All Episodes

US Equity Outperformance Illusion: Earnings Sustainability Over Market Noise

Focus on sustainable earnings, not just market noise, to build resilient portfolios and achieve long-term returns, especially as US growth doesn't guarantee equity outperformance.

View Episode Notes →

US Economic Growth Outpaces Global Peers Driven by AI and Stimulus

The US economy leads global growth, fueled by AI investment and stimulus, positioning risk assets for a strong 2026 despite geopolitical risks. AI will drive productivity and new opportunities.

View Episode Notes →

Strategic Diversification for Risk-Adjusted Returns in Late-Cycle Environment

AI drives demand for energy and data centers, necessitating higher power prices, while emerging markets and Asia offer superior equity returns in 2026.

View Episode Notes →

Global Economic Outlook: US Growth Amidst China's Export Dominance

US growth hits 2.5% in 2026, fueled by fiscal boost and easing conditions, but AI-driven labor shifts pose a key risk.

View Episode Notes →

Global Economy 2026: Sturdy Growth, Stagnant Jobs, Stable Prices

AI-driven productivity growth will boost US GDP but may dampen consumer sentiment by weakening job opportunities.

View Episode Notes →

Venezuela's Oil Potential: US National Security and Shifting Global Flows

Unlock 2 million barrels of Venezuelan oil daily by 2030, potentially lowering global prices by $4 per barrel and reshaping US-China commodity flows.

View Episode Notes →

Trend Following and Dynamic Hedging Enhance Returns Amid Debt Crisis

Systematic trend following and long volatility strategies generate superior risk-adjusted returns by capturing market dislocations, while Bitcoin offers a government-resistant digital collateral alternative in a fracturing world.

View Episode Notes →

Diameter Capital's Total-Return Credit Strategy Amidst AI Disruption

Identify emerging credit market stress by analyzing consumer lending, packaging, and AI infrastructure, forecasting security price impacts over 3-24 months for superior returns.

View Episode Notes →

US-China Tech Race: Application, Installation, and Self-Sufficiency Challenges

China's strategic investment and application of technology, particularly in quantum communications and batteries, challenges US dominance, while US export controls inadvertently spur Chinese AI innovation.

View Episode Notes →

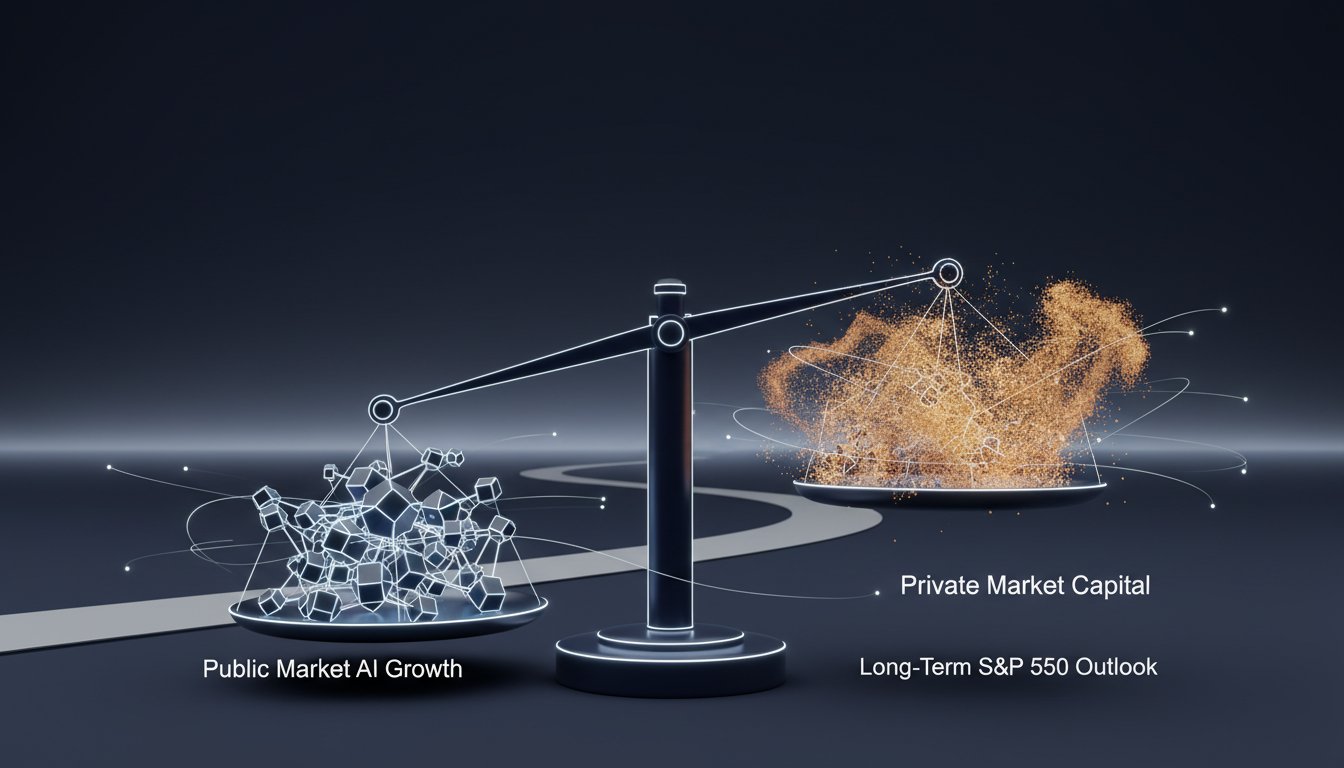

Public AI Markets Stable, Private Markets Show Bubble Risk

Public AI markets are sound, but private AI funding is a bubble. Discover opportunities in healthcare, select consumer segments, and AI revenue growth beneficiaries.

View Episode Notes →

AI and Repositioning Fueling Sustained M&A Surge into 2026

AI's seismic impact and shareholder pressure fuel a surge in mega-deals, driving strategic M&A for flexibility and nimbleness despite economic headwinds.

View Episode Notes →

Navigating Conflicting Signals for Fed Rate Cut Decisions

The Fed faces agonizing rate cut decisions amid conflicting labor and inflation signals, risking policy missteps as tariffs and shutdowns mask potential underlying economic strength or persistent inflation.

View Episode Notes →