Oracle's Data Center Build-Out Faces Investor Anxiety Over Financing

TL;DR

- Oracle's ambitious data center build-out, relying heavily on off-balance-sheet leases, faces investor anxiety due to financing partner changes and the long-term revenue uncertainty of training workloads.

- OpenAI's potential $10 billion raise from Amazon signifies a strategic move to secure compute and leverage Amazon's custom chips, potentially challenging Nvidia's dominance in AI accelerators.

- Waymo's pursuit of over $15 billion in funding at a $100 billion valuation highlights the immense capital required for autonomous vehicle expansion and Alphabet's "other bets" strategy for financial independence.

- The AI hardware market is expanding beyond Nvidia, with Google's TPUs and Amazon's custom chips offering viable alternatives, suggesting a multi-vendor ecosystem rather than a single winner-take-all scenario.

- Micron's strategic shift towards High Bandwidth Memory (HBM) and DRAM production reflects a response to surging AI demand, potentially creating shortages and price strength in broader memory markets.

- The increasing demand for co-branded credit cards from major brands like Booking.com and Rakuten indicates a trend towards personalized financial products integrated into partner ecosystems, driving customer lifetime value.

Deep Dive

Oracle's ambitious pivot to becoming a cloud infrastructure provider, particularly for AI workloads, faces significant investor scrutiny due to the unprecedented scale of its data center financing and the evolving competitive landscape for large language models. While Oracle asserts its projects remain on schedule and it has secured alternative financing, the market's anxiety stems from the reliance on off-balance sheet leases, the company's relative inexperience in this domain compared to established hyperscalers, and questions surrounding the long-term demand for training-intensive AI workloads.

