Interconnected Themes: AI Compute Bottlenecks, Energy Politics, Geopolitics, Societal Shifts

The year 2026 will be defined not by simple growth rates, but by the intricate interplay of four powerful, evolving themes: AI and Tech Diffusion, The Future of Energy, The Multipolar World, and Societal Shifts. While the immediate allure of AI capabilities is undeniable, its true impact, alongside the escalating demands on energy infrastructure and the stark realities of a fragmenting global order, will create complex, cascading consequences. This analysis reveals how these interwoven forces, often underestimated in their downstream effects, will reshape economies and investment landscapes, offering a distinct advantage to those who look beyond the obvious to grasp the structural shifts at play. Investors and strategists seeking to navigate this evolving terrain will benefit from understanding these interconnected dynamics, particularly how delayed payoffs and unexpected constraints create durable competitive moats.

The Bottleneck of Progress: When AI's Promise Meets Physical Limits

The initial excitement around Artificial Intelligence in 2025 was largely about its burgeoning capabilities. However, as Stephen Byrd of Morgan Stanley Research highlights, 2026 marks a critical pivot: the growing chasm between what AI can do and what it can realistically deploy. The non-linear improvements in AI are undeniable, but they are increasingly bumping against a hard physical constraint: compute power. This isn't just about needing more chips; it's about the fundamental infrastructure required to run increasingly complex AI use cases.

The implication is stark: demand for computing power is poised to outstrip supply. This creates a fascinating dynamic where the very engine of future innovation becomes a bottleneck. Companies that historically focused on software efficiency or algorithmic prowess will find their progress hampered by the availability and cost of the underlying hardware. This isn't a problem that a clever algorithm can solve; it's a systemic issue rooted in physics and manufacturing capacity.

"A critical evolution is our view that compute demand is likely to exceed supply meaningfully, even as software and hardware become more efficient. As AI use cases multiply and grow more complex, the infrastructure -- especially computing power -- emerges as a defining constraint."

-- Stephen Byrd

This constraint forces a re-evaluation of AI adoption strategies. Instead of a race to deploy the most advanced models, the competitive advantage will accrue to those who can secure and efficiently utilize compute resources. This might mean investing heavily in proprietary hardware, forging deep partnerships with chip manufacturers, or developing sophisticated methods for optimizing existing compute. The companies that can navigate this supply-demand imbalance, even if it means slower initial deployment, will likely achieve more sustainable, long-term gains. The conventional wisdom of "move fast and break things" falters here, as the "things" being broken are fundamental infrastructure limitations, not just software bugs.

The Politicization of Power: Energy Demand's Unexpected Inflection

The second major theme, The Future of Energy, has also undergone a significant transformation. For years, energy demand in developed markets was assumed to be relatively flat, a predictable constant. However, Byrd points to a crucial inflection: rising energy demand, driven in large part by the insatiable appetite of AI infrastructure and data centers. This isn't a distant future problem; it's happening now.

This surge in demand, coupled with the policy implications, elevates energy from a technical supply-chain issue to a deeply political one. As rising energy costs become more visible to consumers, policymakers face mounting pressure to ensure low-cost, reliable energy. This introduces a new layer of complexity, where the most efficient or technologically advanced energy solutions might be sidelined if they come with a higher price tag or threaten grid stability.

"Rising energy costs are becoming increasingly visible to consumers, elevating a concept we call the ‘politics of energy.’ Policymakers are under pressure to prioritize low-cost, reliable energy, even when trade-offs exist..."

-- Stephen Byrd

The consequence-mapping here is critical. A push for rapid AI deployment, without a corresponding, politically palatable energy strategy, could lead to significant societal pushback and policy intervention. Companies involved in energy production, infrastructure, and even AI development need to consider not just the technical feasibility of their energy sources, but their political viability. This might mean investing in a diverse energy portfolio, advocating for supportive regulatory frameworks, or even developing technologies that minimize energy consumption--a direct response to the compute constraint identified in the AI theme. The delayed payoff here lies in building energy resilience and political capital, which can insulate businesses from volatile energy markets and regulatory shifts.

The Reshaping of Global Competition: From Globalization to Strategic Inputs

The Multipolar World theme, while familiar, has sharpened considerably. The fragmentation of globalization is no longer an abstract concept; it's a strategic reality driven by national priorities around security, resilience, and self-sufficiency. Competition is increasingly defined by access to critical inputs--energy, materials, defense capabilities, and advanced technology.

