Global Capital Diversification Drives European, Asian, and Gold Outperformance

In a landscape brimming with enthusiasm for global equities in 2026, this conversation with Kunal Shah of Goldman Sachs International reveals the subtle, often overlooked, shifts that will dictate market outperformance. Beyond the surface-level optimism for US GDP and easy financial conditions, Shah points to deeper structural changes in capital flows and geopolitical realities that are fundamentally altering the investment calculus for Asia and Europe. This analysis is crucial for investors seeking to navigate beyond consensus views, identifying hidden opportunities and risks that conventional wisdom might miss. Those who grasp these non-obvious implications will gain a distinct advantage in positioning their portfolios for durable, long-term gains, rather than chasing fleeting market trends.

The Fading Exceptionalism: Why the US Won't Dominate 2026 Like It Did 2025

The narrative for 2026 begins with a strong US market, buoyed by easy financial conditions, Fed cuts, and the AI boom fueling CapEx. This is a familiar story, one that has seen US assets perform well. However, Shah’s analysis suggests a critical nuance: the US, while still a strong contender, is unlikely to outperform most other countries as it may have in 2025. The "exceptionalism" that has driven US multiples higher is diminishing, not disappearing, but the reasons for it are shifting. While US corporate earnings growth remains robust, the sheer volume of liquidity and money supply growth, coupled with increasing supply from credit and equity markets (including mega-cap IPOs later in the year), suggests that the easy ride might encounter some indigestion.

The valuation premium for US equities, while still present, is becoming less pronounced. Shah notes that much of last year's return was driven by earnings growth, not just multiple expansion. This is a fundamental strength, but it also means the market is becoming more consensual, with risk capital indicators approaching highs. The implication here is that while the US market has tailwinds, the opportunities for outsized gains might be narrowing, and the risk of a correction increases as consensus views become fully priced in.

"Look, there's a lot of enthusiasm for US assets. We ourselves came in constructive. If you look at the house research call for US GDP, it's quite significantly above consensus at 2.8. You can feel it in these first two weeks in markets; people are catching up to that enthusiasm."

This quote highlights the current bullish sentiment but also hints at a potential peak in enthusiasm as more market participants "catch up." The structural tailwinds--easy financial conditions, Fed cuts, AI CapEx, fading tariff drag, and deregulation--are powerful. However, the analysis of "prime data" showing high growth leverage and risk capital indicators nearing yearly highs suggests that the market may be nearing a point where these factors are fully digested. The supply side, particularly with upcoming IPOs, could also present a challenge later in the year. This isn't to say the US market is a sell, but rather that the narrative of unquestioned outperformance needs a more nuanced perspective. The advice to "don't fight the fundamentals" is sound, but understanding which fundamentals are driving which markets is key.

The Shifting Tides: Why Europe and Asia Aren't Just Afterthoughts

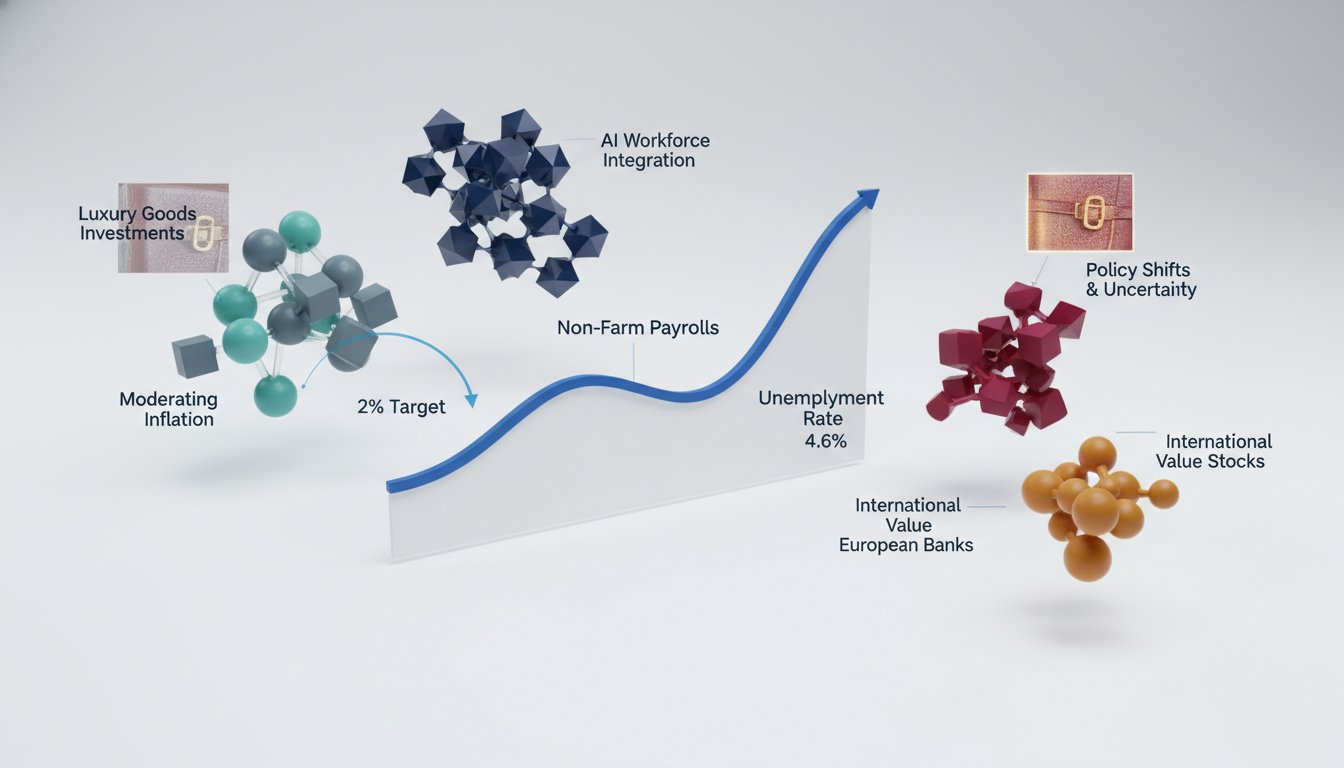

The flip side of the US story is the potential for Europe and Asia to see renewed interest, especially after outperforming in 2025. Shah points to significant structural changes that are diverting capital away from US assets. For years, excess savings from these regions flowed into US Treasuries and dollar-denominated assets. This dynamic is changing. Geopolitical concerns, legacy sanctions, and a greater focus on trade policy mean reserve managers are less active buyers of US assets.

