Private Credit's Scale and Direct Model Drive Market Reshaping

Blackstone's Global CIO Michael Zawadzki Reveals How Private Credit's Scale and Structure Create Durable Advantage, Even as AI Fuels Its Next Growth Wave.

In a landscape often dominated by fleeting trends, Michael Zawadzki, Global Chief Investment Officer for Blackstone Credit and Insurance, offers a compelling counter-narrative on the enduring power of private credit. This conversation with Odd Lots reveals that private credit's meteoric rise isn't a story of unchecked risk-taking, but rather an innovative breakthrough akin to Amazon's disruption of retail. By cutting out intermediaries, it creates a more efficient, transparent, and beneficial ecosystem for both borrowers and investors. The hidden consequence? A fundamental shift in financial stability and a persistent advantage for those who understand its systemic implications. This analysis is crucial for investors, finance professionals, and anyone seeking to grasp the underlying mechanics of capital markets, offering a strategic lens to identify opportunities where scale and structure create long-term competitive moats.

The Farm-to-Table Model: Scale as the Ultimate Differentiator

The explosive growth of private credit, a space Michael Zawadzki has helped build into Blackstone's largest business, is often misunderstood as a simple surge in risk. Zawadzki, however, frames it as a fundamental innovation, comparing it to Amazon's transformation of retail. This "farm-to-table" model directly connects borrowers with investors, eliminating the "leakage" associated with traditional intermediaries like syndication desks and trading floors. The immediate benefits are clear: borrowers gain speed, certainty, and customized solutions, while investors capture higher returns.

"What have you done in that process? You've cut out all the middlemen, all the syndication, all the trading desks, all the stuff that led to leakage along the way. And in the process, you've built something that was better for all market participants."

This efficiency, however, is not merely a matter of cutting costs; it's enabled by scale. Zawadzki points to a staggering statistic: before 2021, there were only five private credit deals exceeding $1 billion. Since then, there have been over 100, with Blackstone leading the charge. This sheer scale of capital allows Blackstone to tackle complex, large-value problems for clients that smaller players simply cannot. Furthermore, the expansion of private credit beyond traditional middle-market direct lending into areas like private investment grade, real assets, and asset-backed finance broadens its addressable market to a staggering $30 trillion. This expansion is not just about finding more deals, but about finding more types of deals where the private credit model offers distinct advantages.

