AI Infrastructure Costs Strain Companies, Delaying Innovation

Oracle's massive debt issuance underscores a critical, often overlooked challenge in the AI gold rush: the sheer, unyielding cost of infrastructure. While the allure of AI-driven productivity and market dominance is powerful, this conversation reveals that the immediate, tangible reality for companies like Oracle is an insatiable demand for capital to build the physical backbone of this digital future. The hidden consequence isn't just financial strain, but a potential bottleneck that could slow the very innovation everyone is betting on. Investors, strategists, and anyone looking to understand the true cost of the AI revolution should read this to grasp the foundational, capital-intensive realities that underpin the hype. It offers a strategic advantage by highlighting where the real friction lies, allowing for more grounded investment and operational planning.

The Unseen Price Tag of AI: Beyond the Code

The current fervor around Artificial Intelligence has captivated markets and strategists alike, promising unprecedented gains in productivity and market share. However, beneath the surface of innovative algorithms and dazzling demonstrations lies a stark, capital-intensive reality: the construction of massive data centers. This isn't a minor operational detail; it's the fundamental bottleneck that companies like Oracle are grappling with, as evidenced by their staggering $45-$50 billion fundraising target. The conversation highlights a critical disconnect: while the market buzzes with AI potential, the foundational need for physical infrastructure--power, land, and immense computing capacity--demands a level of investment that can strain even the largest balance sheets, potentially creating a significant delay in realizing AI's promised benefits.

"The big question has been, how much money will they have to borrow to do that? Will they be able to maintain their investment grade?"

This question, posed by Brody Ford, cuts to the heart of the issue. Oracle's proactive move to raise substantial debt and equity isn't just about funding growth; it's a strategic imperative to maintain financial stability while undertaking an enormous build-out. The implication is that the cost of AI infrastructure is so significant that it jeopardizes a company's investment-grade rating, a crucial indicator of financial health. This isn't a problem confined to Oracle. Paula Selykson elaborates on the broader trend, noting that companies are tapping "all debt markets" to finance data center construction, which is projected to exceed $3 trillion. This systemic demand for capital creates a ripple effect, potentially driving up borrowing costs and making it harder for less capitalized players to compete. The conventional wisdom of investing in AI often focuses on software, talent, and algorithms. This analysis, however, emphasizes that the physical infrastructure is the more immediate and costly hurdle, a point often underestimated in the race for AI supremacy.

The Data Center Dilemma: A Foundation of Debt

The sheer scale of investment required for AI infrastructure is staggering, leading to a complex web of financing strategies. As Paula Selykson explains, companies are not only engaging in traditional on-balance sheet corporate borrowing but also increasingly relying on off-balance sheet financing. This involves creating special-purpose vehicles for individual data center projects, tapping into a diverse range of markets including bank project finance, private placements, and structured finance. This diversification of funding sources highlights the immense pressure on capital markets to support the AI build-out.

The cost of this infrastructure is far from trivial. Selykson notes that yields can range "from just a little bit over investment grade all the way to double-digit teens, mid-teens yields." This variability depends on the structure of the deal and the perceived risk, with hyperscaler-backed projects commanding lower rates than those from smaller, earlier-stage companies. The lack of transparency in some of these private deals is a significant concern. Selykson points out that while Oracle's lease commitments are publicly disclosed, many other private deals may not offer the same level of visibility, creating "unease and uncertainty around the absolute scale of the debt being borrowed right now." This opacity can lead to market jitters, as investors grapple with the unknown extent of financial commitments tied to AI infrastructure. The conventional approach to tech investment often overlooks this foundational layer of debt financing, but it is precisely this layer that could determine the pace and accessibility of AI advancements.

The AI Paradox: Spending vs. Return

The current market enthusiasm for AI is largely fueled by the promise of future productivity gains. However, as Natalie Galles articulates, the critical factor for sustaining current high valuations in 2026 will be "a close in the gap between how much is being spent on AI and the ROI that we're actually going to achieve." This highlights a potential paradox: massive investments are being made with the expectation of significant returns, but the realization of those returns is not guaranteed and may take considerable time.

"If we get those productivity gains, then this is absolutely a great story of foresight. If we don't see those productivity gains, then we're going to have a conversation much more housed around capital misallocation."

This statement underscores the inherent risk in the current AI investment landscape. Companies are channeling vast sums into AI infrastructure and development, but the tangible economic benefits--the productivity gains--are yet to fully materialize across the board. Galles suggests that early signals of these gains should appear in key industries like healthcare, consulting, and finance by 2026. If these gains do not materialize as expected, the conversation could shift from one of innovation to one of "capital misallocation," potentially leading to a significant market correction. The narrative of "circular deals," where companies invest in their clients (like Nvidia's potential investment in OpenAI), is seen as a strategy to foster potential ROI. However, this approach also carries risk; if the broader economic transformation promised by AI doesn't occur, these circular investments could be seen as artificially bolstering revenue numbers, increasing the risk of a market downturn. The conventional focus on AI's technological prowess often overshadows the economic imperative of demonstrating a clear return on investment, a crucial element for long-term market confidence.

