The European Equity Landscape: Beyond the Obvious Discount

The prevailing narrative around European equities often centers on their persistent valuation discount compared to the U.S. market. However, this conversation with Marina Zavolock, Chief European Equity Strategist, and Paul Walsh, Head of Research Product in Europe, reveals a more nuanced and dynamic picture. The critical, often overlooked, implication is that a structural shift in this discount may be underway, driven by factors like AI adoption and a broadening of investment themes beyond the dominant U.S. tech giants. This analysis is crucial for investors seeking to uncover hidden opportunities and avoid the pitfalls of conventional wisdom, offering an advantage to those who understand the subtle yet powerful forces reshaping European markets and can identify pockets of growth that defy the broader, slower-growing European economy.

The Narrowing Gap: When History Breaks its Pattern

For a decade, European equities have languished under a widening valuation discount relative to their U.S. counterparts. This wasn't just a cyclical downturn; it was a structural trend, a consistent widening that seemed immutable. Yet, as Zavolock points out, a significant shift occurred at the close of the previous year. European equities have, for the first time in ten years, consistently broken through the top of this discount range. This isn't merely a fleeting tactical rally; historical precedent suggests that such breakouts often signal a transition into an upward range, where the discount narrows over time. While the path won't be linear, the potential for a significant narrowing from the current 23% discount to single digits is a powerful, underappreciated dynamic. This presents an opportunity for investors willing to look beyond the headline figures and recognize that the historical pattern of widening discounts may be reversing. The immediate influx of diversification flows into Europe, mirroring patterns from the previous year, underscores this sentiment, as investors seek to broaden their portfolios beyond the concentrated U.S. market.

"In the last 10 years, European equities have been in this constantly widening discount range versus the U.S. on valuation. ... But we're in this downward structural range where their discount just keeps going wider and wider and wider. And what's happened on December 31st is that for the first time in 10 years, European equities have broken the top of that discount range."

-- Marina Zavolock

The immediate challenge, however, lies in the stark earnings growth differential. While U.S. strategists project 17% earnings growth, Europe's base case is a more modest 4%. This disparity makes it difficult for European equities to achieve outright outperformance against the U.S. over a full year. Yet, the historical breakouts suggest not necessarily outperformance, but a significantly narrower gap in performance. This is where strategic stock selection becomes paramount. The broader European market may be sluggish, but within it lie pockets of significant growth, particularly among AI adopters. Zavolock highlights that roughly a quarter of the European index comprises leading AI adopters, and these companies are demonstrating substantial earnings and returns outperformance, not just against the European index but also against their global sector peers. This outperformance is growing, suggesting that by the latter half of the year, it will become increasingly difficult for investors to ignore. The European index, with its limited "enablers" of AI and a higher concentration of "adopters," is uniquely positioned to benefit as the AI cycle matures and adopters become the sought-after beneficiaries. This presents a clear case for investing in companies that are actively leveraging AI, rather than those merely producing the infrastructure.

