Global Economic Outlook: US Growth Amidst China's Export Dominance

Navigating the Shifting Sands: A Systems View of Global Economies in 2026

In this conversation, Goldman Sachs Research economists David Mericle, Andrew Tilton, and Jari Stehn map the complex system dynamics shaping the US, Asia, and Europe in 2026. The core thesis reveals that seemingly straightforward economic policies and trends often trigger cascading, non-obvious consequences that systematically alter growth trajectories and competitive landscapes. Hidden consequences emerge from the interplay of trade policy shifts, fiscal impulses, and technological advancements, creating distinct winners and losers. Business leaders, policymakers, and investors who understand these deeper system dynamics will gain a significant advantage by anticipating these downstream effects and positioning themselves proactively, rather than reacting to immediate, superficial changes.

The Illusion of Simplicity: Why Obvious Economic Answers Fall Short

The year 2026 dawns with a familiar economic narrative: growth, inflation, and policy adjustments. Yet, beneath this surface of predictable metrics lies a far more intricate web of cause and effect. Many assume that addressing a problem with a direct solution, like imposing tariffs to protect domestic industries or implementing tax cuts to stimulate demand, will yield straightforward benefits. However, as the economists in this Goldman Sachs Exchanges conversation illustrate, the reality is far more nuanced. These actions, while addressing immediate concerns, often initiate a chain reaction of downstream consequences that can undermine the intended outcomes or create entirely new challenges.

For instance, the US administration's tariff policies, initially intended to bolster domestic industries, are shown to have had their most significant negative impact on growth in 2025, with their drag diminishing in 2026. This shift, while seemingly minor, reveals a critical system dynamic: the immediate pain or benefit of a policy often dissipates or transforms over time, replaced by subtler, compounding effects. Similarly, fiscal boosts, while providing a front-loaded stimulus, carry the inherent consequence of future spending cuts, creating a payback period that can dampen growth in subsequent years. This conversation, therefore, is not merely about forecasting economic figures; it is about dissecting the interconnected systems that drive these economies, revealing how seemingly small policy choices can ripple through the global landscape, creating unexpected advantages for those who can foresee their full trajectory.

The Cascade of Consequences: Mapping the 2026 Economic Landscape

The Fading Echo of Tariffs: US Economic Resilience and the Shifting Policy Landscape

In the United States, the economic narrative for 2026 is one of surprising resilience, largely driven by a shift away from the immediate drag of trade policy. David Mericle, Chief US Economist at Goldman Sachs, explains that many of the tariffs discussed in previous years have either not materialized or are being replaced with less impactful measures. This isn't a simple removal of a burden; it's a systemic shift. The administration, sensing political traction from the "affordability theme" and facing potential Supreme Court challenges, appears to be recalibrating its tariff strategy. The implication is that the most significant negative effects of tariffs on growth were largely felt in 2025. By 2026, the focus shifts. While some tariffs might be replaced, the overall effective tariff rate is projected to fall slightly. This reduction in policy volatility, Mericle notes, means that the uncertainty and tax-like impacts, which tend to manifest quickly after implementation, will no longer be a drag on growth.

This policy recalibration sets the stage for a more favorable growth environment. The US economy is projected to achieve solid, roughly 2.5% GDP growth on a Q4 to Q4 basis. This stronger-than-consensus outlook is further bolstered by a front-loaded fiscal boost from legislation passed in the prior year. This stimulus, a combination of personal and business tax cuts, is expected to contribute more than half a percentage point to GDP growth in the first half of 2026. However, the system's interconnectedness becomes apparent here: this immediate boost is offset by anticipated spending cuts later in the year and into the next, creating a net neutral fiscal impulse by year-end and a slightly negative one the following year. This illustrates how immediate gains are often balanced by future adjustments, a critical distinction between a problem being "solved" and the system merely experiencing a temporary reprieve.

