Tesla's Camera-Only Approach Drives Autonomous Vehicle Market Disruption

TL;DR

- Autonomous vehicle availability is projected to double from 15% to over 30% of the U.S. urban population by year-end 2026, driven by fleet expansion and new city rollouts.

- Tesla's camera-only sensor approach offers a 40% cost advantage over Waymo, but requires proving safety standards comparable to human drivers to validate its scalability.

- Waymo currently leads in safety with a crash rate of 1 per 400,000 miles, significantly outperforming Tesla's 1 per 50,000 miles in limited testing.

- Tesla's ability to rapidly scale production and remove safety drivers without partnerships could significantly impact autonomous adoption and disrupt the rideshare industry.

- Autonomous vehicle growth, projected at 100% CAGR through 2032, will still represent less than 1% of total U.S. miles driven, indicating a massive untapped market.

- The rideshare industry faces a critical shift, with Uber and Lyft potentially decreasing from 100% to 30% of the autonomous market share by 2024 due to evolving AV partnerships.

Deep Dive

2026 is poised to be a pivotal year for autonomous vehicles, marking an inflection point where broader availability and new capabilities will become commonplace. Current projections indicate a doubling of autonomous driving availability to over 30% of the U.S. urban population by year-end 2026, up from 15% in 2025, driven by fleet expansions into new cities and the testing of capabilities in challenging weather conditions like snow. This scaling is underpinned by a dual focus on regulatory approvals and technological advancements, specifically the need for autonomous systems to demonstrably surpass human safety benchmarks.

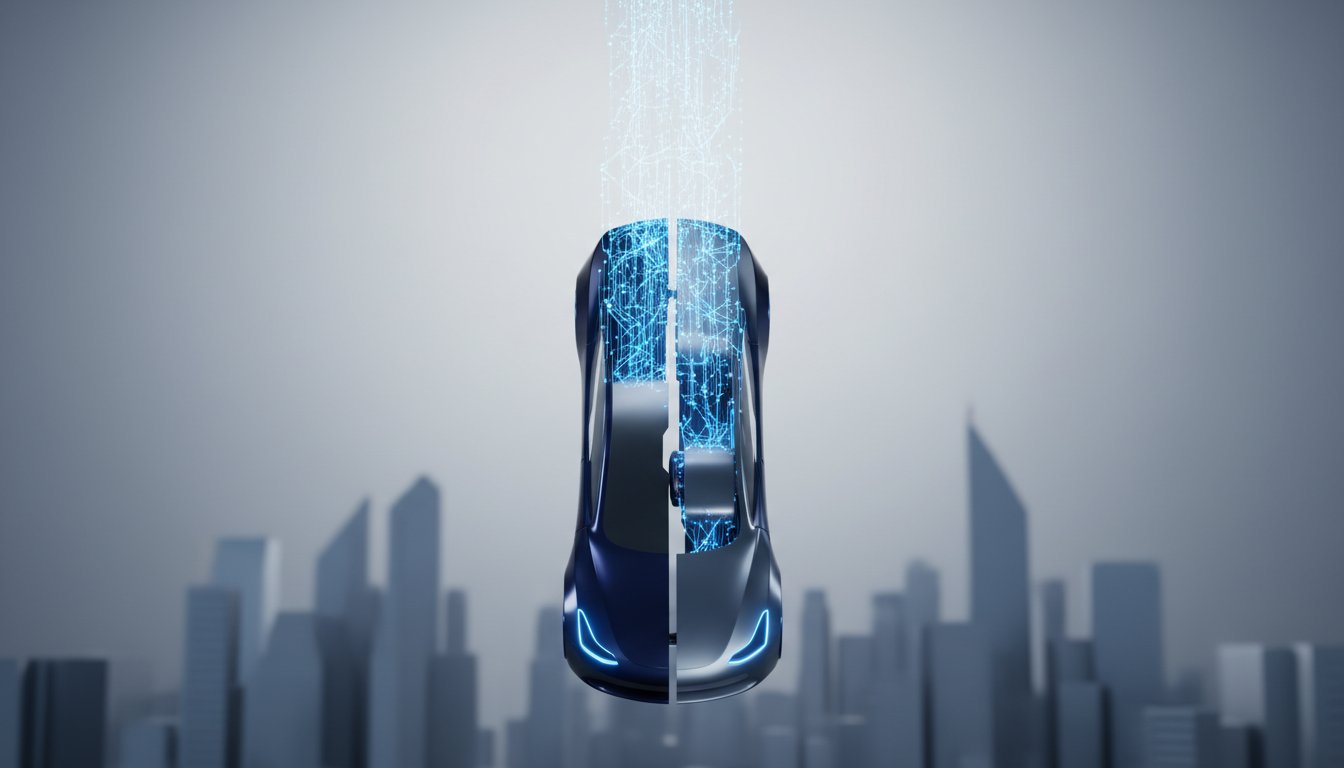

The primary tension in the autonomous vehicle (AV) space lies between cost and safety, exemplified by Tesla's approach versus Waymo's. Tesla currently holds a significant cost advantage, estimated at 40% lower per mile than Waymo, largely due to its camera-only sensor suite and $35,000 vehicle cost, eschewing expensive lidar and radar. However, this comes with a substantial safety data gap: Tesla averages a crash every 50,000 miles in Austin, compared to Waymo's 400,000 miles per crash, though Waymo's data is based on a far larger cumulative mileage. The critical development to watch in 2026 will be Tesla's ability to improve its safety record and validate its camera-only strategy, which could unlock rapid scaling due to its manufacturing capacity. This improved safety data is essential for regulatory approval and for Tesla to remove safety drivers, a move already underway in Austin, and eventually deploy to the public without them.

