Oracle's AI Spending Creates Investor Anxiety Amidst Infrastructure Bottlenecks

TL;DR

- Oracle's significant increase in capital expenditures for AI data centers, exceeding expectations by billions, signals a substantial upfront cost for future revenue, potentially delaying profitability and causing investor anxiety about the return on investment timeline.

- The market's reaction to Oracle's spending suggests a "timing mismatch" where the substantial investment in AI infrastructure is not yet translating into commensurate revenue growth, leading to a perceived lack of confidence in the company's ability to capitalize on demand.

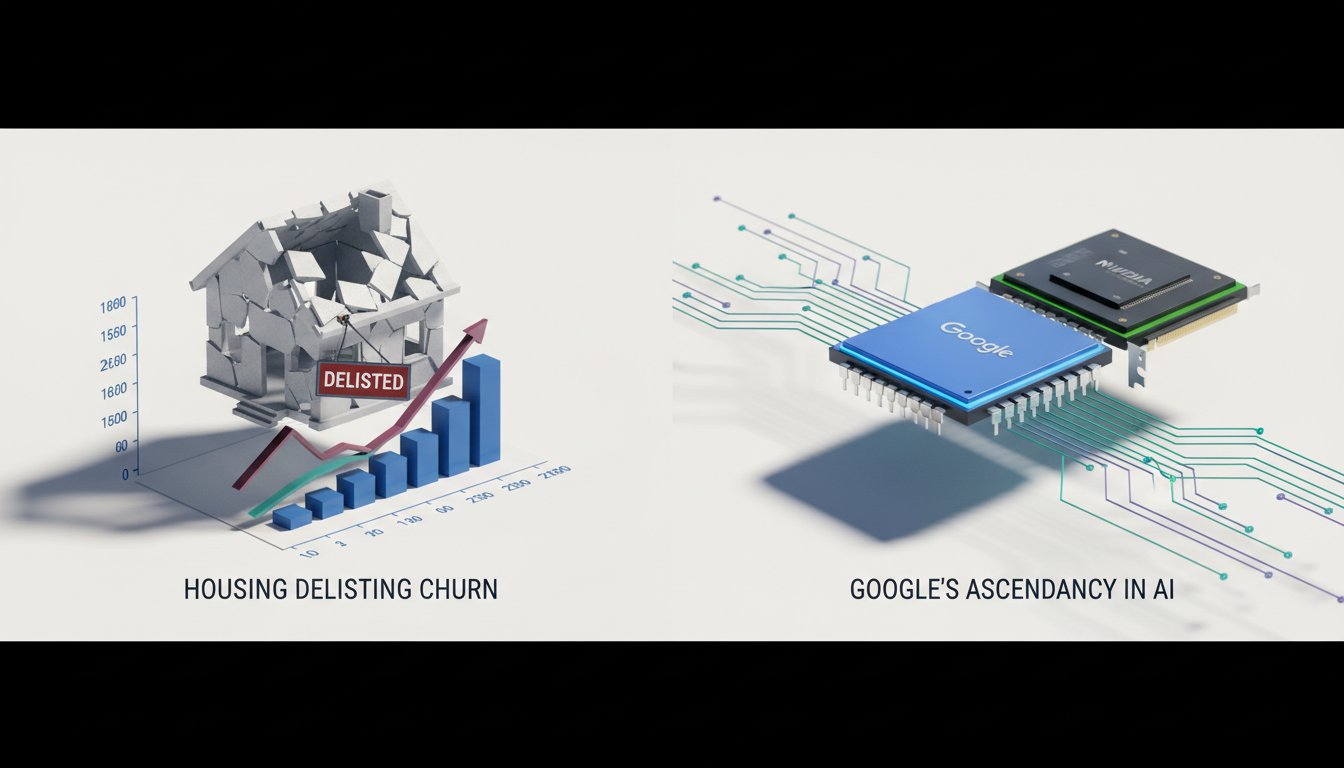

- Disney's $1 billion investment in OpenAI and licensing of characters for Sora and ChatGPT represents a strategic move to monetize intellectual property in the generative AI space, gaining a stake in an emerging technology while securing exclusive access for a limited period.