AI's Capital Hunger: A New Frontier for Private Credit

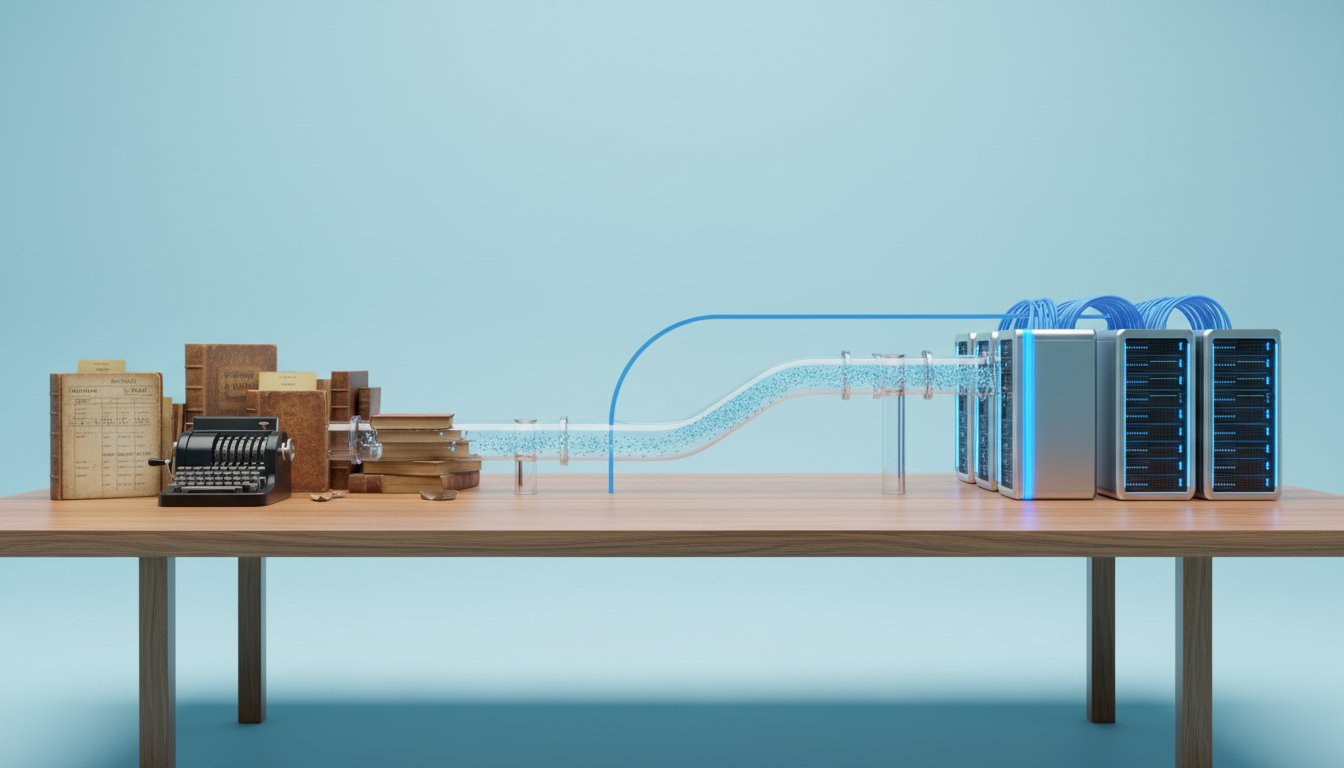

The burgeoning AI revolution presents a significant new catalyst for private credit, particularly in financing digital infrastructure like data centers. Zawadzki highlights Morgan Stanley's estimate that $800 billion in private credit will be needed for this build-out over the next five years alone. What makes this particularly attractive for private credit lenders is the nature of the underlying contracts. Financing 15-20 year "take or pay" contracts with creditworthy hyperscalers, like those in data center leases, provides a predictable stream of cash flows.

"If I can lend against some of the best counterparties in the world against a known defined stream of cash flows and I can do that with 150 to 200 basis points of excess spread versus like rated public credit."

This "excess spread"--the difference in yield between private credit and comparable public investment-grade debt--is a key differentiator. While large tech companies can access public markets, private credit offers customization, speed, and flexibility that public bonds often cannot. This includes funding capital over time during construction phases or structuring cash flow timing in ways that better suit project needs. This ability to provide tailored solutions, even for the most creditworthy entities, underscores the evolving role of private credit beyond distressed or middle-market financing.

The Durable Advantage of Proactive Origination and Systemic Insight

In a competitive market, simply waiting for deals to arrive is insufficient. Zawadzki emphasizes Blackstone's proactive approach, identifying thematic areas--like digital infrastructure, energy, life sciences, and utility services--and pitching customized solutions to companies. This contrasts with passive deal sourcing and represents a significant competitive advantage. By understanding the broader ecosystem, including insights from Blackstone's private equity and infrastructure arms, they can anticipate needs and offer solutions before they become commoditized.

"A lot of people can pick up the phone. Not a lot of people can create their own ideas and actually effectuate them. And I think that's something we're uniquely good at."

This proactive origination, coupled with a unified investment committee and a centralized reporting system, ensures consistency in underwriting standards across Blackstone's diverse credit businesses. This systemic approach allows the firm to identify weaknesses in certain sectors and pivot capital to more attractive opportunities, a crucial capability in navigating market dispersion. The "big get bigger" phenomenon, evident in tech, is equally at play in finance, where scale and sophisticated internal systems create compounding advantages.

Navigating Market Cycles: Defaults, Dispersion, and Durable Models

While concerns about rising defaults and "liability management exercises" (a phenomenon more prevalent in public credit due to weaker documentation) are valid, Zawadzki remains sanguine about the long-term prospects of private credit. He points to a 20-year track record of outperformance and a remarkably low 1% realized loss ratio for the industry. He acknowledges that increased dispersion is likely, meaning some players will underperform, but argues this is a natural evolution of a maturing asset class, creating opportunities for top-tier managers.

Crucially, Zawadzki distinguishes between defaults and losses, highlighting that private credit's more protective documentation allows for negotiation and, if necessary, active management to drive better outcomes for investors. The current environment, with robust corporate earnings and stimulus, doesn't signal an impending recession, further supporting his view of continued growth rather than widespread distress. The enduring model of private credit--offering attractive excess spreads and diversification--remains intact, especially as investment-grade private credit and asset-backed finance expand.

Key Action Items

- Embrace Proactive Deal Origination: Shift from passive deal reception to actively identifying thematic opportunities and pitching customized solutions to potential borrowers. (Immediate Action)

- Develop Systemic Insight: Leverage cross-business intelligence (e.g., from private equity, infrastructure) to understand broader market trends and anticipate future capital needs. (Ongoing Investment)

- Prioritize Durable Structures: Focus on financing models with strong contractual protections and predictable cash flows, such as long-term take-or-pay contracts, to mitigate residual value risk. (Immediate Action)

- Understand the "Excess Spread" Dynamic: Continuously evaluate the yield premium private credit offers over comparable liquid markets as a key indicator of relative value. (Ongoing Analysis)

- Build Internal Connectivity: Implement centralized investment committees and data aggregation systems to ensure consistent underwriting standards and real-time market awareness across all credit strategies. (12-18 Month Investment)

- Focus on Loss Mitigation, Not Just Default Avoidance: Recognize that in sub-investment grade, defaults are normal; the key is robust documentation and the resources to manage challenging situations to minimize investor losses. (Immediate Action)

- Explore Investment Grade Private Credit: Investigate opportunities in private investment grade, asset-backed finance, and corporate solutions, which offer significant growth potential and attractive risk-adjusted returns. (This pays off in 12-18 months)