Private Credit 2.0 Fuels Digital Infrastructure Amidst Evolving Lending Guidelines

The Credit Market Revolution: Beyond the Obvious with AI and Private Capital

This conversation unpacks a profound shift in credit markets, driven by the explosive growth of private capital and the unprecedented demands of the AI-fueled industrial revolution. The non-obvious implication is that the very structures designed to manage risk, like leveraged lending guidelines, inadvertently created the fertile ground for private credit's ascent. This analysis reveals how the lines between traditional public and private finance are blurring, and crucially, how the sheer scale of AI infrastructure build-out will test the limits of capital markets in ways we haven't seen before. Anyone involved in financing, investment, or strategic planning within technology, infrastructure, or finance will gain a critical edge by understanding these evolving dynamics and the potential for future market dislocations. This is not just about current trends; it's about anticipating the structural changes that will define the next decade of capital allocation.

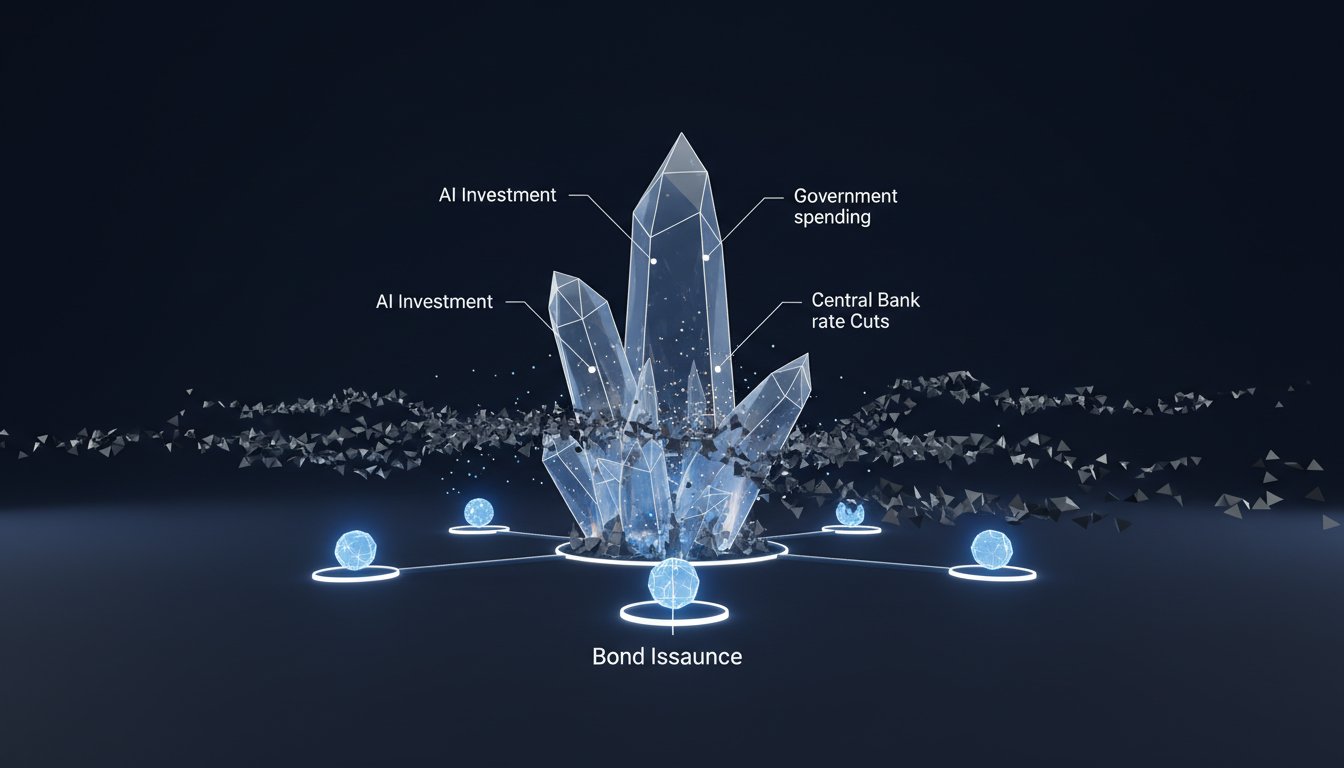

The Unintended Architect: How Regulation Fueled Private Credit's Rise

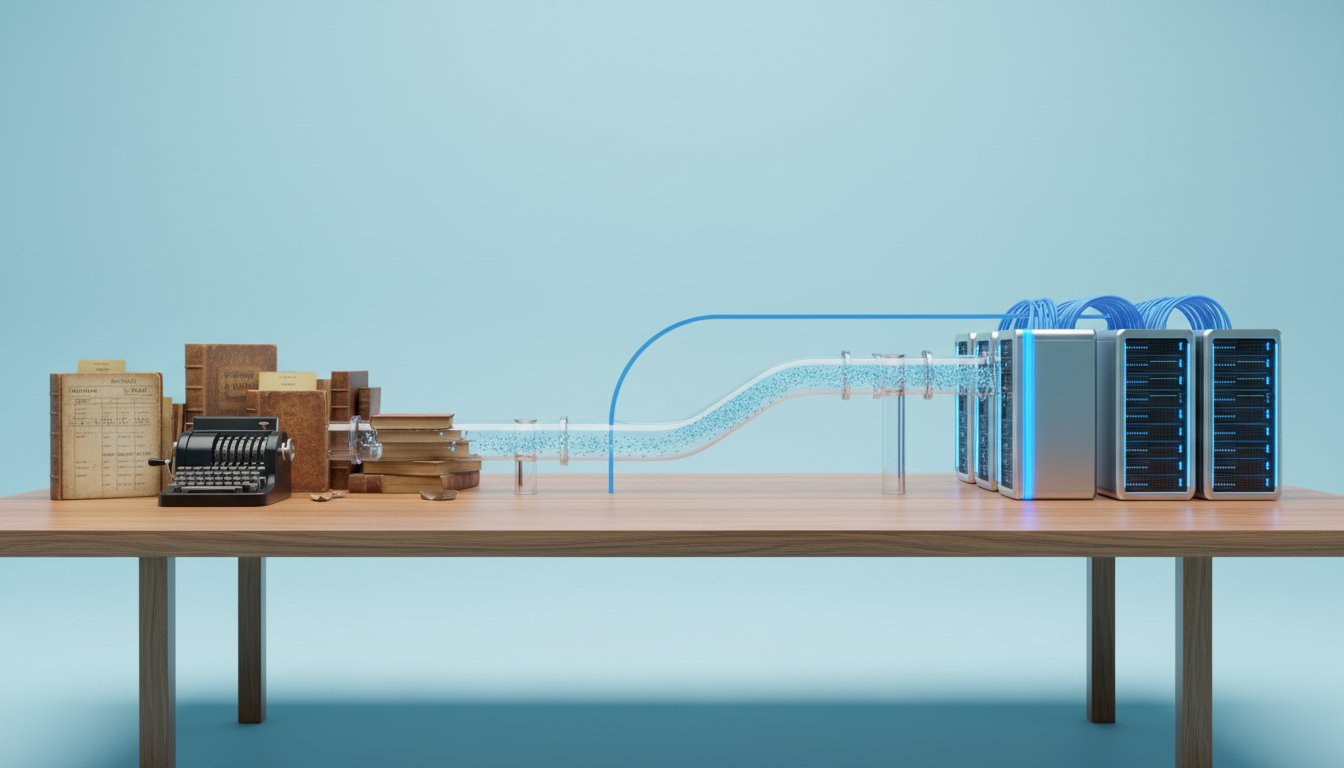

The credit markets are undergoing a seismic transformation, moving beyond traditional distinctions and embracing new forms of capital. Dan Toscano, Chairman of Markets in Private Equity at Morgan Stanley, traces this evolution from the early days of junk bonds to today's complex landscape. What's striking is how regulatory interventions, intended to manage risk, have inadvertently become powerful catalysts for private credit's expansion. The introduction of leveraged lending guidelines after the financial crisis, notably the six-times leverage cap, effectively pushed a significant portion of lending activity out of the traditional banking sector and into the private markets. This wasn't a planned outcome, but a consequence of restricting traditional channels.

