This conversation delves into Elon Musk's audacious $1.25 trillion merger of SpaceX and xAI, revealing not just a financial consolidation but a strategic gambit to fuel Musk's long-term vision of space colonization and AI dominance. The non-obvious implication is that this isn't merely about combining assets; it's about leveraging the established financial power and operational prowess of SpaceX to underwrite the capital-intensive and speculative future of AI. The hidden consequence is the potential for a highly concentrated power structure where the success of a nascent AI venture is inextricably linked to the public market performance of a space exploration giant. Anyone invested in the future of AI, space technology, or understanding Musk's unique brand of disruptive innovation will find value here, gaining insight into how capital, ambition, and technological convergence are being orchestrated at an unprecedented scale.

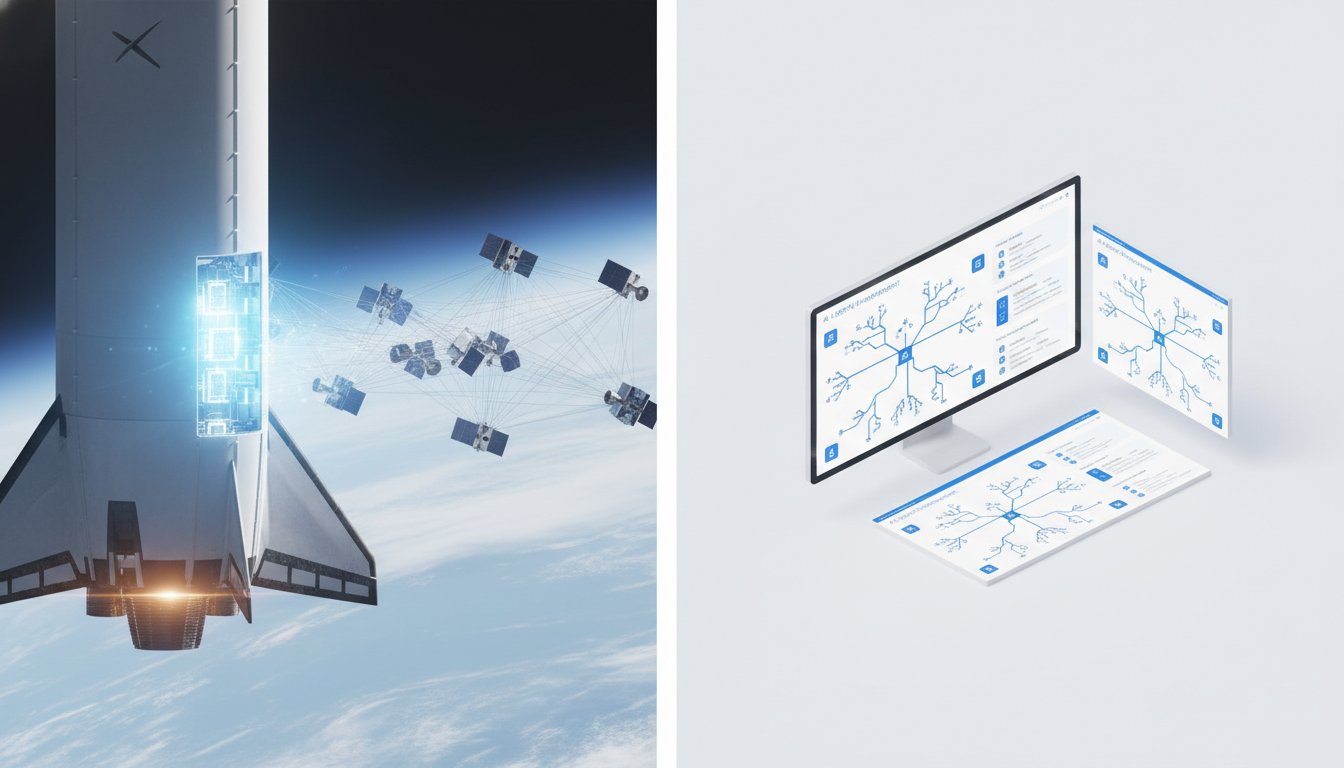

The Orbital Data Center Gambit: Why Space is the Next Frontier for AI

Elon Musk's decision to merge SpaceX and xAI into a $1.25 trillion entity is more than just a financial maneuver; it's a bold declaration of intent to reshape the future of artificial intelligence by relocating its infrastructure to orbit. While the immediate appeal is clear -- leveraging SpaceX's launch capabilities for xAI's AI research -- the deeper implications suggest a strategic move to bypass terrestrial limitations and create a unique competitive moat. This isn't about solving today's AI problems with today's tools; it's about building the infrastructure for tomorrow's AI, a future where Earth's constraints on power and land become obsolete.

