All Episodes

Market Mechanics Create Cascading Crises Through Crowded Trades

Market mechanics, not isolated events, create cascading crises. Discover how risk management structures amplify volatility and turn crowded trades into systemic shocks.

View Episode Notes →

Warsh Nomination: Fed Independence, Communication, and Market Volatility

Fed Chair Kevin Warsh's nomination signals a potential return to market volatility and a fundamental re-evaluation of Fed independence and communication strategies.

View Episode Notes →

US Rare Earth Strategy: Leapfrog China Through Innovation

Leapfrog China's rare earth dominance by innovating cleaner, cost-effective extraction from waste, not by replicating their mining model. Build genuine, long-term strategic advantage.

View Episode Notes →

Internet Centralization: American and Chinese Systems Converge on Control

The internet's evolution reveals a surprising convergence toward centralization and social manipulation, driven by inherent human tendencies rather than freedom versus control.

View Episode Notes →

Utility Overbuild Risk: AI Data Center Demand Overestimated

Utilities are committing to 110 GW of new data center power, far exceeding projected demand and risking a costly overbuild.

View Episode Notes →

Warsh's Record: Shifting Policy Views Undermine Fed Credibility

Kevin Warsh's Fed nomination reveals a pattern of policy views shifting with political winds, raising concerns about credibility and objective decision-making during economic crises.

View Episode Notes →

Commodity Supercycle Driven by Policy Shifts and Resource Demand

Commodity markets are undergoing a policy-driven supercycle, shifting from asset-light to asset-heavy industries. Nations are securing tangible resources, creating unprecedented demand and a strategic imperative for resource security.

View Episode Notes →

Operational Resilience Trumps Strategy in Volatile Markets

Mastering operations in volatile markets requires resilience and ingenuity, not just capital. Discover how ethical consistency and dollar generation become critical competitive advantages.

View Episode Notes →

Banking Consolidation Driven by Scale, Technology, and Strategic Branch Density

PNC leverages scale, strategic branch density, and a decade of tech investment to rival fintechs, now achieving 30% productivity gains with generative AI.

View Episode Notes →

Private Credit's Scale and Direct Model Drive Market Reshaping

Private credit revolutionizes finance with a direct, efficient model, offering borrowers customization and speed while delivering investors higher returns and a resilient system.

View Episode Notes →

Fixed Income Attractiveness Bounds Geopolitical Driven Yield Increases

Fixed income offers equity-like returns with lower risk, creating a ceiling for rising yields despite geopolitical noise. AI is poised to boost asset management productivity.

View Episode Notes →

AI Coding Tools Disrupt SaaS With Custom Solutions

AI coding tools like Claude Code enable rapid, custom software creation, threatening traditional SaaS by making bespoke solutions cheaper and faster to build than to buy.

View Episode Notes →

Iran's Economic Crisis Fuels Widespread Unrest and Financial Instability

Iran's currency has depreciated 98% in a decade, fueling widespread anger and protests driven by economic hardship, not social freedoms.

View Episode Notes →

Energy Demand Surge Requires Infrastructure Adaptation Amidst Volatility

Energy demand is surging, creating a bottleneck that outstrips supply. Invest in companies navigating regulation and technology for growth in this new era of energy scarcity.

View Episode Notes →

DOJ Subpoena Against Fed Chair Threatens Independence Via Criminal Charges

Criminal charges threaten Fed officials, escalating pressure beyond typical politics and potentially consolidating executive control over independent economic functions.

View Episode Notes →

Personalized Portfolio Construction Aligns Assets with Income and Liabilities

Understand how your stable income stream acts as a fixed-income allocation, providing behavioral bandwidth to tolerate greater investment risk and mitigate sequence of returns risk.

View Episode Notes →

The Monroe Doctrine's Evolution to "Don Roe Doctrine" Tribute Demands

US foreign policy retreats to asserting dominance in Latin America during global decline, transforming the Monroe Doctrine into a tool for tribute and control, not law.

