Private AI Investment Surges Amidst Infrastructure Costs and Shifting Tech Models

TL;DR

- Databricks' substantial Series L funding at a $134 billion valuation signals sustained investor confidence in AI-driven data platforms, despite public market AI anxieties, indicating a strong private market appetite for companies enabling LLM deployment.

- Oracle's disclosed $150 billion in data center leases over 15 years highlights significant, previously unknown capital commitments, creating investor indigestion and raising concerns about the true cost of AI infrastructure build-out.

- The US government's "whole of government" approach, exemplified by the Pax Siliconica initiative and Korea Zinc smelter investment, aims to re-industrialize America and secure critical mineral supply chains, reducing reliance on China.

- JetBlue's strategic shift towards premium offerings, including lounges and enhanced cabins, aims to drive profitability by capturing higher-spending leisure travelers, acknowledging the need for diversified revenue streams beyond traditional business routes.

- The automotive industry faces a global pullback from aggressive EV mandates, with manufacturers like Ford learning hard lessons about consumer readiness and pricing, leading to policy re-evaluation in the US and EU.

- AI is transforming executive recruiting by indexing the entire market, enabling search firms to identify optimal candidates beyond their existing networks, thereby addressing the tight executive labor market for software companies.

- TikTok's growing success in livestream shopping in the US, a format popular in China, suggests a unique ability to blend entertainment with commerce, potentially capturing market share where other tech giants have struggled.

