Public AI Markets Stable, Private Markets Show Bubble Risk

TL;DR

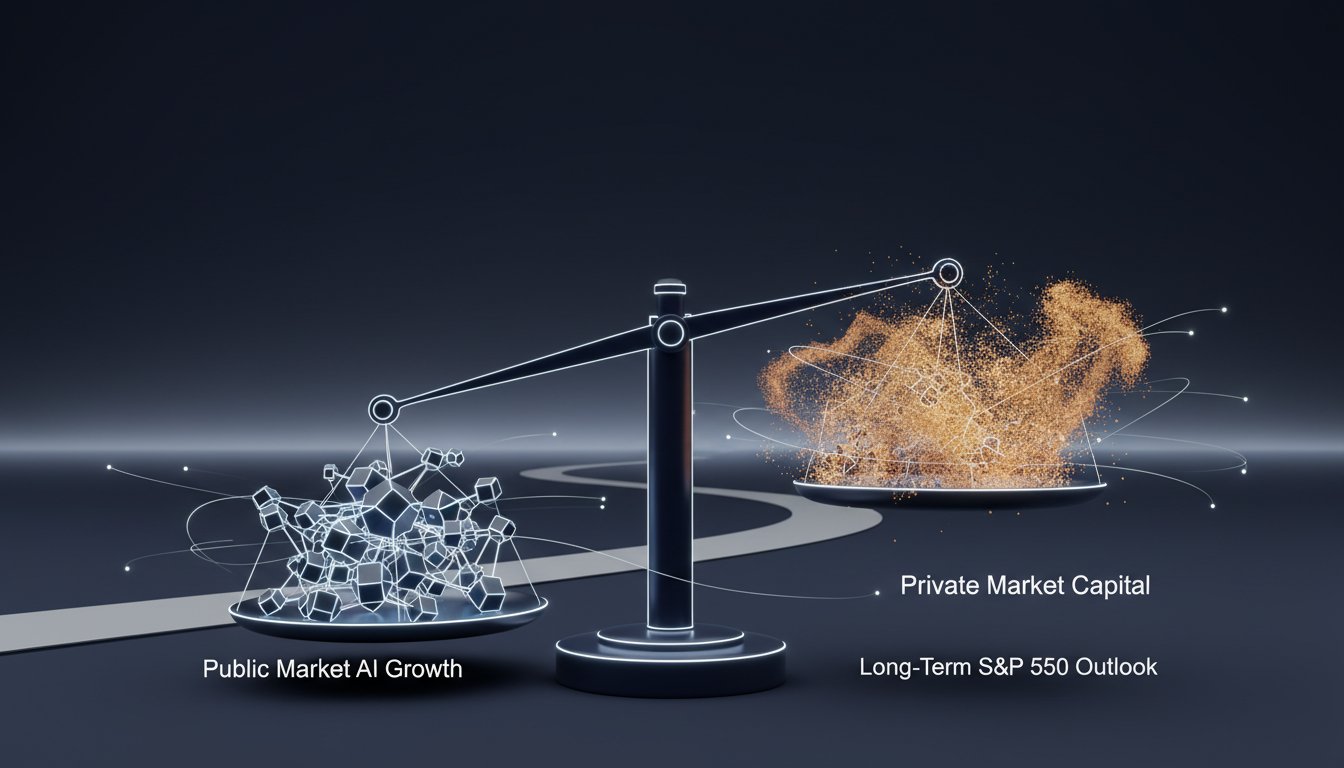

- The AI market is not a bubble in public markets, as Nvidia's share price has matched its earnings growth, unlike speculative bubbles where price outpaces fundamentals.

- Private market AI capital availability is likely unsustainable, exhibiting reflexivity where increased funding drives growth and valuations recursively, a pattern that can reverse sharply.

- Below-average positive returns are anticipated for the S&P 500 over the next decade due to high starting valuations and market concentration, increasing prospective volatility.

- The shift from an "asset-focused" to an "alpha-focused" investment approach means strategists now emphasize individual company attributes over broad asset classes.

- Mutual funds and hedge funds are underperforming benchmarks, with only 29% of mutual funds and 12% of hedge funds beating their style benchmarks year-to-date.

- Healthcare and certain consumer segments are identified as opportunities due to historical undervaluation and potential benefits from tax reform, respectively.

- Understanding one's role within the broader commercial process is crucial for junior professionals to identify opportunities for variant perspectives and client problem-solving.

