Howard Marks Warns AI's Societal Impact Risks Excessive Implementation

TL;DR

- Howard Marks warns that AI's societal impact, while transformative like past technological bubbles, carries risks of excessive implementation and financing, necessitating careful investment consideration.

- Lenders should avoid financing purely conjectural activities, as the limited upside of a fixed return is a poor trade-off for the high probability of losing principal.

- Prudent market behavior, evidenced by harsh reactions to aggressive risk-taking, signals a healthier market discipline compared to periods of widespread imprudence.

- Federal Reserve interest rate manipulation artificially lowers the cost of money, inducing risk-taking and reinforcing a "Fed put" mentality that discourages caution.

- Moderate prospective returns are expected across most asset classes, with equities priced for low future returns, compelling investors to take on excessive risk.

- AI-driven job displacement poses a significant societal concern, potentially leading to widespread purposelessness and a decline in job quality beyond mere income replacement.

- Consumers are increasingly savvy and value-conscious, concentrating spending around promotions and seeking better value, especially in categories impacted by tariffs or price increases.

Deep Dive

Howard Marks, co-founder of Oaktree Capital, warns of the societal disruption posed by artificial intelligence, particularly its impact on employment. While acknowledging AI's potential for societal advancement similar to past technological revolutions, he emphasizes that excessive implementation and financing could lead to capital destruction. This concern extends beyond economics to the broader societal implications of job displacement, including potential increases in purposelessness and a decline in job quality, drawing a parallel to the societal issues observed during the automation and offshoring waves of the past.