The success of Tesla's autonomous deployment, particularly its independent approach without rideshare partnerships, has significant implications for the existing ride-hailing industry. While Waymo partners with Uber and Lyft in some markets, Tesla is forging ahead alone. This divergence means that while Uber and Lyft currently dominate the rideshare market, their share of the autonomous driving market is projected to shrink to 30% by 2024, down from 100% based on current partnerships. For Uber and Lyft to maintain their position, AV deployments must prove to be incremental to the overall rideshare market rather than simply cannibalizing existing demand, and they must secure further partnerships to capture a larger share of the growing autonomous market. Beyond 2026, the long-term disruption hinges on cost reductions to make robotaxis cheaper than personal car ownership, potentially transforming the very model of car ownership itself, even as autonomous miles driven, projected at a 100% CAGR through 2032, will still represent less than 1% of total U.S. miles driven.

Action Items

- Track Tesla's crash rate: Measure miles per crash for Tesla's camera-only approach against Waymo's lidar/radar system (ref: safety data comparison).

- Audit Waymo's snow city readiness: Evaluate operational plans for Washington D.C., Colorado, and Michigan launches to identify potential edge cases.

- Analyze rideshare market share shifts: Project Uber/Lyft's future participation in the AV market based on partnership expansion and incremental TAM growth.

- Measure robotaxi cost reduction roadmap: Quantify potential cost per mile reductions to assess disruption of personal car ownership.

Key Quotes

"We think that overall availability for autonomous driving in the U.S. is going to go from about 15 percent of the urban population at the end of 2025 to over 30 percent of the urban population by year end 2026."

Brian Nowak explains that the availability of autonomous driving technology is projected to double in U.S. urban areas within a single year. This significant increase suggests a rapid scaling of autonomous vehicle deployment and accessibility for consumers. Nowak's projection indicates a potential inflection point for the widespread adoption of this technology.

"We have multiple new cities across the United States where we expect Waymo, Tesla, Zoox, and others to expand their fleet, expand autonomous driving availability, and ultimately make the product a lot more available and commonplace for people."

Brian Nowak anticipates that several companies, including Waymo, Tesla, and Zoox, will broaden their operational reach in 2026. Nowak's statement highlights the planned expansion of autonomous vehicle fleets and services into new cities. This growth is expected to make autonomous driving a more familiar and accessible option for the general public.

"Part of it is regulatory. You know, we are still in a situation where we are dealing with state-by-state regulatory approvals needed for these autonomous vehicles and autonomous fleets to be built. We'll see if that changes, but for now, it's state by state regulation."

Brian Nowak identifies regulatory hurdles as a key factor influencing the development of autonomous vehicles. Nowak points out that current regulations for autonomous fleets are managed on a state-by-state basis. This fragmented regulatory landscape presents a challenge that needs to be navigated for broader deployment.

"The other part that we're very focused on across all the players from Waymo to Tesla to Zoox and others is the cost of the cars. And there is a big difference between the cost of a Waymo per mile versus the cost of a Tesla per mile."

Brian Nowak emphasizes the critical role of cost in the adoption of autonomous vehicles. Nowak notes a significant disparity in the per-mile operating costs between different autonomous vehicle providers, specifically mentioning Waymo and Tesla. This cost difference is a key consideration for the economic viability and scalability of robotaxi services.

"So today, Waymo is the leader on safety. I think the one important caveat that I want to mention here is that's on a relatively small number of miles driven for Tesla. They've only driven about 250,000 miles in Austin, whereas Waymo's driven close to, I think, a hundred million miles cumulatively."

Andrew Percoco provides a comparative analysis of safety data between Waymo and Tesla. Percoco states that Waymo currently demonstrates superior safety performance, measured by miles driven per crash. Percoco also qualifies this by noting the significantly larger cumulative mileage Waymo has accumulated compared to Tesla's more limited data set.

"And so when we look at our model and we say as of 2024, Uber and Lyft make up 100 percent of the rideshare industry based on the current partnerships, which includes Waymo and Tesla and all; and Zoox and all the players, we think that Uber and Lyft will only make up 30 percent of the autonomous driving market."

Brian Nowak projects a substantial shift in the rideshare market due to the rise of autonomous vehicles. Nowak explains that while Uber and Lyft currently dominate the rideshare industry, their market share within the broader autonomous driving sector is expected to decrease significantly. This indicates that autonomous vehicle providers will capture a larger portion of the future mobility market.

Resources

External Resources

People

- Brian Nowak - Head of US Internet Research at Morgan Stanley

- Andrew Procaccoco - Head of North America Autos and Shared Mobility Research at Morgan Stanley

Organizations & Institutions

- Morgan Stanley - Host of the "Thoughts on the Market" podcast

- Waymo - Autonomous vehicle company expanding fleet and availability

- Tesla - Autonomous vehicle company with a cost advantage due to vertical integration and camera-only sensor approach

- Zoox - Autonomous vehicle company expanding fleet and availability

- Uber - Rideshare company partnering with autonomous vehicle players

- Lyft - Rideshare company partnering with autonomous vehicle players

Websites & Online Resources

- Pro Football Focus (PFF) - Data source for player grading (mentioned in example, not text)

- Unexpected Points newsletter - Newsletter associated with Kevin Cole (mentioned in example, not text)

Other Resources

- Autonomous vehicles - Subject of discussion regarding availability, safety, and cost

- Robotaxi business - Business model for autonomous vehicle services

- Rideshare industry - Industry impacted by autonomous vehicle deployment