- Synopsys's backlog of $11.5 billion for FY26 indicates strong demand across its portfolio, driven by hyperscalers seeking multiple optimization strategies, including custom ASICs and merchant chips, all requiring essential silicon design tools.

- The AI infrastructure shortage is a critical roadblock across all industries, with hyperscalers like Oracle facing immense pressure to meet insatiable compute demand, highlighting the bottleneck in deploying AI functionalities broadly.

- The legal claims against OpenAI and Microsoft alleging psychological manipulation by ChatGPT underscore the evolving risks of advanced AI, prompting calls for improved safety measures and user education to mitigate potential harms.

Deep Dive

Oracle's stock experienced a significant decline, its largest in over two decades, following a substantial increase in capital expenditures for AI data centers that outpaced revenue growth expectations. This spending surge, while signaling Oracle's commitment to AI infrastructure, raises concerns about the timeline for revenue recognition and the overall profitability of these investments, creating market anxiety and impacting broader tech sector sentiment.

The core issue for Oracle is the timing mismatch between massive upfront capital investment and the delayed realization of revenue from its AI infrastructure build-out. While the company has secured significant commitments, notably from OpenAI, the sheer scale of spending--billions beyond Wall Street's projections--suggests a prolonged period before these investments yield substantial returns. This has led to concerns about negative free cash flows and a rising debt pile, reflected in the increased cost of credit default swaps. Analysts acknowledge the insatiable demand for compute power across the industry, including from hyperscalers like Microsoft Azure, but emphasize that Oracle's heavy reliance on a few key clients, particularly OpenAI, introduces concentration risk. The market's apprehension stems from the uncertainty surrounding the conversion of Oracle's substantial backlog into tangible revenue and the potential for these investments to become "empty calories" if not managed effectively.

This situation highlights a critical tension in the AI boom: the immense demand for infrastructure versus the financial discipline required to ensure profitable growth. While Oracle's pivot to AI infrastructure is strategically sound, the market's reaction underscores the need for clear evidence of accelerating cloud revenue and AI-driven outperformance to justify its valuation. The company's ability to convert its large backlog into profitable revenue streams will be pivotal in restoring investor confidence and validating its long-term strategy in the competitive AI landscape.

Action Items

- Audit Oracle's AI infrastructure spending: Quantify capital expenditure variance against street expectations and identify revenue recognition timelines for 3-5 key AI deals.

- Analyze Disney's OpenAI licensing terms: Assess the exclusivity period and potential for future IP monetization beyond the initial 1-year agreement.

- Evaluate Synopsys' China market strategy: Project revenue impact assuming a continued status quo environment and identify alternative growth drivers.

- Track AI infrastructure bottlenecks: For 3-5 industries (e.g., healthcare, finance), measure the impact of AI infrastructure shortages on deployment timelines.

- Measure AI adoption productivity gains: For 3-5 traditional knowledge worker roles, quantify the observed improvement in capabilities using AI tools.

Key Quotes

"very simply capital expenditures several billion dollars beyond what the street thought they would be in the quarter cloud growth we're talking cloud growth way up there particularly in the infrastructure unit but just shy of very high expectations interesting right now if you look at the chip space nvidia also like broadcom big declines and at the index level that you were just showing us caroline those names are part of the drag so we need to dig into what's going on"

This quote highlights the market's reaction to Oracle's financial report, specifically the significant increase in capital expenditures and cloud growth that fell just short of high expectations. The speaker points out that this situation is impacting broader tech indices, affecting companies like Nvidia and Broadcom.