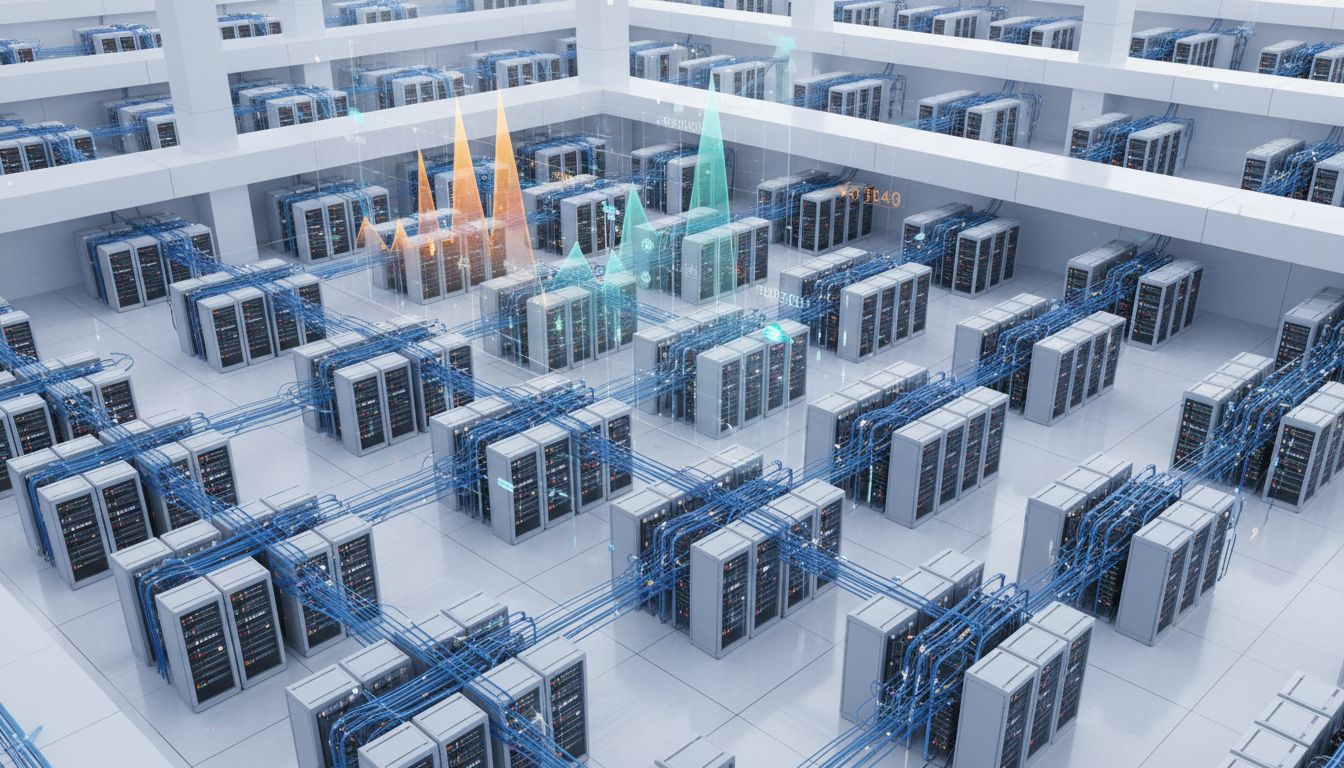

The core of Oracle's strategy involves a massive build-out of data center capacity, primarily through leases, totaling hundreds of billions of dollars in future commitments. This approach allows Oracle to avoid immediate on-balance sheet capital expenditures, but it creates a substantial future financial obligation. Investors are concerned about the sheer magnitude of these commitments relative to Oracle's overall business size and the potential for unforeseen costs or shifts in demand. The withdrawal of Blue Owl Capital, a key financing partner, from a significant Michigan data center deal, while Oracle claims a suitable replacement was found, has amplified these concerns. This situation is exacerbated by Oracle's late entry into the hyperscale data center market, where established players like Amazon, Microsoft, and Google have decades of experience and different financial profiles. The market is actively questioning whether Oracle can execute this transformation successfully, especially given the aggressive timelines and the need for demand to materialize in three to five years.

Furthermore, the financing challenges for Oracle are intertwined with the broader AI ecosystem's dynamics. The demand for data center capacity is heavily influenced by the success and competitive positioning of AI model providers like OpenAI. As new, potentially more efficient models emerge from competitors such as Google's Gemini and Anthropic, and as the industry grapples with the high costs and uncertain returns of AI model training versus inferencing, the long-term demand for the specific types of compute Oracle is building capacity for becomes less predictable. While Oracle's infrastructure could potentially serve various LLM providers, including those diversifying away from a sole reliance on OpenAI, the market remains hesitant to underwrite the substantial costs associated with AI model training, a segment where Oracle may be heavily exposed. This uncertainty around future demand and the ROI of training workloads creates a challenging environment for financing such large-scale future capacity.

The implications of these financing and demand uncertainties extend beyond Oracle. The broader market is grappling with the "AI bubble" question, with significant capital chasing infrastructure and chip providers. While companies like Nvidia continue to see strong demand, the emergence of alternatives from Amazon (Trainium chips), Google (TPUs), and others, coupled with Alphabet's strategic investments in Waymo and its own AI advancements, suggests a more competitive landscape for AI hardware. This competition, while potentially beneficial for end-users and fostering innovation, creates uncertainty for investors focused on specific infrastructure plays. The market is increasingly scrutinizing the sustainability of current demand patterns and the long-term economic viability of massive compute investments, particularly those tied to the most expensive and potentially less predictable AI training workloads.

The key takeaway is that Oracle's ambitious data center expansion, while potentially transformative, is navigating a complex and uncertain financial and competitive environment. Investor anxiety is rooted in the scale of its off-balance sheet financing, its relative inexperience in the hyperscale market, and the evolving dynamics of AI model development and demand, particularly concerning the high costs of training. This situation highlights the systemic risks and trade-offs inherent in the rapid build-out of AI infrastructure, where future demand and technological advancements create significant financial headwinds.

Action Items

- Audit Oracle's data center financing: Analyze 3-5 recent projects for debt-to-equity ratios and lender diversification to assess systemic risk.

- Evaluate OpenAI's compute strategy: Track compute allocation across 2-3 providers (Amazon, Oracle, others) to identify long-term cost optimization opportunities.

