Embrace Complexity: Musk, Disney, Minivans Reveal Strategic Advantage

The following analysis unpacks the strategic implications of Elon Musk's audacious corporate maneuvers, Disney's complex leadership transition, and the surprising resurgence of the minivan, revealing how seemingly disparate events highlight a common thread: the strategic advantage found in embracing complexity and long-term vision over immediate gratification. This conversation is essential reading for leaders, strategists, and anyone seeking to understand the hidden dynamics that shape market success and competitive moats. By dissecting these case studies, we uncover how conventional wisdom often fails to account for second- and third-order consequences, offering a blueprint for identifying opportunities where discomfort today yields significant advantage tomorrow.

The Musk Corporate Universe: A Symphony of Interconnected Ambition

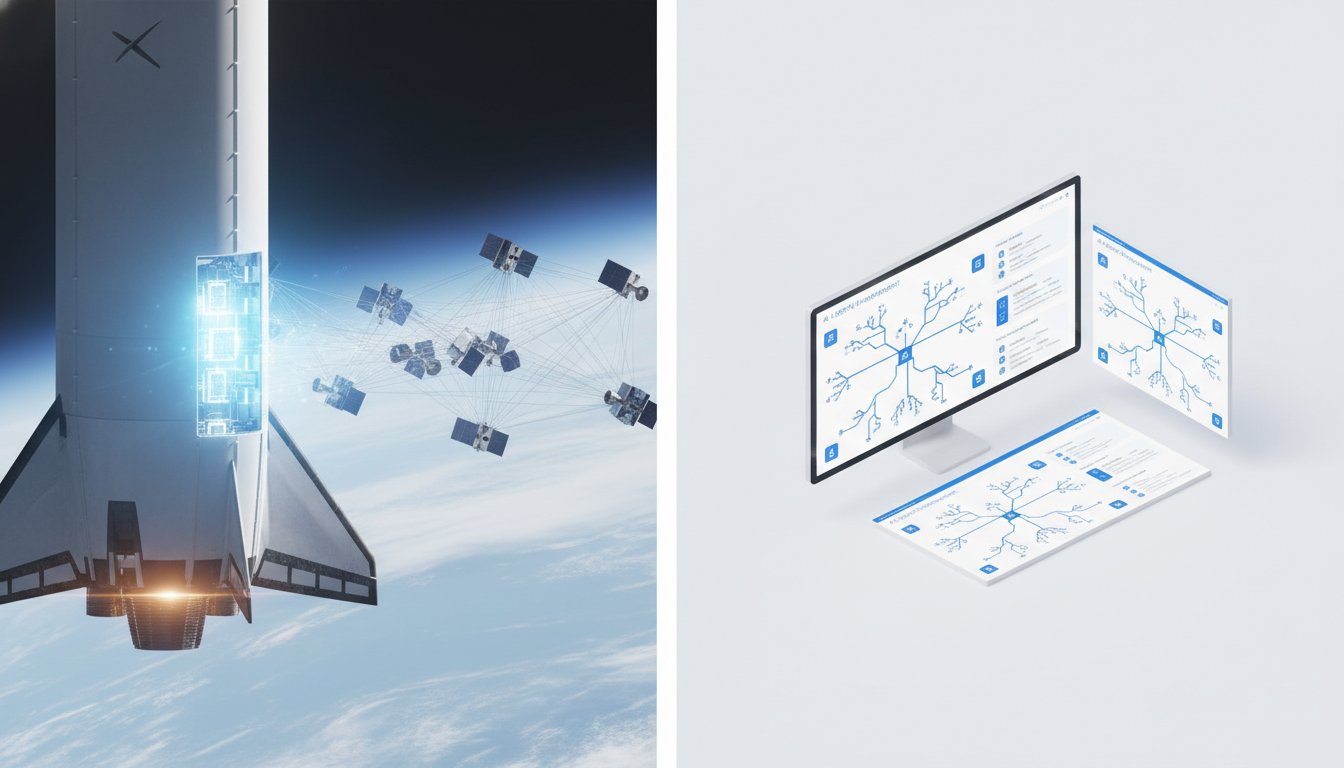

Elon Musk's decision to merge SpaceX and xAI is not merely a financial transaction; it's a bold declaration of a unified vision for innovation, one that deliberately blurs corporate lines to create an "innovation engine on and off Earth." This move, valued at a staggering $1.25 trillion, signals a fundamental belief that the future of AI infrastructure lies not on the ground, but in orbit. The immediate implication is a massive consolidation of resources and talent, but the deeper consequence is the creation of a vertically integrated powerhouse capable of tackling engineering challenges that span from rocket propulsion to advanced AI computation, all powered by abundant solar energy in space.