Deep Dive

David Kostin, Goldman Sachs' outgoing Chief US Equity Strategist, contends that while public AI markets are not in a bubble due to earnings growth matching price appreciation, private AI markets exhibit unsustainable capital availability and pricing, indicative of a bubble. This distinction is critical for investors navigating market sentiment, as it implies divergent risk profiles and potential outcomes across public and private investment landscapes.

The current market, characterized by a VIX around 19, has seen a steady increase since April, supported by strong third-quarter earnings that rose nearly 9% year-over-year, broadening beyond the "Magnificent Seven." Despite this underlying strength, many mutual funds and hedge funds have struggled to outperform their benchmarks, largely due to the market's performance being driven by AI-related trades. This has created a difficult environment for fund managers who may not have fully participated in the rally or who are adhering to diversification rules that limit exposure to the largest, best-performing stocks.

Kostin identifies three key areas offering opportunities for discerning investors: healthcare, which is statistically the cheapest it has been in 30 years relative to the market; select consumer retail companies, particularly those benefiting from stability in the middle-income segment and upcoming tax reforms; and AI beneficiaries that demonstrably drive revenue growth, rather than solely focusing on margin expansion. These recommendations are grounded in a value perspective and a forward-looking view on how specific companies are leveraging technology for tangible business expansion, presenting a counter-narrative to pure momentum-driven trades.

Looking ahead, Kostin maintains a cautious outlook for long-term S&P 500 returns, forecasting an annualized total return of around 6.5% over the next decade, likely on the lower end of that range. This projection is primarily driven by historically high starting valuations and significant market concentration, which he believes will lead to below-average returns despite positive growth. The anticipated multiple contraction, where valuation decreases even as earnings grow, underscores the risk of being compensated less for higher expected volatility in a concentrated market.

Kostin's career reflection highlights a significant shift in capital markets from an "asset-focused" to an "alpha-focused" paradigm. Early in his career, the emphasis was on asset value and company worth; now, the focus is on individual company characteristics and the ability to generate outperformance through specific strategies, such as trading baskets of companies with shared attributes like strong balance sheets or international revenue exposure. This evolution has fundamentally changed the role of a strategist, requiring a deeper understanding of how to implement diverse investment strategies across a wide spectrum of sophisticated clients, including sovereign wealth funds, pension funds, and hedge funds, each with distinct horizons and risk tolerances. The enduring framework of analyzing the economy, earnings, valuation, and money flow remains, but its application is increasingly tailored to these nuanced client needs and the evolving market structure.

Action Items

- Audit AI private market capital: Assess reflexivity risk and vendor financing sustainability for 3-5 key AI startups.

- Analyze public market AI valuation: Compare current P/E multiples of top 10 AI-related companies against 1999 and 2021 historical data.

- Track 5-10 AI revenue growth beneficiaries: Identify and monitor companies demonstrating concrete AI-driven revenue expansion, not just cost reduction.

- Measure mutual fund underperformance: Calculate the percentage of mutual funds beating style benchmarks over the last 6-8 months.

- Evaluate healthcare sector value: Analyze relative P/E multiples for healthcare stocks against the broader market over the past 30 years.

Key Quotes

"The most frequently asked question from investors all over the world has been are we in an AI bubble and that is, I think, important to answer that in two ways. The first is, it's not a single market. There's a market for price and there's a market for capital availability. Those are two markets. They exist both in the public and the private space."

David Kostin explains that the question of an AI bubble requires a nuanced approach, distinguishing between the price of assets and the availability of capital. Kostin highlights that these two factors operate independently in both public and private markets, suggesting that a blanket answer to the "AI bubble" question is insufficient.

"In the public market, Nvidia, which is the company that people most associate with AI, its share price has increased by 12-fold in the last three years, and earnings have increased by 12-fold as well. So pretty much the price and the earnings have matched each other. That would be one exhibit, one example of where the price in the public markets, if you will, AI is not a bubble; it's sort of matched the earnings growth and the price."

David Kostin uses Nvidia as an example to argue against the notion of a public market AI bubble. Kostin points out that the company's share price growth has been commensurate with its earnings growth over the past three years. This alignment, according to Kostin, suggests that the valuation is supported by fundamental performance rather than speculative excess.

"George Soros argued in The Alchemy of Finance that that is not the right way to think about it. That actually, the valuation of the shares today, the price change is an integral part of the valuation of the shares. That is a differentiating view. It's thinking about momentum."

David Kostin introduces George Soros's theory of reflexivity from "The Alchemy of Finance" to explain market dynamics beyond traditional discounted cash flow models. Kostin explains that Soros's view posits that price movements themselves are not just a reflection of future value but actively influence and become part of that valuation. This concept, Kostin notes, is particularly relevant for understanding momentum in markets.