- Measure AI chip market share: Analyze 3-5 key chip providers' (Nvidia, AMD, Google TPUs, Amazon Trainium) revenue growth and customer commitments to forecast competitive landscape shifts.

- Assess Waymo's expansion capital needs: Project funding requirements for 3-5 new city launches to understand long-term financial sustainability and Alphabet's commitment.

Key Quotes

"The big context on oracle is that they are embarking on a historic build out of data centers where it's really a logistical feat it's quite a um tight schedule they need to be on and if all goes right it's transformational for oracle and the entire industry but all that needs to happen for that to get off is a couple of things falling out right and that's the issue with what we're seeing today is that the ft is reporting that there's been some issues in getting the financing for one of their big centers and that's giving investors a lot of anxiety that hey are are these lenders seeing something that we are not that's what's driving the fear this morning."

Brody Ford explains that Oracle's ambitious data center expansion faces significant logistical challenges and tight timelines. Ford highlights that issues in securing financing for a major center are causing investor anxiety, suggesting that lenders might perceive risks not immediately apparent to the market.

"What's interesting is you've been writing about the sheer scale of leases and i think leases is something different because it's off balance sheet and always think we're hearing it in a 10q that they could have up to 300 billion worth thereabouts in terms of their overall leases that eventually they're on the hook for paying but how is this different from capital expenditure and the like right so we're used to hearing about capital expenditures which is i'm going out and buying computers i'm buying wires i'm buying the data centers themselves but what's becoming more popular is renting the data centers and that allows you to not pay everything upfront and not have that be on your books directly and so what we've seen is a big spike in these kind of future dated commitments that oracle is the example that they have about 250 billion that they're on the hook for over the next 20 years or so and most likely this michigan data center would be one of them it's just kind of you know one more pool of spending that we realize quite how large this build out is going to be."

Brody Ford clarifies the distinction between capital expenditures and leases in the context of data center financing. Ford notes that leases, being off-balance sheet, allow companies like Oracle to commit to significant future spending without immediate on-book liabilities, as demonstrated by Oracle's substantial future lease commitments.

"Yeah it's right amazon also a close partner of anthropic they've invested 8 billion in that company as part of a deal that got anthropic to use amazon's own homegrown ai chip for their models right so this would definitely be a coup for amazon's in house chip making effort um which analysts are still trying to uh to struggle a little bit to um understand the effectiveness of to date in part because there's just few enormous customers for this stuff there's not a whole lot of big model trainers out there so it goes without saying that if openai can make you know the gpt suite work on top of amazon's silicon that's that's a big deal for for aws and for amazon because it was such a big deal for alphabet and we think about the endorsement that its vertical model seems to be getting from the market."

Matt Day explains that Amazon's potential investment in OpenAI, similar to its investment in Anthropic, could serve as a significant endorsement for Amazon's in-house AI chips. Day points out that the effectiveness of these chips is still being assessed by analysts due to the limited number of large-scale customers, making OpenAI's adoption a crucial validation for Amazon's silicon efforts.

"Yeah well i think the first is the market is growing and so um you know this is an exponential growth curve so i don't think that it's a winner take all and so you know multiple companies can can do well and in some ways i think when you step back and think about what's going on um you know there are there is kind of a space race for ai but they're going to multiple areas multiple moons um and so they're all doing their own kind of tech domain expertise i think like with the tpu it's very optimized um you know for a specific stack and for the google ecosystem and then i think nvidia is like kind of more the merchant like broader platform uh can run everything and i think both can have a place um and you can see that you know google's been doing really well over the last five years uh so has nvidia uh so has amd so has broadcom and so to me i think that um you know there there's not a winner take all here."

Tony Wang argues that the rapidly growing AI market is not a zero-sum game, allowing multiple companies to succeed. Wang likens the AI landscape to a "space race" with "multiple moons," where different companies, like Google with its optimized TPUs and Nvidia with its broader platform, can carve out distinct niches. Wang supports this by noting the success of various chipmakers over the past five years.