Financial conditions also play a crucial role in this unfolding system. While the neutral assumption is that anticipated interest rate cuts by the Federal Reserve will be largely priced into the bond market, the significant easing in financial conditions already observed, particularly driven by a strong stock market rally, will continue to provide a gradual growth boost, especially in the first half of the year. The Fed's dilemma, as Mericle highlights, lies in balancing a stronger-than-expected growth outlook with falling inflation and a slowing job market. The divergence in opinions among Fed officials regarding the appropriate federal funds rate underscores the complexity of navigating these crosscurrents. The forecast suggests a compromise around 3% to 3.25%, implying two more 25-basis-point cuts. The key risk, however, lies in the labor market. If ongoing softening, fueled by corporate focus on AI-driven cost reduction and layoffs, persists, it could necessitate earlier and larger rate cuts, fundamentally altering the monetary policy trajectory. This exemplifies how a focus on immediate efficiency gains (AI adoption) can have profound downstream consequences on employment and broader economic policy.

China's Export Juggernaut: A Double-Edged Sword for Asia and Beyond

In Asia, China presents a complex picture, with robust growth forecasts (4.8%) tempered by significant headwinds. Andrew Tilton, Chief Asia Pacific Economist at Goldman Sachs, identifies the property downturn as a major drag, estimated to have cost nearly two percentage points off Chinese GDP growth in 2025 and an estimated 1.5 points in 2026. This isn't just about construction; it impacts local government finances and spending. The decline in home prices, which constitute about two-thirds of Chinese household wealth, has severely affected household balance sheets, despite a stronger equity market acting as a partial offset. This wealth effect, combined with a soft labor market characterized by weak hiring, high youth unemployment, and decelerating wage growth, contributes to muted consumer spending growth.

The system's response to this property-induced slowdown is a greater reliance on savings. With a high official saving rate exceeding 30% and substantial household deposits, the challenge lies in convincing households to reduce their precautionary savings, which are driven by a limited social safety net. This creates a scenario where significant liquidity exists but is held back by a lack of confidence in future security, a direct consequence of structural economic weaknesses.

The most significant tailwind for China, and a source of considerable competitive pressure globally, is its extraordinarily competitive manufacturing sector. Chinese companies exhibit substantial cost advantages in mid- to high-tech sectors, leading to export volume growth that outpaces global trade. Tilton expects this trend of market share gains to continue, with Chinese exports growing 5% to 6% annually in volume terms. This success, particularly in sectors like batteries, electric vehicles, and electronics, is a critical system dynamic. It forces other export-oriented Asian economies into a difficult competitive position. Without a comparable cost advantage, they must find niches, like Taiwan's high-end semiconductors or India's service exports, to survive. Otherwise, they risk being outcompeted and must increasingly rely on boosting their own domestic demand, a more challenging path to sustained growth.