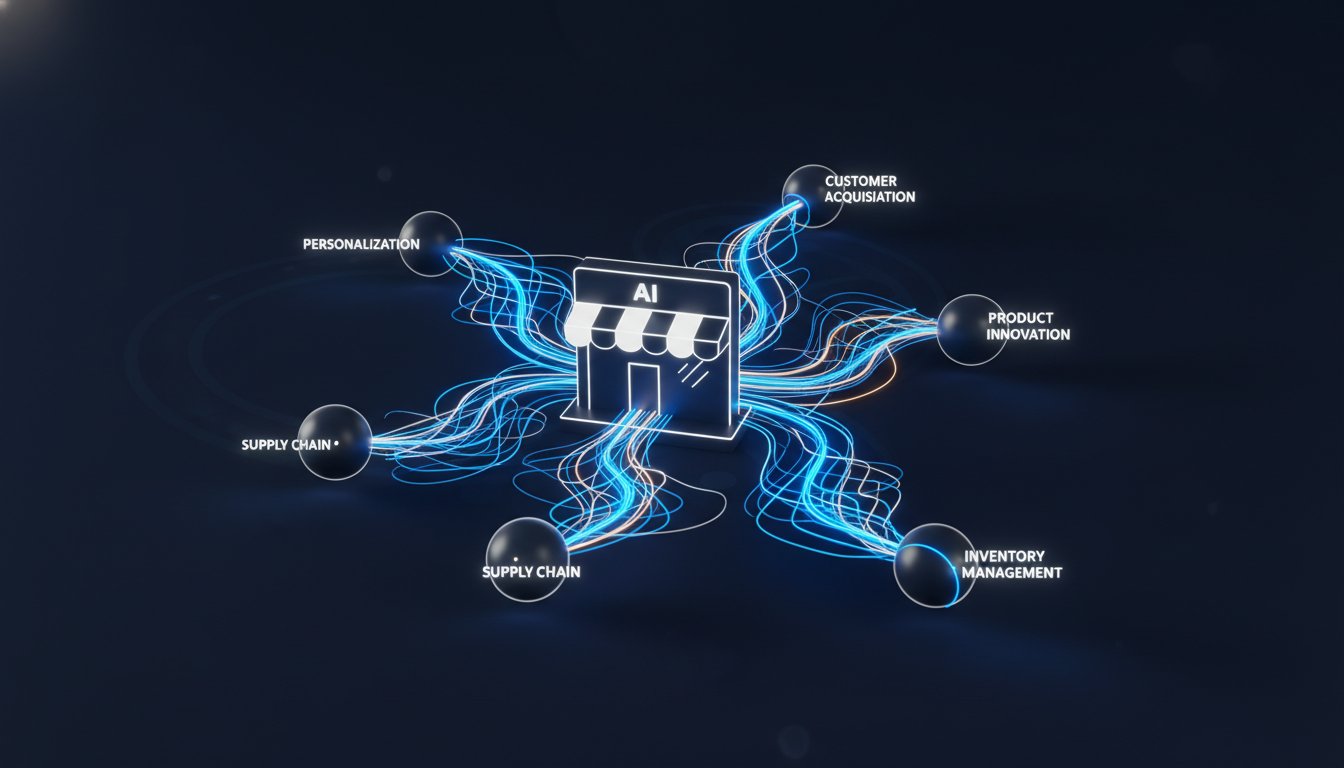

The AI Advantage and the Echoes of M&A

The most critical theme for the bull case in Europe, according to Zavolock, is AI adoption. This isn't just about theoretical potential; it's about quantifiable outperformance. European companies leading in AI adoption are already showing robust earnings growth that outpaces both the broader European market and their sector-specific peers. This trend is accelerating, making these AI-adopting stocks increasingly attractive. Importantly, these European AI adopters still trade at a significant discount (27%) compared to their U.S. counterparts. This creates a compelling opportunity: investing in companies at the forefront of a transformative technology, but at a reduced price. Furthermore, Europe faces significant productivity and demographic challenges that AI is well-suited to address, providing a fertile ground for AI adoption to yield substantial benefits.

Beyond AI, other structural drivers are at play. Mergers and acquisitions (M&A) are on the rise in Europe, mirroring trends in the U.S. This activity is supported by easing competition commission rules, a reversal after a decade of stringent oversight, and a releveraging of corporate balance sheets from historic lows. These factors suggest that M&A activity, while still far from its cyclical peak, has room to grow and can drive value. Additionally, structural initiatives like the Savings and Investment Union aim to deepen capital markets and encourage investment, potentially unlocking further growth. These themes, while less headline-grabbing than AI, contribute to a more constructive outlook for European equities, particularly for those investors who recognize that growth can emerge from a confluence of factors, not just a single dominant trend.

"When we take our global AI mapping and we look at leading AI adopters in Europe, which is about a quarter of the index, they are showing very strong earnings and returns outperformance, not just versus the European index, but versus their respective sectors."

-- Marina Zavolock

The investment strategy within Europe, therefore, is not about broad sector bets like cyclicals versus defensives or value versus quality. Instead, it's about discerning stock-level dispersion. The trend of rising dispersion--the divergence in performance between individual stocks--is expected to continue. Morgan Stanley's analyst top picks have consistently outperformed the European index and the S&P 500, demonstrating the power of focused, high-conviction stock selection. Key sectors favored include Banks, driven by a compelling investment case, and Defense, benefiting from the structural rearmament theme in Europe and a favorable seasonal pattern. The "powering AI" thematic is also a strong focus, with utilities recently upgraded to reflect this.

Adding another layer to the AI narrative, Paul Walsh highlights the semiconductor space, particularly the semi-cap sector. This area is bolstered by robust global demand for wafer fab equipment, with double-digit growth projected for both 2026 and 2027. The outlook for memory chips is especially encouraging, with a potential "memory super cycle" driven by AI inference, leading to capacity constraints and extended order book visibility. Looking further ahead, the proliferation of humanoid robots presents a significant long-term growth opportunity, with a projected global semiconductor market for humanoids exceeding $300 billion by 2045. These specialized areas within the tech ecosystem offer distinct growth pathways that are less tied to the broader European economic sentiment.

Conversely, certain sectors are flagged for avoidance. Autos, Chemicals, Luxury, Transport, and Food & Beverage are at the bottom of the model due to their association with lower growth, high exposure to China's sluggish economy, and increasing competition from China. These "old economy" cyclical sectors are likely to drag down overall growth and offer limited potential for multiple expansion.

Key Action Items

- Immediate Action (Next 1-3 Months):

- Analyze current portfolio for exposure to European AI adopters and assess their valuation relative to U.S. peers.

- Review recent performance of European defense stocks and consider their seasonal strength through April.

- Investigate Morgan Stanley's European analyst top picks for immediate alpha-generating opportunities.

- Short-Term Investment (Next 3-6 Months):

- Increase allocation to European banks, given their compelling investment case.

- Explore opportunities within the semiconductor supply chain, particularly in memory and wafer fab equipment.

- Begin research into companies poised to benefit from the long-term humanoid robot trend.

- Longer-Term Investment (6-18 Months+):

- Monitor the narrowing of the European equity valuation discount against the U.S. and adjust exposure accordingly.

- Evaluate structural drivers such as the Savings and Investment Union for potential long-term growth catalysts.

- Consider sectors benefiting from easing competition rules and corporate releveraging, such as those ripe for M&A.

- Discomfort Now, Advantage Later: Focus on identifying European AI adopters trading at a discount, as their current underpricing, relative to U.S. counterparts, creates a significant long-term advantage as their growth becomes undeniable.