Data Center Financing Navigates Infrastructure Bottlenecks, Technological Risks, and Public Scrutiny

TL;DR

- Data center financing relies on established securitization structures from cell towers and solar, adapted for the unique asset class by focusing on long-term leases and tenant quality.

- The sheer scale of data center capital requirements, projected at $2.9 trillion globally through 2028, necessitates complex financing structures beyond traditional corporate bonds.

- Power and grid interconnection are the primary bottlenecks for data center development, often involving multi-year approval processes that significantly impact project timelines and financing.

- While AI drives demand, data center financing faces risks from GPU obsolescence, tenancy rollover, and potential macroeconomic downturns, requiring careful underwriting of lease terms and tenant credit quality.

- Public-private partnerships and government loan guarantees are being explored to lower the cost of capital for data center projects, leveraging federal backing to enhance lender confidence.

- The increasing demand for data centers is reallocating critical infrastructure resources like power, potentially crowding out other productive economic uses and influencing project viability.

- Community opposition to data centers regarding water usage and environmental impact is intensifying, prompting developers to adopt more proactive sustainability measures and engage with local stakeholders.

Deep Dive

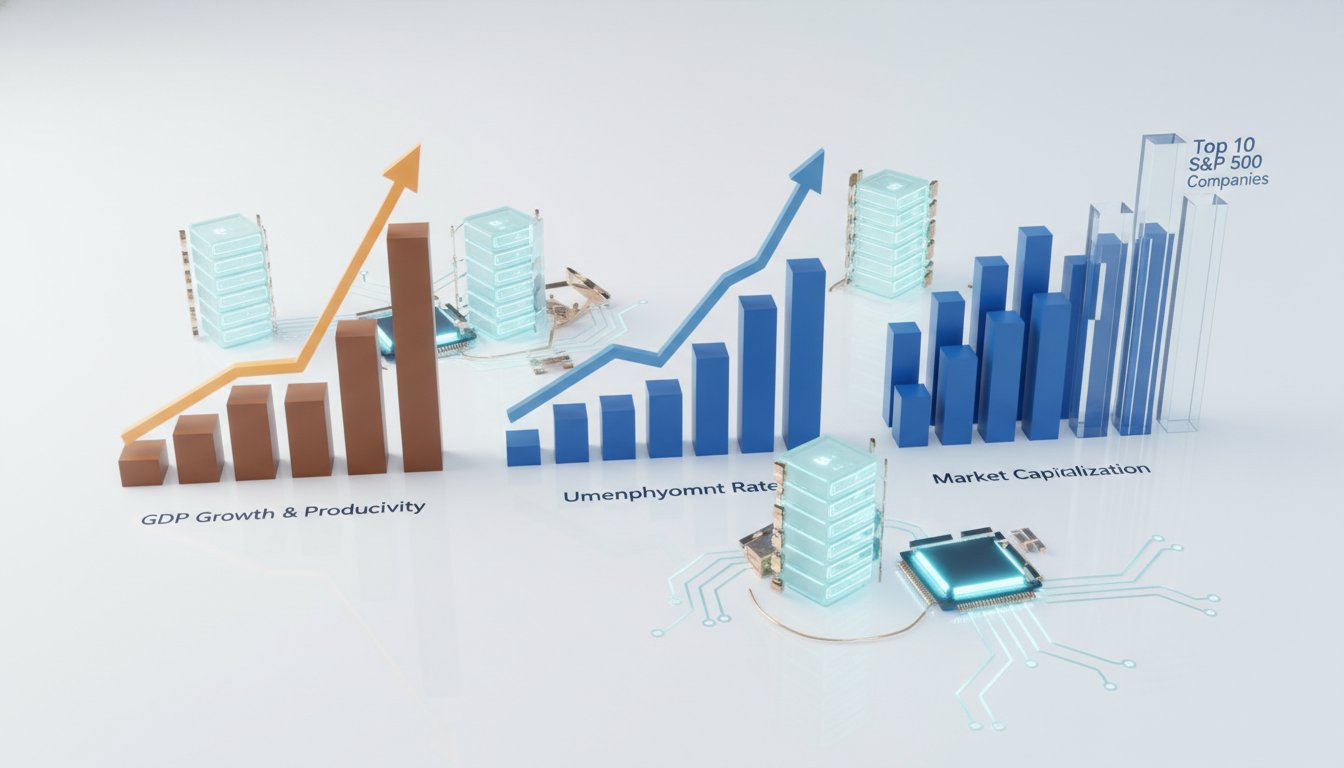

Data centers, a complex fusion of real estate and advanced technology, present significant financing challenges driven by their immense capital requirements and uncertain development timelines. The current market grapples with a substantial gap between projected data center spend of $2.9 trillion through 2028 and the comparatively modest $16 billion in existing generative AI revenue, necessitating innovative financing structures to bridge this disparity. This situation is further complicated by the long lead times for grid interconnection and power generation, creating a critical dependency on reliable infrastructure that can delay projects by years.

The financing landscape for data centers leverages established securitization techniques, adapting structures from cell towers and solar power to accommodate the unique asset class. These include asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS), which securitize cash flows from data center leases and associated services. However, risks are concentrated on tenant quality, lease terms, and the facility's ability to withstand technological obsolescence. To mitigate these risks, lenders employ strategies such as conservative loan-to-value ratios and structuring bonds with longer maturities than underlying leases, anticipating that cash flows will support repayment well before the bond's final maturity.

Beyond securitization, private credit offers attractive, non-dilutive capital with customizable terms, though often at higher return expectations than traditional bank lending or public bond markets. The explosive growth of AI has intensified demand for specialized hardware like GPUs, creating a rapid obsolescence cycle that impacts asset valuation and financing. While private credit and equity may underwrite based on GPU lifecycles, securitization primarily focuses on the data center's physical infrastructure and long-term lease agreements, treating the technology as a component within a larger, stable asset.

