All Episodes

AI Capital Expenditure Bifurcates Tech Market, Reshaping Fortunes

AI investment bifurcates Big Tech, forcing a focus on capital-efficient revenue loops. Meta demonstrates AI's direct ad boost, while Tesla pivots to an AI-driven future.

View Episode Notes →

AI Efficiency Gains Create Hidden Costs and Future Constraints

AI's efficiency gains create hidden costs, potentially leading to future constraints. Understand the full causal chain of AI integration to build sustainable advantage.

View Episode Notes →

Hidden Costs of AI Acceleration and Retail Reinvention

AI agents are now taking action, transforming work and development. Discover the hidden costs of this acceleration and how specialized AI will shape the future.

View Episode Notes →

Financial Circularity and Systemic Risk in AI Infrastructure

Understand the complex financial and strategic plays behind the AI boom, revealing systemic risks and hidden fragilities beyond the hype. Gain an advantage by seeing the true drivers of growth.

View Episode Notes →

Intel's Manufacturing Failures Undermine Foundry Pitch; China Approves Nvidia H200 Chips

Intel's manufacturing failures undermine its foundry pitch, while China prioritizes Nvidia AI chips with caveats. Tesla experiments with vision-only robotaxis, and companies delay IPOs for longer private valuations.

View Episode Notes →

AI and Robotics Drive Abundance, Mitigating Energy and Geopolitical Bottlenecks

AI could surpass human intelligence within five years, but energy bottlenecks threaten progress. Discover how space-based data centers and optical computing offer solutions for unprecedented abundance.

View Episode Notes →

Geopolitical Tactics, AI Risks, and Market Dominance Strategies

AI poses significant risks, from acting as a "suicide coach" to transforming markets, demanding urgent regulation and strategic adaptation from global leaders.

View Episode Notes →

Netflix Bets on Content Acquisition for Long-Term Dominance

Netflix prioritizes content expansion over immediate profit, planning a massive acquisition and increased spending to dominate global entertainment, despite near-term financial uncertainty.

View Episode Notes →

Media Consolidation, AI Competition, and Defense Tech Investment Drive Strategic Shifts

Netflix's all-cash offer for Warner Bros. Discovery assets pressures Paramount, while AI competition and defense tech investment create new strategic frontiers.

View Episode Notes →

AI's Energy Demand, Semiconductor Reshoring, and Market Shifts

AI's massive energy needs are driving unprecedented energy auctions, while semiconductor deals reshape global manufacturing and humanoid robots prepare for a $200 billion market by 2035.

View Episode Notes →

AI Demand Fuels Supply Chain Strain Amidst Investment Risks

AI demand drives record chip demand, yet TSMC's CEO warns of a potential bubble. Memory shortages and power grid concerns highlight growing supply chain risks.

