Intel's Manufacturing Failures Undermine Foundry Pitch; China Approves Nvidia H200 Chips

Intel's manufacturing woes reveal a critical lesson: the seductive allure of immediate fixes often masks deeper, compounding problems. This conversation, featuring insights from Bloomberg's Ian King and analyst Joan Finney, unpacks how Intel's pursuit of a comeback is being hampered by execution failures in its core manufacturing processes. The hidden consequence? A prolonged struggle to regain market leadership and a stark reminder that even with significant investment and government backing, operational excellence in complex manufacturing is a marathon, not a sprint. Those who can patiently build and execute on foundational manufacturing capabilities, rather than chasing short-term gains, will find themselves with a durable competitive advantage.

The Perilous Path of "Fixing" Manufacturing

Intel's narrative arc in this discussion is one of a company attempting a significant turnaround, only to be tripped up by the very foundations of its business: chip manufacturing. The core issue isn't a lack of demand for their products, but a failure in execution--specifically, in production yield and inventory management. Ian King highlights that Intel "basically didn't believe that the demand for some of their best products... was there. Didn't build inventory, didn't assign supply to that." This immediate misjudgment, a failure to accurately forecast and allocate resources, directly impacts their ability to meet existing demand.

The downstream effect of this is a compounding problem in their foundry business ambitions. As King explains, for Intel to attract external customers for its factories, those factories "have to be showing their best side. They have to be operating at full... maximum efficiency." When yield--the number of functional chips produced from a wafer--is low, it directly undermines their credibility as a reliable foundry partner. This isn't just about missing current sales; it's about jeopardizing future revenue streams by failing to demonstrate core competency.

"So they've really left quite a lot of orders on the table here and obviously that is not good."

-- Ian King

Joan Finney further elaborates on the impact of these manufacturing challenges, particularly concerning Intel's gross margins. Historically, Intel commanded margins above 60% in the PC business. Now, with a reported 37.9%, it signals a significant erosion of profitability. This isn't merely a financial metric; it's a direct indicator of manufacturing inefficiency. The "chicken and egg problem" Finney describes regarding the 14nm process--needing customer commitments to invest in capacity, but needing proven capacity to secure customers--is a classic systems-level dilemma. It illustrates how a failure in one area (manufacturing execution) creates a cascading failure in strategic initiatives (foundry business) and financial performance (gross margins).

