Auto Loan Delinquencies Signal Broad Consumer Stress Amidst Rising Costs

TL;DR

- Rising auto loan delinquencies, now the riskiest credit product, signal broader consumer stress beyond subprime borrowers due to increased car prices and insurance costs.

- Higher income households, previously insulated, are now experiencing increased delinquency rates, indicating a widening "K-shaped" economy driven by wealth disparities rather than just income.

- The resumption of student loan payments has led to delinquency rates over 20%, significantly higher than historical norms, impacting a substantial portion of borrowers.

- Increased insurance premiums for both auto and homeowners are exerting significant financial pressure, potentially becoming the "straw that breaks the camel's back" for struggling households.

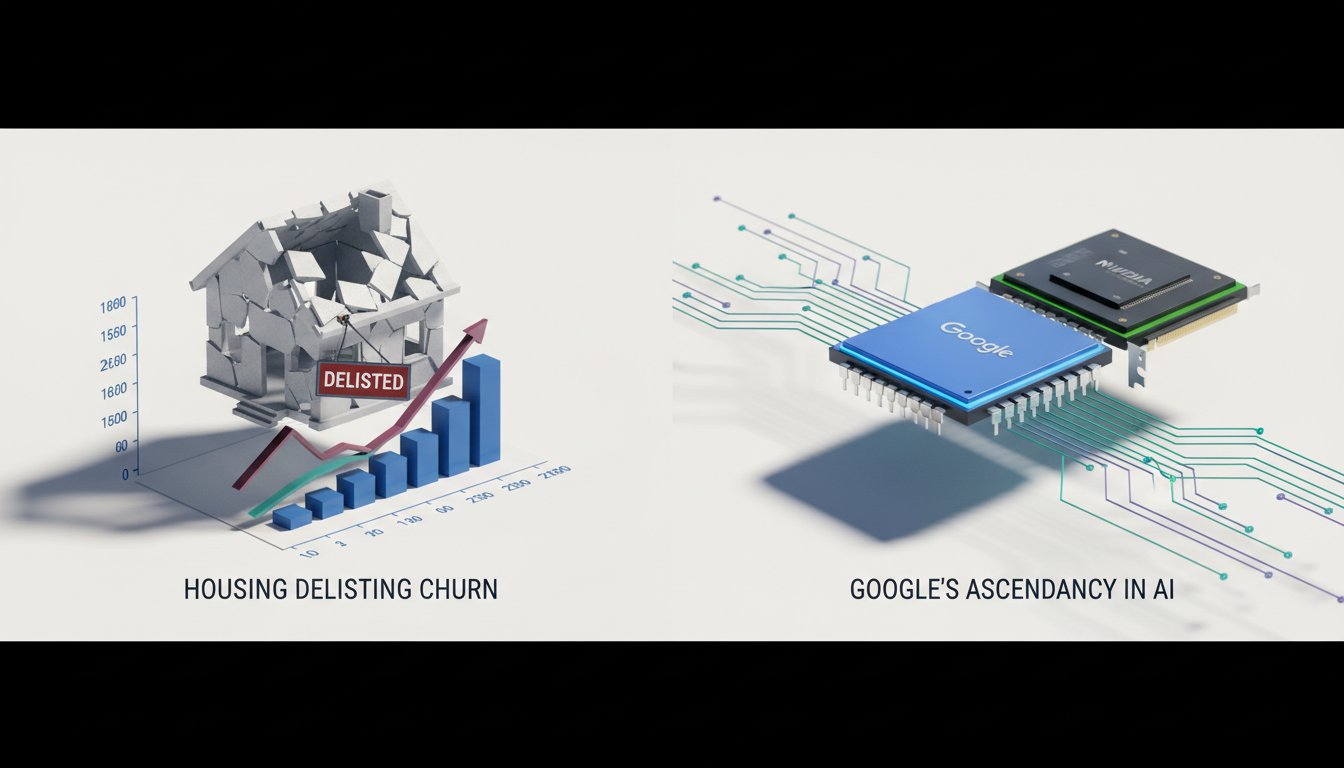

- Vantage Score's updated algorithms, incorporating time-series and alternative data like utility payments, enable scoring for 33 million more individuals, expanding credit access.

- The FHFA's rule change allowing Vantage Score in mortgage applications, removing minimum FICO limits, could increase homeownership demand and positively impact economies in underserved regions.

- While unsecured loan delinquencies are decreasing, mortgage and auto loan delinquencies continue to rise, indicating a complex and shifting consumer credit landscape.