Deep Dive

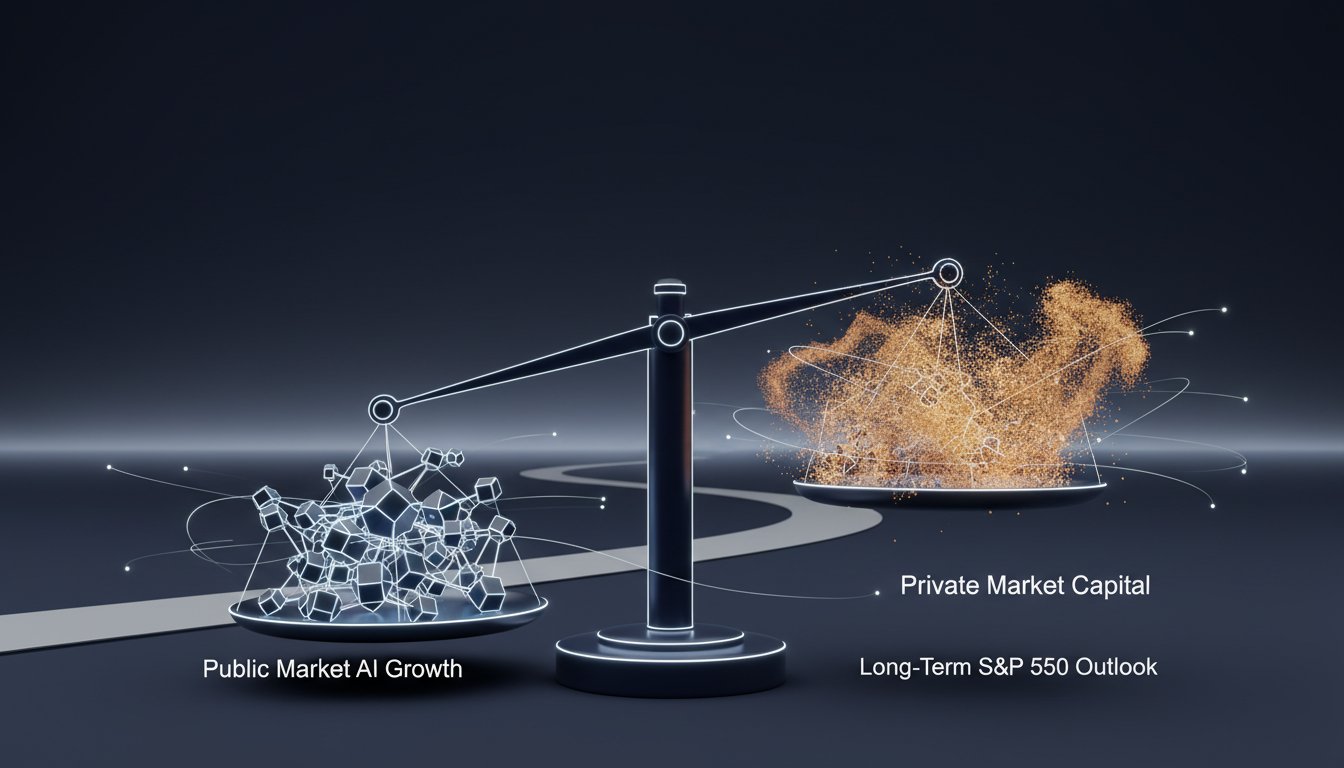

Databricks' substantial $4 billion funding round, valuing the private software firm at $134 billion, signals sustained investor confidence in AI-centric companies, even amidst public market anxieties. This highlights a bifurcated market where private investors are actively seeking AI-enabling technologies, while public markets grapple with the costs and complexities of AI infrastructure. Separately, TikTok's growing success in US livestream shopping demonstrates its ability to translate user engagement into e-commerce, a feat that has eluded other platforms.

The private market's robust appetite for AI companies like Databricks, which promises to consolidate data for LLM deployment, underscores the perceived long-term value of AI infrastructure. This influx of capital into private markets contrasts with the public market's caution, partly driven by concerns over the significant capital expenditures required for AI data centers. Oracle's disclosed $150 billion in leases for data centers, for instance, has generated "indigestion" as investors weigh the cost of AI expansion against profitability. This discerning investor behavior, while potentially leading to higher valuations for promising private companies, also signifies a demand for clear financial performance and strategic clarity, even within the growth narrative of AI.

TikTok's advancement in livestream shopping indicates a potent monetization strategy that leverages its entertainment-focused user base. By integrating commerce seamlessly into the scrolling and viewing experience, TikTok taps into user habits that make shopping feel less like a transaction and more like an extension of entertainment. This success has the potential to redefine e-commerce by prioritizing engagement and influencer-led sales, a model that has proven highly effective in Asian markets and is now gaining traction in the US, where other tech giants have struggled to replicate it.

The broader economic landscape, as discussed regarding the labor market and geopolitical strategies, reveals a complex interplay of technological advancement and market forces. While AI is creating demand for specialized skills, concerns about AI-related layoffs and the rising unemployment rate suggest a period of adjustment. Simultaneously, the US government's proactive measures to secure AI supply chains through initiatives like the Pax Silica program and investments in domestic manufacturing highlight a strategic imperative to reduce reliance on geopolitical rivals. This approach, a blend of public-private partnerships and international cooperation, aims to build resilience and maintain a competitive edge in critical future industries, even as it navigates the complexities of global trade and national security.

Action Items

- Audit AI agent identity: Implement Okta for securing AI agents to prevent business jeopardization.

- Track 3-5 key AI supply chain minerals (e.g., rare earths) to assess US dependency on China.

- Measure TikTok live shopping conversion rates for 5-10 small businesses to understand its US market viability.

- Analyze 3-5 private equity-held software companies for executive leadership AI talent readiness before Q3 2026 exits.

Key Quotes

"data bricks another tell raising over 4 billion in a new funding round that values the private software firm at 134 billion bloomberg's freddy ford joins us now to discuss what just seems to be relentless even though we have ai anxiety in the public markets we are all in in the private sector it feels"

This quote highlights Databricks' significant Series L funding round, valuing the company at $134 billion. Freddy Ford notes the contrast between public market AI anxiety and continued private sector investment, suggesting that companies with a strong AI narrative, like Databricks, are attracting substantial capital.

"if you're able to tell an ai story and for data bricks that is we're going to get all your data together and make it easy for you to run llms on it then investors will be lining up and i mean this is a company with very clean financials with a lot of momentum and so you know my guess is in six months we'll be here again talking about the series whatever letters after l and maybe it gets to z"

Freddy Ford explains that Databricks' ability to articulate a compelling AI story, specifically around data aggregation for Large Language Models (LLMs), is a key driver for investor interest. He points to the company's strong financials and momentum as reasons for continued investor confidence and potential future funding rounds.