"And inadvertently, or maybe by plan, really gave rise to the growth in the private credit market. So, when you think about everything that's going on in the world today, including, which I'm sure we'll talk about, the relaxation of the leveraged lending guidelines, it was really fuel for private credit."

-- Dan Toscano

This regulatory shift created a vacuum that private credit, with its greater flexibility and bespoke structuring capabilities, readily filled. The subsequent relaxation and withdrawal of these guidelines by the FDIC and OCC don't signal an end to private credit but rather a further blurring of lines. Banks, now freed to participate across the entire credit continuum, will increasingly find themselves competing and collaborating with private credit funds. This dynamic suggests a future where the distinctions between public and private credit become less about who is lending and more about the customized solutions offered, driven by specific client needs and market opportunities. The "continuum" Toscano describes means that capital providers will need to be adept at navigating both traditional and alternative lending structures.

Private Credit 2.0: The Trillion-Dollar AI Infrastructure Boom

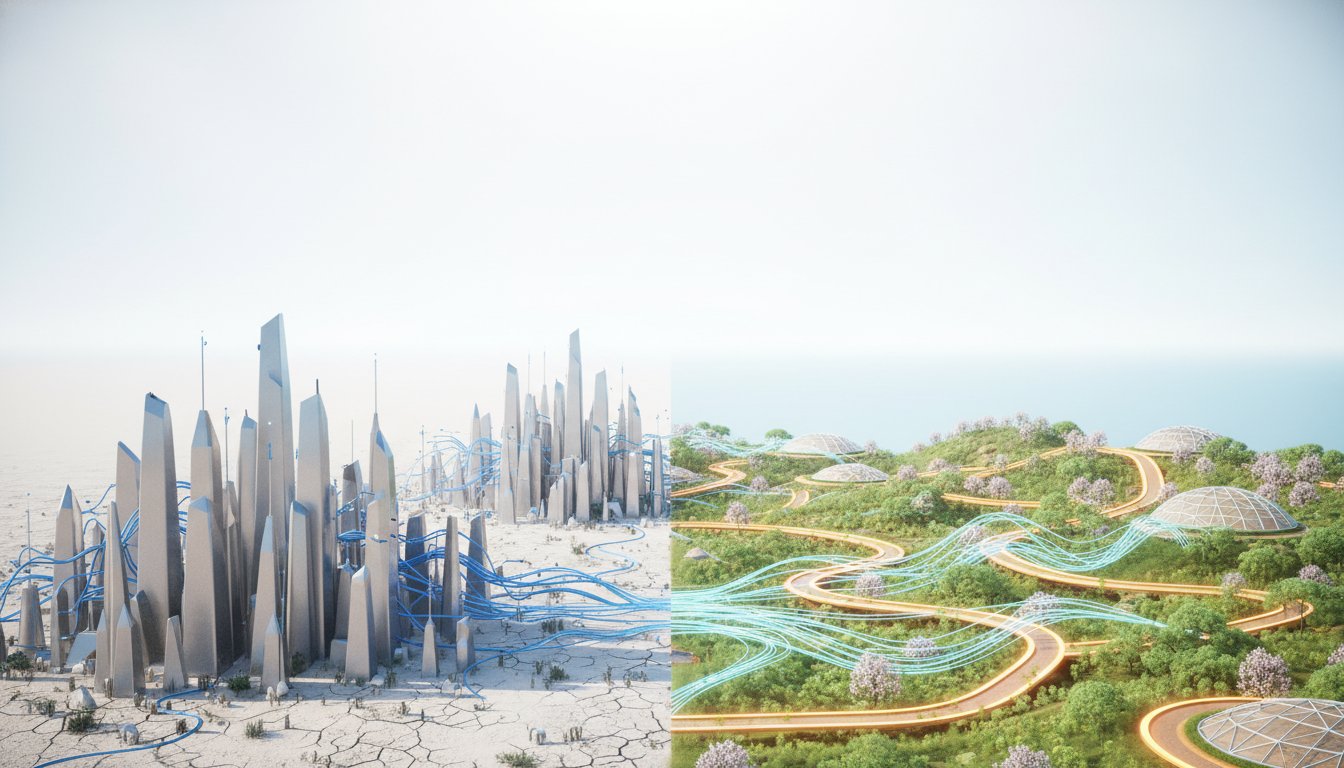

The next frontier for private credit, dubbed "Private Credit 2.0," is being defined by the gargantuan capital requirements of digital infrastructure, particularly in the age of artificial intelligence. Toscano highlights this as the "elephant in the room," pointing to the trillions of dollars needed for the build-out of data centers, power generation, and the associated technologies. This isn't just about financing existing businesses; it's about funding a fundamental industrial revolution. The scale of this demand is unprecedented, dwarfing previous financing cycles.

The challenge lies not just in the sheer volume of capital, but in structuring it appropriately. Private credit's advantage here is its ability to employ elements of structured finance to create risk profiles suitable for these massive, long-term projects. This is where the real competitive advantage lies: those who can effectively structure and deploy capital for these massive infrastructure plays will be at the forefront of this transformation. The conventional wisdom of simply providing loans is insufficient; it requires a deep understanding of the underlying infrastructure needs, supply chain complexities, and evolving technological demands.