Deep Dive

American consumers are experiencing a growing strain on their finances, driven by a confluence of rising prices, increased interest rates, and a significant surge in insurance costs, leading to record-high auto loan delinquencies. While aggregate household balance sheets may appear healthy due to home equity and investment gains, this masks a more precarious reality for many, particularly as savings dwindle and essential expenses climb. This emerging pressure indicates a more fragile consumer base than in previous years, with potential implications for broader economic stability.

The "auto squeeze" is a critical indicator of this strain, characterized by several compounding factors. Firstly, the average cost of a car has escalated dramatically, increasing the average loan value to a greater extent than even mortgages over the past 15 years. This is exacerbated by higher interest rates, meaning borrowers are paying more on both principal and interest. Crucially, consumers often overlook the substantial increases in auto insurance and repair costs, which, when combined with loan payments, push many beyond their means. Given that auto loans are essential for transportation to work and daily life, defaults in this sector are a strong signal of widespread financial distress, as individuals will only default when they have exhausted all other options.

This auto loan stress is occurring within a broader economic landscape marked by a "K-shaped" recovery, where higher-income households, despite their relative advantage, are also showing increased delinquency rates. This trend suggests that the pressure is not solely confined to lower-income groups, as rising costs for essentials like rent, childcare, and education disproportionately affect larger outlays that scale with income. While delinquencies in credit cards and personal loans have begun to decline, mortgage and auto loan delinquencies continue to rise, creating a topsy-turvy credit picture. Furthermore, the resumption of student loan payments after a prolonged forbearance period has significantly increased delinquency rates, reaching historic highs, indicating that many borrowers struggle to manage these obligations without prior experience or adequate preparation.

The increasing financial pressures on consumers, particularly the rise in auto loan and student loan delinquencies, highlight a growing fragility in the consumer base. While no single catalyst for a widespread collapse is apparent, the accumulation of these stresses--higher loan costs, rising insurance and repair expenses, and the reintroduction of student loan payments--suggests that the consumer is less resilient than in prior periods, making them more susceptible to economic shocks.

Action Items

- Audit auto loan portfolio: Analyze 2020-2022 loan vintages for delinquency drivers beyond interest rates, focusing on insurance and maintenance cost impacts.

- Track consumer spending by merchant type: Monitor high-end (LVMH) vs. discount (Walmart) performance and McDonald's trends to identify spending shifts.

- Measure wealth impact on delinquency: For 3-5 income cohorts, calculate correlation between home/asset ownership and delinquency rates.

- Evaluate credit scoring models: Compare VantageScore 4.0 and FICO Classic performance on mortgage applications using historical data.

- Analyze insurance cost impact: For 5-10 regions with rising insurance premiums, assess correlation with auto loan delinquency rates.

Key Quotes

"By and large, American households are in a healthy economic position. Yes, unemployment has been rising, but it's still at fairly low levels. Consumer spending has held up well despite terrible sentiment. And many households are sitting on huge stock market gains and have a big home equity cushion."

The hosts of Odd Lots introduce the paradox of the American consumer, noting that despite negative sentiment and rising unemployment, aggregate economic indicators like consumer spending, stock market gains, and home equity suggest a generally healthy household financial position. This sets the stage for exploring the underlying issues that contradict this broad picture.

"Most notably, auto loan delinquencies have been surging to their highest level in history. It's the same with student loans, where delinquencies are far higher than normal."

The hosts highlight specific areas of concern that challenge the overall positive economic outlook for American households. They point to auto loan and student loan delinquencies as significant indicators of stress, suggesting that these rising default rates are at historic highs and warrant further investigation.

"So what's going on? On this episode, we speak with Rikard Bandebo, the chief economist at VantageScore, which offers a consumer credit score that's different from the traditional FICO measures. He explains how surging prices, rising interests, and -- crucially -- rising insurance costs have created an auto squeeze."

To address the perplexing economic situation, the podcast introduces Rikard Bandebo, an economist from VantageScore, who will provide expert analysis. Bandebo is expected to explain the specific factors, such as inflation, interest rates, and insurance costs, that are contributing to the financial strain on consumers, particularly in the auto loan market.

"The general view is that the American consumer or the American household has a very big cushion. There is a lot of home equity built up there that is not a thin and layer obviously anyone with money and any sort of investment account has done phenomenally well."

Joe Weisenthal and Tracy Alloway discuss the prevailing narrative about the American consumer's financial health. They acknowledge that many households appear to have substantial financial buffers, including significant home equity and investment gains, which would typically indicate resilience.

