AI Disrupts SaaS; Musk Unifies Space/AI; Disney Bets on Parks

This conversation, hosted on Bloomberg Tech, dissects a complex web of market dynamics, corporate strategy, and technological evolution, revealing how seemingly disparate events--from CEO transitions at Disney to AI's disruptive potential in software and the ambitious consolidation of Elon Musk's ventures--are interconnected. The hidden consequence is the accelerating pace at which established industries must confront radical technological shifts and strategic pivots, often requiring painful, long-term investments for future advantage. Anyone involved in technology, finance, or corporate strategy will gain a clearer lens on how to anticipate and navigate these cascading changes, moving beyond immediate concerns to understand the deeper systemic forces at play. This analysis is crucial for identifying opportunities and avoiding the pitfalls of obsolescence in a rapidly transforming landscape.

The Unseen Costs of "Solving" Software: AI's Looming SaaS Apocalypse

The tech market is currently experiencing a stark divergence, with some companies like Palantir demonstrating robust growth while others, particularly in the software-as-a-service (SaaS) sector, face intense selling pressure. This fear is largely driven by the rapid advancement and increasing accessibility of Artificial Intelligence, which has led some traders to declare a "SaaS apocalypse." The core of this anxiety lies in the potential for AI tools to directly replicate or even surpass the functionalities of paid software, eroding growth prospects and creating significant pricing pressure.

Greg Moskovitz of Mizuho highlighted Palantir's impressive financial performance, noting a significant beat on revenue growth and free cash flow margins. However, even Palantir faces challenges in acquiring new customers, a hurdle attributed to the high cost and significant investment required to implement their sophisticated software. This illustrates a broader theme: while existing customers are expanding their use of advanced AI-driven platforms due to demonstrated success, the initial barrier to entry for new clients remains substantial.

"Palantir software is not cheap, Ed. And so what we're seeing is the customers again that are bought in, they're seeing successes. In many cases, they are expanding and expanding very materially."

This dynamic underscores a critical consequence: the difficulty in onboarding new, high-value customers can cap long-term growth, even for a successful company. The reliance on existing customers for expansion, while currently effective, creates a vulnerability if new customer acquisition stagnates.

Meanwhile, the broader SaaS market is grappling with existential questions. Ryan Vlastelica described the sentiment as bordering on "doomsday," with investors worried about AI tools disrupting legacy software companies. The concern is that AI can perform the same tasks, often with greater efficiency, rendering expensive software subscriptions obsolete. This isn't just about theoretical disruption; it's about a fundamental shift in how value is delivered and priced.

"The outlook has become extremely clouded and by most accounts extremely negative. People are viewing this as a, one person called it, like a SaaS apocalypse."

The implication here is that companies that fail to adapt their business models or integrate AI meaningfully into their offerings risk becoming irrelevant. The "SaaS apocalypse" narrative suggests that the competitive advantage will shift dramatically towards those who can leverage AI to provide superior, more cost-effective solutions, potentially displacing established players who are slow to evolve. This forces a re-evaluation of what constitutes valuable software and how it should be priced and delivered.

Anna Raffburn of Grenadella Advisory offered a more nuanced perspective, suggesting that while the sell-off might be overdone in the short term, the concerns are not entirely unwarranted. She pointed out that even established companies like Salesforce have struggled with AI implementation, indicating that the transition is complex. However, the underlying threat remains: AI tools are becoming increasingly capable of handling tasks previously requiring specialized software.

"This is something we do need to think about seriously."

The consequence of this AI-driven disruption is a potential restructuring of the software industry. Companies that once enjoyed durable growth and consistent trends now face an uncertain future. The immediate pain for these companies--declining valuations, increased investor scrutiny, and pressure to innovate rapidly--could lead to a long-term advantage for those that successfully pivot. This requires not just technological adoption but a strategic reorientation towards AI-native solutions, a process that is often uncomfortable and resource-intensive in the short term. The failure to embrace this shift means a guaranteed loss of competitive advantage over time.