The most telling indicator of this theme's impact is that the top-performing thematic stock categories in 2025 were driven by these multipolar dynamics. This underscores a fundamental shift: geopolitical and industrial realignments are no longer just background noise; they are direct drivers of market outcomes.

This has profound implications for supply chains and corporate strategy. Companies that relied on lean, globalized supply chains are now vulnerable. The focus shifts from cost optimization to resilience and control over key inputs. This might involve reshoring production, diversifying suppliers across geopolitical blocs, or investing in the domestic production of critical materials.

The competitive advantage here is built on foresight and a willingness to invest in resilience, even when it appears more expensive in the short term. Companies that anticipate these shifts and secure access to critical inputs will be better positioned to weather geopolitical storms and maintain operational continuity. Conversely, those who cling to outdated globalization models risk significant disruption. The conventional wisdom of chasing the lowest production cost fails when geopolitical stability becomes the paramount concern.

The Broadening Impact of Societal Transformation

The most significant evolution in Morgan Stanley's framework is the expansion of the "Societal Shifts" theme, building on prior work on Longevity. This new, broader theme captures a complex web of forces: AI's impact on labor, aging populations, evolving consumer preferences, the "K-economy" (likely referring to a widening economic divide), the pursuit of healthy longevity, and challenging demographics.

These aren't isolated trends; they are interconnected forces that increasingly influence government policy, corporate strategy, and economic growth. For instance, aging populations create demand for healthcare and retirement services, while AI-driven labor disruption necessitates new approaches to education and workforce development. Changing consumer preferences, influenced by factors like sustainability and health, redirect capital and demand.

"These shifts increasingly influence government policy, corporate strategy, and economic growth -- and their impact spans far more industries than investors often expect."

-- Stephen Byrd

The non-obvious consequence here is the sheer breadth of industries affected. While longevity might intuitively point to healthcare and pharmaceuticals, the ripple effects extend to consumer goods, financial services, urban planning, and even technology adoption. Companies that fail to recognize how these societal shifts alter consumer behavior, workforce dynamics, and regulatory landscapes will be caught off guard. The advantage lies in anticipating these demographic and behavioral changes and aligning business strategy accordingly. This requires a long-term perspective, as many of these shifts unfold over years or even decades, creating durable opportunities for those patient enough to capitalize on them.