"We're according to as of December 12th yesterday I think the s&p 500 hit yet a new all time high so if you have any sort of home equity built up if you have any sort of investment you are doing very well on the other hand of course people are stretched from years of inflation we know that hiring has slowed down we know that you know we see these headlines delinquencies for cars have like shot up but I've been seeing these headlines for years I don't totally know what they mean or how apples to apples they are with the past I just don't know I just I'm very confused."

Joe Weisenthal expresses his confusion about the current economic climate, contrasting the positive performance of the stock market with the persistent headlines about rising delinquencies. He questions the comparability of current delinquency data to past periods, indicating a lack of clear understanding of the consumer's true financial state.

"The thing that i haven't been able to get my head around is how much of that year over year increase in spending on the holidays is driven by the prices of the goods going up versus people buying things that would have traditionally been more expensive or splurging more that for me isn't obvious and i think that again when trying to understand how the economy is going it's so important if you're looking at from a spending perspective to actually look at the different merchants right how's mcdonald's doing what are the trends there what's happening in high end how is lvmh doing versus walmart etcetera because again you know even though i said that you know there's a silver lining in that high income um consumers are seeing declines middle income have come down but they're still increasing and low income are seeing persistently higher on 8 year over year increases in their delinquency rates and so we're probably next year going to see more households struggling to make ends meet than we saw this year"

The speaker discusses the difficulty in discerning whether increased holiday spending is due to inflation or genuine consumer splurging. They emphasize the importance of analyzing spending trends across different types of merchants, from fast food to luxury goods, to gain a clearer picture of the economy, especially as lower-income households continue to face rising delinquency rates.

Resources

External Resources

Books

- "The Great Financial Crisis" by Tracy Alloway and Joe Weisenthal - Mentioned in relation to historical economic events.

Articles & Papers

- "Rise of the ‘Zombie’ Loans" (Bloomberg) - Discussed as a related article on consumer debt.

- "First Brands Asks Lenders for Fresh Cash of Up to $800 Million" (Bloomberg) - Discussed as a related article on corporate finance.

People

- Rikard Bandebo - Chief economist at VantageScore, discussing consumer credit and auto loan delinquencies.

- Joe Weisenthal - Host of the Odd Lots podcast.

- Tracy Alloway - Host of the Odd Lots podcast.

Organizations & Institutions

- VantageScore - Consumer credit scoring company, discussed in relation to credit scoring innovation and expanding access to credit.

- Experian - Credit bureau, co-founder of VantageScore.

- Equifax - Credit bureau, co-founder of VantageScore.

- TransUnion - Credit bureau, co-founder of VantageScore.

- FICO - Company that created the first known credit score.

- FHFA (Federal Housing Finance Agency) - Mentioned for changing rules regarding credit scores used in mortgage applications.

- Fannie Mae - Government-sponsored enterprise involved in mortgage lending.

- Freddie Mac - Government-sponsored enterprise involved in mortgage lending.

- Federal Reserve of St. Louis - Found that older credit scoring models did not perform well during the last crisis.

- JPMorgan - Published data on the amount of cash in checking accounts.

Websites & Online Resources

- Bloomberg - Business News, Stock Markets, Finance, Breaking & World News (bloomberg.com) - Source for business news and the Odd Lots podcast.

- bloomberg.com/subscriptions/oddlots - Subscription page for the Odd Lots newsletter.

- discord.gg/oddlots - Discord server for the Odd Lots podcast.

- omnystudio.com/listener - Website for listener privacy information.

Other Resources

- FICO scores - Traditional credit scoring system discussed in relation to its history and limitations.

- VantageScore 4 - A version of the VantageScore credit scoring model.

- Trended data (time series data) - Type of data used in credit scoring to analyze past consumer behavior.

- Utility payments and rent - Data points now being incorporated into credit scoring.

- AI methods (clustering) - Advanced mathematical techniques used in credit scoring.

- K-shaped economy - Economic phenomenon where different income groups experience divergent outcomes.

- Mortgage rates - Interest rates on home loans, discussed in relation to housing affordability and refinancing.

- Auto loan delinquencies - Instances of borrowers failing to make payments on car loans, discussed as a rising concern.

- Student loan delinquencies - Instances of borrowers failing to make payments on student loans, discussed in relation to historical norms and recent increases.

- Buy Now Pay Later (BNPL) programs - Point-of-sale installment loans, discussed in relation to consumer leverage and data visibility.

- Cash flow data - Financial data reflecting the movement of money into and out of an account, increasingly used in credit scoring.

- Insurance rates - Cost of insurance policies, discussed as a significant factor impacting consumer budgets, particularly for auto and homeowners insurance.