AI, Robotics, and AR: Tangible Applications Amidst Geopolitical Competition

TL;DR

- China's potential approval of Nvidia H200 chips for commercial use signifies a strategic move to access advanced AI capabilities, impacting global semiconductor market dynamics and US export control effectiveness.

- AI companies like Anthropic and OpenAI are raising substantial funds, indicating a significant investment race and potential consolidation as the market may only support a few dominant players.

- Humanoid robots are transitioning from science experiments to viable products, leveraging existing home and workplace infrastructure, suggesting a near-term integration into daily life and industry.

- The AR glasses market is heating up with XREAL's lower-priced offerings, positioning them as a potential phone replacement and a key platform for AI assistants, fostering an ecosystem play with Google.

- US policy aims to secure AI supply chains and lead innovation through initiatives like Pack Silica, balancing technology diffusion with protecting sensitive capabilities to counter concentrated global manufacturing.

- Nvidia is strategically positioning itself as the "Fed for AI," king-making the physical AI sector by providing essential chips, models, and data to foster competition and maintain its compute dominance.

- The drone industry highlights a US weakness due to China's state-backed industrial policy, necessitating a focus on domestic production and international partnerships to counter market flooding.

Deep Dive

The current landscape of AI and robotics, as showcased at CES, reveals a rapid evolution from theoretical concepts to tangible, albeit nascent, real-world applications, driven by significant investment and strategic geopolitical maneuvering. While the promise of widespread AI integration is palpable, particularly in robotics and augmented reality, significant challenges remain in scaling these technologies and navigating complex market dynamics and international competition.