"The experience in 1999 was that at a point in time when the growth cannot be sustained or may not be sustained, you have a recursive or reflexivity coming lower. It's so-called circular financing."

David Kostin draws a parallel between current market conditions and the dot-com bubble of 1999 to illustrate the potential downside of reflexivity. Kostin explains that when growth projections become unsustainable, the self-reinforcing cycle of rising valuations and increased capital can reverse sharply. This "circular financing" can lead to a rapid decline, as experienced in 1999.

"If you look at the mutual funds, around 29% of the mutual funds are beating their style benchmarks. That would be the relative performance of core managers versus the S&P 500 index, growth managers versus the Russell 1000 Growth Index, and value managers versus the Russell 1000 Value Index. So those are the sort of measures that you think about, and that's typically around 37%."

David Kostin presents data on mutual fund performance to illustrate the difficulty many investors have faced in the current market environment. Kostin notes that only 29% of mutual funds are outperforming their respective benchmarks, which is significantly lower than the historical average of around 37%. This underperformance, Kostin suggests, indicates a challenging market for active managers.

"The framework that we use is actually quite similar. I think about in terms of the economy, earnings, valuation, and money flow. And I think about those as almost four legs of a table, and trying to understand where the opportunities may exist."

David Kostin describes the consistent analytical framework he has employed throughout his career as an equity strategist. Kostin outlines four key pillars: the economy, earnings, valuation, and money flow. He likens these to the legs of a table, emphasizing their foundational importance in identifying investment opportunities. This framework, Kostin notes, has remained largely unchanged despite market evolution.

Resources

External Resources

Books

- "The Alchemy of Finance" by George Soros - Referenced for his theory of reflexivity and its application to capital markets, particularly in understanding private market dynamics for AI.

People

- David Kostin - Chief US equity strategist at Goldman Sachs, retiring at the end of 2025, discussed US equity markets, AI trade, and his career.

- George Soros - Author of "The Alchemy of Finance," whose theory of reflexivity was discussed in relation to market valuation and capital markets.

- Warren Buffett - Mentioned for a meeting in 2015 and a previous meeting in 1991, highlighting his extraordinary memory and engagement with research.

- Paul Jones - Tudor Investments, discussed for his engagement with equity market analysis and its implications for rates, currency, and commodities markets.

- Jim Parsons - JP Morgan Capital, discussed for intense dialogues regarding stock analysis and portfolio positions.

- Don O'Neill - Retired after 40 years at Capital Group, discussed for his long-horizon perspective on market developments and challenging thought processes.

- Steve Freeman - Senior partner at Goldman Sachs, whose resignation/retirement occurred on David Kostin's first day.

- Steve Strongin - Hired at the same time as David Kostin to focus on commodities.

- Lee Cooperman - Former equity strategist at Goldman Sachs, focused on stocks.

- Abby Cohen - Immediate predecessor to David Kostin, focused on the economy and its implications for the equity market.

- Ben Snyder - David Kostin's successor as equity strategist at Goldman Sachs.

- Eric Dobkin - Senior partner at Goldman Sachs, credited with inventing equity capital markets on Wall Street.

Organizations & Institutions

- Goldman Sachs - The firm where David Kostin is Chief US Equity Strategist, and the host of the "Exchanges" podcast.

- Tudor Investments - Mentioned in relation to Paul Jones's engagement with market analysis.

- JP Morgan Capital - Mentioned in relation to Jim Parsons's engagement with stock analysis.

- Capital Group - Mentioned in relation to Don O'Neill's long-horizon market discussions.

Websites & Online Resources

- http://www.gs.com/research/hedge.html - Provided for disclosures applicable to research with respect to issuers.

- megaphone.fm/adchoices - Mentioned for learning more about ad choices.

Other Resources

- AI Trade - Discussed as a significant factor in recent market performance and investor focus.

- VIX - Mentioned as a measure of market volatility and investor nervousness.

- Magnificent Seven - Mentioned in the context of strong third-quarter earnings.

- S&P 500 Index - Used as a benchmark for comparing mutual fund and hedge fund performance.

- Russell 1000 Growth Index - Used as a benchmark for growth managers.

- Russell 1000 Value Index - Used as a benchmark for value managers.

- Equity Capital Markets - Discussed as an area invented by Eric Dobkin on Wall Street.

- Alpha - Discussed as a shift in focus from asset value to company characteristics and trading strategies.