Productivity-Driven Growth Masks Complex Economic and Market Dynamics

TL;DR

- AI investment spending contributed minimally to measured GDP growth (approx. 20 basis points over four years), as much of the hardware is imported and semiconductors are treated as intermediate inputs, not direct investment.

- The broad U.S. equity market, beyond mega-cap tech, has delivered consistent ~15% annual returns for three years, indicating sustained performance across the S&P 490 despite market focus on a few large names.

- Tariffs have had a smaller-than-expected inflation impact (approx. 50 basis points pass-through so far), suggesting greater absorption by businesses, supply chain restructuring, and cost-cutting efficiencies rather than full consumer price hikes.

- Rising productivity growth, potentially accelerated by AI, is expected to keep unemployment near 4.5% even with GDP growth, as it allows for more output without a proportional increase in labor demand.

- The market's optimism is currently more grounded in near-term earnings realization rather than speculative bets on future AI productivity gains, a contrast to the dot-com bubble's valuation expansion based on anticipated benefits.

- China's manufacturing and export sectors remain robust despite U.S. tariffs due to production efficiencies and control over critical resources like rare earths, though its domestic economy faces significant headwinds from a struggling housing market.

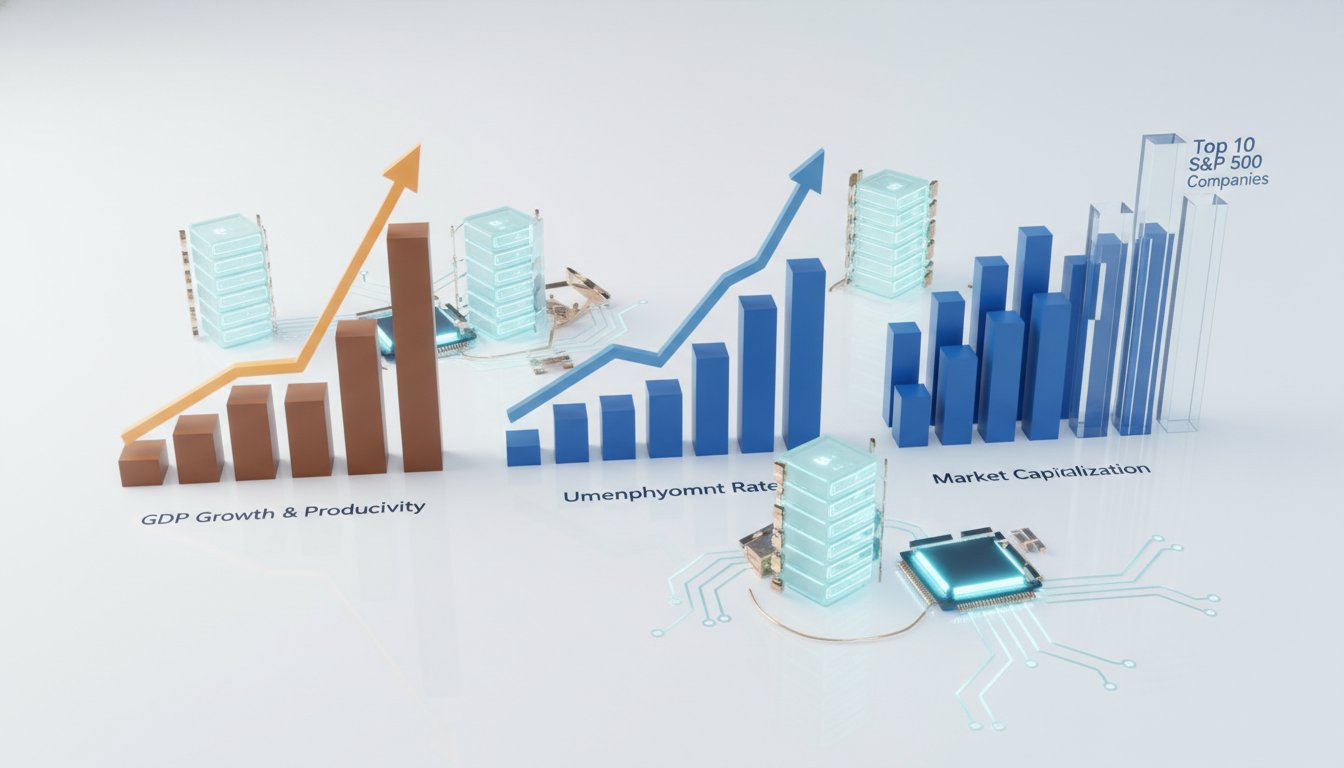

- The dominance of the top 10 S&P 500 companies in market capitalization is now mirrored in earnings, a trend not seen in 100 years of U.S. market history, suggesting continued outperformance if this earnings trend persists.

- Investors should remain cautious of potential market downturns signaled by tightening Fed policy, rising jobless claims, or investors justifying valuations with stretched narratives, as these have historically preceded equity bull market tops.

Deep Dive

The 2026 economic outlook suggests a continuation of robust GDP growth, driven by accelerating productivity, but with a nuanced impact on unemployment. While headline GDP figures may appear strong, the underlying trend is moderated by an anticipated rise in unemployment and the persistent effects of tariffs and supply chain adjustments. This environment presents a complex landscape for equity markets, where the focus is shifting from AI infrastructure investment to identifying long-term productivity beneficiaries, necessitating a careful assessment of valuations and market concentration.