"Yeah we're definitely on an upward trajectory and memory prices so i think what's going on there is that hbm the stuff that goes into these gpus and ai systems you know they soak up a lot of wafer capacity and so as a result creating shortages in broader dram and then also that's creating shortages in broader nand um and so that you're seeing this ripple effect into other areas like sandisk for example has seen you know tremendous appreciation in their stock price so you know i think that there will be these areas where um you know the economic profit can be distributed to even more that didn't participate as much over the last few years."

Kim Forrest explains the current upward trend in memory prices, attributing it to high demand for High Bandwidth Memory (HBM) used in AI systems. Forrest details how this demand strains wafer capacity, leading to shortages in DRAM and NAND, which in turn positively impacts related companies like SanDisk. Forrest suggests that this ripple effect will distribute economic profits to a broader range of companies in the sector.

"Yeah we think about it as kind of two sides of the coin right one is the customer experience that you've mentioned and one is how we build the company on customer experience automation and ai allows us you know to personalize how much rewards you get how we talk to the customer how the experience even shape shifts for the customer and more and more investing in that so it feels radically different to anything that a bank has ever provided in the past for these brands or for these customers the really interesting thing and maybe it's not um as apparent on the surface is we get to rebuild what looks like a financial company or even a fintech um in the time of automation and ai so over the last year we've grown the business by almost 300 and we've grown headcount by 20 and every turn we get to choose are we going to build a new team here are we going to invest in technology and automation so we don't have to hire a team of people we can actually scale the company using technology which is an amazing opportunity that i don't think anybody has ever had."

Dara Murphy discusses how Imprint

Resources

External Resources

Books

- "10-Q Report" - Mentioned in relation to financial disclosures and off-balance sheet financing.

Articles & Papers

- "Bloomberg Tech" (Bloomberg) - Mentioned as the podcast name and source of the episode.

- "Bloomberg Audio Studios" (Bloomberg) - Mentioned as a source for podcasts and radio news.

- "The FT" (Financial Times) - Mentioned as the source reporting issues with Oracle's data center financing.

People

- Caroline Hyde - Co-host of Bloomberg Tech.

- Adam Shoal - Co-host of Bloomberg Tech.

- Brody Ford - Bloomberg reporter covering Oracle.

- Matt Day - Bloomberg reporter covering Amazon.

- Tony Wang - Portfolio Manager at T. Rowe Price's Science and Technology Fund.

- Kim Forrest - CIO at Bokeh Capital Partners.

- Dara Murphy - CEO of Imprint.

- Sarah Fry - Bloomberg space reporter covering Waymo.

- Eric Schmidt - Former Google boss and new CEO of Relativity Space.

- Elon Musk - Mentioned in relation to the Twitter deal and putting data centers in space.

- Jeff Bezos - Mentioned as founder of Blue Origin and discussing putting data centers in space.

Organizations & Institutions

- Oracle - Company whose data center financing is being questioned.

- OpenAI - Company in talks to raise $10 billion from Amazon and plans to use its training chips.

- Amazon - Discussed as a potential investor in OpenAI and a provider of cloud compute.

- Nvidia - Competitor in AI chips, with its dominance being challenged.

- Waymo - Robotaxi maker in talks to raise over $15 billion.

- Alphabet - Parent company of Waymo, also developing AI chips (TPUs).

- Microsoft - Mentioned in relation to its AI infrastructure commitments and refusal to fund training workloads for OpenAI.

- Blue Owl Capital - Oracle's largest data center finance partner, which will not back a $10 billion deal.

- Related Digital - Oracle's development partner for its Michigan data center project.

- T. Rowe Price - Investment firm where Tony Wang is a portfolio manager.

- Bokeh Capital Partners - Investment firm where Kim Forrest is CIO.

- Imprint Payments - Fintech startup helping retailers offer co-branded credit cards.

- Cohesity - Company mentioned for its resilience solutions.

- Okta - Company providing identity solutions for AI agents.

- Chase for Business - Provider of business credit cards.

- CVS Caremark - Provider of prescription plans with savings.