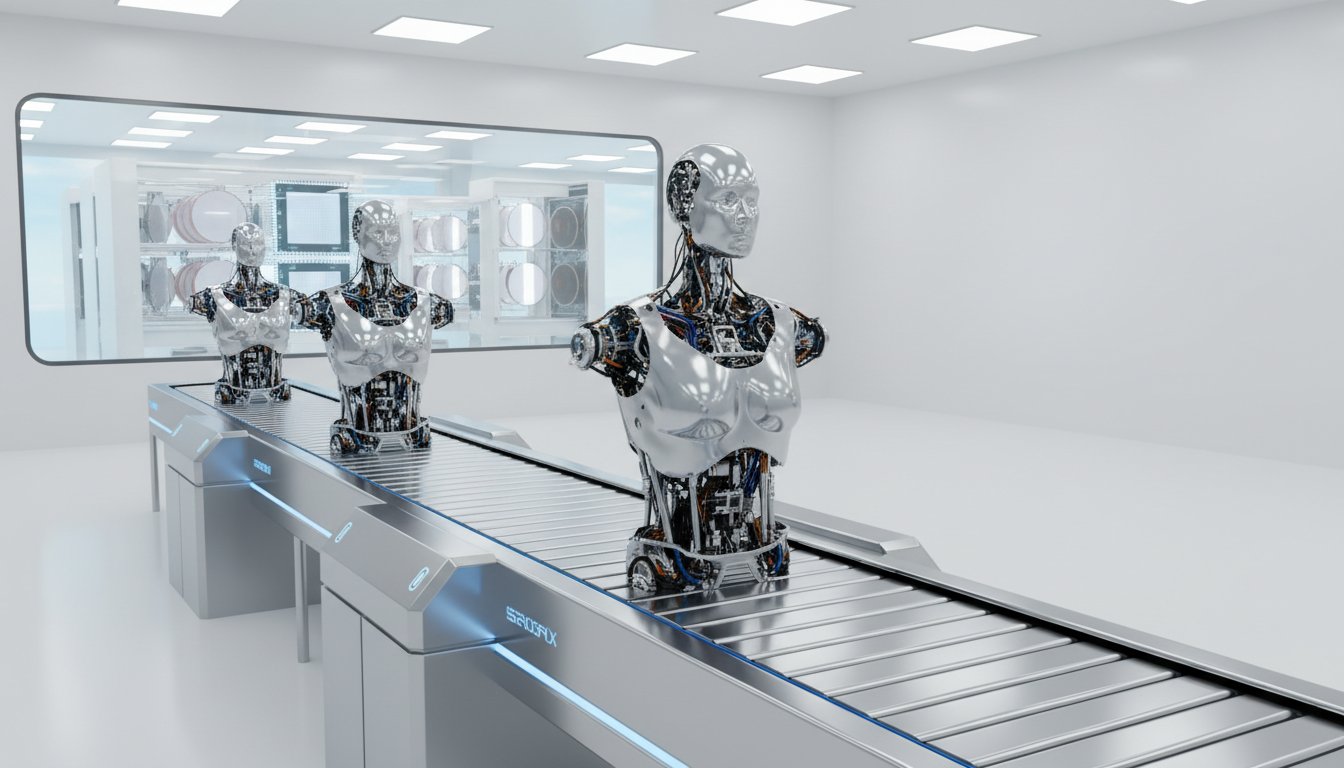

The burgeoning field of humanoid robotics, exemplified by Boston Dynamics' Atlas and the numerous other models on display, signifies a shift from "science experiments" to potentially practical products for homes and workplaces. This progress is enabled by advancements in software, with companies like OpenMind providing operating systems that allow for greater integration and developer customization, akin to a smartphone ecosystem. However, the true frontier lies not just in physical capabilities like object manipulation, which is largely solved for industrial settings, but in "social robotics" -- the complex ability to interact with humans in nuanced ways, a capability still in its early stages. The compatibility of humanoid form factors with existing human infrastructure (doors, stairs, light switches) presents a compelling argument for their widespread adoption, particularly in sectors like elder care, where human interaction is scarce and technological companionship offers a vital, albeit sometimes ethically complex, solution.