View Episode Notes →

Sovereign Debt Restructuring Complexities--Odious Debt, Sanctions, and Creative Solutions

Sovereign debt restructurings defy simple renegotiations, complicated by diverse creditors, non-bond liabilities, and U.S. sanctions that block even communication.

View Episode Notes →

US Intervention in Venezuela: Geopolitical Power Play, Not Oil Market Driver

US intervention in Venezuela demonstrates power projection, not oil market strategy, as decades of decay render reserves economically unviable.

View Episode Notes →

Federal Reserve Conferences Incubate Policy Ideas on Economic Vulnerability

US economic vulnerability to global shocks is underestimated, as integrated networks amplify disruptions into persistent inflation, demanding more reactive policy.

View Episode Notes →

Restaurant Identity Shifts: Politics, Labor, and Ambiance Drive Business

Restaurants increasingly align with political brands, shifting from location to ideology, while labor shortages double wages and supply chains demand menu flexibility.

View Episode Notes →

Journalists Should Kill More Stories; Market Narratives Face Scrutiny

AI's value may accrue to hardware, not labs, challenging innovation models. Bitcoin's narrative shifts, while inflation expectations remain anchored despite Fed challenges.

View Episode Notes →

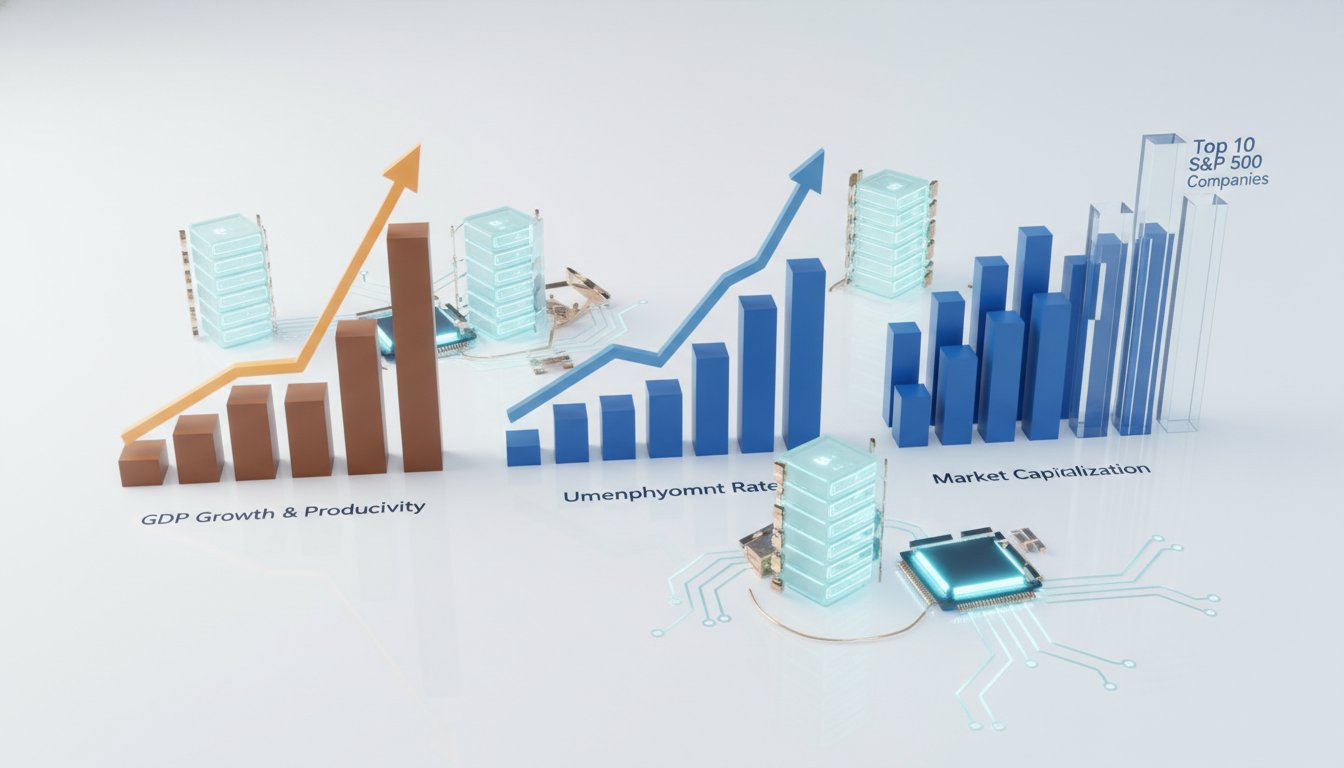

Productivity-Driven Growth Masks Complex Economic and Market Dynamics

AI investment contributes minimally to GDP, yet broad market returns are strong. Productivity growth is key, but watch for rising unemployment and market concentration.

View Episode Notes →

John Law's Radical Monetary Theories and French Financial Reform

Money is a technological tool, not intrinsic value. Discover how John Law's radical theories, forged in exile and gambling, shaped modern monetary systems and state finance.

View Episode Notes →

US Tech Force Reforms Federal Hiring and Culture for Modernization

Federal hiring reforms ditch degree and tenure requirements, enabling merit-based advancement and attracting tech talent with challenging problem-solving opportunities.

View Episode Notes →

Auto Loan Delinquencies Signal Broad Consumer Stress Amidst Rising Costs

Auto loan delinquencies surge, signaling broader consumer stress beyond subprime as rising car, insurance, and student loan costs strain even higher-income households.

View Episode Notes →

Gray Market Peptides Fuel Self-Optimization Amidst Regulatory Gaps