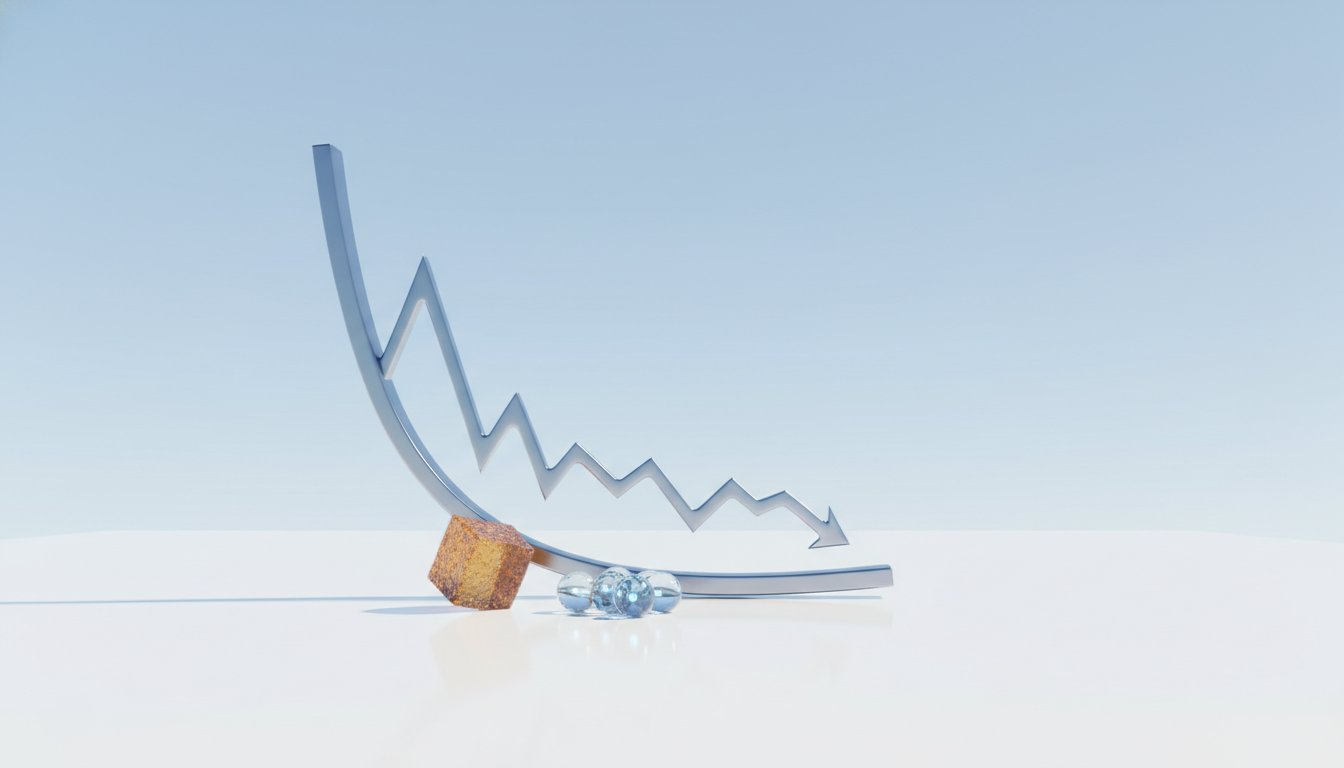

The 2026 Reckoning: When Infancy Gives Way to Reality

While the capital raising for AI infrastructure in 2025 has occurred in a relatively benign environment, Toscano expresses a degree of concern about 2026. As these massive build-outs move from infancy to seasoning, problems are inevitable. The "essence of credit risk," as he puts it, is that issues will emerge. This could manifest as project delays, cost overruns due to supply chain constraints (steel, roofing, labor), or unexpected labor shortages and rising costs. These are the kinds of downstream effects that are often underestimated during the initial planning and capital-raising phases.

The danger lies in a potential market overreaction. Having operated in what Toscano describes as a "perfect environment" in 2025, investors might be ill-prepared for the inevitable hiccups. The laws of supply and demand will become paramount. While demand for AI-driven infrastructure is immense and growing, visibility on the supply side--both in terms of materials, labor, and crucially, the capital needed to execute these plans--is still developing. The question isn't whether there's enough money, but how efficiently it will be allocated and how the market will react when the first significant challenges arise. This foresight is precisely where experienced practitioners can find advantage, by anticipating these friction points and structuring deals that can weather them.

Navigating the Uncharted Waters: Key Action Items

-

Immediate Action (Next Quarter):

- Deepen understanding of AI infrastructure needs: Identify specific areas of digital infrastructure (e.g., power, data centers, specialized hardware) that are critical to the AI revolution and assess their capital requirements.