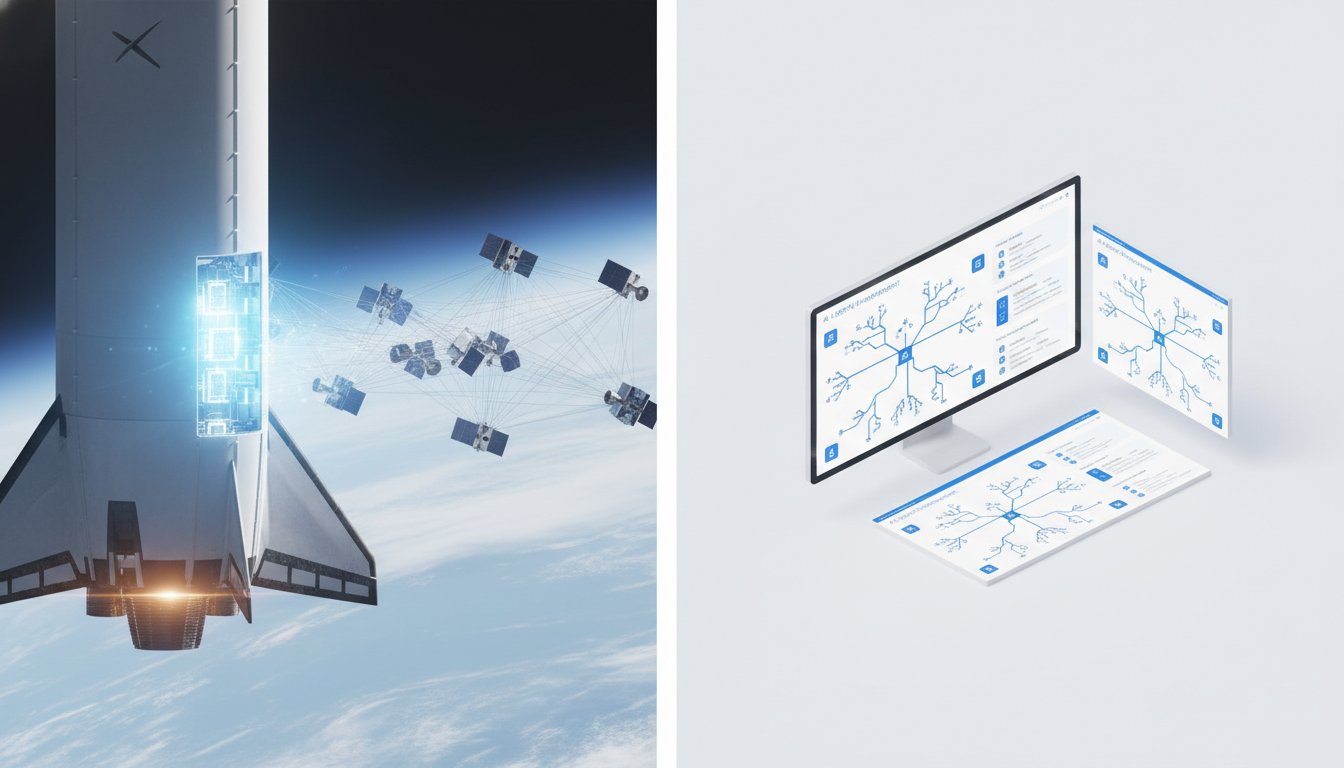

Elon Musk's Grand Unification: Space, AI, and the $1.25 Trillion Question

Elon Musk's decision to combine SpaceX and xAI into a single entity, valued at $1.25 trillion, represents a bold, albeit complex, strategic maneuver. The stated rationale is to create the most ambitious vertically integrated company focused on AI, utilizing space for advanced computing. This move, however, raises significant questions about long-term vision and financial sustainability.

Lauren Glass, who reported on the deal, highlighted the memos outlining Musk's vision for massive data centers in space to support AI development. The valuation breakdown--$1 trillion for SpaceX and $250 billion for xAI--underscores the immense scale of this ambition. Yet, the immediate consequence of this consolidation is the absorption of xAI's substantial operational costs, reportedly around $1 billion per month, by the combined entity.

"xAI comes with a lot of debt. Where does that debt go? How is that going to get paid off?"

