Utility Overbuild Risk: AI Data Center Demand Overestimated

The AI Energy Boom: A Utility Analyst's Warning of Imminent Overbuild

The prevalent narrative surrounding the AI-driven data center expansion paints a picture of insatiable demand and strained energy grids, creating a seemingly lucrative "picks and shovels" investment opportunity in utilities. However, a deeper dive into the actual numbers, as articulated by utilities analyst Andy DeVries, reveals a starkly different reality: a looming oversupply and significant financial risks for utilities and potentially consumers. This conversation exposes the hidden consequence of unchecked optimism and the critical need to scrutinize supply commitments against actual demand projections. Investors and utility executives who grasp these non-obvious implications will gain a crucial advantage in navigating an increasingly complex energy landscape.

The Illusion of Scarcity: Why Data Center Demand Might Be Overestimated

The prevailing sentiment is that the insatiable appetite for AI computation will necessitate a massive build-out of data center capacity, straining existing power grids and creating a secular growth driver for utilities. This narrative, amplified by industry conferences and media coverage, has led to a surge in optimism, with utility growth rates projected to climb significantly. However, Andy DeVries of CreditSights presents a compelling counter-argument, rooted in straightforward arithmetic, that suggests the market is overlooking a critical imbalance: supply is poised to far outstrip demand.

DeVries meticulously breaks down the projected growth in data center energy consumption. While third-party estimates forecast a need for an additional 50 gigawatts of power by 2030, bringing the total to around 95 gigawatts, his analysis of utility commitments paints a different picture. Utilities are actively tracking and committing to connecting approximately 110 gigawatts of new data center capacity. This figure, even after adjusting for power usage effectiveness (PUE), indicates that the committed supply is already nearly equivalent to the demand projected for 2035.

"So, just to make sure on the same page, third-party estimates, 45 gigawatts for data centers now going to 95. That's 50. Utilities are working at 110. They don't give timing for that. Some of it's going to be past 2030. But I'm trying to say is there is a lot of supply of data centers coming and it's very unclear if there's going to be demand for this."

-- Andy DeVries

This discrepancy highlights a fundamental flaw in the current market narrative: an overemphasis on demand projections without a commensurate focus on the supply side. DeVries points out that while tech enthusiasts are focused on the "AI build-out," they often neglect the utility analysis required to understand grid capacity. The utilities themselves are eager to connect this new demand, as it boosts their earnings through investments in transmission, distribution, and substations. This creates a powerful incentive to overcommit to capacity, potentially leading to a significant overbuild.

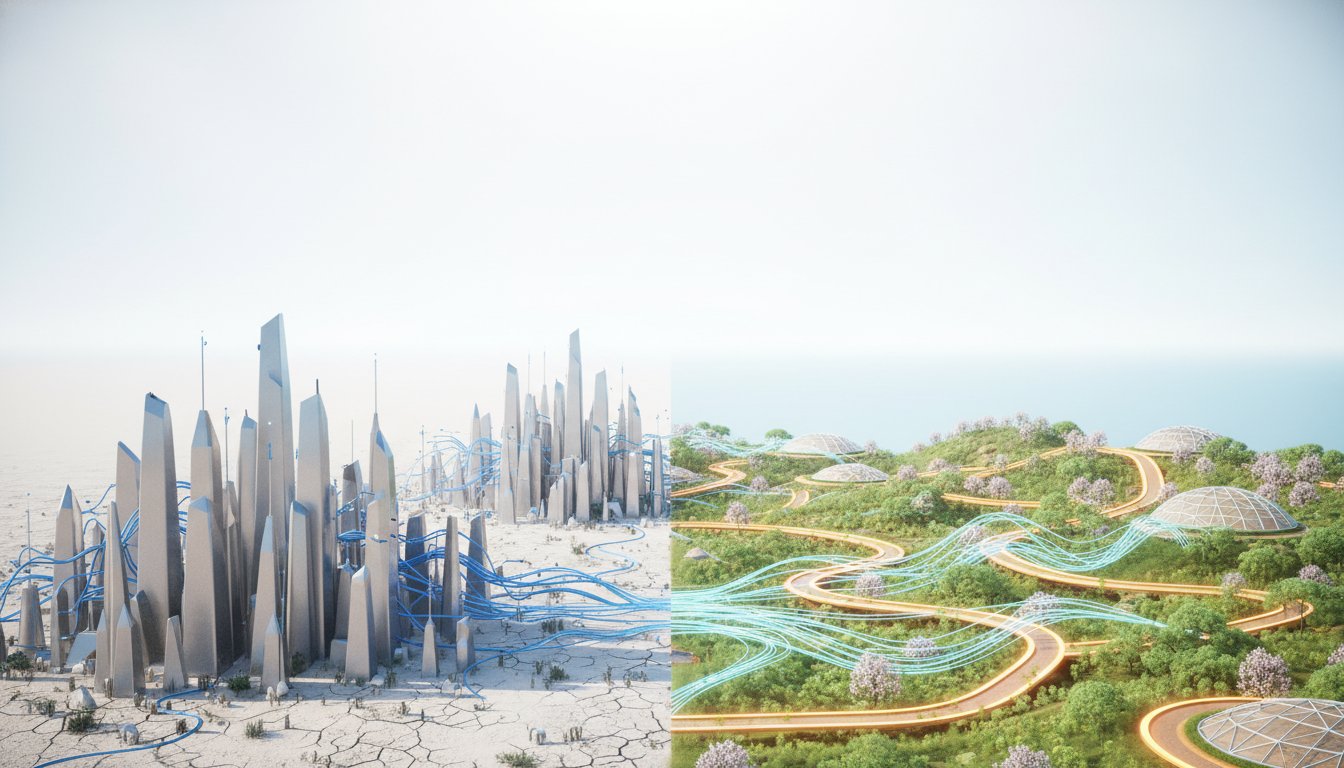

The implications of this potential oversupply are far-reaching. If demand does not materialize as projected, utilities could be left with stranded assets and the financial burden of unused infrastructure. This could translate into increased rates for existing customers, a scenario that DeVries notes is being addressed by some utilities through specific ratepayer protections, but not universally. The risk is that the cost of this overbuild will be socialized, with consumers ultimately footing the bill for speculative capacity.