"ai anxiety is right i mean the big question for oracle and all of its peers right now is is building ai infrastructure a good business to be in wall street understands it takes a lot of upfront costs but it seems like every single quarter it's more than we thought it would be and the revenue recognition is further out than we thought it would be and so oracle kind of gave the exact message that wall street wasn't hoping for which is we're spending more and it's it's taking a little longer than you expected to see the revenue uplift but it's it's a trade off with growth"

The speaker explains that the core concern for Oracle and its competitors is the profitability of building AI infrastructure, given the substantial upfront costs and delayed revenue recognition. Oracle's message of increased spending and longer-than-expected revenue uplift is precisely what Wall Street did not want to hear, indicating a trade-off between investment and immediate growth.

"yeah i think right now it's a timing mismatch i think we're getting overly penalized for a number of uh elements i think there is kind of a vote of no confidence from the market around uh the ability to grow uh and serve open ai uh both on the ai front quite frankly and the and the oracle front and i think that that's a mistake uh we truly believe the compute demand uh at the moment is insatiable it's not just insatiable for open ai uh it's insatiable for other foundation model companies it's also insatiable for other hyperscalers"

Alex Zukerman argues that the market is overreacting to Oracle's situation, attributing the penalty to a "timing mismatch" and a lack of market confidence in Oracle's ability to serve AI demand, particularly from OpenAI. Zukerman believes this is a mistake, emphasizing that compute demand is currently "insatiable" across various AI-focused companies and hyperscalers.

"i i think it's always hard to call a bubble when you're in the middle of it we do see a tremendous amount of productivity enhancement uh that is happening in the industry and i think depending on where you are and if you're what part you're looking at you can have a completely different picture i think at this point if you're an engineer or if you're a software developer you can't imagine life without agentic uh coding you can't go back to a time when you weren't using one of those tools"

This quote addresses the AI bubble debate, with the speaker finding it difficult to definitively label it a bubble while acknowledging significant productivity enhancements. The speaker highlights that for engineers and software developers, AI tools like "agentic coding" have become indispensable, indicating a fundamental shift in how work is done.

"yeah there's been a lot of anxiety about how ai will affect the entertainment industry and disney's support its investment in open ai is uh a huge development i mean this is something that you know we didn't really expect there's been a lot of you know tension and controversy with ai in film"

Hannah Miller describes Disney's investment in OpenAI as a significant development, especially given the existing anxiety and controversy surrounding AI's impact on the entertainment industry. This investment was unexpected and marks a notable step in how major entertainment companies are engaging with generative AI technologies.

"well you know when people talk about the ai bubble i think i don't know exactly what they mean and usually i say there's two way to look at it if you look at the industry i don't think there is a bubble so the the impact of ai on the industry is just starting and the impact on the industry will be positive for many many years to come so there there is no bubble i think that the value of ai the industrial value of ai is extremely high and this will be developing over time"

Christoph Fukui distinguishes between the industrial impact of AI and stock market valuations, stating that while there might be excitement leading to high company valuations, the overall industrial value of AI is immense and just beginning. Fukui believes the AI's impact on industries will be positive for many years, indicating that there is no "bubble" in terms of its fundamental value and application.

Resources

External Resources

Books

- "The AI Bubble" - Mentioned in the context of discussions about potential stock market overvaluation related to AI excitement.

Articles & Papers

- "Bloomberg Opinion" - Mentioned as a source for analysis on the Disney and OpenAI deal.

People

- Larry Ellison - Mentioned in relation to Oracle's financial performance and AI spending.

- Bob Iger - Mentioned in relation to Disney's investment in OpenAI and intellectual property licensing.

- Christoph Fukui - CEO and President of ASML, discussed regarding AI bubble concerns and demand for semiconductor manufacturing equipment.

- Michelle Lee - CEO of Medra, discussed regarding the company's Series A funding round and its "physical AI" approach to lab automation.