View Episode Notes →

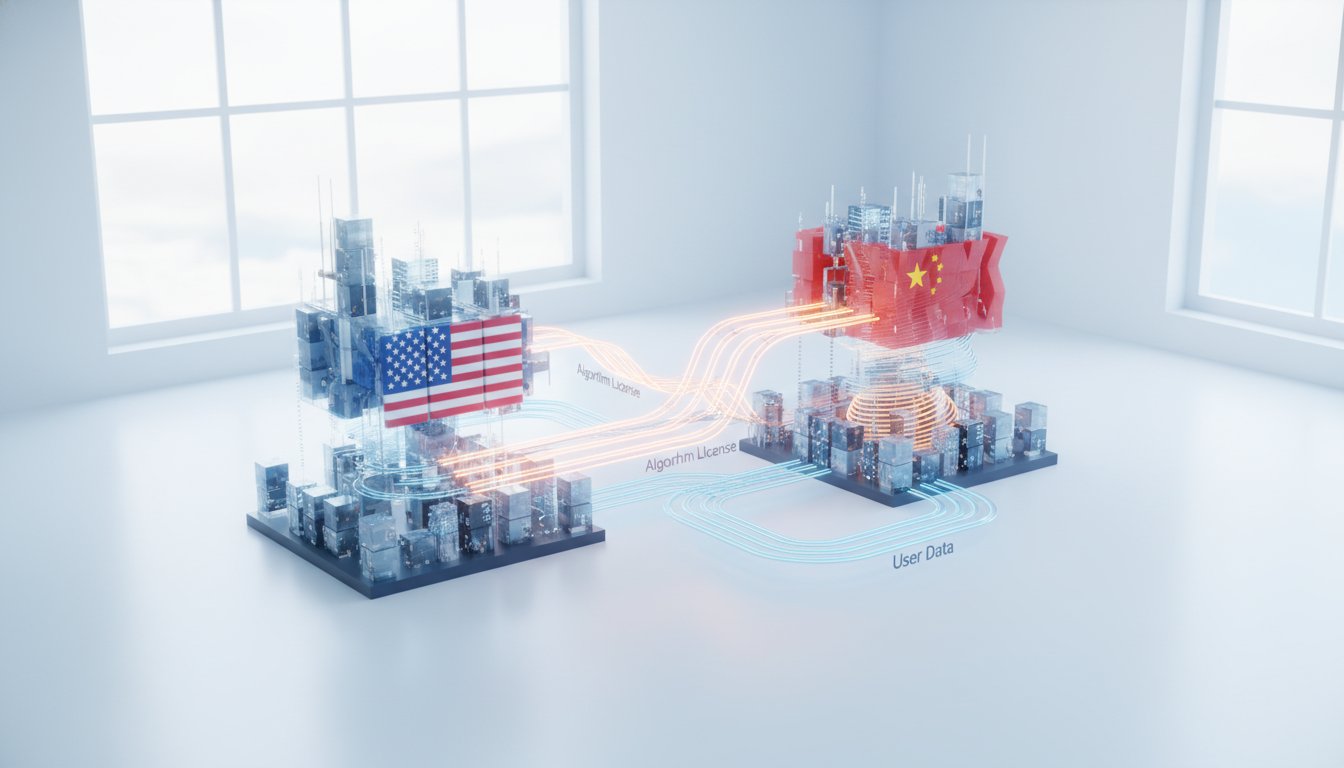

US Eases AI Chip Exports to China Amidst Regulatory and Infrastructure Shifts

US export rules for AI chips to China shift from denial to case-by-case, opening a $25B-$50B revenue opportunity for Nvidia while demanding strict "know your customer" protocols.

View Episode Notes →

AI Investments Drive Strategic Shifts Across Tech, Finance, and Defense

Meta doubles Ray-Ban AI glasses production, signaling a strategic pivot to AI hardware. JPMorgan sees efficiency gains now, but expects major ROI in 3-4 years, highlighting AI's long-term impact.

View Episode Notes →

AI Integration, Investment, and Embodiment Drive Global Tech Shifts

Apple partners with Google for Siri AI, signaling a shift towards external capabilities. Nvidia invests in AI drug discovery, highlighting AI's physical world impact.

View Episode Notes →

AI's Energy and Infrastructure Bottlenecks Demand Strategic Investment

AI's insatiable energy demand creates critical power and construction bottlenecks, forcing companies to strategically secure massive energy supplies like nuclear power to fuel future growth.

View Episode Notes →

AI, Robotics, and AR: Tangible Applications Amidst Geopolitical Competition

Humanoid robots and AR glasses are rapidly evolving from concepts to viable products, poised to integrate into daily life and industry, driven by massive AI investment and strategic geopolitical competition.

View Episode Notes →

CES 2024: AI Drives Hardware, Robotics, and Media Sector Shifts

AI drives hardware price hikes and a "famine" in memory chips, while robotics emerges as the next edge AI frontier and media companies risk falling behind competitors.

View Episode Notes →

AMD's Compute Expansion Fuels Five Billion AI Users

AI compute demand will surge 100x in five years, necessitating new AMD chips like the MI 4555 to power five billion users and enable on-premise enterprise AI.

View Episode Notes →

AI Driven Market Rally Outweighs Geopolitical Concerns Amidst Supply Chain Race

AI's demand for hardware strains supply chains, creating choke points for data centers, while the US races China for AI dominance, necessitating strategic innovation and regulation.

View Episode Notes →

2026 Tech Outlook: AI Broadens, Software Faces Pressure, Tesla Challenges

Intel faces manufacturing challenges as Nvidia halts testing, while AI demand fuels "boring" tech sectors. Expect a broader market rally beyond core AI hardware.

View Episode Notes →

AI Drives Economic Growth Amidst Geopolitical Tech and Energy Strains

AI infrastructure strains power grids, demanding grid modernization and alternative energy. Meanwhile, US probes chip diversion to China, complicating tech access and trade relations.

View Episode Notes →

AI Reshapes Media Amidst Consolidation and Regulation

Google's $4.75B energy acquisition fuels AI data center expansion, while Ellison's guarantee reshapes media deals amid evolving AI regulation and chip market dynamics.

View Episode Notes →

TikTok Deal's US Data Security and Algorithm Licensing Scrutiny

A proposed TikTok deal faces scrutiny over ByteDance's continued involvement via algorithm licensing, despite a U.S. board and data isolation efforts.