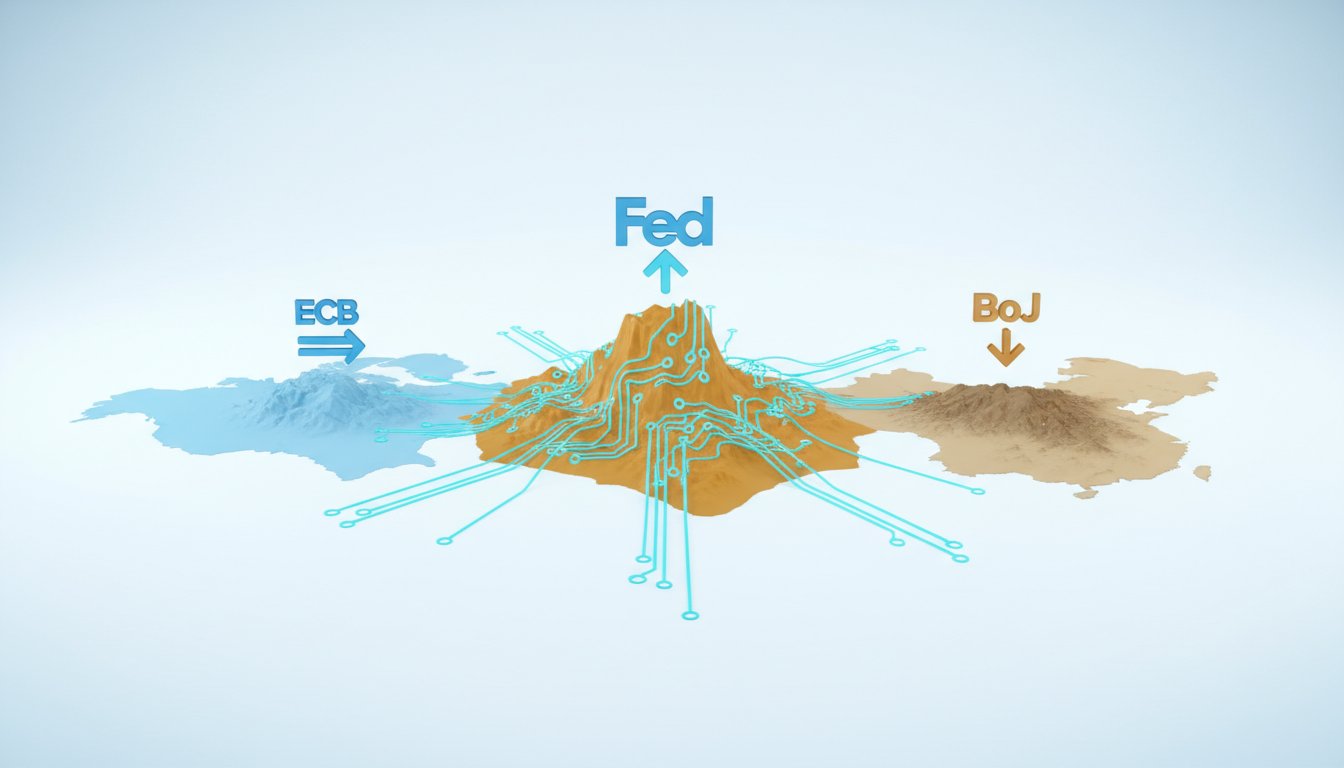

This dynamic extends to Japan, which, unlike many regional economies, is tightening monetary policy. The Bank of Japan's rate hikes to 0.75% and rising government bond yields create a stark contrast with easing policies elsewhere. While Japan's growth is expected to be steady at just under 1%, driven partly by looser fiscal policy, its higher interest rates and stronger yen (relative to other regional currencies) present a different set of challenges and opportunities within the broader Asian economic system.

Europe's Structural Drag: Navigating Competition and Cyclical Shifts

Jari Stehn, Chief European Economist at Goldman Sachs, highlights Europe's ongoing struggle with structural weaknesses: high energy and wage costs, a high regulatory burden, and an aging population. The lack of significant structural reforms, with only a fraction of initiatives like the Draghi report being implemented, leaves Europe vulnerable. This vulnerability is acutely exposed by the rising export competition from China. Europe has already lost market share, a trend expected to accelerate as China pursues an export-led growth strategy. This is a clear example of how a system's internal weaknesses make it susceptible to external competitive pressures, creating a compounding negative effect.

Despite these structural headwinds, Stehn forecasts a cyclical improvement in European growth for 2026, projecting 1.3% for the Euro area, slightly above consensus. Three key drivers underpin this optimism. First, more expansionary fiscal policy in Germany, with public spending expected to rise by 2% of GDP over two years, is a significant stimulus. Second, fading trade tensions mean Europe has largely absorbed the tariff impacts from the previous year, and constructive global growth forecasts reduce the headwind from trade policy uncertainty. Third, the backdrop for consumption is constructive, with falling inflation, high saving rates, and resilient labor markets, particularly in Southern Europe, expected to support consumer spending.