The critical bottleneck for data center development is not financing or chips, but power and its distribution. Securing grid interconnection for both power consumption and generation can be a multi-year process, significantly delaying projects. This scarcity, coupled with increasing community opposition due to concerns over water usage and environmental impact, is driving a shift towards "behind-the-meter" solutions, where data centers develop their own power generation, particularly in regions like Texas. However, this approach carries the risk of stranded assets if demand for AI services diminishes or technology evolves rapidly. The value of reliable grid access is paramount, with "powered land"--parcels with secured power infrastructure--becoming a highly attractive asset class for developers.

The political and regulatory environment surrounding data centers has become more contentious, with heightened public awareness of their resource demands. While some regions are exploring moratoriums, others, like Texas, are actively incentivizing development through tax breaks and infrastructure support, recognizing the substantial tax revenue data centers generate. Public-private partnerships and government loan programs, such as those offered by the Department of Energy, are also being explored to provide backstops and potentially lower the cost of capital by enhancing lender confidence through federal guarantees. Ultimately, the successful financing and development of data centers hinge on navigating complex infrastructure dependencies, evolving technological risks, and increasingly scrutinized public and regulatory landscapes.

Action Items

- Audit interconnection queues: Identify and remove duplicate applications to accurately assess real project demand and potential bottlenecks.

- Draft standardized data center financing agreements: Define clear terms for power, water, and technology lifecycle to mitigate tenant rollover and asset obsolescence risks.

- Measure correlation between data center lease terms and anticipated repayment dates: Ensure cash flows adequately support bond repayment timelines, especially for shorter lease durations.

- Evaluate geographic diversification strategies for data center financing: Analyze risks and opportunities of expanding beyond saturated markets like Northern Virginia to Texas and other regions.

- Track data center construction capital deployment: Monitor loan-to-value ratios and advance rates to ensure adequate credit protection for lenders against project delays.

Key Quotes

"Data centers are weird things. They're partly real estate assets. They're partly extremely advanced technological products. And they have to find a way to consume a tremendous amount of electricity from the grid -- or they increasingly have their own power plants on site."

Travis Wofford explains that data centers possess a dual nature, functioning as both physical real estate and highly advanced technological products. This complexity extends to their significant energy demands, requiring either substantial grid connections or on-site power generation.

"The other big question is if you actually stack that up against existing revenue from generative ai existing revenue is like 16 billion right so there's like there's a bit of a gap there that needs to be filled completely correct."

Joe Weisenthal highlights a significant discrepancy between the projected global data center spend and the current revenue generated by generative AI. This gap indicates a substantial need for future investment and revenue growth to justify the massive capital outlays in the data center sector.