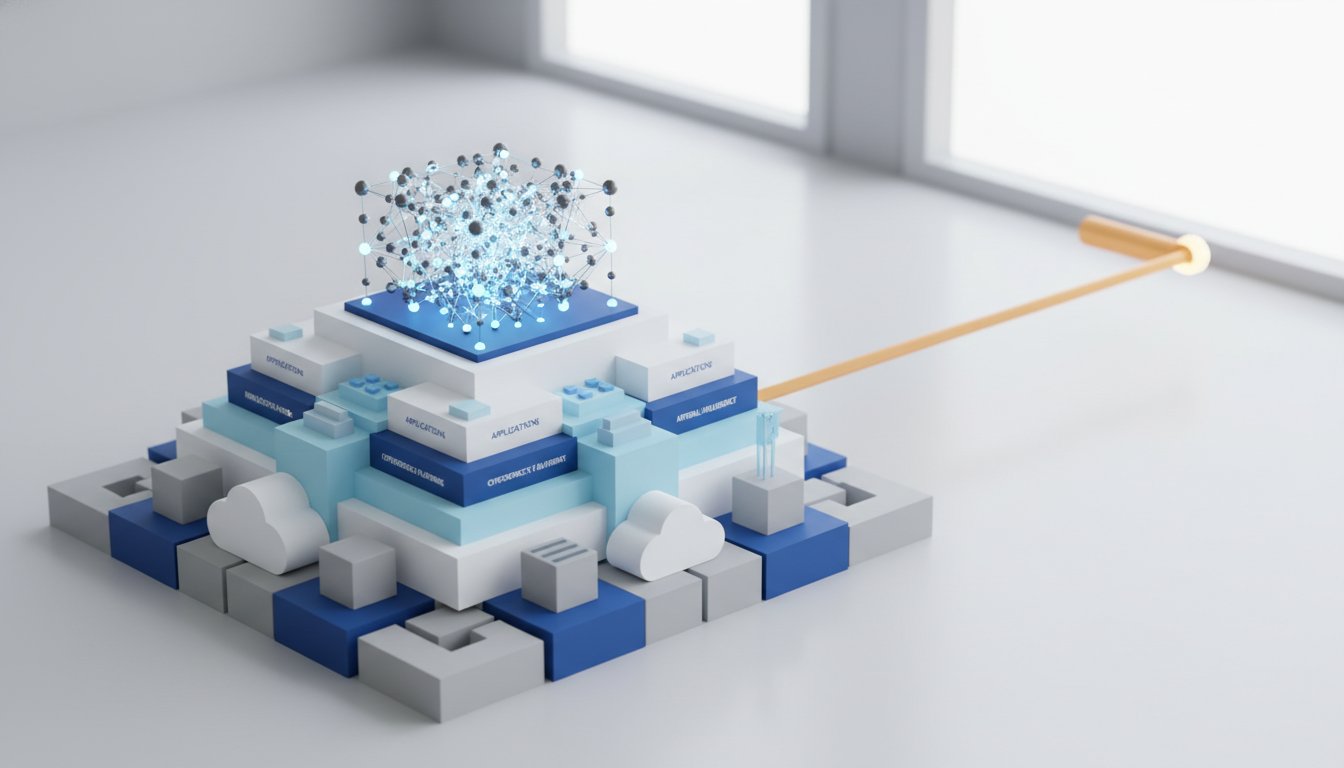

Concurrently, the augmented reality (AR) space is witnessing intense competition and a push towards more accessible hardware. XREAL's introduction of more affordable AR glasses, coupled with strategic partnerships with tech giants like Google, signals a move to establish AR as a potential successor to the smartphone. The vision is an AI assistant integrated into a user's field of vision, offering constant, context-aware support. This mirrors Nvidia's strategy in the chip market, where they are "king-making" the entire physical AI sector by providing the foundational compute power, open-source models, and data necessary for numerous companies to develop their own autonomous systems and robotic applications. Nvidia's approach fosters a competitive landscape, ensuring demand for their GPUs while positioning them as the central enabler of this technological wave.

Geopolitically, the advancement of AI and semiconductor technology is inextricably linked to US-China competition. China's potential approval of Nvidia's H200 chips for commercial use, while seemingly a market opportunity, underscores the strategic balancing act the US faces. The "Pack Silica" initiative, a coalition of technologically advanced nations, aims to diversify semiconductor supply chains and secure market share for AI technologies, emphasizing that reliance on any single country for critical components is a significant global liability. This strategic imperative extends to drone technology, where China's state-backed industrial policy has created a dominant global market, prompting US efforts to foster domestic production and competitive alternatives. The underlying tension is clear: securing technological leadership and supply chain resilience is paramount for national security and economic prosperity in the 21st century.

The takeaway is that while the technological building blocks for a more integrated AI and robotics future are rapidly solidifying, the path forward involves overcoming significant hurdles in scaling, ethical deployment, and navigating a complex geopolitical landscape. The current momentum suggests a significant consolidation and maturation of the industry in the coming years, with a select few players likely to dominate across various AI-driven sectors.

Action Items

- Audit AI agent capabilities: Identify 3-5 core functions and assess their current performance against stated goals (ref: AI agents, Sierra.ai).

- Track humanoid robot development: Monitor 3-5 key players (e.g., Boston Dynamics, Tesla Optimus) for progress in practical applications and software integration (ref: Jan Lippert, CES).

- Evaluate AR glasses market: Analyze 2-3 leading AR glasses manufacturers for hardware-software integration and AI assistant potential (ref: XREAL, Google).

- Measure drone industry competition: Assess the impact of US bans on Chinese drone imports on domestic market growth over 1-3 years (ref: Palmer Luckey, DJI).

- Analyze semiconductor supply chain diversification: Track 3-5 countries involved in the Pack Silica initiative for progress in securing supply chains (ref: Jacob Helberg, Pack Silica).

Key Quotes

"Well, just a few years ago, the robots here were kind of janky, and they were wobbly, and they had wires coming out of their head, and they looked like science experiments. It's really fascinating to see just how quickly humanoids are turning into a real product, and Atlas is, of course, just one of those. So instead of them being science experiments, they look like real things that you might want to have in your home or in your workplace."

Jan Lippert, founder and CEO of Open Mind, highlights the rapid advancement in humanoid robotics. Lippert contrasts the current state of robots, which appear as functional products, with their earlier iterations that resembled unfinished science projects. This observation underscores the significant progress made in making robots more practical and appealing for everyday use.

"So instead of them being science experiments, they look like real things that you might want to have in your home or in your workplace. You're also a professor at Stanford, and you know the academic discussion here, which I've loved, it's been, 'Hey guys, we think we've solved the software problem.' Have we solved the software problem?"

