Robotaxis Scale in 30 US Cities by 2026

TL;DR

- Robotaxi deployment is projected to shift from pilot projects to large-scale operations in approximately 30 US cities by 2026, signaling a significant market maturation beyond testing phases.

- The robotaxi market faces a "whack-a-mole" regulatory environment, requiring state-by-state approval based on disengagement reports, which dictates the pace of removing safety drivers.

- Waymo leads current robotaxi deployment with 2,000 vehicles, but Tesla's camera-based system and in-house production capacity position it to rapidly scale, contingent on remote operator ratios.

- Traditional ride-hailing players face disruption as robotaxis can capture significant market share in top cities with fewer than a thousand vehicles, necessitating strategic partnerships.

- The robotaxi experience offers a private, quiet environment for passengers to work or relax, akin to the transition from Blackberries to iPhones, enhancing user experience.

- AI's move from data centers to the physical world is exemplified by robotaxis, which are essentially driving robots with an added intelligence layer.

Deep Dive

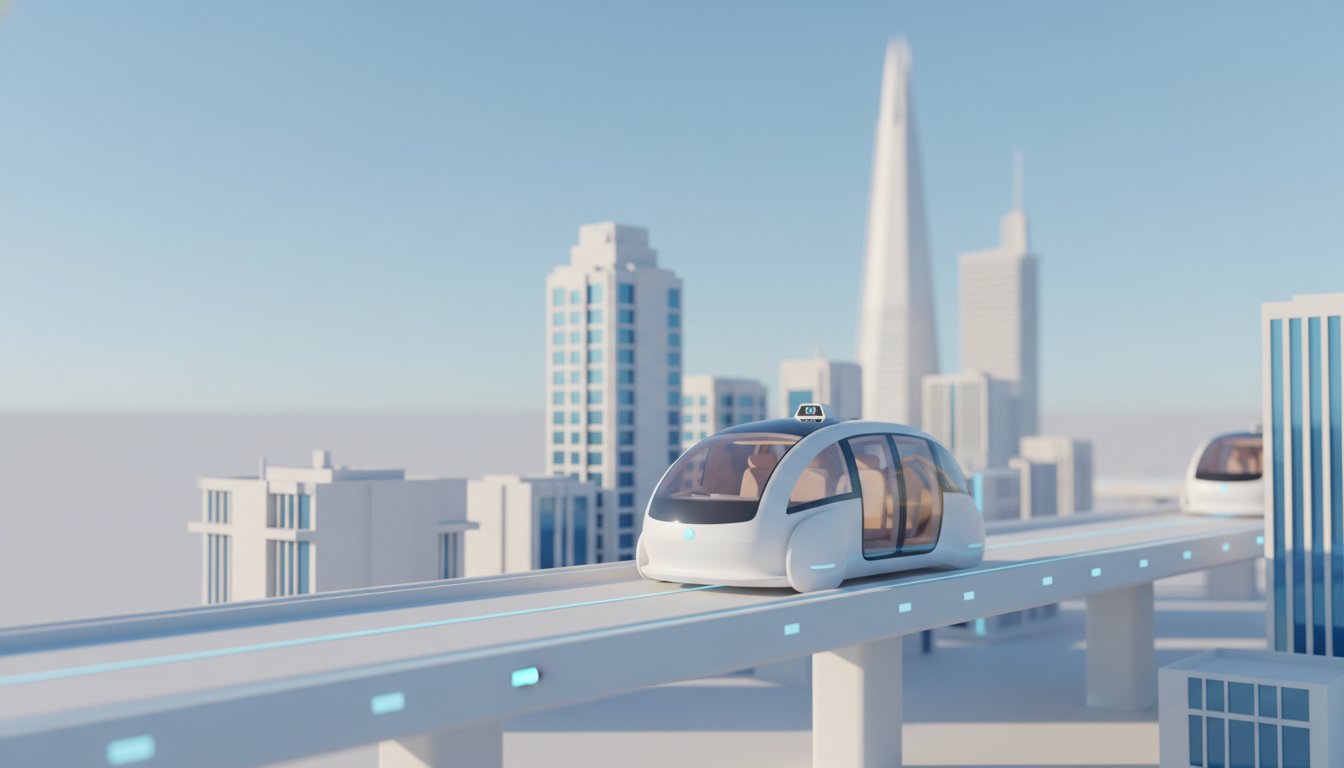

2026 is poised to be a transformative year for autonomous vehicle technology, marking a shift from pilot programs to large-scale robotaxi deployment across major US cities. This transition is driven by expanding fleets, the removal of safety drivers, and evolving partnerships, fundamentally challenging the existing ride-hailing market and signaling a significant application of AI in the physical world.

The robotaxi landscape is rapidly developing, with Waymo currently leading in scale, operating approximately 2,000 vehicles, a number projected to double by the end of 2026. Tesla is positioned as another key player, leveraging a camera-based system and in-house production capabilities, though its deployment is currently gated by the remote operator ratio required for fleet management. Regulatory approval, state by state, relies on disengagement reports demonstrating safety, a hurdle that companies must clear to operate without safety drivers. This regulatory environment, coupled with the need for robust AI and infrastructure, means that while 2025 was a year of testing, 2026 will see significant expansion into approximately 30 cities, with similar trends expected internationally.

The implications for traditional ride-hailing companies are substantial. With approximately 70% of human ride-hail volume concentrated in the top 20 US cities, a relatively small number of robotaxis (around 1,000 per city) could significantly disrupt this market. Traditional players face a strategic imperative to either develop their own robotaxi capabilities or partner with AV technology providers to avoid obsolescence. Failure to adapt risks ceding market share in lucrative urban and airport-to-downtown routes, where robotaxis offer a compelling value proposition due to their privacy, reduced noise, and potential for increased productivity during transit.

