Mentioned as economically sensitive

- Copper prices - Mentioned as an economically sensitive leading indicator

- Non-traded industrial commodities - Mentioned as a leading indicator less influenced by investor activity

- Market cycle - Concept discussed in relation to potential for sustained growth