Jan Lippert, also a professor at Stanford, points out that while the physical appearance of robots has improved, the question of whether the underlying software challenges are fully resolved remains. Lippert suggests that the definition of "solved" depends on the specific application, indicating that while basic tasks may be handled, more complex interactions are still under development.

"So what you saw here was a great launch between Nuro, Lucid, and Uber to not only fit retrofit a Lucid car with autonomy, full level four, not eight S, right, not level two plus plus assistance, but full self-driving capability like Waymo and Tesla FSD, and launched that with Lucid on the Uber network. So you'll be able to open up your Uber app at the end of this year in the Bay Area and be able to take a self-driving car."

Steve Jang, Managing Partner at Kindred Ventures, explains a significant partnership in the autonomous vehicle space. Jang details how Nuro, Lucid, and Uber are collaborating to integrate full Level 4 self-driving capabilities into vehicles available on the Uber network, signaling a move towards widespread public access to autonomous ride-sharing. This initiative aims to provide a practical application of advanced self-driving technology.

"So what Nvidia is doing, and it's very smart of Nvidia, they're selling chips, right? And so what they want to do is sell you a starter kit. They want to give you an open source model. They want to give you open data sets, and they say, 'Go to town. We want you to build a self-driving car platform to fit these cars, to fit your ride-sharing or delivery network, your logistics network.' And what they're saying is, 'We want to have many competitors out there so we can sell you more GPUs.'"

Steve Jang of Kindred Ventures describes Nvidia's strategic approach to the AI and autonomous vehicle market. Jang explains that Nvidia is leveraging its chip sales to foster an ecosystem by providing foundational tools like open-source models and data sets. This strategy aims to encourage widespread development and adoption of AI platforms, thereby increasing demand for Nvidia's graphics processing units (GPUs).

"Well, that's a great question. We do have this kind of global supply chain strategy as well. It can be China, it can be other parts of it, it can be even in the US someday."

Xu Zhu, CEO of XREAL, addresses concerns about the company's supply chain origins. Zhu indicates that XREAL employs a global strategy for its supply chain, which includes manufacturing in China but also encompasses other regions and potentially the United States in the future. This approach suggests a flexible and diversified manufacturing plan to mitigate risks and optimize operations.

"So part of the goal of winning the supply chain means we need to expand market share, and sometimes there's a bit of a tension between innovation and diffusion because when you diffuse technology, sometimes you're compromising a little bit on innovation because more people have access to that technology, which narrows your technological edge."

Jacob Helberg, US Department of State Under Secretary for Economic Affairs, discusses the strategic balance between technological advancement and market expansion. Helberg explains that while diffusing technology can broaden market share, it may also reduce a nation's unique technological advantage. This highlights the complex considerations involved in international technology policy and trade.

Resources

External Resources

Books

- "The Big Short" by Michael Lewis - Mentioned as an example of an author who has been a guest on the Masters in Business podcast.

- "Moneyball" by Michael Lewis - Mentioned as an example of an author who has been a guest on the Masters in Business podcast.

Articles & Papers

- Bloomberg story - Mentioned in relation to outlining the compensation of CEOs and the proposed salary cap.

People

- Tom Keen - Host of Bloomberg Surveillance podcast and Bloomberg Tech.

- Paul Sweeney - Co-host of Bloomberg Surveillance podcast.

- Lisa Mateo - Co-host of Bloomberg Surveillance podcast.

- Caroline Hyde - Co-host of Bloomberg Tech.

- Ed Ludlow - Co-host of Bloomberg Tech.

- Mike Shepperd - Bloomberg Senior Tech Editor.

- Jenssen Huang - Mentioned in relation to his interview and optimism about chip approvals.

- Donald Trump - Mentioned in relation to verbal blessing for chip approvals and calling for capping executive pay.

- Jan Lippart - Founder and CEO of OpenMind.

- Robert Playter - CEO of Boston Dynamics.

- Xu Zhu - CEO of Xreal.

- Amy Morris - Anchor for Bloomberg News Now.

- Karen Moscow - Anchor for Bloomberg News Now.

- Will.i.am - Grammy-winning artist and founder/CEO of FYI AI.