The Signals in the Market: Power Curves and Natural Gas

DeVries leverages market signals, specifically forward power and natural gas curves, to further support his thesis. In Texas, a key market for data centers, the forward power curve shows only a modest increase in prices by 2030, a trajectory that contradicts the aggressive demand growth being forecast. If demand were truly expected to surge by 20-30 gigawatts, one would anticipate a more significant upward pressure on power prices.

The natural gas market offers an even more striking signal. Despite the acknowledged growth in LNG exports and domestic demand, the forward curve for natural gas is inverted, sloping downward. This suggests that market participants expect lower prices in the future, a stark contrast to the bullish narrative surrounding energy demand. DeVries posits that this disconnect between the popular narrative and market pricing indicates a potential mispricing of future energy needs, or perhaps an underestimation of future supply or efficiency gains.

"And the forward curve for gas is much more liquid than it is for power. And the forward curve for gas is inverted. It goes from 370 to 360 by the end of the decade. So as my energy analyst Charles Johnson points out, the bigger driver there isn't data center demand. We're at 6 BCF a day there. A lot of people are at 10, 12. We can get into that. But LNG exports, we're exporting 18 BCF a day now. We're going to add another 12. Like you'd think that curve would be at least upward sloping by 25 cents, 30 cents."

-- Andy DeVries

The fact that big tech companies are willing to pay a premium, such as $95 per megawatt-hour for round-the-clock power in Texas, compared to the current market price, highlights their urgency to secure supply. However, this premium, while significant for utilities, is a relatively small cost in the grand scheme of data center expenditures, which can run into the tens of thousands of dollars per kilowatt. This willingness to pay a premium, coupled with the market signals, suggests a potential disconnect between the perceived scarcity and the actual availability of power.

The Credit Market's Unease and the Risk of Overbuilding

The burgeoning private credit market's involvement in financing data center projects further underscores the potential for financial risk. DeVries notes that while large, highly-rated companies like Meta can secure financing with relatively tight spreads, the increasing competition for deals in the private credit space could lead to a relaxation of covenants and protections. This is particularly concerning for second-tier data center operators and their financiers.

The circular nature of some financing deals, where chip manufacturers invest in data center companies that then purchase their chips, raises parallels to past market excesses. While the immediate payoff for entities like Pimco on the Meta deal was substantial, DeVries cautions that as demand for these deals grows, the documentation and protections for lenders may diminish. This creates a scenario where, if demand falters, the downstream players, rather than the large tech giants, are most vulnerable.

The construction costs for new power generation are also escalating, with combined cycle gas plants now costing around $3,000 per kilowatt, a significant increase from a decade ago. While this cost is dwarfed by data center expenditures, it adds another layer of financial pressure if capacity is ultimately overbuilt. DeVries argues that much of the new power generation capacity is not strictly necessary, as existing grid infrastructure could accommodate significant increases in demand with only minor utilization adjustments.

The core of DeVries's argument is that the market is caught in a narrative of AI-driven demand scarcity, incentivizing utilities to commit to building capacity that may never be fully utilized. This creates a significant risk of overbuilding, with the potential for financial repercussions for utilities and their customers, and a misallocation of capital.

Key Action Items

-

For Investors:

- Scrutinize Utility Commitments: Analyze utility disclosures for the gap between contracted data center capacity and realistic demand forecasts. Prioritize utilities with clear ratepayer protection mechanisms.

- Monitor Power and Gas Curves: Pay close attention to forward power and natural gas price curves, particularly in key data center markets. Deviations from the bullish narrative could signal oversupply.

- Assess Private Credit Exposure: Evaluate the risk associated with private credit funds heavily invested in data center debt, focusing on covenant strength and borrower quality.

- Time Horizon Focus: Recognize that the oversupply risk is primarily a 2030 event. Short-term gains may mask longer-term structural issues.

-

For Utility Executives:

- Prioritize Ratepayer Protection: Implement robust mechanisms to shield existing customers from the costs of potential overcapacity.

- Demand-Side Scrutiny: Conduct rigorous, independent demand forecasting for data centers, rather than relying solely on third-party estimates or customer projections.

- Strategic Capacity Planning: Focus on optimizing existing infrastructure and incremental, demand-driven build-outs rather than speculative capacity expansion.

- Transparency in Contracting: Clearly disclose the terms and risks associated with data center power purchase agreements to stakeholders.

-

For Data Center Operators:

- Realistic Demand Forecasting: Base expansion plans on conservative, data-backed demand projections, considering efficiency gains and market saturation.

- Financial Prudence: Secure financing with strong covenants and avoid circular financing arrangements that obscure underlying risk.

- Long-Term Power Strategy: Explore diverse power sourcing options, including on-site generation and renewable PPAs, to mitigate reliance on grid capacity that may become oversupplied.