Structural Inflation Shift Requires Real Asset Portfolio Diversification

TL;DR

- A structural shift to higher inflation is driven by both demand-side factors like the global GenAI infrastructure boom and K-shaped economic consumption, alongside supply-side constraints and evolving policy dynamics.

- Policymakers face constrained degrees of freedom in managing inflation due to high debt levels, potentially limiting central banks' ability to use interest rates and forcing reliance on balance sheet management.

- The U.S. faces significant constraints in electricity generation and transmission infrastructure to meet AI data center demand, leading to potential price rationing and upward inflationary pressure.

- In a high-inflation regime, traditional 60-40 stock-bond portfolios offer diminished diversification as stocks and bonds become positively correlated, necessitating a shift towards real assets.

- Investors should consider adding real assets, infrastructure, energy, transportation, commodities, and gold to portfolios to hedge against inflation, as fixed income returns are eroded by rising prices.

- Long-term inflation expectations may remain anchored due to short investor memories and faith in technology, but the risk of a new inflationary regime is not fully priced into markets.

Deep Dive

A new inflationary regime is emerging, driven by a confluence of demand-side pressures from global infrastructure booms and wealth concentration, coupled with supply-side constraints exacerbated by policy shifts and debt limitations. This structural shift challenges traditional investment diversification strategies, necessitating a proactive approach to portfolio construction that accounts for potentially higher and more persistent inflation.

The current inflationary environment is fueled by distinct demand and supply-side factors that signal a departure from previous disinflationary trends. On the demand side, significant global infrastructure investment, particularly in areas like GenAI, is driving up commodity prices, including precious and industrial metals. Concurrently, a "K-shaped" economy, where wealth accumulation benefits a select group who then dominate consumption, further concentrates demand. On the supply side, dynamics such as immigration patterns and housing market pressures contribute to price increases. Crucially, policymakers are increasingly constrained by high levels of debt, limiting their ability to deploy traditional tools like interest rate hikes to cool demand, creating an era of "fiscal dominance" where policy decisions are shaped by debt management rather than solely by inflation control. This policy constraint is further amplified by political considerations, as voters are sensitive to inflation but also resistant to the austerity measures traditionally used to combat it.

