Compressed Risk Premiums Require Dynamic Asset Allocation

TL;DR

- Compressed risk premiums, with U.S. equity risk at only 2% and emerging markets at -1%, mean investors are paid less for taking on risk, shifting the efficient frontier lower and flatter.

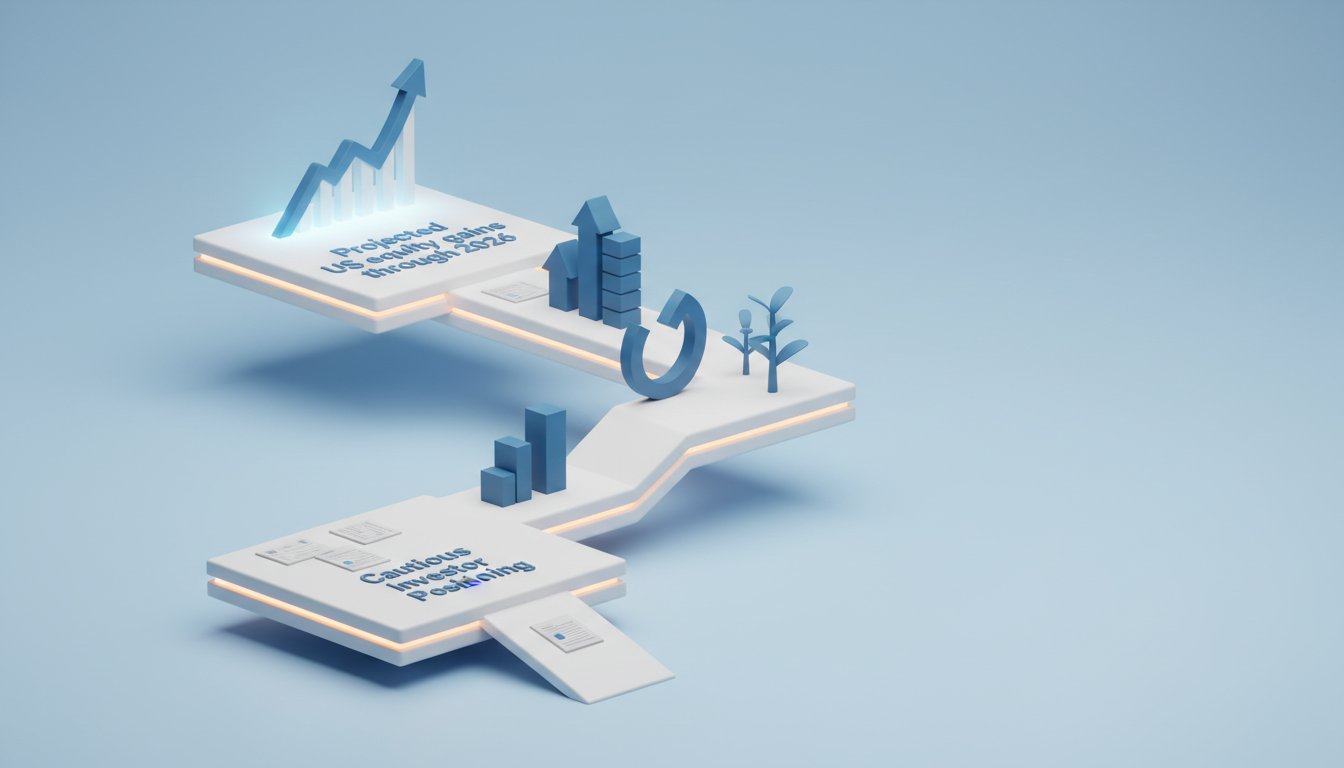

- The traditional 60/40 portfolio is projected to yield only 6% annually over the next decade, significantly below its historical 9% average, necessitating portfolio re-evaluation.

- Advances in AI may cause stocks and bonds to move more in sync, potentially justifying an equity allocation beyond the traditional 60/40 split for enhanced returns.

- Rich U.S. equity valuations, while near dot-com bubble highs, are partially justified by a dramatic improvement in company profitability and free cash flow since 2000.

- Fixed income, particularly government and corporate bonds, offers relatively elevated returns above long-run averages due to higher current yields, presenting a more attractive risk-reward profile.

- The optimal asset allocation is not static; it must be continuously revisited as market dynamics evolve, especially in a landscape where risk assets appear expensive.

Deep Dive

Long-term market outlooks suggest significantly lower equity returns and compressed risk premiums compared to historical averages, fundamentally altering the risk-reward landscape for investors. This shift necessitates a re-evaluation of traditional asset allocation strategies, including the long-standing 60/40 portfolio, as the expected benefits of taking on greater risk are diminished.