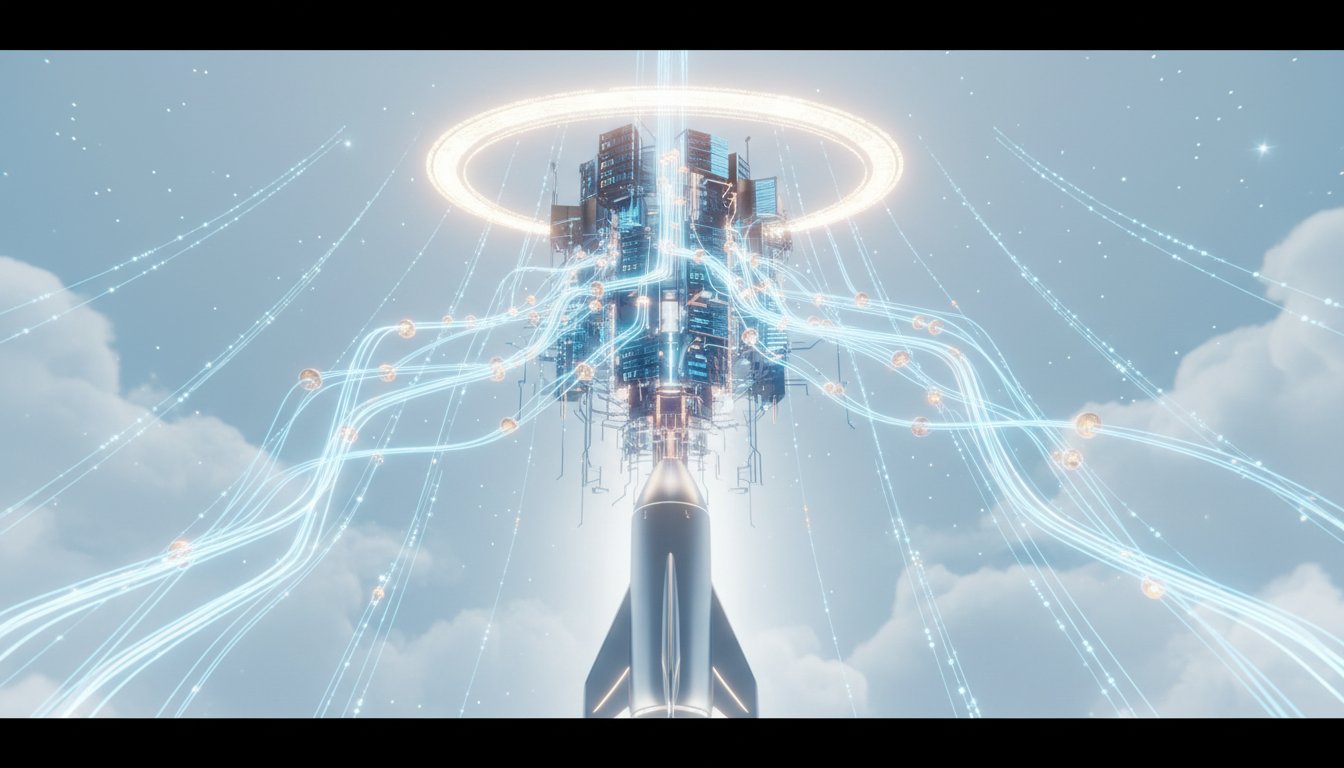

The core thesis driving this merger, as articulated by Musk, is the necessity of orbital data centers. The sheer energy and land requirements for training and operating advanced AI models on Earth are becoming prohibitive. Space, however, offers seemingly limitless solar power and an abundance of "space" for these facilities. This isn't a minor engineering challenge; it's a fundamental re-imagining of where and how AI operates.

"The net effect is that the lowest cost place to put AI will be space, and that will be true within two years, maybe three, three at the latest."

This statement, made by Musk at the World Economic Forum, underscores the urgency and long-term vision behind the merger. The implication is that terrestrial data centers, despite their current ubiquity, are a temporary solution. By positioning xAI within SpaceX, Musk is essentially pre-empting a future where orbital infrastructure is not just an option, but a necessity. This foresight, if realized, creates a significant first-mover advantage. While other tech giants like Google are exploring pilot programs, none possess the integrated launch capability and established space infrastructure that SpaceX offers. This synergy allows for a more direct and potentially faster path to deploying these orbital data centers.