- Sasan Ghodsi - CEO of Synopsys, discussed regarding the company's earnings, guidance, and the impact of Nvidia's investment.

Organizations & Institutions

- Oracle - Discussed extensively regarding its AI spending, capital expenditures, and stock performance.

- OpenAI - Mentioned in relation to Disney's investment, licensing of characters, and its role in AI infrastructure demand.

- Disney - Discussed in relation to its investment in OpenAI and licensing of characters for generative video platforms.

- Nvidia - Mentioned in relation to its equity investment in Synopsys and its role in the AI chip market.

- Synopsys - Discussed regarding its fourth quarter results, forecast, and the impact of Nvidia's investment.

- ASML - Discussed as Europe's most valuable company and its role in the global AI supply chain, with its CEO addressing AI bubble concerns.

- Medra - Discussed as a startup focused on "physical AI" for lab automation, having closed a Series A funding round.

- Microsoft - Mentioned as a major investor in OpenAI and in the context of AI infrastructure demand and potential liability lawsuits.

- CVS Caremark - Mentioned in relation to prescription plan savings.

- Verizon Business - Mentioned in relation to its "Biz Plan" for mobile services.

- Cohesity - Mentioned in relation to resilience and business continuity.

- Mastercard - Mentioned in relation to B2B card payment solutions.

- Public - Mentioned as a platform for building multi-asset portfolios, including generated assets.

- Adobe - Mentioned in the context of its Acrobat Studio and AI-powered PDF features.

- Chase Sapphire Reserve for Business - Mentioned as a business credit card.

- Chase Ink Business Premier - Mentioned as a business credit card.

- Genentech - Mentioned as a biopharma company using Medra's technology.

- YouTube TV - Mentioned in relation to a multi-year deal with Disney.

- FedEx - Mentioned in relation to its supply chain solutions.

- Mint Mobile - Mentioned as a provider of wireless services.

- JPMorgan Chase Bank, N.A. - Mentioned as the issuer of Chase business cards.

Tools & Software

- ChatGPT - Mentioned in relation to OpenAI's generative video platform and potential psychological manipulation.

- Sora - Mentioned as OpenAI's generative video platform, with Disney licensing characters for its use.

- Adobe Acrobat Studio - Mentioned for its AI-powered PDF features.

Websites & Online Resources

- omnystudio.com/listener - Mentioned for privacy information.

- chase.com/reservebusiness - Mentioned for learning more about Chase Sapphire Reserve for Business.

- cmk.co/stories - Mentioned for learning how CVS Caremark helps members save.

- verizon.com/business - Mentioned for learning more about Verizon's Biz Plan.

- mastercard.com/commercialacceptance - Mentioned for learning about Mastercard's B2B acceptance solutions.

- public.com/market - Mentioned for earning a bonus when transferring a portfolio.

- adobe.com/dothatwithacrobat - Mentioned for learning more about Adobe Acrobat Studio.

- chase.com/businesscard - Mentioned for learning more about Chase business cards.

- cohesity.com/resilience - Mentioned for learning more about Cohesity's resilience solutions.

Other Resources

- AI Spending - Discussed as a primary driver of market reaction for companies like Oracle.

- AI Infrastructure - Identified as a bottleneck and a significant area of investment and demand.

- Capital Expenditures (CapEx) - A key metric discussed in relation to Oracle's financial performance and AI investments.

- Cloud Growth - Discussed as a measure of performance for cloud service providers.

- Generative AI - The overarching technology discussed in relation to various companies and its impact on industries.

- Intellectual Property (IP) - Discussed in the context of licensing for AI platforms and potential disputes.

- Physical AI - A concept introduced by Medra, referring to the automation of scientific experiments through robotics and AI.

- Resilience - Mentioned in relation to business continuity and preparedness.

- Territorial Control - Mentioned in the context of the Ukrainian peace deal.

- Virtual Card Payments - Discussed as a growing demand in the B2B payment landscape.