AI Race Becomes Capital-Intensive Arms Race Demanding Sustained Investment

The $200 Billion Gamble: Why Amazon's AI Spending Spree Signals a Deeper Shift in Tech Investment

This conversation reveals a critical, often overlooked, consequence of the current AI gold rush: the immense, sustained capital expenditure required not just for innovation, but for survival. While headlines focus on Amazon's stock dip following its $200 billion AI infrastructure pledge, the deeper implication is that the AI race is rapidly evolving into a capital-intensive arms race, potentially creating significant barriers to entry and reshaping competitive landscapes. Investors, strategists, and technology leaders who understand this shift will gain a crucial advantage in navigating the coming years, identifying companies built for sustained capital deployment and those likely to falter under its weight. This isn't just about building better AI models; it's about building the foundational infrastructure to support them at scale, a reality that demands a long-term perspective often at odds with short-term market reactions.

The Unseen Cost of the AI Arms Race: Beyond the Code

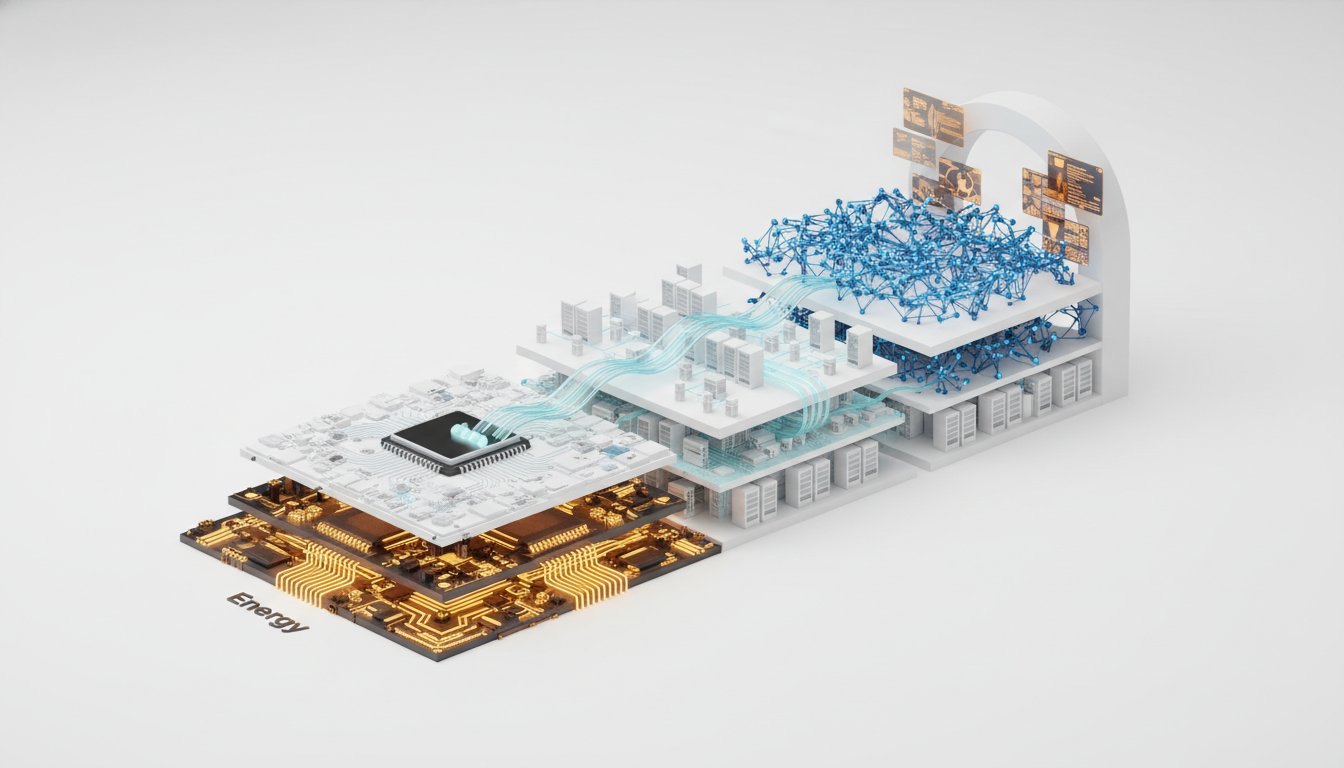

The narrative surrounding Artificial Intelligence often centers on algorithmic breakthroughs and innovative applications. However, the recent pronouncements from tech giants like Amazon, pledging staggering sums for infrastructure, highlight a less glamorous but equally critical aspect: the sheer, unyielding cost of building and maintaining the physical and digital scaffolding for AI. This isn't merely about buying more servers; it's a fundamental re-evaluation of capital allocation, where massive, ongoing investment becomes a prerequisite for relevance.

Amazon's decision to spend $200 billion on data centers, chips, and equipment, while initially met with "sticker shock" and a stock dip, is a clear signal that the AI race is morphing into a capital-intensive competition. This massive expenditure, dwarfing many other corporate investments, is not an optional add-on but a foundational requirement. As analyst Roll H. Kothari notes, the market reaction reflects a misunderstanding of Amazon's diversified investment strategy beyond just AI, as well as a concern about the long-term return on such a colossal outlay. The implication is that companies not prepared for this level of sustained capital deployment risk being left behind, their innovative software outpaced by the sheer physical capacity of their competitors.

"The concern is, is the trade-off worth it here? There is a big backlog for AWS and AI business."