- Analyze current private credit structures: Evaluate the flexibility and scalability of existing private credit vehicles to handle the magnitude of AI-related financing.

- Map labor and material supply chains: Proactively identify potential bottlenecks in the supply of labor and commodities required for large-scale infrastructure projects.

-

Medium-Term Investment (Next 6-12 Months):

- Develop expertise in structured finance for infrastructure: Invest in building capabilities to structure complex financing solutions that can accommodate the unique risks of digital infrastructure projects.

- Foster relationships across public and private credit markets: Recognize the blurring lines and build bridges with traditional banks and other capital providers to create more comprehensive financing packages.

- Scenario planning for market dislocations: Develop contingency plans for potential overreactions or mispricings in the credit markets as AI infrastructure projects begin to face challenges in 2026.

-

Longer-Term Strategic Play (12-18 Months and Beyond):

- Establish a track record in financing next-generation infrastructure: Focus on originating and successfully executing deals within the AI and digital infrastructure space to build a reputation and attract further capital.

- Monitor regulatory shifts impacting credit markets: Stay attuned to any further changes in banking regulations or credit guidelines that could impact the competitive landscape between public and private credit.

- Cultivate patience for delayed payoffs: Recognize that the most substantial advantages in financing this industrial revolution will likely come from investments that require significant upfront effort and a long-term perspective, where immediate discomfort creates lasting competitive moats.