However, this cyclical improvement masks the persistent structural drag. While Germany is expected to move from stagnation to above-trend growth, and Southern European economies like Spain, Portugal, and Greece are showing continued strength due to structural shifts like immigration and public investment, the overall picture is one of navigating increased competition. The European Central Bank (ECB) is expected to remain on hold at 2%, with limited room for maneuver unless inflation proves sticky or growth deteriorates significantly. The Bank of England (BOE), however, faces a different system dynamic. With a rising unemployment rate, higher redundancy rates, and a belief that policy remains restrictive, the BOE is forecast to implement three more rate cuts, bringing the bank rate down to 3%. This divergence in monetary policy between the ECB and BOE reflects differing economic realities and structural challenges within their respective economies, influencing gilt yields and currency valuations.

The Unseen Advantage: Embracing Difficulty for Long-Term Gains

Across all regions, a recurring theme is the competitive advantage derived from embracing difficulty and delayed payoff. Mericle points out that the US labor market's potential softening, driven by AI adoption, presents a risk but also an opportunity for those who can anticipate and adapt. Similarly, Tilton's analysis of China's manufacturing prowess highlights that other nations must undertake the difficult task of finding unique niches or bolstering domestic demand, rather than attempting to compete on cost alone. Stehn's observation that Europe has implemented only a fraction of its reform agenda underscores the systemic aversion to immediate discomfort for long-term gain.

The most durable insights in this conversation stem from recognizing that immediate solutions often create downstream complexities. The US fiscal boost is temporary, the impact of tariffs shifts over time, and China's export success creates competitive challenges that require strategic adaptation, not just reactive policy. The UK's expected rate cuts are a response to structural labor market shifts, not just cyclical fluctuations. These are not simple cause-and-effect relationships but intricate systems where actions have delayed, compounding, and often counterintuitive consequences. The true advantage in 2026 will belong to those who can map these consequence chains, understand the time horizons involved, and act with the patience required for solutions that create lasting moats, rather than fleeting fixes.

Key Action Items

- US Businesses: Anticipate a continued, albeit moderating, boost from eased trade tensions and past financial easing in the first half of 2026. However, prepare for potential labor market softening driven by AI adoption. Action: Develop strategies to leverage AI for efficiency while mitigating direct labor cost pressures and exploring opportunities arising from increased hiring demand in specific sectors that benefit from stronger final demand. Time Horizon: Immediate to 12 months.

- Asian Exporters (Ex-China): Recognize that direct cost competition with China is unsustainable. Action: Identify and invest in niche markets or high-value segments (e.g., advanced manufacturing, specialized services) where differentiation, rather than cost, is the primary competitive factor. Time Horizon: 6-18 months for strategic planning; ongoing for implementation.

- European Policymakers: Acknowledge that structural weaknesses (regulation, demographics, energy costs) are exacerbated by global competition. Action: Accelerate the implementation of structural reforms, focusing on improving scale, competitiveness, and innovation to counter China's export-led growth. Time Horizon: Immediate focus on reform implementation; payoff over 2-5 years.

- Investors: Understand that fiscal stimulus in economies like Germany provides a cyclical boost but is often followed by fiscal consolidation. Action: Differentiate between short-term cyclical plays and long-term structural trends. Favor investments in sectors or regions demonstrating durable competitive advantages or those benefiting from necessary but difficult structural adjustments. Time Horizon: Ongoing portfolio review and rebalancing.

- UK Businesses: Prepare for a more accommodative monetary policy environment as the Bank of England anticipates further rate cuts. Action: Evaluate opportunities for investment and expansion that may become more attractive with lower borrowing costs, while monitoring labor market data for signs of sustained weakness. Time Horizon: 3-12 months for financing and investment decisions.

- All Stakeholders: Recognize that immediate economic solutions often have delayed or compounding consequences. Action: Prioritize understanding the full causal chain of policy decisions and business strategies, focusing on long-term sustainability and competitive advantage over short-term gains. Time Horizon: Continuous strategic assessment.

- Technology Adopters: Understand that investments in AI for cost reduction, as seen in US corporate commentary, will continue to reshape labor markets. Action: Develop a proactive strategy for workforce adaptation and reskilling, focusing on roles that complement AI capabilities rather than being directly replaced by them. Time Horizon: Immediate planning and phased implementation over 1-3 years.