This capital expenditure isn't a one-off; it's a commitment to an ongoing build-out. Unlike previous tech cycles where software innovation could often outpace hardware limitations, the current AI landscape demands parallel investment in both. Amazon's strategy, as highlighted by Kothari, involves vertical integration across cloud, retail, and advertising, all underpinned by significant infrastructure. This multi-pronged approach, while potentially leading to greater long-term profitability, requires a patience that the market often eschews. The immediate consequence of such massive spending is a strain on free cash flow, a concern that analysts raise but is dismissed by those familiar with Amazon's history of delivering ROI through sustained investment.

The Infrastructure Mandate: Why Scale Demands Capital

The sheer scale of investment required for AI infrastructure is reshaping the competitive landscape. Amazon's $200 billion pledge, alongside similar commitments from other hyperscalers like Meta, signals a new era where the ability to deploy capital rapidly and at scale becomes a primary differentiator. This isn't just about having the best algorithms; it's about having the most robust and expansive infrastructure to run them.

The market's reaction to Amazon's announcement underscores a common misinterpretation: that massive capex is inherently negative. Historically, significant capital expenditure was often a sign of aggressive growth and future potential. However, in the current AI-driven environment, the sheer magnitude of these investments, coupled with concerns about immediate profitability, has spooked investors. The analyst commentary suggests that while capex was expected, the simultaneous "slight yellow flags in operating margins" and the realization of Amazon's broader investment scope--including satellites and new Whole Foods--created a perception of overextension.

"The worry here is, next two, three years, how high of an investment curve are we looking at for Amazon, and what level of ROI do they get beyond the core AI investments?"

This highlights a critical systemic dynamic: the AI race is not just about technological advancement, but about a capital-driven arms race. Companies like Nvidia, providing the essential GPU hardware, benefit directly from this surge in spending, seeing their stock prices rise in response. This creates a feedback loop where infrastructure providers thrive on the massive investments of AI developers, further solidifying the financial advantage of the largest players. The implication for smaller or less capitalized companies is stark: competing in this environment requires not only technical prowess but also access to substantial, sustained capital.

The Delayed Payoff: Building Moats Through Patient Investment

The true competitive advantage in the current AI landscape may lie not in immediate gains, but in the willingness to endure delayed payoffs. Amazon's strategy, with its focus on long-term vertical integration and broad investment, exemplifies this. While the market fixates on current operating income and short-term ROI, companies like Amazon are building for a future where their integrated infrastructure provides a durable moat.

The conversation around Amazon's investment touches upon its history of prioritizing reinvestment over immediate profitability. This approach, while sometimes met with skepticism, has historically yielded significant returns. The current capex push is a continuation of this philosophy, aiming to build a comprehensive AI ecosystem. The "GenAI winner" narrative, as described by analysts, hinges on this long-term vision, suggesting that Amazon's diversified bets will eventually pay off.

"I think Amazon is with all of the above again. They are vertically integrating in a way that absolutely no other company on Earth is trying to replicate at the scale at which Amazon is trying to do: vertically integrating cloud, vertically integrating retail, and having the diversity of advertising."

This patient, capital-intensive approach contrasts sharply with strategies focused on rapid, short-term gains. The "sticker shock" from Amazon's capex announcement is a manifestation of this temporal mismatch. Investors accustomed to quicker returns may struggle to appreciate the strategic value of building foundational infrastructure that will only yield substantial dividends over several years. However, this is precisely where durable competitive advantage is forged. Companies that can weather the immediate financial pressures of massive infrastructure investment are positioning themselves for market leadership in an AI-driven future, creating a moat that is difficult for competitors to breach due to the sheer capital required.

Key Action Items:

-

Short-Term (Immediate - 3 Months):

- Re-evaluate Capital Allocation Frameworks: For companies operating in tech-adjacent sectors, critically assess current capital allocation strategies. Are they sufficiently accounting for the escalating infrastructure costs of AI integration and development, even if not directly building AI models?

- Analyze Competitor Capex: Closely monitor the capital expenditure announcements of direct and indirect competitors. Understand the scale of their infrastructure investments and how these might reshape market dynamics.

- Scenario Planning for Infrastructure Costs: Develop financial models that project the potential long-term costs of AI infrastructure (e.g., cloud services, specialized hardware). This helps in understanding the financial runway required.

-

Medium-Term (3-12 Months):

- Identify Infrastructure Dependencies: Map out critical dependencies on cloud providers and hardware manufacturers. Understand how their capex plans might impact pricing, availability, and service levels for your organization.

- Explore Strategic Partnerships for Infrastructure: Investigate potential partnerships that could share the burden of infrastructure investment or provide access to specialized hardware/cloud services without massive upfront capital outlay.

-

Long-Term (12-24 Months+):

- Develop a Multi-Year Infrastructure Investment Roadmap: Create a strategic plan for sustained infrastructure investment that aligns with AI development goals. This should account for the iterative nature of AI hardware and software evolution.

- Assess ROI on Infrastructure, Not Just Applications: Shift the focus of ROI analysis from solely AI application performance to the underlying infrastructure's efficiency, scalability, and long-term cost-effectiveness.

- Build Financial Resilience for Extended Investment Cycles: Ensure the company's financial structure can support multi-year investment cycles with potentially delayed returns, prioritizing long-term strategic positioning over short-term profitability.

- Cultivate Investor Patience: Proactively communicate the long-term vision and the strategic necessity of infrastructure investment to stakeholders, educating them on the capital-intensive nature of AI leadership and the delayed payoff model.