Looking ahead, the integration of robotaxis represents a critical manifestation of AI moving beyond data centers into physical applications. This advancement, alongside ongoing developments in AI infrastructure and models, suggests a continued cycle of investment and innovation. The success of robotaxis will hinge on overcoming regulatory complexities, building consumer trust, and achieving operational efficiency, particularly through optimizing the remote operator-to-vehicle ratio. As these autonomous systems become ubiquitous, they promise to reshape urban mobility and create new economic opportunities, while simultaneously pressuring incumbent transportation models to evolve.

Action Items

- Audit robotaxi deployment: Assess regulatory compliance and safety data across 30 cities targeting 2026 rollout.

- Measure remote operator ratio: Track current ratios (e.g., 1:5) and project target ratios (e.g., 1:50) for 5-10 robotaxi fleets.

- Analyze ride-hail disruption: Quantify market share impact on top 20 US cities using 1,000 robotaxis per city.

- Evaluate Tesla's production advantage: Compare Model Y weekly production (e.g., 50,000 units) against Waymo's fleet size (e.g., 2,000 vehicles).

- Track AI investment cycle: Monitor shifts between infrastructure, Gemini, and OpenAI exposure across 3-5 key AI themes.

Key Quotes

"It's definitely all over the place and in a way it changes on a weekly basis. So we've kind of gone from being very excited about the entire AI basket to bifurcating between names that are exposed to Google or Gemini winning the AI race. Then we flipped to names that are exposed to OpenAI and ChatGPT winning the AI race. And then we've had a risk-off where investors have kind of moved away from the AI infrastructure-related part of the trade."

Ross Sandler explains that investor sentiment around AI is highly dynamic and shifts rapidly between different dominant players and technologies. Sandler notes that this volatility is characterized by initial broad excitement, followed by a focus on specific companies, and then periods of investor caution regarding infrastructure investments.

"So you're right that 2025 was mostly about announcements and about testing of small fleets. The only city, like I said, where you see the glimpse into the future is San Francisco. If you kind of walk down a city block, you can't go 10 feet without seeing half a dozen Waymos or other robotaxis cruising around. Every other city's going to look like this eventually. We have about 30 cities going from initial announcement to deployment stage in 2026, and we're going to see a similar trend outside the US and in some of the top international markets."

Patrick Coffey highlights that 2025 served as a testing and announcement phase for robotaxis, with San Francisco offering a preview of future widespread adoption. Coffey projects that approximately 30 cities will transition to deployment stages in 2026, with similar expansion expected internationally.

"So there's no national autonomous regulation in the US. You kind of have to go state by state. And what the regulators do, it's generally like the California Transportation Authority, they will look at the data from a robotaxi fleet. They'll assess how safe the service is. These companies have to provide what's called a disengagement report, which is the number of miles traveled before the cockpit driver has to override the system."

Ross Sandler describes the fragmented regulatory landscape for autonomous vehicles in the US, where approval is managed on a state-by-state basis. Sandler explains that regulators like the California Transportation Authority evaluate safety by reviewing operational data and disengagement reports, which document instances requiring human intervention.

"So this is like the first manifestation of AI kind of moving out of the data center into the physical world. Robotaxis are essentially driving robots with an intelligence layer added on. And you're going to want to watch Tesla because they have a unique approach with their full self-driving software, their intelligence stack, and they also are the one company that has in-house production, unlike Waymo who buys their cars from Jaguar or from Hyundai or others in the future."

Ross Sandler positions robotaxis as a prime example of AI transitioning from digital environments to physical applications, functioning as intelligent automated vehicles. Sandler points to Tesla's integrated approach, combining proprietary software with in-house vehicle manufacturing, as a distinguishing factor compared to companies that rely on external car manufacturers.

"Absolutely. The kind of human ride-hail providers are in a bit of a tricky situation. So they're partnering with a bunch of different technology companies. But the big problem that they have is that around 70% of human ride-hail trip volume lives in just the top 20 cities in the US. The remaining kind of suburbs and tier two cities only represent about 30% of trips, which makes sense because if you're in the suburbs, everybody's got two cars, they've got a garage, a driveway, they can park at the grocery store."

Ross Sandler explains that traditional ride-hailing companies face significant challenges due to the concentration of their customer base in major urban centers. Sandler notes that the majority of ride-hail trips occur in the top 20 US cities, with suburban and smaller city markets representing a smaller portion, often due to personal vehicle ownership.

Resources

External Resources

People

- Ross Sander - Head of US Internet Research at Barkley's

- Patrick - Host of the Barkley Brief podcast

- Dan Levy - Covers Tesla and the auto space for Barkley's

Organizations & Institutions

- Barkley's - Research firm

- California Transportation Authority - Regulatory body

- Waymo - Robotaxi company

- Tesla - Automaker and technology company

- Jaguar - Automaker

- Hyundai - Automaker

Websites & Online Resources

- Unexpected Points - Newsletter by Ross Sander

Other Resources

- AI (Artificial Intelligence) - Discussed as a major investment theme and technological driver

- Robotaxis - Discussed as a transformative mobility technology and investment area

- Web 1.0 companies - Mentioned in relation to challenges from Google search referrals

- Full Self-Driving (FSD) - Tesla's autonomous driving software

- Lidar system - Sensor technology used in autonomous vehicles

- Camera-based system - Sensor technology used in autonomous vehicles

- Remote operator ratio - Metric for assessing the efficiency of remote oversight in autonomous vehicle fleets

- Human ride hail - Traditional ride-sharing services

- Blackberry - Mobile device

- iPhone - Smartphone

- GPT 6 equivalent - Future iteration of OpenAI's language model

- Agentic AI - AI systems capable of autonomous action