The Interconnected System: Where Themes Reinforce Each Other

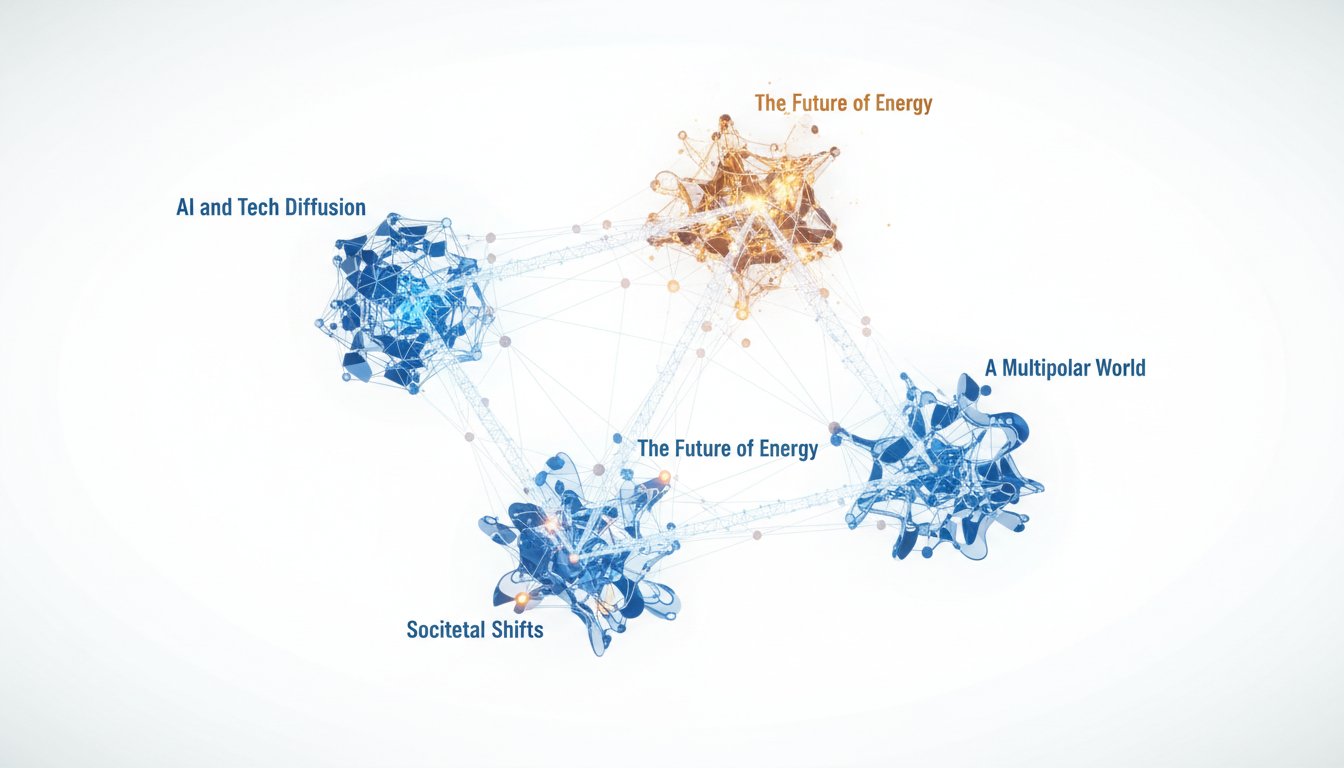

Crucially, these four themes do not exist in silos. Byrd emphasizes that their power lies in their intersections. AI accelerates energy demand, creating the conditions for the "politics of energy." Energy costs and geopolitical tensions shape national priorities within the "Multipolar World." And all of these macro forces feed directly into "Societal Shifts," influencing employment, consumption, and social stability.

Understanding these feedback loops is where true thematic investing insight emerges. A company that appears strong in one area might be vulnerable to disruptions in another, interconnected theme. For example, a tech company heavily reliant on AI compute might face headwinds from energy price volatility or supply chain disruptions driven by geopolitical instability.

The advantage, therefore, comes from mapping these systemic interactions. It’s about seeing how the demand for AI infrastructure (Theme 1) intensifies the need for energy (Theme 2), which in turn becomes a point of geopolitical leverage (Theme 3), ultimately impacting societal structures like employment and economic inequality (Theme 4). This holistic view allows for the identification of opportunities and risks that are invisible when themes are analyzed in isolation. The most enduring competitive advantages will be built by those who can navigate this complex, interconnected system, understanding that solutions in one area often create new challenges in another.

Key Action Items

- Immediate Action (Next Quarter):

- Assess Compute Dependency: Quantify your organization's current and projected reliance on compute power. Identify potential bottlenecks in supply or cost escalation.

- Energy Strategy Review: Evaluate your current energy sources and contracts. Begin exploring options for more stable, cost-effective, and politically resilient energy procurement, considering both traditional and renewable sources.

- Supply Chain Resilience Audit: Map critical inputs and identify single points of failure in your supply chain, particularly those with geopolitical exposure. Begin diversifying suppliers or exploring domestic sourcing options.

- Medium-Term Investment (6-12 Months):

- AI Optimization Focus: Shift R&D and operational focus from simply increasing AI capabilities to optimizing existing AI deployments for compute efficiency and cost-effectiveness.

- Policy Engagement: Actively engage with policymakers on energy infrastructure and critical input security issues relevant to your industry. Understand the evolving political landscape of energy.

- Demographic and Labor Trend Analysis: Integrate AI's impact on labor and aging demographics into workforce planning, talent acquisition, and training strategies.

- Long-Term Investment (12-18 Months+):

- Strategic Compute Partnerships: Forge long-term partnerships or investments in compute infrastructure providers or hardware manufacturers to secure future capacity.

- Energy Infrastructure Development: Explore investments in diversified energy generation or storage solutions that offer both cost stability and grid reliability, aligning with political priorities.

- Societal Shift Alignment: Develop new products, services, or business models that directly address the evolving needs and preferences driven by demographic shifts and changing consumer values. This creates a durable moat as societal needs evolve.