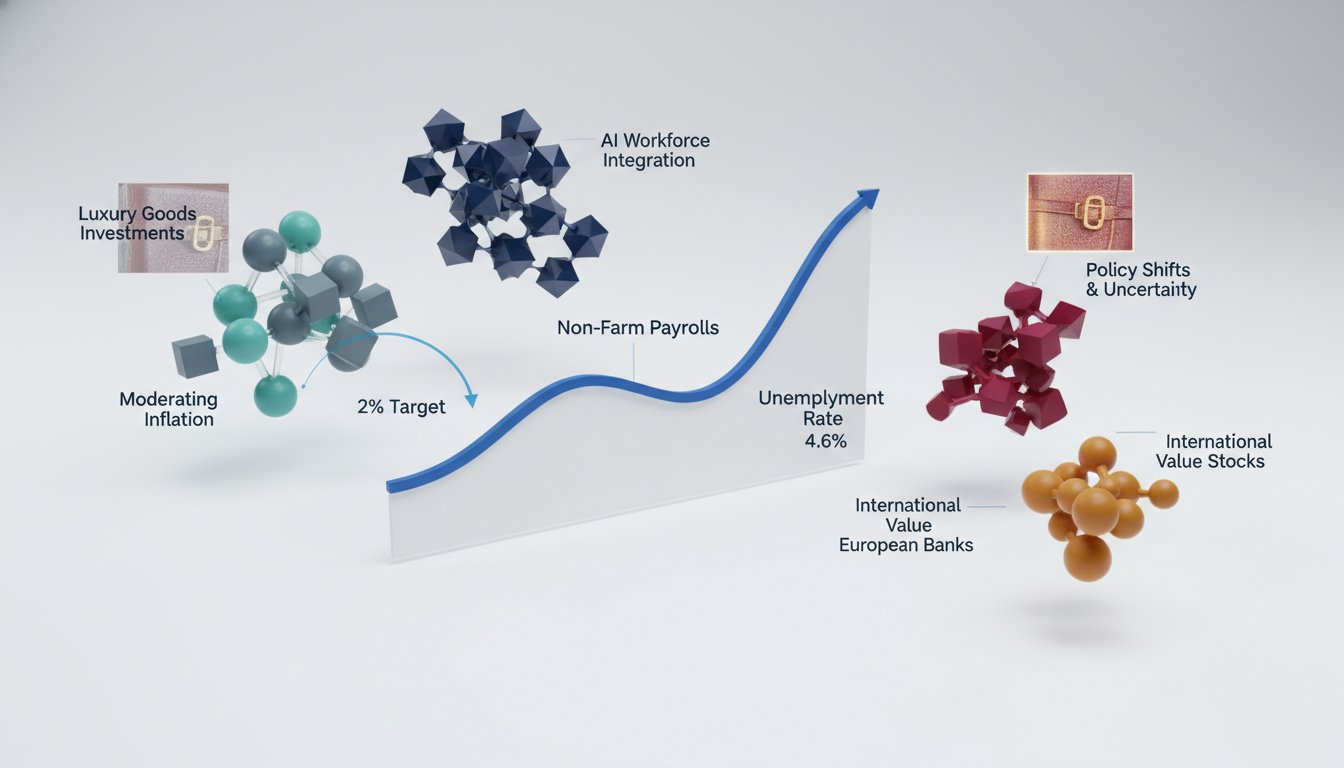

The current market environment, despite the excitement around AI, presents a complex risk-reward landscape. Marks advises caution, distinguishing between productive and unproductive bubbles. While productive bubbles, fueled by technological progress, can reshape society, their implementation often involves over-acceleration and excessive financing, leading to inevitable excesses. Investors must be wary of overhyped and overpriced assets, a sentiment that contrasts with the market's current enthusiasm for AI. He suggests that in highly uncertain ventures, equity participation may be more prudent than debt lending, as lenders have limited upside and significant downside risk in speculative endeavors. The market's reaction to aggressive, risk-indicating activities, such as Oracle's recent borrowing for AI investment, is seen as a healthy sign of applied discipline, contrasting with the imprudent behavior observed in previous market peaks.

Regarding monetary policy, Marks criticizes the Federal Reserve's interventions as price controls that artificially lower the cost of money, inducing risk-taking and reinforcing a belief in a "Fed put." He advocates for a more passive Fed, intervening only in extreme economic conditions, and questions the current merit of further rate cuts or balance sheet expansion given the absence of overheating or significant underactivity. He notes that current interest rates, while higher than the recent past, are moderate by historical standards, leading to moderate prospective returns across most asset classes. The equity market, particularly the S&P 500, appears priced for very low prospective returns based on historical price-to-earnings ratios.

Michelle Meyer, Chief Economist at Mastercard, provides an optimistic outlook on consumer spending, projecting mid-single-digit growth for the holiday season driven by sustained consumer engagement. Despite inflationary pressures, real spending and volume growth remain healthy, with consumers demonstrating increasing savviness in their purchasing decisions, concentrating spending around promotional periods and prioritizing value. While tariffs and other price increases are impacting purchasing decisions, consumers are navigating these realities by evaluating the necessity and value of goods. Meyer observes that spending patterns vary by income cohort and sector, with strong engagement in restaurants and travel, while furniture and home improvement show weakness, and apparel remains a robust category. The overall sentiment is one of continued consumer resilience and adaptability in the face of economic shifts.

Action Items

- Audit AI impact on labor: Analyze 3-5 job categories for potential displacement and identify 2-3 retraining program frameworks.

- Create lending criteria: Define 5-7 risk assessment factors for AI-driven ventures, distinguishing between productive and speculative bubbles.

- Measure consumer spending shifts: Track 3-5 discretionary spending categories for 2-3 income cohorts to identify value-seeking behaviors.

- Evaluate Fed policy impact: Analyze 2-4 Fed actions for their influence on risk-taking and market price discovery.

Key Quotes

"I find the resulting outlook for employment terrifying. I'm enormously concerned about what will happen to the people whose jobs AI renders unnecessary or who can't find jobs because of it."

Howard Marks expresses deep concern regarding the potential societal impact of AI on employment. He highlights the fear that AI could displace a significant number of workers, leading to widespread joblessness and social disruption.

"Well I think that the unproductive bubbles I would describe as financial fads, portfolio insurance was one, subprime mortgages was another, just you know financial activities that become fashionable zoom into popularity, get overhyped and then recede. But then there are bubbles which are based on technological progress starting with the steam engine, the railroad, the radio, the automobile, computers, internet, etcetera, and these actually push society ahead and change it irreversibly."

Howard Marks distinguishes between "unproductive bubbles" driven by financial fads and "productive bubbles" fueled by technological advancements. He explains that while both can involve overhyping and capital destruction, the latter fundamentally transforms society for the better, even if their implementation is initially excessive.