"So it's a really good question and you know i always go back to the expression there's nothing new under the sun when you actually think about what we're doing you're building a power project you're building out a data center the powered shell or the powered land or the powered land or the like people have been doing that before when you're financing these we're actually using a lot of the same financing structures it may not be exactly the same but it rhymes."

Travis Wofford suggests that while the current data center boom feels novel, the underlying financing structures and project development principles are not entirely new. He draws parallels to past securitization technologies used for cell towers and residential solar, indicating that established financial mechanisms are being adapted for data centers.

"So the return on their invested capital is much better on the tech side than it is on the infrastructure side infrastructure is usually low margins but the benefit with that is it's long term reliable understood assets such as again if you're doing a large energy project or even the powered shell itself it's land it's a building it's got the fiber connection it's got the power connection and that's something that can continue over a long period of time whereas on the tech side they make a lot more money and have much greater margins as we all know right."

Travis Wofford explains that large tech companies often finance data centers off-balance sheet because the return on invested capital is typically higher in their core technology businesses than in infrastructure. While infrastructure offers stable, long-term assets, the profit margins are generally lower compared to the high-margin tech sector.

"So one of the things that's sort of like people tweet about and uh people even write about including us and we've talked about even this whole thing about gpu life and some of these questions regarding the long term value of the assets and people like uh you know like to claim oh they're not is it going to be as valuable long term as people think does this come up in your work and like what's what's really going on here."

Joe Weisenthal raises a common concern regarding the long-term value and lifespan of GPUs, which are critical components of data centers. He questions whether this technological obsolescence is a significant factor in the financing and valuation of these assets.

"So power continues to be the number one bottleneck i don't think anybody would dispute that water obviously is an issue as well getting the turbines and getting what you actually need in order to produce power is very difficult i do think though that when you look at how some of these interconnection requests are prepared you have five or 10 different people making applications for the exact same project so it inflates what the expectations are on the number of projects in the market at a given time."

Travis Wofford identifies power as the primary bottleneck in data center development, followed by water availability. He also notes that the interconnection process for power generation can be artificially inflated by multiple applications for the same project, creating a misleading picture of market demand.

Resources

External Resources

Books

- "Odd Lots: How Markets Work, How They Fail, and How to Rebuild Them" by Tracy Alloway and Joe Weisenthal - Mentioned as the source of the podcast.

Articles & Papers

- "Oracle Earnings May Not Be Enough to Assuage Debt, AI Deal Fears" (Bloomberg) - Discussed as a related article.

- "Google and Nextera to Develop Data Centers with Power Plants" (Bloomberg) - Discussed as a related article.

People

- Travis Wofford - Partner at Baker Botts, works in the firm's AI practice, and discusses data center financing intricacies.

- Arvind Krishna - Chairman and CEO of IBM, discusses how companies can use AI to create smarter businesses.

- Malcolm Gladwell - Host of the podcast "Smart Talks with IBM."

- Corbin Wittington - Individual featured in "Untold Stories: Life with a Severe Autoimmune Condition."

- Don Wilson - Individual interviewed on a previous "Odd Lots" episode about setting up a GPU futures trading firm.

- Travis Kavula - Individual interviewed on a previous "Odd Lots" episode about grid capacity and data center build-outs.

Organizations & Institutions

- Baker Botts - Law firm where Travis Wofford is a partner.

- Palantir - Company mentioned for building AI that helps workers.

- IBM - Company discussed for scaling and managing AI for businesses.

- Intuit QuickBooks - Platform mentioned for small businesses to access AI agents and experts.

- Ruby Studio - Production company for "Untold Stories: Life with a Severe Autoimmune Condition" and "Mind the Business."

- Argentix - Partner company for "Untold Stories: Life with a Severe Autoimmune Condition."

- CVS - Company mentioned for community involvement and services.

- Showtime - Network for the series "All's Fair."

- Hulu - Streaming service for the series "All's Fair."

- Disney Plus - Streaming service for the series "All's Fair."

- Colgate - Company mentioned for its Total Active Prevention System.

- Amazon - Company mentioned for its five-star theater and performance mesh boxer briefs.

- NRG - Company mentioned in relation to grid capacity and data center build-outs.

- Fitch - Rating agency mentioned in relation to data center securitization.

- S&P - Rating agency mentioned in relation to data center securitization.

- Moody's - Rating agency mentioned in relation to data center securitization.