This financial burden is a critical downstream effect. While the vision of space-based AI computing is futuristic, the immediate reality is managing significant debt and operational expenses. For investors, this raises concerns about the dilution of SpaceX's original mission--establishing a Mars settlement--in favor of AI infrastructure. The "detour" into AI data centers, as described by Glass, could alienate shareholders who invested in the company for its space exploration goals.

The structural separation between SpaceX and xAI, due to regulatory constraints on SpaceX's defense-related activities, further complicates the integration. While they will function separately for now, the long-term plan for synergy and branding opportunities remains to be seen. This operational complexity, coupled with the financial strain, means that the immediate future involves navigating these challenges before the grand vision can be fully realized. The delayed payoff for this ambitious consolidation hinges on successfully managing these immediate complexities and proving the viability of space-based AI.

Disney's Succession Strategy: Betting on the Parks Chief

Disney's appointment of Josh D'Amaro, head of its parks division, as its next CEO signals a strategic bet on operational experience and proven execution in a core, high-performing segment of the company. Disney Chairman James Gorman emphasized that D'Amaro "beat all comers" in a rigorous selection process, underscoring confidence in his leadership.

The chairman's explanation reveals a deliberate process, acknowledging the strong credentials of other internal candidates like Dana Walden and Alan Bergman. However, the decision to elevate D'Amaro suggests a prioritization of tangible, revenue-generating operations over other areas.

"Josh is just a standout executive. We looked all over the world, as you could imagine. We wanted to do this right. We wanted to make sure that whoever got the job beat all comers, and he beat all comers. So we're thrilled."

The immediate implication is a focus on the robust and profitable theme parks and experiences division. This strategy assumes that D'Amaro's success in managing these complex, capital-intensive operations will translate to navigating the broader challenges facing Disney, including the ongoing transformation of its media and streaming businesses. The chairman also noted that Bob Iger will remain involved through 2026, providing mentorship, which suggests a phased transition aimed at minimizing disruption.

However, the narrative also touches upon the pressure that may have influenced the timeline. Reporting suggested Iger might have wanted to leave before his contract ended, potentially accelerating the succession process. This highlights a common consequence in corporate leadership transitions: external pressures and internal dynamics can influence strategic decisions, sometimes leading to choices that might not have been the first preference under ideal conditions.

The emphasis on "getting the company fit for purpose" during Iger's second tenure, as Gorman stated, implies that the groundwork for D'Amaro's leadership has been laid. The long-term advantage of this decision will depend on D'Amaro's ability to replicate the success of the parks division across the entire Disney empire, particularly in the challenging streaming landscape. This choice prioritizes operational strength, a decision that could yield significant dividends if D'Amaro can effectively leverage his experience to revitalize other, less profitable segments of the company.

Key Action Items

- Immediate Action (Next Quarter): For SaaS companies, conduct a thorough audit of existing product functionalities against emerging AI capabilities. Identify areas where AI can either augment current offerings or render them redundant.

- Immediate Action (Next Quarter): Palantir and similar high-cost enterprise software providers should explore tiered pricing models or pilot programs to lower the barrier to entry for new customer acquisition, focusing on demonstrating clear ROI early in the sales cycle.

- Longer-Term Investment (6-12 Months): Companies in traditional media and entertainment should actively explore how AI can enhance content creation, distribution, and personalized viewer experiences, rather than viewing it solely as a threat.

- Longer-Term Investment (12-18 Months): Elon Musk's ventures (SpaceX/xAI) must demonstrate a clear roadmap for managing xAI's substantial operational costs and debt, alongside tangible progress on space-based AI infrastructure, to reassure investors of long-term financial viability.

- Strategic Pivot (Ongoing): Disney's leadership, under Josh D'Amaro, should focus on leveraging the operational expertise of the parks division to drive efficiency and innovation across all business segments, particularly in the cost-intensive streaming sector.

- Competitive Adaptation (18-24 Months): Defense tech startups like Overland AI should continue to focus on real-world deployment and tangible life-saving applications, solidifying their value proposition beyond experimentation to secure sustained government contracts and explore dual-use commercial opportunities.

- Workforce Development (Ongoing): Companies across all sectors should proactively invest in upskilling and reskilling programs to prepare their workforce for AI-driven job displacement, turning a potential crisis into an opportunity for a more adaptable and skilled labor force.