"But whenever everybody likes something and is excited about something, chances are it may be overhyped and overpriced. So you just have to be careful."

Howard Marks advises caution when an asset or idea is widely popular and generates excitement. He suggests that such widespread enthusiasm often leads to overvaluation, making it crucial for investors to exercise careful judgment rather than blindly following the crowd.

"The lender has no upside. You make a 9% loan, all you're going to get is 9%, no matter how well the thing does. You certainly shouldn't do that in activities that have a high probability of not paying off at all, because then you have unlimited downside and limited upside. That's absolutely the wrong combination."

Howard Marks explains the inherent risk in lending to ventures with uncertain outcomes. He argues that lenders are capped in their potential gains while facing significant downside risk if the venture fails, making it a poor risk-reward proposition compared to equity participation in such cases.

"So if people are reacting harshly to to aggressive possibly risk indicating activities, yes, that's a healthy sign and this market is is seems healthier than the than the 2000 market to me."

Howard Marks views negative market reactions to potentially risky behaviors as a positive indicator of market health. He suggests that when investors show appropriate concern and discipline, it signals a more robust and less speculative market environment, contrasting it with the excesses of the 2000 era.

"And if the Fed puts money artificially cheap, then it induces the Fed's behavior like risk-taking. It it forces people into riskier activities because the returns on safe activities are so low. It it tends to reinforce the view that there's a Fed put, that if there's a problem, the Fed will solve it, and that contributes to risky behavior."

Howard Marks criticizes the Federal Reserve's policy of keeping interest rates artificially low. He contends that this practice encourages excessive risk-taking by diminishing the returns on safe investments and fostering a belief that the Fed will always intervene to prevent losses.

"The trouble is that the S&P, based on its P/E ratio relative to history, appears to be priced to provide a very low prospective return. Historically, if you bought at this P/E ratio, your return over the next 10 years averaged in the very low single digits."

Howard Marks points out that the current valuation of the S&P 500, based on its Price-to-Earnings ratio, suggests a low expected return for investors over the next decade. He notes that historical data indicates significantly lower returns when the market is valued at similar P/E levels.

"And I think that this is very worrisome, and as I said in the addendum, when we lost jobs to automation and offshoring, I think that coincided with the opioid epidemic, and not only in amount but also in location. And I think it's a natural consequence of people sitting around all day and even if we if we can find a way to replace their income, I worry about purposelessness."

Howard Marks expresses concern that job displacement due to automation and offshoring may have societal consequences beyond income loss. He draws a parallel to the opioid epidemic, suggesting that a lack of purpose and engagement can lead to social problems, even if economic needs are met.

"I think we've moved from the headlines, the uncertainty, to the reality. So now we're actually seeing that enter into the economy. It's still happening, but there's a little bit more stability in terms of the the the process."

Michelle Meyer describes a shift in how consumers perceive economic factors like tariffs. She explains that the initial uncertainty and headline-driven anxiety have transitioned into a more stable, albeit present, reality of these factors impacting the economy.

"And so you look at kind of the evolution of consumer psychology in this moment. I think there was a lot of anxiety surrounding the prospect of what tariffs might mean for all of us. Has that eroded? I see you just a moment ago talking about how people might feel once these tax benefits come into effect. Are we at a point where the immediate effects of those tariffs are now not front of mind for a lot of consumers?"

Michelle Meyer discusses the changing consumer mindset regarding economic policies like tariffs. She questions whether the initial anxiety about tariffs has lessened as consumers have adapted to their reality and potentially benefited from other economic factors like tax changes.

Resources

External Resources

Books

- "The Most Important Thing Illuminated" by Howard Marks - Mentioned as a source for understanding productive and unproductive bubbles.

Articles & Papers

- "Bloomberg Economics" (Source) - Mentioned in relation to Anna Wong's analysis of Kevin Hasset.

People

- Howard Marks - Co-Founder & Co-Chairman of Oaktree Capital Management, author of memos discussing AI's impact on employment and investment strategies.