Projected annualized returns over the next decade are nearly 7% for global equities, with the S&P 500 at 6.8%, European and Japanese equities at approximately 8%, and emerging markets at a lower 4%. Fixed income offers more competitive returns than in prior decades, with U.S. Treasuries yielding close to 5%, German Bunds near 4%, and Japanese government bonds around 2%. Crucially, the equity risk premium has compressed to 2% in the U.S. and is negative (-1%) for emerging markets, meaning investors are compensated less for bearing risk. While U.S. equity valuations are rich, near dot-com bubble levels, an improvement in company profitability and free cash flow generation (nearly triple that of 2000) provides some justification. This recalibration of risk and return means the efficient frontier, representing the optimal trade-off between risk and reward, has flattened and lowered, implying that higher risk portfolios will not yield proportionally higher returns. Consequently, the traditional 60/40 portfolio, which has historically returned around 9% annually, is now projected to yield only about 6% over the next decade. Furthermore, the increasing synchronization of stock and bond movements, potentially driven by AI advancements, could further challenge the diversification benefits of this classic allocation.

The primary implication is that static investment strategies are insufficient; investors must adapt their asset allocation as market dynamics evolve. The optimal mix of stocks and bonds is no longer a fixed constant but a fluid target requiring continuous reassessment. In this environment of expensive risk assets and shifting correlations, a deeper understanding of how risk, return, and correlation interact is paramount for navigating future market conditions. While the 60/40 portfolio is not obsolete, its efficacy is diminished, and investors may need to consider adjustments, potentially increasing equity allocations, to align with the new risk-return paradigm.

Action Items

- Analyze portfolio risk premiums: Calculate current equity and emerging market risk premiums to assess investor compensation for risk.

- Model 60/40 portfolio returns: Project annualized returns for a 60/40 portfolio over the next decade using projected equity and bond returns.

- Evaluate AI impact on correlation: Assess how advances in AI may affect stock and bond correlation and its implications for asset allocation.

- Rebalance allocation strategy: Review and adjust optimal stock and bond allocation weights based on evolving market dynamics and lower risk premiums.

Key Quotes

"The extra return you get for taking on risk -- what we call the risk premium -- has compressed across the board. In the U.S., the equity risk premium is just 2 percent. And for emerging markets, it's actually negative at around -1 percent. In very plain terms, investors aren’t being paid as much for taking on risk as they used to be."

Serena Tang explains that the risk premium, the additional return investors expect for taking on risk, has decreased significantly. Tang highlights that in the U.S., this premium is only 2%, and in emerging markets, it's even negative at -1%. This indicates investors are receiving less compensation for bearing risk compared to historical norms.

"The efficient frontier -- meaning the best possible return for any given level of portfolio risk -- has shifted. It’s now flatter and lower than in previous years. So, it means taking on more risk in a portfolio right now won’t necessarily boost returns as much as before."

Serena Tang discusses how the efficient frontier, which represents the optimal balance between risk and return, has changed. Tang notes that it is now flatter and lower, implying that increasing risk in a portfolio will not yield proportionally higher returns as it might have in the past.

"Looking ahead, though, we expect only around 6% annual returns for a 60/40 portfolio over the next decade versus around 9% average return historically. Importantly though, advances in AI could keep stocks and bonds moving more in sync than they used to be. If that happens, investors might benefit from increasing their equity allocation beyond the traditional 60/40 split."

Serena Tang projects that the traditional 60/40 portfolio is expected to yield approximately 6% annually over the next decade, a decrease from the historical average of 9%. Tang also suggests that advancements in AI might cause stocks and bonds to move more closely together, potentially making a higher allocation to equities more beneficial for investors.

"Either way, it’s important to realize that the optimal mix of stocks and bonds is not static and should be revisited as market dynamics evolve."

Serena Tang emphasizes that the ideal allocation between stocks and bonds is not fixed. Tang advises that investors should regularly reassess their portfolio mix to adapt to changing market conditions.

"In a world where risk assets feel expensive and the old rules don't quite fit, it’s essential to understand how risk, return, and correlation work together. This will help you navigate the next decade."

Serena Tang underscores the importance of understanding the interplay between risk, return, and correlation in the current investment environment. Tang suggests that this knowledge is crucial for investors to effectively manage their portfolios in the coming years, especially as risk assets appear overvalued and traditional strategies may be less effective.

Resources

External Resources

Articles & Papers

- "insights" (Morgan Stanley) - Referenced for additional market analysis.

People

- Serena Tang - Chief Cross-Asset Strategist at Morgan Stanley, discussing market conditions and asset allocation.

Websites & Online Resources

- Morgan Stanley - Provided additional market insights.

Other Resources

- 60/40 portfolio - Discussed as a traditional investment strategy whose effectiveness is being re-evaluated.

- cyclically adjusted price-to-earnings ratio - Mentioned as a valuation metric for the S&P 500.

- efficient frontier - Referenced as a concept illustrating the relationship between portfolio risk and return.

- equity risk premium - Discussed as the extra return investors receive for taking on equity risk, noting its compression.

- free cash flow - Mentioned as a measure of company profitability.

- risk premium - Discussed as the additional return for taking on risk across asset classes.