- Palmer Luckey - Founder of Anduril.

- Jacob Helberg - U.S. State Department Under Secretary for Economic Affairs and founder of the Hill and Valley Forum.

- Xi - Mentioned in relation to reiterating a goal of reunification with Taiwan.

- Steve Jiang - Managing Partner and Founder of Kindred Ventures.

- Dara - Mentioned in relation to Uber's self-driving car strategy.

- Travis Kalanick - Mentioned in relation to Uber's original plans for self-driving car technology.

- Lisa Su - Mentioned in relation to her presentation on compute scale.

- Barry Ritholtz - Host of the Masters in Business podcast.

- Peter Lynch - Mentioned as a fund manager guest on Masters in Business.

- Bill Miller - Mentioned as a fund manager guest on Masters in Business.

- Ray Dalio - Mentioned as a fund manager guest on Masters in Business.

- Dick Thaler - Mentioned as a behaviorist guest on Masters in Business.

- Bob Shiller - Mentioned as a behaviorist guest on Masters in Business.

- Michael Lewis - Mentioned as an author guest on Masters in Business.

Organizations & Institutions

- Sierra AI - Mentioned as a platform for AI-powered customer experience.

- Bloomberg Surveillance Podcast - Podcast mentioned for daily business news and analysis.

- Bloomberg Tech - Program covering technology news, live from CES.

- Nvidia - Mentioned in relation to chip approvals, competition, and AI compute.

- Anthropic - Mentioned in relation to raising new funding and valuation.

- OpenAI - Mentioned in relation to fundraising and comparison with Anthropic.

- Xai - Mentioned as one of the four players in AI.

- Google - Mentioned in relation to market cap, AI, and partnership with Xreal.

- Alphabet - Parent company of Google.

- Apple - Mentioned in relation to market cap and comparison with Google.

- OpenMind - Startup building an operating system for intelligent machines.

- Boston Dynamics - Company known for humanoid robots like Atlas.

- Hyundai - Partnering with Boston Dynamics for manufacturing plants.

- Xreal - Company unveiling new AR glasses.

- Meta - Mentioned in relation to AR/VR efforts and competition.

- Android XR - Google's platform for extended reality.

- HTC - Mentioned as an early partner with Google for smartphones.

- LG - Mentioned as a partner with Google for smartphones.

- Samsung - Mentioned in relation to quarterly profit and memory chips.

- Andromeda - Company building robots for memory care facilities.

- Anduril - Company mentioned in relation to defense and competition with China.

- DJI - Drone company mentioned in relation to a US ban.

- Japan - Mentioned as a nation that can build its own drones.

- Hill and Valley Forum - Forum co-hosted by Jacob Helberg.

- Packsilica - Initiative involving seven technologically advanced countries.

- Mitsubishi - Mentioned as a technologically advanced country.

- Alibaba - Mentioned as a company interested in buying Nvidia H200 chips.

- BYD - Mentioned as a company interested in buying Nvidia H200 chips.

- UAE - Mentioned as a country for strategic bilateral deals.

- Saudi Arabia - Mentioned as a country for strategic bilateral deals.

- Singapore - Mentioned as a member of the economic security coalition.

- Israel - Mentioned as a member of the economic security coalition.

- Kindred Ventures - Early-stage venture firm.

- Uber - Mentioned in relation to self-driving car technology and partnership with Nuro.

- Nuro - Company partnering with Uber and Lucid for self-driving cars.

- Waymo - Mentioned in relation to self-driving car technology.

- Tesla - Mentioned in relation to its Optimus program and FSD capability.

- Lucid - Partnering with Nuro and Uber for self-driving cars.

- AGX Thor - Nvidia's platform for autonomous vehicles.

- Qualcomm - Mentioned as a chipmaker impressing markets.

- Xreal CEO GZ - Mentioned in relation to Xreal's AR glasses.

- Minimax - Company to be featured in an interview about Hong Kong listing and China IPO market.

- Bloomberg Business Week Daily Podcast - Podcast offering reporting from the magazine on global business, finance, and tech.

- Bloomberg News Now - On-demand news report delivered to a podcast feed.

- National Football League (NFL) - Mentioned in relation to sports discussion.