The expected economic growth in 2026, projected at approximately 2.6% for real GDP, is underpinned by a significant acceleration in productivity growth, which has outpaced previous cycles. This productivity surge is anticipated to continue, with artificial intelligence expected to play an increasingly prominent role in future gains. However, this growth is not translating into declining unemployment; instead, the forecast holds unemployment steady at 4.5%. This divergence is attributed to the fact that a portion of the growth is offset by imported goods used in AI development, and importantly, semiconductors are often classified as intermediate inputs rather than direct investment in GDP calculations. Consequently, the direct contribution of AI investment to measured GDP growth is modest, around 20 basis points over the last few years.

For the equity markets, 2025 has been characterized by strong corporate earnings growth, with the S&P 500 reporting a 12% increase and the median stock showing around 10% growth. This performance has extended beyond mega-cap tech, with the broader S&P 493 delivering consistent 15% returns over the past three years. Despite this broad strength, recent weeks have seen some deceleration in mega-cap tech, driven by concerns about decelerating AI investment and the increased debt required to sustain it. The market's valuation, while elevated, is not seen as excessively speculative, remaining below the peaks of the dot-com bubble and the post-COVID reopening period. The primary driver for this valuation is the expectation of improving earnings, fueled by the anticipated productivity gains from AI, though investors are increasingly focused on current earnings rather than speculative future benefits.

Second-order implications arise from the AI-driven productivity acceleration. While historically technological advancements have not led to a net destruction of jobs in the long term, the transition period can see increased frictional unemployment as new jobs are created to replace those lost in affected industries. The speed of AI adoption will be critical; a slower diffusion over a decade would allow the economy more time to adapt, whereas a rapid rollout could exacerbate short-term unemployment challenges. Furthermore, the concentration of market capitalization within the top ten stocks, now representing 40% of market cap and a third of earnings, suggests that while these companies have delivered significant value, their continued outperformance is contingent on sustained earnings growth. A shift in regulatory policy or a future earnings downturn for these dominant firms could significantly alter market dynamics. The impact of tariffs, while initially feared to compress margins, has been absorbed through price increases, supply chain adjustments, and cost efficiencies, indicating a greater resilience in corporate profit margins than initially anticipated.

The closing takeaway is that the economic outlook for 2026 is one of sustained, productivity-driven growth, but with a complex interplay of rising unemployment and evolving market dynamics. Investors must look beyond the AI infrastructure boom to identify companies that can translate productivity gains into sustained earnings, while also remaining vigilant to the potential for increased frictional unemployment and the implications of market concentration.