A gray market for peptides, fueled by distrust and self-optimization trends, offers accessible, low-cost alternatives to FDA-regulated treatments, bypassing traditional medical pathways.

View Episode Notes →

State AI Regulation Faces Industry Pushback and Preemption Threats

AI labs face mandated safety disclosures and incident reporting, mirroring historical industry accountability, as significant investments target politicians shaping AI regulation.

View Episode Notes →

Animal Products Drove Colonial Economy, Spurred Conservation Efforts

Deerskins, not agriculture, fueled early colonization, with hunting's economic impact shaping America's trajectory and conservation efforts.

View Episode Notes →

Biotech Investing: Navigating Low Probabilities, China's Rise, and AI's Limits

Biotech investing demands managing extremely low success probabilities, requiring specialized expertise to navigate the "valley of death" from discovery to product.

View Episode Notes →

Data Center Financing Navigates Infrastructure Bottlenecks, Technological Risks, and Public Scrutiny

Power and grid interconnection are the primary bottlenecks for data center development, requiring multi-year approvals that significantly impact project timelines and financing.

View Episode Notes →

Fixed Income Returns: Higher Yields, Greater Dispersion, and Global Opportunities

Bond investors now earn yield for risk as fixed income becomes attractive based on valuation, not just correlation. Global opportunities offer diversification beyond the U.S. market.

View Episode Notes →

Excel's Enduring Dominance: Bundling, Tabular Thinking, and AI Integration

Excel's enduring dominance stems from strategic bundling and its deeply ingrained data processing paradigm, resisting AI replacement due to its precise computation and transparent reasoning.

View Episode Notes →

Affirm's BNPL Model: Ethical Lending, Customer Loyalty, and Credit Building

Affirm aligns lender and borrower interests by eliminating late fees and compounding interest, fostering loyalty and building credit history unlike traditional cards.

View Episode Notes →

AI Quantifies Lender Fortification Amidst Borrower Flexibility

Lenders demand more structural protections as deal terms signal growing anxiety about potential distress, while borrowers inflate cash flow with record "cost savings add backs."

View Episode Notes →

AI Demand Strains US Electricity Grid Infrastructure and Regulation

AI data center demand strains the US electricity grid, exposing underinvestment and outdated regulations. Learn how this forces a critical reevaluation of market function and capacity financing.

View Episode Notes →