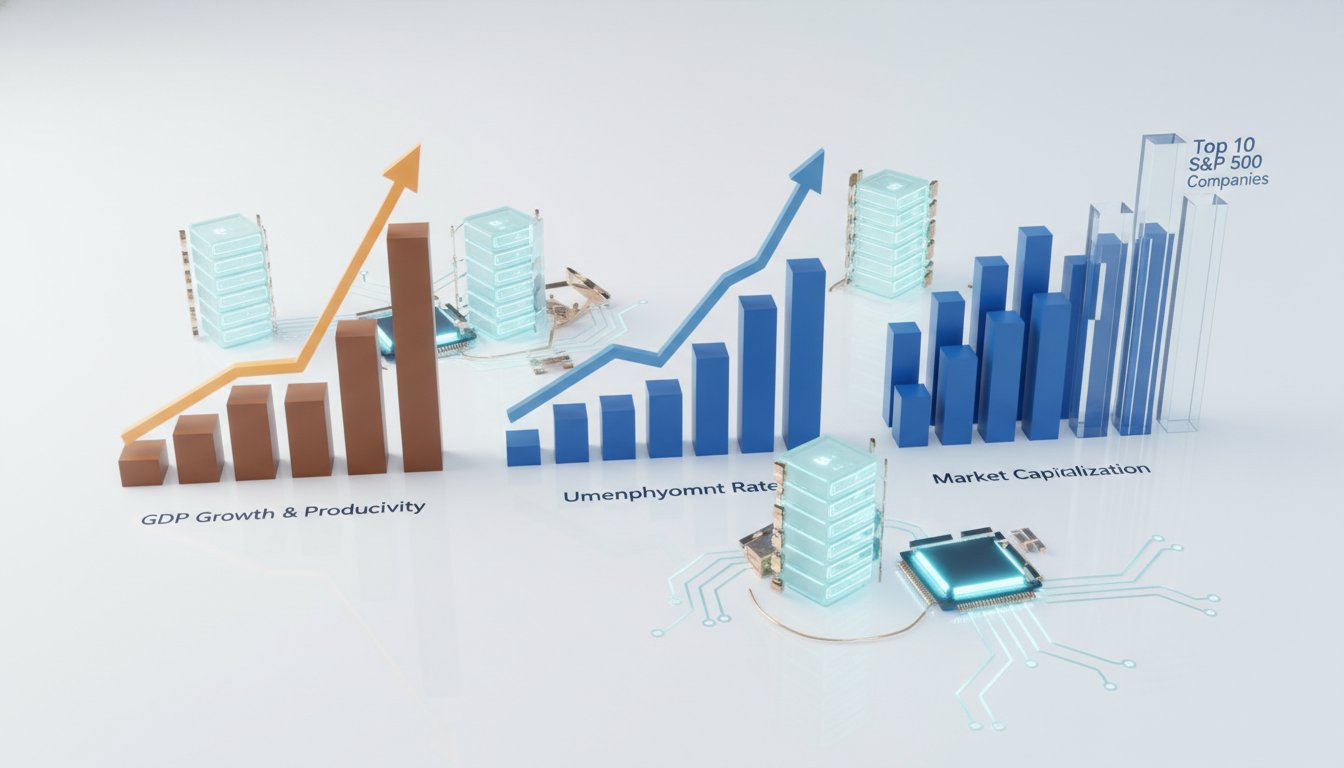

The implications of this regime change extend significantly into investment strategies. The positive correlation that can emerge between stocks and bonds during high inflation periods erodes the effectiveness of traditional 60-40 portfolios, which rely on their diversification benefits. Stocks, as pro-inflationary assets, can allow many companies to pass on price increases, while fixed income instruments are directly devalued by inflation, eroding real returns. Consequently, investors are advised to look beyond traditional fixed income and consider adding real assets, infrastructure, energy, transportation assets, commodities, and even gold to their portfolios. These assets tend to perform better in inflationary environments where their value or income streams can rise with prices. Furthermore, the debate around long-term inflation expectations highlights a potential disconnect: while markets may remain anchored by faith in policymakers and technological deflationary forces, the structural crosscurrents suggest a non-zero risk of a sustained inflationary regime. This uncertainty necessitates hedging strategies and diversified portfolios that can withstand the volatility and potential repricing of assets in a higher inflation landscape.

Action Items

- Audit inflation drivers: Analyze demand-side (AI infrastructure, K-shaped economy) and supply-side (immigration, housing) factors for 3-5 key commodities.

- Measure policy constraint impact: Calculate the correlation between U.S. debt levels and central bank flexibility in controlling inflation over the past 2-3 years.

- Evaluate energy infrastructure risk: Assess electricity generation and transmission costs in the U.S. versus 2-3 global competitors for AI data center viability.

- Track inflation expectation divergence: Monitor the 10-30 year yield curve steepness and identify drivers (term premium vs. unanchored expectations) for 1-2 quarters.

- Construct diversified portfolio: Add real assets, infrastructure, energy, transportation, commodities, and gold to hedge against positive stock-bond correlation in a high-inflation regime.

Key Quotes

"And the reason we're calling this a regime change is because we see factors for inflation coming from both the demand side and the supply side. For example, on the demand side, the role of the infrastructure boom, the GenAI infrastructure boom, has become global. It has caused material appreciation of many commodities in 2025. We're seeing it obviously in some of the dynamics around precious metals. But we're also seeing it in industrial metals. Things like copper, things like nickel."

Lisa Shalett explains that the current inflationary environment is being driven by factors on both the demand and supply sides. Shalett highlights the global impact of the GenAI infrastructure boom, which is increasing demand and thus the appreciation of commodities like copper and nickel. This indicates a potential shift from previous inflationary periods.

"But perhaps the wrapper around all of it is how policy is shifting -- because increasingly policymakers are being constrained by very high levels of debt and deficits. And determining how to fund those debts and deficits actually removes some of the degrees of freedom that central bankers may have when it comes to actually using interest rates to constrain demand."