- Libby Cantrill - Managing Director - Head of Public Policy at PIMCO, discussed in relation to the Federal Reserve and potential nominees.

- Michelle Meyer - Mastercard Chief Economist, discussed in relation to consumer spending data and economic forecasts.

- Kevin Hassett - Mentioned as a potential Federal Reserve nominee and discussed in relation to his views on Fed independence.

- Kevin Warsh - Mentioned as someone who has discussed the structure and potential changes to the Federal Reserve.

- Anna Wong - Mentioned in relation to her analysis of Kevin Hassett's career and views on Fed independence.

- Steve Cherron - Mentioned in relation to his view on consumer spending as a "sell story" for recovery and acceleration in 2026.

- Robert Isam - Mentioned as an interviewee who stated consumers are still traveling and embracing discretionary spending.

Organizations & Institutions

- Oaktree Capital Management - Mentioned as the institution where Howard Marks is Co-Founder & Co-Chairman.

- PIMCO - Mentioned as the institution where Libby Cantrill is Managing Director - Head of Public Policy.

- Mastercard - Mentioned in relation to its economic institute's predictions and its adaptive approach to B2B acceptance.

- J.P. Morgan Asset Management - Mentioned in relation to active fixed income ETFs and exploring opportunities in the US public bond market.

- Adobe - Mentioned in relation to its Acrobat Studio product with AI-powered PDF features.

- Public - Mentioned as a platform for building multi-asset portfolios, including generated assets with AI.

- Federal Reserve (Fed) - Discussed extensively in relation to monetary policy, interest rates, and potential nominees.

- Bloomberg - Mentioned as the source of reporting on Kevin Hassett being a frontrunner for Fed Chair and on bond market concerns.

- FT (Financial Times) - Mentioned as the source of an earlier piece on growing concern within the bond market regarding Kevin Hassett.

- CVS Caremark - Mentioned in relation to a prescription plan with built-in savings.

- CVS - Mentioned as a community-focused pharmacy that fills prescriptions and offers snacks.

- Cisco Duo - Mentioned as a solution for phishing resistance and session theft protection.

Tools & Software

- Adobe Acrobat Studio - Mentioned for its AI-powered PDF features, including generating insights from market research and tailoring report tone.

- Generated Assets (on Public) - Mentioned as a feature allowing users to turn ideas into investable indexes with AI.

Websites & Online Resources

- omnystudio.com/listener - Mentioned for privacy information related to the podcast.

- jpmorgan.com/getactive - Mentioned as a resource to learn more about J.P. Morgan Asset Management's active fixed income ETFs.

- mastercard.com/commercialacceptance - Mentioned as a resource to discover Mastercard's solutions for B2B acceptance.

- adobe.com/dothatwithacrobat - Mentioned as a resource to learn more about Adobe Acrobat Studio.

- public.com/market - Mentioned as a resource to learn more about Public's generated assets and to transfer portfolios.

- public.com/disclosures - Mentioned for complete disclosures related to Public's generated assets.

- cmk.co/stories - Mentioned as a resource to learn how CVS Caremark helps members save on medication.

- duo.com/cisco - Mentioned as a resource to learn more about Cisco Duo's security solutions.

Other Resources

- AI (Artificial Intelligence) - Discussed as a transformative technology impacting the labor market and investment strategies.

- Machine Learning - Mentioned in relation to AI's impact on the labor market.

- Fixed Income ETFs - Mentioned in the context of J.P. Morgan Asset Management's offerings.

- B2B Card Payment Landscape - Discussed as an evolving area creating opportunities for merchant acquiring businesses.

- Virtual Card Payments - Mentioned as a demand from buyers for paying invoices.

- Market Research - Mentioned as a type of document that AI can process for insights.

- Sales Proposals - Mentioned as a document type for which Acrobat Studio can provide templates.

- Market Report Tone Tailoring - Mentioned as a capability of Adobe Acrobat Studio's AI specialist.

- Multi-Asset Portfolio - Mentioned as a type of portfolio that can be built on the Public platform.

- Stocks - Mentioned as an asset class available on the Public platform.

- Bonds - Mentioned as an asset class available on the Public platform.

- Options - Mentioned as an asset class available on the Public platform.