The Long Game: Building Moats Through Manufacturing Mastery

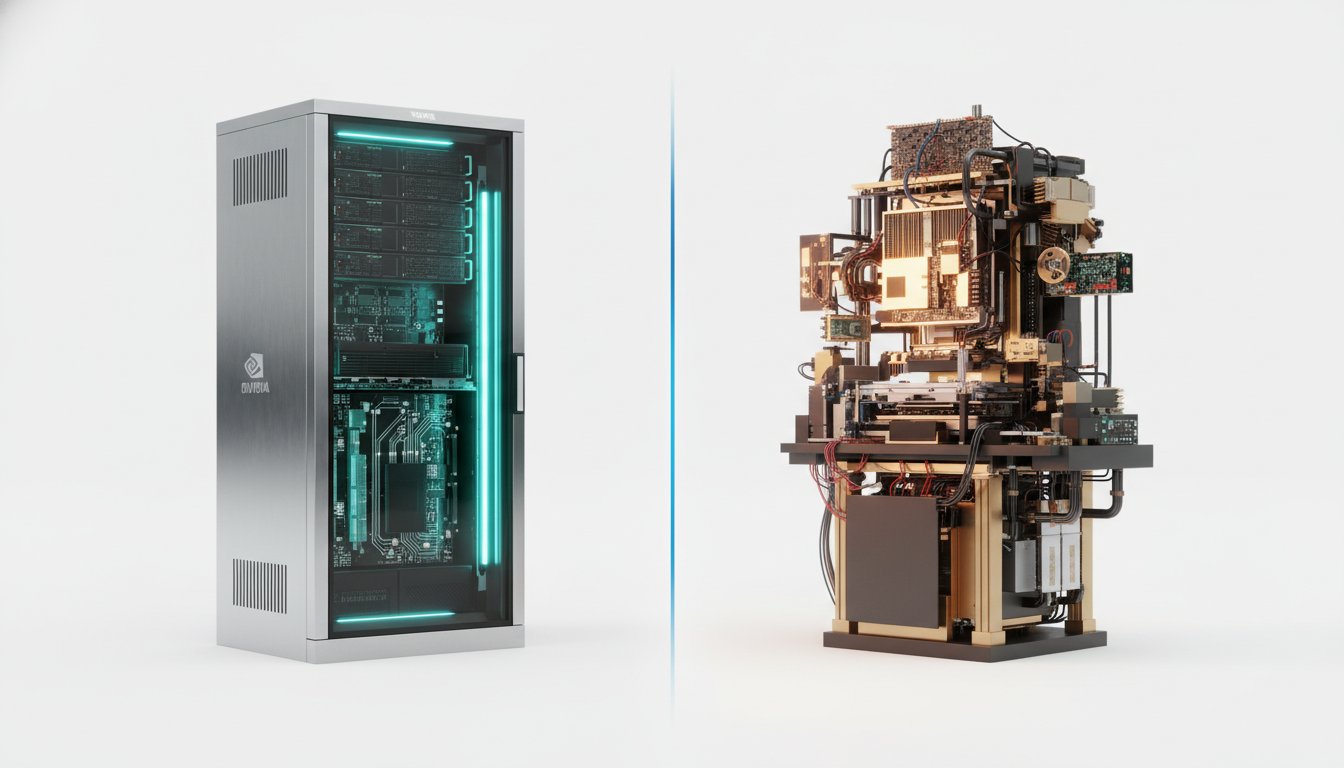

The conversation implicitly contrasts Intel's struggles with the success of its competitors, like Nvidia and AMD, who are lauded for their market leadership and strong partnerships with foundries like TSMC. Finney points out that these companies "have ironed out the design challenges and through their partners to like TSMC, the manufacturing challenges. And so they're delivering." This highlights a crucial distinction: Intel is trying to rebuild its manufacturing prowess from within, a far more arduous and time-consuming task than designing chips and leveraging existing, highly efficient manufacturing partners.

The delayed payoff for mastering manufacturing is precisely where competitive advantage lies. While competitors focus on design and market capture, Intel is engaged in a foundational, high-stakes effort to ensure its factories can reliably produce chips at scale and with high yields. This is not a quick fix; it requires sustained investment, meticulous execution, and a willingness to endure periods of underperformance. The "show-me story" described by Ryan Lastella regarding Intel’s valuation reflects this skepticism. Investors are wary because the transformation is fundamental and the timeline for success is protracted.

"We think that the opportunity cost is just too high. And you can own Broadcom, which we've owned for, you know, 11 years for clients. You can own Nvidia, which you've owned, we've owned for clients since 2022. These are clearly market leaders and they've ironed out the design challenges and through their partners to like TSMC, the manufacturing challenges. And so they're delivering."

-- Joan Finney

The conventional wisdom might suggest Intel should focus solely on design and outsource manufacturing entirely. However, Intel's strategy, as articulated by CEO Pat Gelsinger, involves rebuilding its internal foundry capabilities. This is a high-risk, high-reward strategy that, if successful, could create a significant moat. The immediate pain of low yields, high CapEx, and missed market opportunities is the necessary precursor to a future where Intel controls its manufacturing destiny. This is precisely the kind of difficult, long-term play that differentiates market leaders from those merely participating.

Key Action Items

-

Short-Term (Immediate-3 Months):

- Focus on Yield Improvement: Intel must prioritize and visibly demonstrate progress in improving manufacturing yields across its key process nodes. This is the foundational metric for all other foundry ambitions.

- Transparent Communication: Continue to communicate candidly about manufacturing challenges and progress, managing investor expectations while reinforcing the long-term strategy.

- Secure Foundational Customer Commitments: Actively pursue and announce volume commitments for specific process technologies, even if it means accepting less favorable initial terms.

-

Medium-Term (3-12 Months):

- Demonstrate Foundry Reliability: Showcase successful production runs for early foundry partners, proving consistent output and quality. This builds trust and de-risks future engagements.

- Strategic CapEx Allocation: Continue investing in manufacturing capacity, but with a clear line of sight to customer commitments and projected demand, avoiding speculative build-outs.

- Competitor Benchmarking: Continuously benchmark manufacturing performance against industry leaders like TSMC, identifying specific areas for improvement.

-

Long-Term (12-24 Months+):

- Achieve Competitive Margins: Work towards regaining historical gross margins through manufacturing efficiencies, signaling a return to operational health.

- Establish Foundry Ecosystem: Cultivate a robust ecosystem of design partners and customers for its foundry services, solidifying its position as a viable alternative to existing players.

- Develop Next-Generation Manufacturing: Invest in and successfully implement next-generation process technologies (e.g., 1.4nm) to maintain a competitive edge in the semiconductor race. This pays off in 18-24 months by securing future market share.