Shalett points out that a significant factor influencing inflation is the changing landscape of policy. She argues that high levels of debt and deficits are limiting the options available to policymakers, particularly central bankers, who may have less flexibility to use interest rates to control demand. This suggests that traditional monetary policy tools might be less effective in the current environment.

"So, on the monetary side, we're already seeing the Fed beginning to signal that perhaps they're going to rely on other tools in the toolkit. And what are those tools in the toolkit? Well, they're managing the size of their balance sheet, managing the duration or the mix of things that they hold in the balance sheet. And it's actual, you know, returns to how they think about reserve management in the banking system."

Andrew Sheets discusses the potential shift in monetary policy strategy. Shalett explains that the Federal Reserve may be signaling a move towards utilizing alternative tools beyond interest rate adjustments. These tools include managing the central bank's balance sheet and its holdings, which are related to how they manage reserves within the banking system.

"This is one of the areas where the U.S., at the minute, is facing genuine constraints. When you think about some of the forecasts that have been put out there in terms of $10 trillion of spending related to Generative AI, the number of data centers that are going to be built, and the power shortfall that has been forecast. We're talking about someone having to pay the price, if you will, to ration power until you can upgrade the grid."

Shalett identifies energy and technology, specifically AI data center construction, as a significant factor contributing to inflation. She notes that the U.S. is experiencing constraints in this area, with substantial spending on AI and a projected power shortfall. Shalett suggests that these constraints will lead to increased costs for electricity as demand outstrips supply until grid infrastructure is upgraded.

"So, the first thing that we think it's really important for folks to appreciate is that typically when we've been in these higher inflation regimes in the past, stocks and bonds become positively correlated. And what that means is that the power of a very simple 60-40 or stock-bond-cash portfolio to provide complete or optimal diversification fades."

Lisa Shalett advises investors on navigating a high inflation regime by highlighting a key historical correlation. She explains that in past high inflation periods, stocks and bonds have tended to move in the same direction, reducing the effectiveness of traditional diversification strategies like a 60-40 portfolio. This suggests a need for investors to consider alternative approaches.

"Now, all of those things may absolutely, positively be true. The problem that we have is that the alternate case, right? The case that we’re making -- that maybe we’re in a new inflationary regime is not priced, and the risk is non-zero."

Shalett addresses the market's current perception of inflation expectations. She acknowledges that factors like anchored inflation expectations and faith in policymakers and technology may be valid. However, Shalett emphasizes that the alternative scenario, where inflation is structurally higher, is not fully reflected in market pricing, presenting a non-zero risk to investors.

Resources

External Resources

Articles & Papers

- "New report" - Discussed as a source for analysis on structural shifts in inflation.

People

- Andrew Sheets - Head of Corporate Credit Research at Morgan Stanley, co-host of the podcast.

- Lisa Shalett - Chief Investment Officer for Morgan Stanley Wealth Management, co-host of the podcast and author of a discussed report.

Organizations & Institutions

- Morgan Stanley - Employer of the podcast hosts and source of investment insights.

- Federal Reserve - Mentioned in relation to interest rate policy and inflation targets.

Websites & Online Resources

- morganstanley.com/insights - Provided as a link for further insights from Morgan Stanley.

Podcasts & Audio

- Thoughts on the Market - Podcast where the discussion took place.

Other Resources

- GenAI infrastructure boom - Discussed as a demand-side driver of inflation.

- K-shaped economy - Mentioned as a demand-side factor influencing consumption patterns.

- 60-40 portfolio - Referenced as a traditional portfolio construction that may lose effectiveness in a new inflationary regime.

- Real assets - Suggested as an investment category for navigating higher inflation.

- Infrastructure assets - Suggested as an investment category for navigating higher inflation.

- Energy assets - Suggested as an investment category for navigating higher inflation.

- Transportation assets - Suggested as an investment category for navigating higher inflation.

- Commodities - Suggested as an investment category for navigating higher inflation.

- Gold - Suggested as an investment category for navigating higher inflation.

- Cryptocurrencies - Suggested as an investment category with potentially lower correlations to portfolios.