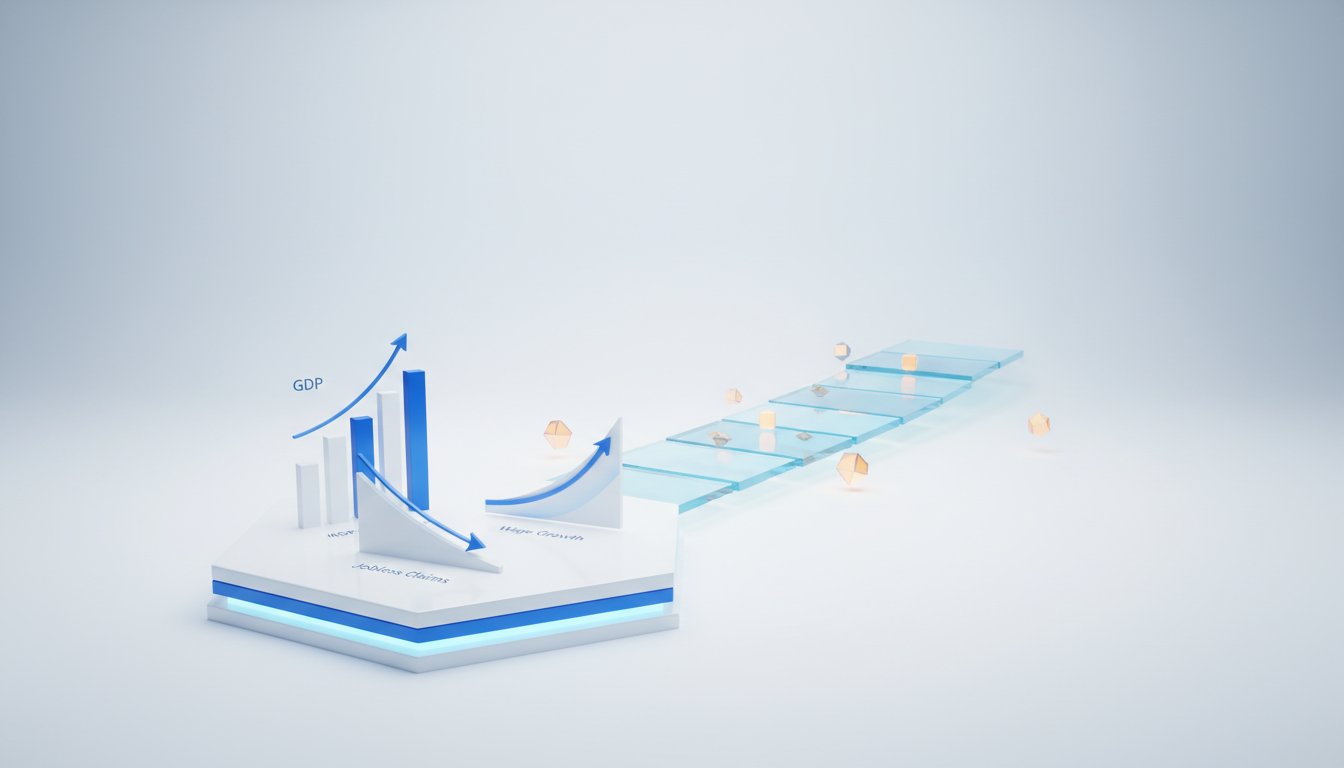

The Long Game: Delayed Payoffs in AI Infrastructure

The conversation around AI infrastructure financing reveals a pattern of delayed payoffs, a concept that challenges conventional short-term investment horizons. Oracle's strategy, for instance, involves significant upfront investment with the expectation of free cash flow generation "a couple of years out, once those OAI contracts and others start flowing." This temporal disconnect between expenditure and return is a recurring theme.

The commitment of companies like Nvidia to potentially invest "a great deal of money, probably the largest investment we've ever made" in OpenAI, even if not the previously rumored $100 billion, signifies a long-term bet on the ecosystem's growth. Seth Fiegerman notes that such deals, while monumental, "never said a firm timetable or fixed amount," allowing for imagination about their ultimate scale and duration. This patient approach is precisely where competitive advantage can be built. While many investors and companies focus on immediate gains, those willing to invest in foundational infrastructure with a multi-year horizon are positioning themselves for more substantial, lasting benefits. This requires a strategic patience that is often at odds with the market's typical demand for quarterly results. The risk, as Galles points out, is that without demonstrable productivity gains, these long-term investments could be perceived as misallocations, leading to volatility. However, for those who can weather the initial storm of capital expenditure, the payoff could be significant, creating a durable moat in the increasingly competitive AI landscape.

Key Action Items

- Assess AI Infrastructure Costs Realistically: For any organization planning AI integration, conduct a thorough, multi-year assessment of the capital expenditure required for data centers, power, and computing resources. This goes beyond software and talent acquisition. (Immediate Action)

- Explore Diverse Debt Financing Options: Understand and explore the full spectrum of debt markets, including traditional corporate bonds, leveraged loans, and private credit, to finance infrastructure build-outs. (Immediate Action)

- Prioritize Transparency in Financing: For companies involved in private financing of AI projects, strive for clear disclosures to investors and the market to mitigate unease and uncertainty about the scale of debt. (Ongoing Investment)

- Develop a Multi-Year ROI Projection for AI: Move beyond short-term projections and develop detailed, multi-year return on investment models for AI initiatives, focusing on tangible productivity gains. (12-18 Month Investment)

- Build Strategic Patience for Infrastructure Investments: Recognize that the build-out of AI infrastructure is a long-term play. Be prepared for significant upfront costs with payoffs that may materialize over several years. (Strategic Mindset)

- Monitor Productivity Data Closely: For investors and strategists, pay close attention to productivity data in key sectors as an early indicator of AI's economic impact and the realization of ROI. (Ongoing Monitoring)

- Evaluate the "Circular Deal" Dynamic: Understand how investments in clients and partners, while potentially fostering growth, also create interdependencies and risks that need careful assessment. (Strategic Analysis)