The strategic brilliance, and indeed the Muskian trademark, lies in the deliberate intermingling of his corporate entities. As Toby Howell notes, this is a pattern: "He loves doing this. In 2016, he used Tesla stock to acquire SolarCity... Last year, he used xAI to acquire X. So this kind of Russian doll of corporate maneuvering is something that is an Elon trademark because this is how he likes to run his companies." This isn't about inefficiency; it's about creating a fluid ecosystem where talent and capital can be redeployed across seemingly disparate ventures--SpaceX engineers aiding Twitter's takeover, Tesla's manufacturing prowess potentially bolstering SpaceX's orbital data center ambitions. The immediate benefit is agility, but the long-term advantage is the ability to solve problems that no single, siloed company could address. The ultimate goal, building data centers in space, is a monumental engineering feat. The conventional approach would be to tackle this incrementally, perhaps through partnerships. Musk, however, is leveraging his existing, highly valued entities to accelerate this vision, betting his empire on a future that requires immense capital and intricate engineering.

"form the most ambitious vertically integrated innovation engine on and off Earth with AI, rockets, space-based internet, direct-to-mobile device communications, and the world's foremost real-time information and free speech platform."

This merger is a masterclass in consequence mapping. While terrestrial data centers face regulatory hurdles and land constraints, Musk sees space as the ultimate frontier for AI's insatiable demand for compute power. This foresight, coupled with the sheer scale of SpaceX's launch capabilities and xAI's burgeoning intelligence, creates a unique synergy. The immediate challenge is the immense engineering complexity of orbital data centers. However, the delayed payoff--a potentially unfettered, cost-effective, and scalable AI infrastructure--offers a competitive moat that few, if any, could replicate. This is where conventional wisdom falters; it prioritizes immediate feasibility over long-term, disruptive potential.

Disney's Succession Shuffle: The Peril of Short-Term Fixes

Disney's ongoing succession saga, marked by Bob Iger's impending second departure, highlights the perils of short-term fixes and the difficulty of building durable leadership. Iger's return in 2022 was a response to a perceived failure in his initial succession plan, a move that stabilized the company but underscored the underlying challenge: establishing a clear, robust path for leadership beyond a single charismatic figure. The board's current task is to select a successor, a process fraught with the ghosts of past missteps.

The narrative suggests that while Disney's parks and streaming divisions are performing strongly, driven partly by price hikes--a strategy with immediate revenue benefits but potential long-term customer loyalty implications--the company is still grappling with its post-Iger identity. The internal candidates, Josh D'Amaro (parks) and Dana Walden (content), represent different facets of Disney's empire. D'Amaro's leadership of the highly profitable parks division makes him a strong contender, as "the parks business has been the main profit center for Disney for the last decade or so." Yet, the reliance on price increases, while boosting immediate earnings, risks alienating consumers if value doesn't keep pace. This creates a downstream effect where customer satisfaction could erode, impacting long-term brand perception.

"I think what is noteworthy is that when I came back three years ago, I had a tremendous amount that needed fixing."

Iger's own assessment points to the lingering issues he inherited. While he claims to be leaving the company in a "good hand," the repeated need for a CEO "fixer" suggests that the underlying structural challenges--particularly in integrating streaming profitability and navigating a rapidly evolving media landscape--remain. The acquisition of 21st Century Fox, while now framed favorably by Iger, also represents a complex integration that has had its own set of downstream consequences. The true test for Disney will be whether its next leader can foster sustainable growth and innovation, rather than simply managing immediate financial pressures. The temptation to rely on proven, immediate revenue drivers like park price hikes can obscure the need for deeper, more systemic changes that build lasting competitive advantage.

Minivans: The Unsung Heroes of Practicality

The resurgence of the minivan, a vehicle once relegated to the "mom mobile" stereotype, is a compelling case study in how market perception can shift when practical utility reclaims its throne. Minivan sales have surged, outperforming the broader auto market, as a new generation of consumers, particularly millennial parents and aging Gen X and Baby Boomers, prioritize space, cost-effectiveness, and versatility. This trend challenges the long-held dominance of SUVs and trucks, revealing a hidden demand for functional design.

The key insight here is the minivan's ability to offer "bang for your buck." With average new car prices soaring, minivans like the Chrysler Voyager and Honda Odyssey provide comparable cargo capacity to SUVs at a significantly lower cost. This economic advantage, combined with evolving marketing strategies that position minivans for adventure (off-road tires, rooftop tents), has helped shed their outdated image. The Kia Carnival, described as a "maxi van," exemplifies this shift, blending SUV aesthetics with minivan practicality, making it desirable for a wider demographic.