More importantly, countries in Europe and Asia are shifting from being net savers to net spenders. Increased defense spending and the need to fund domestic expansion mean capital is more likely to be invested domestically. This creates a natural drift of capital back into these regions, even if their growth rates are not as explosive as the US.

"We have to remember that for years, you had excess savers in the other time zones recycling and buying US assets, and some of those things have just structurally changed."

This structural shift is a critical insight. It suggests that the prior flow of capital into the US was not necessarily a permanent state but a function of specific global economic conditions. As those conditions evolve, so too will capital flows. Shah notes that pessimism surrounding Europe, while prevalent, might actually lower the bar for outperformance. Positive signs, like German industrial orders reflecting domestic defense spending, indicate that beneath the surface, there are pockets of strength. The Euro currency is expected to strengthen in line with a shallow dollar depreciation, potentially reaching 1.20, which would be a tailwind for European assets, though not the primary driver.

China, despite policy attempts to temper its sharp rally, is also seen as a continuation play, driven by a doubling down on export-led growth and expected macro and fiscal easing. The AI theme is also alive in markets like Korea and Taiwan, bolstering an emerging market equity thesis. While Shah’s forecasts place all three regions (US, Europe, Asia) within a few percentage points of each other, the structural shifts suggest that ex-US markets are becoming more attractive destinations for capital that previously flowed predominantly to the US.

Gold's Enduring Appeal: Protection in a World of Uncertainties

The conversation turns to risk and protection strategies in an environment where "everything is awesome"--a classic signal to buy protection. Shah dismisses credit shorts as a hedge, citing tight spreads and high demand for shorting credit from non-specialists, which often signals a crowded trade. US rates, however, are presented as a potential portfolio diversifier, especially given the priced-in shallow easing cycle. The risk to the broader narrative, he notes, would be labor market weakness or a US cycle slowdown despite stimulus. In such a scenario, US fixed income could offer diversification.

However, the most compelling protection strategy discussed is gold. Despite everyone piling in, Shah argues that the reasons for gold's outperformance are structural and likely to persist. The de-dollarization theme, debasement fears due to monetary and fiscal stimulus, and geopolitical-driven deglobalization are all contributing factors. Central bank participation is real, but so is demand from institutional and private wealth clients.

"I do think that de-dollarization theme was real, and that's why we did see central bank participation. I do think the debasement theme is also there, and it's lurking because of the monetary, the fiscal stimulus you're seeing, and that's leading investors, not just central banks, to buy."

The size of gold allocations, while large relative to its own history, is small compared to overall market liquidity. This suggests room for continued growth. The structural underpinnings--de-dollarization, debasement, and deglobalization--are not short-term phenomena. For gold's appeal to wane, confidence in fiat currencies would need to return, or real rates in the US would need to rise significantly, making a flat-to-negative carry asset like gold less attractive. Given the current short-term outlook, Shah finds these scenarios unlikely. This makes gold a durable hedge, offering protection against the very uncertainties that underpin the current bullish consensus. The willingness to "buy gold on dips" signals a belief in its long-term value as a diversifier and store of wealth, even as its price appreciates.

Key Action Items:

-

Immediate Actions (Next 1-3 Months):

- Diversify US Equity Exposure: While constructive on the US, avoid over-concentration. Seek opportunities to trim positions where valuations appear stretched and reallocate to regions showing structural tailwinds.

- Increase Gold Allocation: Begin or increase strategic allocation to gold as a hedge against de-dollarization, debasement, and geopolitical risks. Buy on any significant dips.

- Analyze European Industrial Strength: Monitor German industrial orders and defense spending indicators for signs of sustained domestic demand, which could signal opportunities in related equities.

- Review Currency Hedges: Consider hedges against potential dollar depreciation, aligning with the base case for a stronger Euro.

-

Medium-Term Investments (Next 6-12 Months):

- Build Positions in Asia/Emerging Markets: Focus on markets like Korea, Taiwan, China, India, and Brazil, driven by AI themes, domestic stories, and structural capital flow shifts.

- Evaluate US Fixed Income for Diversification: Monitor US labor market data. If weakness emerges, US rates could offer attractive diversification and potential upside as the Fed might resume deeper cuts.

- Assess IPO Market Supply: Be mindful of increased equity supply from mega-cap IPOs later in the year, which could create temporary headwinds for broader market sentiment.

-

Longer-Term Investments (12-18 Months+):

- Capitalize on Structural Capital Flow Shifts: Continue to favor regions benefiting from reduced US asset inflows and increased domestic investment (Europe, Asia). This is a multi-year trend.

- Monitor Geopolitical and De-Globalization Trends: These factors are likely to sustain demand for gold and other non-fiat hedges, creating opportunities for those who maintain positions through volatility.

- Prepare for Potential FX Divergence: While not the base case, be ready to capitalize if FX markets reawaken with broader divergence, potentially driven by US institutional quality concerns or sharper US labor market weakening. This could significantly boost ex-US equity outperformance.