- Crypto - Mentioned as an asset class available on the Public platform.

- Investable Index - Mentioned as a product that can be created with AI on the Public platform.

- Prompt (AI) - Mentioned as the starting point for creating generated assets on the Public platform.

- Free Cash Flow - Mentioned in relation to renewable energy companies as a characteristic for AI screening.

- Revenue Growth - Mentioned in relation to semiconductor suppliers as a characteristic for AI screening.

- S&P 500 - Mentioned as a benchmark for backtesting generated assets.

- Thesis (Investment) - Mentioned as the basis for customizable generated assets.

- Fed Put - Mentioned as a concept contributing to risky behavior in markets.

- Interest Rates - Discussed extensively in relation to Federal Reserve policy and investment returns.

- Risk Reward Pendulum - Mentioned as a concept Howard Marks discusses.

- Fear and Greed Pendulum - Mentioned as a concept Howard Marks discusses.

- Oracle - Mentioned in relation to borrowing more money and stock sell-offs.

- Buffett - Mentioned in relation to his quote about prudence in financial affairs.

- Fed Funds Rate - Mentioned as a specific interest rate.

- PE Ratio - Mentioned in relation to the S&P 500 and prospective returns.

- Productive Bubbles - Mentioned as a category of financial phenomena.

- Unproductive Bubbles - Mentioned as a category of financial phenomena.

- Steam Engine - Mentioned as a historical technological progress example.

- Railroad - Mentioned as a historical technological progress example.

- Radio - Mentioned as a historical technological progress example.

- Automobile - Mentioned as a historical technological progress example.

- Computers - Mentioned as a historical technological progress example.

- Internet - Mentioned as a historical technological progress example and in relation to job quality.

- Automation - Mentioned in relation to job loss.

- Offshoring - Mentioned in relation to job loss.

- Opioid Epidemic - Mentioned as a potential consequence coinciding with job losses from automation and offshoring.

- Purposelessness - Mentioned as a societal concern related to job loss.

- Global GDP Growth - Mentioned in relation to Mastercard's Economic Institute predictions.

- Trade Realignment (US and China) - Mentioned as a key dynamic influencing global GDP growth.

- Consumer Spending - Discussed extensively in relation to economic data and trends.

- Holiday Sales - Mentioned in the context of consumer spending forecasts.

- Black Friday - Mentioned in relation to increased spending data.

- CPI Report - Mentioned as a forthcoming economic report.

- Inflation - Discussed in relation to consumer spending and price increases.

- Volume (Spending) - Mentioned in relation to real spending growth.

- Basket of Shopping Items - Mentioned in relation to inflation tracking.

- Tariffs - Discussed in relation to their impact on consumer prices and purchasing decisions.

- Promotional Periods - Mentioned as times when consumers concentrate their spending.

- Digitalization - Mentioned as a factor increasing consumer power and choices.

- Restaurants - Mentioned as a spending category experiencing strong engagement.

- Travel - Mentioned as a spending category experiencing strong engagement.

- Lodging - Mentioned as a spending category experiencing strong engagement.

- Furniture - Mentioned as a spending category that is weaker.

- Home Improvement - Mentioned as a spending category that is weaker.

- Footwear - Mentioned as a spending category that is weaker.

- Apparel - Mentioned as a strong spending category.

- Promotional Emails - Mentioned as a tactic used by online retailers.

- LCL C (Low-Density Lipoprotein Cholesterol) - Mentioned in relation to Repatha's effect.

- Heart Attack Risk - Mentioned in relation to Repatha's effect.

- Statin - Mentioned as a treatment used in conjunction with Repatha.

- Prescription Plan - Mentioned in relation to CVS Caremark.

- Medication Costs - Mentioned as a concern for families.

- Fishing (Metaphorical) - Used as a metaphor for hacking attempts.

- Phishing - Mentioned as a hacking tactic.

- Phishing Resistance - Mentioned as a feature of Cisco Duo.

- Session Theft Protection - Mentioned as a feature of Cisco Duo.

- AI-Powered Monitoring - Mentioned as a feature of Cisco Duo.

- Multi-Factor Authentication - Mentioned as a security measure.