- Cyrus One - Company that operates a data center where a recent outage occurred.

- Lloyd's of London - Insurance market mentioned for specialized policies.

- Amazon Web Services (AWS) - Mentioned as an example of a tech company expanding into infrastructure.

- Microsoft - Company mentioned as a potential guarantor for projects.

- Google - Company mentioned as a potential guarantor for projects.

- Nvidia - Company mentioned for its new chipsets.

- Coreweave - Neocloud company that lowered a growth forecast due to a data center project delay.

- Department of Energy Loan Program Office - Government entity that can provide financing support.

- Department of Defense - Government entity with programs that can be made available.

- ERCOT (Electric Reliability Council of Texas) - ISO/RTO mentioned in the context of generation approval and interconnection in Texas.

Websites & Online Resources

- Bloomberg.com - Mentioned for business news, stock markets, finance, and breaking world news.

- bloomberg.com/subscriptions/oddlots - URL for subscribing to the Odd Lots newsletter.

- omnystudio.com/listener - URL for privacy information.

- rethinkyourrecovery.com - Website mentioned for information on opioid addiction treatment.

- odoo.com - Website to try Odoo for free.

- bloomberg.com/oddlots - URL for more Odd Lots content.

- discord.gg/oddlots - URL for the Odd Lots Discord server.

- shopcolgate.com - Website to purchase Colgate products.

- cvs.com - Website for CVS.

Podcasts & Audio

- Odd Lots - The podcast where the discussion takes place.

- Smart Talks with IBM - Podcast hosted by Malcolm Gladwell featuring Arvind Krishna.

- Untold Stories: Life with a Severe Autoimmune Condition - Podcast produced by Ruby Studio and Argentix.

- Mind the Business: Small Business Success Stories - Podcast produced by Ruby Studio and Intuit QuickBooks.

Other Resources

- CMBS (Commercial Mortgage-Backed Securities) - Discussed as a financing option for data centers.

- ABS (Asset-Backed Securities) - Discussed as a financing option for data centers.

- Whole Business Securitizations - Financing structure mentioned as similar to data center securitizations.

- Cell Tower ABS - Type of securitization discussed as a comparison to data center securitization.

- Residential Solar Securitization - Type of securitization discussed as a comparison to data center securitization.

- Credit Tenant Leases - Type of lease discussed in data center financing.

- GPU (Graphics Processing Unit) - Technology discussed in relation to data center financing and aging.

- AI (Artificial Intelligence) - Central theme of the discussion regarding data center financing.

- Power Plants - Mentioned as a component of data center infrastructure.

- Grid Interconnection - Critical aspect of data center development and financing.

- Securitized Markets - Market discussed for data center financing.

- Private Credit - Financing option discussed for data centers.

- Private Equity - Financing option discussed for data centers.

- Bank Lending - Financing option discussed for data centers.

- Corporate Bonds - Financing option discussed for data centers.

- Special Purpose Vehicle (SPV) - Entity used in financing structures.

- Loan to Value (LTV) - Metric used in financing.

- Anticipated Repayment Date (ARD) - Term used in bond structures.

- Service Level Agreements (SLAs) - Contracts within data centers regarding power and operations.

- Reserve Account - Financial mechanism associated with service level agreements.

- Powered Shell - Type of data center development.

- Turnkey Solution - Type of data center development.

- Behind the Meter - Concept of generating power on-site for data centers.

- Stranded Asset - Risk associated with behind-the-meter power generation.

- Interconnection Queue - Process for requesting grid connection.

- Subsea Cables - Infrastructure mentioned in relation to data center location.

- Latency Risk - Factor in data center siting.

- Public Private Partnerships (PPPs) - Explored as a financing model for data centers.

- Non-Dilutive Capital - Benefit of private credit financing.

- Internal Rate of Return (IRR) - Metric used in financing.

- Velocity of Money - Concept related to government backstops and private capital.

- Wholesale Data Centers - Type of data center with single tenants.

- Colocation Style Data Center - Type of data center with multiple tenants.

- GPU Futures Trading - Theoretical financial instrument discussed.

- Operational Risk - Risk associated with data center operations.

- Cyber Risk - Risk associated with data centers.

- Technology Risk - Risk related to the obsolescence of technology.

- Powered Land - Land secured with sufficient power for data center development.