"i think discerning spells out somewhat if we just take the public markets and we look at for example when you had five of them meg 7 all report in the same week and some and they all for the most part beat expectations and yet some stocks rallied and some declined because of investors listening through to the story"

Carol Shive discusses how investors are becoming more discerning, even when major tech companies (the "Meg 7") report strong earnings. Shive indicates that investors are not just looking at headline numbers but are "listening through to the story," suggesting a deeper analysis of company narratives and future prospects is influencing market reactions.

"we're going to make it tennessee now an affordable pickup truck so these are going to be better investments for the company profit and all those hybrid sales you know those are really profitable vehicles for us"

Jim Farley, Ford CEO, discusses the company's strategy to focus on more profitable vehicle types, specifically mentioning an affordable pickup truck and hybrid sales. Farley emphasizes that these vehicles represent better investments for the company and contribute significantly to profitability.

"i think with uh with what we've seen just in the last uh you know day day and a half at this point it's really a matter of of sort of plenty of blame going around right uh this is a case where uh the consumer absolutely has not been ready to to go fully electric uh you know universally i think manufacturers like ford have learned that the hard way and i think they have you know some some mistakes to wear here in terms of uh you know bringing out electric vehicles that were just too expensive not supporting them with enough charging infrastructure"

Craig Trudell analyzes the challenges in the electric vehicle (EV) market, suggesting that consumers have not been universally ready for a full transition to electric. Trudell points to manufacturers like Ford learning "the hard way" by introducing EVs that were too expensive and lacked sufficient charging infrastructure.

"well ultimately the the president's been clear that we want to have a constructive stable and positive relationship with china uh and at this we're going to do that all the while standing up for america and putting america first and so he delivered a landmark speech um back in july on winning the ai race um our policy is we want to win the ai race because we want to put america first and so we're never going to apologize uh or back down from defending american interests"

Jacob Helberg outlines the U.S. policy towards China, stating a desire for a "constructive, stable, and positive relationship" while simultaneously prioritizing American interests and "putting America first." Helberg references a speech on "winning the AI race," emphasizing that the U.S. will defend its interests and will not apologize for doing so.

Resources

External Resources

Books

- "The President's National Security Strategy" - Mentioned as providing a strategy for the Senate and outlining the administration's approach to economic security.

Articles & Papers

- "Bloomberg Tech" (Bloomberg) - Mentioned as the podcast where the episode was featured.

- "Bloomberg Audio Studios" (Bloomberg) - Mentioned as the producer of the podcast.

- "Screen Time" (Bloomberg) - Mentioned as an event where Instagram's head hinted at a TV app.

People

- Adam Mosseri - Head of Instagram, mentioned for hinting at a dedicated TV app.

- Alex Levine - Colleague of Kurt Wagner, mentioned for a story on livestream shopping on TikTok.

- Ali Gonsi - Mentioned in relation to running a cash-positive business and tapping public markets.

- Ben Max - Co-host of Bloomberg Tech.

- Carol Shive - Chief Market Strategist at BMO Private Wealth, discussed market perspectives and AI's role in the economy.

- Caroline Hyde - Co-host of Bloomberg Tech, discussed Databricks' funding round and US-China tech relations.

- Craig Trudell - Covers the automotive industry for Bloomberg, discussed the EV market and global policies.

- Donald Trump - Former President, mentioned for filing a defamation suit against the BBC and extending deadlines for TikTok.

- Ed Ludlow - Co-host of Bloomberg Tech, discussed Databricks' funding round and US-China tech relations.

- Eric Welzicowski - CEO of Bespoke Partners, discussed AI's impact on executive recruiting and the labor market.

- Freddy Ford - Bloomberg reporter, discussed Databricks' funding round.

- Jacob Helberg - Under Secretary of State for Economic Affairs and founder of the Hill and Valley Forum, discussed US efforts to secure its silicon supply chain and US-China tech relations.

- Jim Farley - CEO of Ford, discussed the company's EV business overhaul.

- Joanna Geraghty - CEO of JetBlue, discussed the airline's strategy, premium offerings, and financial outlook.