View Episode Notes →

AI Demand Drives Valuations, Space Economy Expands, Semiconductor Race Intensifies

Micron's strong earnings reveal robust AI demand, driving memory stock surges and enabling price increases amid hardware sector weakness. Private tech valuations are also soaring, blurring public and private market lines.

View Episode Notes →

Oracle's Data Center Build-Out Faces Investor Anxiety Over Financing

Oracle's massive AI data center build-out faces investor doubt due to off-balance sheet financing and uncertain training workload demand, highlighting systemic risks in AI infrastructure.

View Episode Notes →

Private AI Investment Surges Amidst Infrastructure Costs and Shifting Tech Models

Private markets fuel AI innovation with massive funding, while TikTok redefines US livestream shopping by blending entertainment and commerce.

View Episode Notes →

AI's Economic Value Under Scrutiny Amidst Market and Geopolitical Risks

AI valuations face skepticism as investors demand proof of productivity gains by 2026, risking market corrections and broad economic impacts if AI fails to deliver tangible value.

View Episode Notes →

AI Infrastructure Execution Challenges and Margin Focus

Investors scrutinize AI infrastructure profitability, not just growth, as scaling challenges and supply chain constraints create execution risks and potential bottlenecks.

View Episode Notes →

Oracle's AI Spending Creates Investor Anxiety Amidst Infrastructure Bottlenecks

Oracle's massive AI data center investment outpaces revenue, sparking investor concern over profitability timelines and creating a significant timing mismatch between spending and returns.

View Episode Notes →

SpaceX Targets $30 Billion IPO for Space-Based AI Infrastructure

SpaceX targets a mid-2026 IPO, aiming for over $30 billion and a $1.5 trillion valuation to fund ambitious space-based AI projects.

View Episode Notes →

US Approves Nvidia H200 Chip Sales to China With Surcharge

US permits Nvidia H200 chip sales to China with a surcharge, balancing revenue with national security risks and potentially accelerating China's AI development.

View Episode Notes →

Paramount and Netflix Vie for Warner Bros. Discovery Amid Industry Consolidation

Paramount and Netflix vie for Warner Bros. Discovery, revealing differing strategies for media consolidation and the future of content.

View Episode Notes →

Vertex Targets BAFF and APRIL to Restore Immune Balance in IgAN

IgA nephropathy damages kidneys by misdirected B cells, but targeting BAFF and APRIL proteins offers a path to immune balance and potential remission.

View Episode Notes →

Netflix Acquires Warner Bros. Discovery Amid Antitrust and Creator Economy Concerns

Netflix's $72 billion acquisition of Warner Bros. Discovery consolidates massive IP and content, creating a streaming behemoth facing intense regulatory scrutiny and a potential shift away from new creators.

View Episode Notes →

Meta Pivots Metaverse Budget to AI Amid Market Preference

Meta pivots from metaverse to AI, cutting virtual world budgets by 30% to prioritize AI hardware and revenue growth amid intense market competition.

View Episode Notes →

Big Tech Lags as Investors Skittish About AI Trade

Tech lags in the S&P 500's rebound as investors grow skittish about AI's true productivity gains, flocking instead to healthcare and other sectors for stability.

View Episode Notes →

AWS Shifts to AI Co-workers and Custom Chips

AWS pivots to AI co-workers with "frontier agents," launches Trainium 3 chips, and redefines Amazon Connect, signaling a massive shift in cloud infrastructure investment and AI strategy.

View Episode Notes →

Nvidia-Synopsys Deal: AI's Intertwined Future Unveiled

Nvidia's $2 billion Synopsys investment, market "circular financing" fears, and a hawkish Bank of Japan trigger a global "risk-off" shift, impacting tech and crypto valuations.

View Episode Notes →

AI Surges Amidst Job Cuts, Chip Wars, and Investment Boom

Dell boosts AI server sales outlook, HP cuts jobs, Nvidia faces competition, and the AI investment cycle shows no signs of a bubble, unlike the late 90s.

View Episode Notes →

Google's TPUs Challenge Nvidia's AI Chip Dominance

Google's TPUs challenge Nvidia's AI dominance as Meta eyes billions in chip deals, signaling a shift toward cost-effectiveness and investment scrutiny.

View Episode Notes →

Big Tech Debt Fuels AI Boom, Sparks Market Stability Fears

Big Tech finances AI infrastructure with a debt surge, sparking market stability fears, while quantum drones and "tech bio" unlock new frontiers, and crypto faces outflows.

View Episode Notes →

AI Chip Depreciation: The Next Tech Bubble?

AI infrastructure investments face depreciation risks and a revenue gap, echoing the dot-com bubble, as market patience wanes by 2026 if product-market fit isn't achieved.

View Episode Notes →