The merger also serves as a critical financial lifeline for xAI. The world of AI development is notoriously capital-intensive, requiring vast sums for research, talent acquisition, and, crucially, computing power. As the transcript notes, "some investors acknowledged that it was very difficult for XAI to survive as an independent company in the long term. They'd either have to keep raising huge sums of money or get acquired by one of Elon's other businesses." By integrating xAI into SpaceX, a company with a strong financial profile and plans for an IPO, Musk provides a stable funding source. This allows xAI to focus on its AI research without the immediate pressures of profitability and revenue growth that would typically burden an independent startup.

"For XAI, being hitched to SpaceX ahead of an initial public offering gives it more financial muscle to compete with other AI companies like OpenAI and Anthropic."

This strategic alignment ahead of SpaceX's IPO is a calculated move to bolster xAI's competitive position. The combined entity, presenting itself as an AI-powered space company, could command a higher valuation and attract more investment than xAI could alone. This "halo effect" from a potentially massive SpaceX IPO could allow xAI to outmaneuver rivals like OpenAI and Anthropic in the race for capital and market attention. It’s a classic Musk play: creating a narrative that transcends individual company limitations and positions the consolidated entity for outsized success.

However, this ambitious vision is not without its challenges and skepticism. The integration of two distinct corporate cultures, especially when one is a well-established, profitable entity like SpaceX and the other is a speculative AI venture, presents significant hurdles. The transcript highlights this, stating, "...they have to actually integrate and unify the cultures. So there's a lot of legwork to do there, and that takes time..." Furthermore, the core premise -- operational orbital data centers powered by solar energy -- is an unproven technology. Investors, particularly those within the SpaceX camp, are reportedly exhibiting a "nervous and mixed reception."

"The rationale for the acquisition, there isn't really an immediate tangible benefit to SpaceX's bottom line."

This candid observation points to the long-term, speculative nature of the merger from SpaceX's perspective. The immediate financial returns are not apparent. Instead, the benefit lies in the potential for SpaceX to gain deep expertise in designing systems that can effectively interface with and support advanced AI models. This knowledge, developed through the necessity of building and operating orbital data centers, could become a critical differentiator in future space endeavors, from satellite operations to deep space missions. It’s an investment in future capabilities rather than immediate profit.

The merger forces a re-evaluation of what constitutes competitive advantage in the AI race. While others focus on optimizing current hardware and software, Musk is betting on a future infrastructure that few are prepared to build. This requires a willingness to endure the "discomfort" of unproven technology and long development cycles, a trait often lacking in conventional business strategies. The delayed payoff of orbital data centers, coupled with the immediate financial strain and integration challenges, is precisely what creates a durable advantage. Most competitors will likely continue to focus on incremental improvements on Earth, leaving the truly transformative, albeit difficult, path to space wide open for this merged entity.

Key Action Items:

- Immediate Action (Next Quarter): Begin internal cross-functional working groups within SpaceX and xAI to identify immediate areas of technical collaboration, focusing on shared data needs and potential AI applications for SpaceX operations (e.g., launch trajectory optimization, satellite network management).

- Immediate Action (Next Quarter): Develop a clear, unified communication strategy for the merged entity, addressing investor concerns about cultural integration and the long-term vision for orbital data centers.

- Short-Term Investment (Next 6-12 Months): Prioritize R&D efforts on the engineering challenges of solar power capture and data center operation in space, leveraging SpaceX's existing satellite technology expertise.

- Longer-Term Investment (12-18 Months): Initiate preliminary design and feasibility studies for the first orbital data center prototypes, mapping out the necessary launch cadence and infrastructure requirements.

- Strategic Consideration (Ongoing): Monitor the progress and investment trends of competitors like OpenAI and Anthropic, and adjust the strategic roadmap for the SpaceX IPO to highlight the unique value proposition of integrated AI and space capabilities.

- Cultural Investment (12-18 Months): Implement targeted cultural integration programs designed to foster collaboration and shared understanding between SpaceX and xAI teams, acknowledging that immediate discomfort in merging distinct cultures will lead to a more resilient and innovative combined entity.

- Delayed Payoff Focus (2-3 Years): Maintain a steadfast commitment to the orbital data center vision, understanding that the significant engineering and capital investments required will yield a substantial, defensible competitive advantage only after considerable time and effort.