- Julian Edelman - Former NFL player, mentioned in relation to "Dudes on Dudes with Gronk and Jules" and morning crunchables sandwiches.

- Kim Kardashian - Mentioned for a holiday special for her Skims company on TikTok Live and for cocktails with Snoop Dogg.

- Kurt Wagner - Bloomberg reporter, discussed social media trends, Instagram's TV app, and TikTok's shopping initiatives.

- Lisa Ramowitz - Bloomberg reporter, discussed JetBlue's new airport lounge.

- Matt Miller - Bloomberg reporter, interviewed Ford CEO Jim Farley.

- Snoop Dogg - Mentioned for doing cocktails with Kim Kardashian by TikTok.

Organizations & Institutions

- Bespoke Partners - Executive recruiting firm, mentioned in relation to AI's impact on the labor market.

- Bloomberg - Media company, mentioned as the source of the podcast and its reporters.

- Bloomberg Audio Studios - Podcast production arm of Bloomberg.

- BMO Private Wealth - Financial institution, mentioned through its Chief Market Strategist Carol Shive.

- Cboe - Mentioned as looking to write options and futures on private companies.

- Cohesity - Mentioned in relation to resilience and AI agents.

- Databricks - Software firm, mentioned for raising $4 billion in a Series L funding round.

- Emon Private Wealth - Financial institution, mentioned through its Chief Market Strategist Carol Shive.

- Ford - Automotive company, mentioned for its EV business overhaul and taking a charge.

- Hill and Valley Forum - Mentioned as an organization founded by Jacob Helberg.

- IBM - Technology company, mentioned in relation to managing AI.

- Instagram - Social media platform, mentioned for unveiling its first dedicated TV app.

- iShares - ETF provider, mentioned for its Volley Large Cap Premium Income Active ETF.

- JetBlue - Airline, discussed its new airport lounge, premium offerings, and financial strategy.

- JP Morgan - Financial institution, mentioned as being involved in a public-private partnership for a smelter.

- Korea Zinc - Company involved in a $7.4 billion smelter project in Tennessee.

- Mastercard - Financial services corporation, mentioned for its adaptive approach to B2B acceptance.

- Meta - Technology company, mentioned as having made efforts in livestream shopping.

- MP Materials - Mentioned in relation to a $400 million investment.

- National Football League (NFL) - Professional American football league.

- Nasdaq - Stock exchange, mentioned for seeking regulatory approval to extend trading hours.

- New England Patriots - Professional football team.

- Nvidia - Technology company, mentioned in relation to its forward PE ratio compared to Walmart.

- Okta - Technology company, mentioned for securing AI agents' identities.

- Oracle - Technology company, mentioned in relation to leases for data centers.

- PFF (Pro Football Focus) - Data source for player grading.

- Public - Investment platform, mentioned for its generated assets and bonus for portfolio transfers.

- Snowflake - Company, mentioned as a competitor to Databricks.

- TikTok - Social media platform, mentioned for its livestream shopping initiatives and potential ban in the US.

- US Air Force - Mentioned in relation to a close call incident with a JetBlue plane.

- US Department of War - Mentioned as an instrumental pillar to the Korea Zinc deal and for its commitment to securing critical mineral supplies.

- United - Airline, mentioned for its "Blue Sky Partnership" with JetBlue.

- Walmart - Retail company, mentioned in relation to its forward PE ratio compared to Nvidia.

- Warner Brothers Discovery - Media company, mentioned in the context of competition for TV attention.

- YouTube - Video platform, mentioned for its efforts in livestream shopping and dominating TV attention.

Tools & Software

- Adobe Acrobat Studio - Mentioned for its AI-powered PDF capabilities.

- AI Agents - Mentioned as being prevalent across fields and functions.

- Databricks - Software firm, mentioned for its AI-oriented technology and data management capabilities.

- Generated Assets - Feature on the Public platform, allowing users to turn ideas into investable indexes.

- LLMs (Large Language Models) - Mentioned in relation to Databricks' capabilities.

- Okta - Platform for identity and access management, mentioned for securing AI agents.