- Mastercard - Provider of commercial acceptance solutions for B2B payments.

- Warner Brothers Discovery - Urging shareholders to reject Paramount/Skydance takeover bid.

- Paramount - Company involved in a takeover bid with Skydance.

- Skydance - Company involved in a takeover bid with Paramount.

- Netflix - Company with an agreement with Warner Brothers Discovery.

- Google - Releasing a new version of its AI model, Gemini 3 Flash.

- Tesla - Facing a ban on car sales in California due to misleading ads about self-driving technology.

- Anthropic - Company that invested in Amazon's AI chips.

- AMD - Mentioned as a competitor in AI accelerators.

- Broadcom - Company whose stock has been under pressure.

- Micron - Chipmaker scheduled to report earnings.

- Corvvie - Mentioned as a new cloud provider doing well.

- Lambda Inc. - Private company with a unique cloud stack, partnered with T. Rowe Price.

- Thrive Capital - Investor in Imprint.

- Ribbit Capital - Investor in Imprint.

- Kleiner Perkins - Investor in Imprint.

- Spice Capital - Investor in Imprint.

- PDD Holdings - Creator of e-commerce site Temu.

- Temu - E-commerce site created by PDD Holdings.

- Mythic - Chip startup that raised $125 million.

- Metax - Chinese chipmaker with a strong market debut.

- Relativity Space - Space startup receiving new funding and a new CEO.

- Blue Origin - Company founded by Jeff Bezos.

- CVS - Pharmacy chain.

- Colgate - Company offering oral health products.

- Thrive Team - Specialized experts helping people with CIDP.

Tools & Software

- Bloomberg Terminal - Mentioned as a resource for checking fund holdings.

Websites & Online Resources

- omnystudio.com/listener - Mentioned for privacy information.

- chase.com/businesscard - Website to learn more about Chase for Business credit cards.

- cmk.co/stories - Website to learn how CVS Caremark helps members save.

- mastercard.com/commercialacceptance - Website to discover Mastercard's commercial acceptance solutions.

- public.com/market - Website to learn more about Public's generated assets.

- public.com/disclosures - Website for complete disclosures on Public's generated assets.

- public.com - Platform for building multi-asset portfolios.

- publicinvesting.inc - Brokerage services provider.

- publicadvisors.llc - SEC registered advisor.

- cvs.com - Website for CVS.

- shopcolgate.com/total - Website to purchase Colgate Total products.

- rarewelldone.com - Website to watch the reality series "Rare Well Done."

Other Resources

- AI Agents - Discussed in relation to identity and security.

- AI Infrastructure - A key area of investment and development.

- AI Accelerators - Hardware used for AI processing.

- TPU (Tensor Processing Unit) - Google's AI chip.

- ASICs (Application-Specific Integrated Circuits) - Mentioned in relation to Broadcom.

- HBM (High Bandwidth Memory) - Memory used in GPUs and AI systems.

- DRAM (Dynamic Random-Access Memory) - A type of memory.

- NAND - A type of flash memory.

- LLM (Large Language Model) - Discussed in relation to AI development and compute needs.

- GPT-5 - New version of OpenAI's flagship model.

- Gemini 3 Flash - Google's new AI model.

- Gemini 3 Pro - Previous version of Google's AI model.

- Cohesity.com/resilience - Website to learn more about Cohesity's resilience solutions.

- Co-branded credit cards - A financial product offered by Imprint.

- Loyalty platform - A service offered by Imprint.

- CIDP (Chronic Inflammatory Demyelinating Polyneuropathy) - A rare disease discussed in the context of the "Rare Well Done" series.

- 3D printing of rockets - The original focus of Relativity Space.

- Data centers in space - A potential future development discussed by Eric Schmidt.

- Virtual card payments - A growing demand in B2B payments.

- Self-driving technology - Tesla's advertised feature.

- Scaling laws - A concept in AI development.

- Training workloads - A type of computational task for AI models.

- Inferencing - A type of computational task for AI models.

- Crossover financings - Investments in private companies.

- Generated Assets - Investable indexes created with AI on the Public platform.