- New England Patriots - Mentioned as an example team for performance analysis.

- Pro Football Focus (PFF) - Data source for player grading.

Tools & Software

- Open Source Model - Mentioned as something Nvidia provides to build self-driving car platforms.

- Open Data Sets - Mentioned as something Nvidia provides to build self-driving car platforms.

Websites & Online Resources

- Bloomberg.com - Mentioned for news reporting.

- YouTube - Platform where Bloomberg Surveillance podcast can be found.

- Apple Podcasts - Platform where Bloomberg Surveillance podcast can be found.

- Spotify - Platform where Bloomberg Surveillance podcast can be found.

Other Resources

- AI Agents - Mentioned as impressive and working 24/7 to solve customer problems.

- H200 Chips - Nvidia chips mentioned in relation to China's import plans.

- Non Farm Payrolls Data - Economic data mentioned as a market driver.

- Humanoid Robotics - Discussed as a key focus at CES.

- Augmented Reality (AR) - Discussed in relation to robotics and CES.

- Venture Capital - Discussed in relation to robotics and CES.

- Government - Discussed in relation to robotics and CES.

- Physical AI - Discussed as breaking through to the mainstream at CES.

- Operating System for Intelligent Machines - What OpenMind is building.

- Social Robotics - Robots designed to live with and interact with people.

- Memory Care Facilities - Mentioned as a use case for robots.

- AR Glasses - Xreal's product.

- Wearable Space - Mentioned as seeing more competition.

- AI Assistant - Concept of an AI assistant sitting in one's eye.

- Project Aura - Google's initiative related to AR glasses.

- 2D to 3D Lifetime Conversion - Feature of Xreal's AR glasses using AI conversion.

- Chip Export Curbs - Discussed in relation to US and China.

- Semiconductors - Discussed in relation to national security and US-China relations.

- Taiwan Question - Mentioned in relation to geopolitical strain and reunification goals.

- Drone Technology - Discussed in relation to US competition with China.

- Silicon - Mentioned as the material the 21st century runs on.

- Compute - Mentioned as the material the 21st century runs on.

- AI Race - US policy to win the AI race.

- Supply Chains - Discussed in relation to securing them and diversification.

- LLMs (Large Language Models) - Mentioned in relation to compute capacity.

- Economic Security Coalition - Coalition focused on diversifying supply chains.

- Industrial Capacity - Focus of infrastructure projects.

- Fabs (Factories) - Focus of infrastructure projects.

- Refineries - Focus of infrastructure projects.

- Capital - Focus of infrastructure projects.

- Energy - Focus of infrastructure projects.

- Peace Through Power - Interpretation of Packsilica.

- International Norms - Mentioned in relation to geopolitical events.

- Arctic - Mentioned in relation to geopolitical encroachment.

- Latin America - Mentioned in relation to geopolitical encroachment.

- Category Defining Startups - What Kindred Ventures backs.

- Robotaxis - Discussed in relation to Uber, Nuro, and Lucid.

- Autonomy Full Level Four - Level of self-driving capability.

- Level Two Plus Plus Assistance - Level of driver assistance.

- Tesla FSD - Tesla's Full Self-Driving capability.

- Capital Light Model - Strategy for fleet management.

- GPUs (Graphics Processing Units) - Mentioned in relation to Nvidia's business.

- Physical AI - Mentioned as a sector Nvidia is kingmaking.

- Autonomy - Mentioned as a sector Nvidia is kingmaking.

- Mobility - Mentioned as a sector Nvidia is kingmaking.

- Fed for AI - Analogy for Nvidia's role in the AI sector.

- Foundational Models - Discussed in relation to AI competition.

- Generative Media - Mentioned as a platform that will see competition whittling down.

- Agents - Mentioned as a platform that will see competition whittling down.

- Inference - Mentioned as exceeding training in compute demand.

- Training - Mentioned in relation to compute demand.

- HBM Shortage - Shortage of High Bandwidth Memory.

- Memory Chips - Discussed as a key story and bottleneck.

- PC - Mentioned in relation to memory chips.

- Data Center - Mentioned in relation to memory chips.

- Lollipop that plays music as you eat it -