Websites & Online Resources

- Adobe.com - Mentioned for learning more about Adobe Acrobat Studio.

- Bloomberg.com - Mentioned for accessing the Bloomberg Tech podcast.

- Cohesity.com - Mentioned for learning more about resilience.

- iShares.com - Mentioned for viewing prospectuses for ETFs.

- Mastercard.com/commercialacceptance - Mentioned for discovering Mastercard's B2B acceptance solutions.

- Omnystudio.com/listener - Mentioned for privacy information related to the podcast.

- Public.com/market - Mentioned for earning a bonus when transferring a portfolio.

- Public.com/disclosures - Mentioned for complete disclosures related to generated assets.

- www.ishares.com - Mentioned for viewing ETF prospectuses.

Other Resources

- AI Supply Chain Resiliency - Mentioned as a key initiative by the US government.

- B2B Card Payment Landscape - Mentioned as evolving with buyer demands.

- B2B Acceptance - Mentioned as a high growth opportunity for merchant acquiring businesses.

- Blue Sky Partnership - Partnership between JetBlue and United.

- Capital Market Assumptions - Mentioned as a core theme for BMO Private Wealth.

- Commercial Acceptance - Mentioned in relation to Mastercard's solutions.

- Compute Capacity - Mentioned in relation to the US pursuing a two-track approach to winning the AI race.

- Dudes on Dudes with Gronk and Jules - Podcast, mentioned in relation to Julian Edelman.

- Economic Security Strategy - Mentioned as having four pillars by the State Department.

- EV Business - Mentioned in relation to Ford's overhaul and global pullback from green policies.

- EV Fuel - Mentioned in relation to the US and Europe's relationship with electric vehicles.

- Executive Recruiting Industry - Mentioned in relation to AI's impact and the tight labor market for executives.

- Fintech Companies - Mentioned as potentially entering the banking system.

- First Class Product - Mentioned as a premium offering by JetBlue.

- Global Supply Chain - Mentioned as being global and requiring cooperation with allies.

- Heathrow Slot - Mentioned as a gate access that JetBlue bid on and was denied.

- Hill and Valley Forum - Mentioned as an organization founded by Jacob Helberg.

- Hybrid Sales - Mentioned as profitable vehicles for Ford.

- Identity - Mentioned as crucial for trusting AI agents and for Okta's services.

- Industrial Revolution 4.0 - Mentioned as a core macro theme.

- Interdependency - Mentioned in the context of US-China relations.

- Investable Index - Feature on the Public platform, allowing users to create indexes from ideas.

- JFK Airport - Mentioned as the location of JetBlue's first airport lounge.

- Jet Forward Strategy - JetBlue's strategic plan.

- Labor Market - Mentioned in relation to unemployment rates and AI's impact.

- Large Cap Premium Income Active ETF - Mentioned as a product from iShares.

- Leisure Carrier - Mentioned as JetBlue's primary customer base.

- Livestream Shopping - Mentioned as a format popular in China and gaining traction on TikTok in the US.

- Managed Decline - Mentioned as a choice Europe faces.

- Market Sentiment - Mentioned in relation to US unemployment.

- Merchant Acquiring Businesses - Mentioned as having a high growth opportunity in B2B payments.

- Mint Class - Premium offering by JetBlue.

- Morning Crunchables Sandwiches - Snack product, mentioned by Julian Edelman.

- Multi-asset Portfolio - Feature on the Public platform.

- National Airspace System - Mentioned in relation to safety nets.

- National Security Strategy - Mentioned as a document from the US government.

- Non Farm Payrolls - Economic indicator, mentioned in relation to the jobs report.

- OEM (Original Equipment Manufacturer) - Mentioned in relation to the automotive industry.

- Options and Futures - Mentioned as instruments Cboe is looking to write on private companies.

- Packs Silica - Framework for securing supply chains, mentioned by Jacob Helberg.

- Panorama Documentary - BBC documentary, mentioned in relation to a defamation suit by Donald Trump.

- Partnership - Mentioned in relation to JetBlue and United.

- PayPal Bank - Mentioned as a potential bank application by PayPal.

- **Paypal