"They're really the Boston Market rotisserie chicken meal of cars. You get a little bit of everything, and you're always filled up afterward."

Furthermore, the rise of the gig economy has created a new user base for minivans, with drivers for services like Amazon, Grubhub, Uber, and Lyft valuing their cargo space and passenger capacity. This broad appeal, from families to entrepreneurs, demonstrates how a product category, when re-evaluated through the lens of evolving consumer needs and economic realities, can experience a powerful comeback. The immediate benefit is affordability and practicality. The delayed payoff is a redefinition of what constitutes a desirable vehicle, proving that enduring utility can trump fleeting trends. This also extends to future applications, with Waymo already utilizing minivans for its robotaxi fleets, hinting at a future where these vehicles are central to autonomous transportation.

The Indie Film Revolution: Creator Power and Fandom Economics

The success of the indie horror film Iron Lung, grossing over $22 million globally on a $3 million budget, offers a potent example of how creators can bypass traditional gatekeepers and leverage their dedicated fan bases to achieve significant commercial success. Markiplier (Mark Fischbach), a YouTube personality with 38 million subscribers, wrote, directed, and financed the film himself, demonstrating a direct-to-consumer model that mirrors the agility and direct engagement seen in other industries.

The critical insight is the power of a pre-existing, engaged audience. Unlike traditional studio films that rely on broad marketing campaigns, Iron Lung benefited from direct promotion to its built-in fanbase, who were eager to support their favorite creator. This allowed the film to expand its theatrical release based on "excess demand from ravenous fans." The financial success is undeniable: a healthy profit margin achieved by sidestepping the traditional studio distribution model, allowing the creator to retain a larger share of the revenue.

"The result is not self-important so much as punishingly sincere."

This model, while incredibly effective for niche audiences, raises questions about scalability and broader appeal. Critics point out that the film's "punishingly sincere" nature and claustrophobic, one-shot style might alienate viewers unfamiliar with the source material or Markiplier's content. However, the experience for fans--described as a "communal live streaming moment"--highlights a shift in how audiences engage with entertainment. They seek shared experiences, even if that experience involves a high degree of niche appeal or an unconventional narrative. This trend, echoed by Taylor Swift's Eras Tour movie, suggests that for creators with deep fandom connections, the traditional Hollywood pipeline is no longer the only viable path to box office success. The delayed payoff here is the potential for a new paradigm in filmmaking, where creators can fund and distribute their work directly, fostering a more intimate and potentially more profitable relationship with their audience.

Key Action Items

- Embrace Vertical Integration (Where Synergistic): For companies with distinct but complementary business units, explore how resource and talent sharing can create unique innovation engines. This requires a willingness to break down traditional silos.

- Time Horizon: Ongoing strategic review; implementation over 6-18 months.

- Prioritize Long-Term Vision Over Immediate Fixes: When addressing complex challenges (e.g., leadership transition, product development), resist the temptation to implement solutions that offer only short-term relief. Map out the downstream consequences of quick fixes.

- Time Horizon: Immediate application in decision-making; ongoing cultural reinforcement.

- Re-evaluate Core Value Propositions: Periodically assess how evolving consumer needs and economic conditions might create demand for previously overlooked product categories or service models.

- Time Horizon: Quarterly market analysis; strategic adjustments over 12-24 months.

- Leverage Direct-to-Audience Channels for Content Creation: Creators and businesses with strong community engagement should explore self-funded and self-distributed models to maximize revenue and control over their narrative.

- Time Horizon: Immediate consideration for new projects; ongoing experimentation.

- Invest in "Unpopular but Durable" Solutions: Identify and commit to initiatives that require significant upfront effort or delayed gratification but offer substantial long-term competitive advantage. This often involves areas where competitors are unwilling to invest due to the lack of immediate visible returns.

- Time Horizon: 18-36 months for significant payoff.

- Foster Cross-Functional Collaboration: Encourage teams to think beyond their immediate departmental goals and understand how their work impacts other areas of the organization and the broader market system.

- Time Horizon: Ongoing cultural initiative.

- Build for Scalability Beyond Terrestrial Constraints: For industries with rapidly growing computational or logistical needs, proactively explore and invest in solutions that are not limited by current physical or regulatory boundaries.

- Time Horizon: 3-5 years for foundational infrastructure; ongoing R&D.