Action Items

- Audit AI investment impact: Quantify AI's contribution to GDP growth, accounting for imports, to validate economic impact claims (ref: Hatzius's GDP analysis).

- Track S&P 493 earnings growth: Monitor the median S&P stock's earnings performance over 3-5 quarters to assess broad market health beyond mega-caps.

- Analyze tariff pass-through: Measure the percentage of tariffs absorbed by businesses versus passed to consumers over 6-12 months to understand margin pressures.

- Evaluate AI productivity capture: Identify 3-5 companies demonstrating quantifiable AI-driven productivity gains to understand long-term winner identification.

- Monitor jobless claims: Track weekly jobless claims for 4-6 weeks to identify potential shifts in labor market frictional unemployment.

Key Quotes

"We have flat unemployment at 4 and a half percent but it's not going down as you might think when you're printing let's say 2 6 for real gdp in 2026 and a small part of the answer is that that 2 6 probably overstates the underlying trend a bit because we had the shutdown that depressed q4 it's going to add to q1 but the more important part of the answer is accelerating productivity growth and we've seen that over the last five years the five years since the pandemic have shown about 2 underlying trend productivity growth the prior cycle was at about 1 and a half percent and i think there's reason to believe that that acceleration is still ongoing because it probably doesn't have a lot of ai in it we expect more of a boost from ai going forward in the next five years than in the last five years and i think that's got important implications for the relationship between gdp and unemployment"

Jan Hatzius explains that while GDP growth is projected, unemployment may not decrease proportionally due to factors like the previous quarter's shutdown and, more significantly, accelerating productivity growth. Hatzius suggests this productivity acceleration, potentially boosted by AI in the future, could alter the traditional relationship between economic output and job creation.

"For three years we've been obsessed with ai as a market and for three years really the story has been increased capex extraordinarily growth in ai investment spending and although we're discussing a lot the eventual productivity benefits as jan mentioned really the trade in the equity market has been the companies with earnings that are benefiting from those capex dollars and what's happened this year especially in the last several months is it's become increasingly clear that a probably that growth will decelerate next year and b to continue that growth it's going to require more debt and both of those factors have made investors understandably uncomfortable"

Ben Snider highlights that the market's focus on AI has been driven by increased capital expenditure (capex) and investment spending. Snider notes that recent investor discomfort stems from the realization that this growth may decelerate and require more debt, shifting the market's attention from capex beneficiaries to the underlying productivity benefits.

"The impact of tariffs this is our concern too most of earnings variability is driven by margin variability when you have years with very large earnings growth or very poor earnings growth it's usually because of margins and earlier this year we were concerned that in part because of tariffs margins would get squeezed and that would weigh on earnings was it just you who was concerned and it and it really didn't materialize now i think part of what we have to keep in mind is the counterfactual so for the last couple of quarters s p 500 profit margins have basically been flat well in an environment of pretty healthy nominal gdp growth normally you would expect some operating leverage that would cause margins to expand and so i think part of the story here is you didn't get that counterfactual but we've seen consistently over the last few quarters companies across earnings calls really point to three levers they've been pulling to offset these pressures one is of course as john mentioned pushing through some in the form of prices second is both pushing back on suppliers to absorb some of the costs and restructuring supply chains where necessary and the third is cutting costs improving efficiency within companies and that ties back to the slightly better productivity story we've seen"

Ben Snider discusses how tariffs were a concern for compressing corporate profit margins, which are a key driver of earnings variability. Snider explains that despite expectations, margins have remained flat, and companies have offset pressures by raising prices, negotiating with suppliers, and improving internal efficiency, linking this resilience to productivity gains.

"The general consensus certainly that we have and that most of our clients have is that ai eventually will create a very large productivity boost to the economy that will create value for someone who that someone is is hard to answer and as i mentioned earlier what the market has been doing given that uncertainty over the last couple of years is really focusing on near term earnings it's been the semiconductors obviously it's been the hyper scalers to some extent power companies etc i think that is actually one of the key differences between this market and what happened 25 years ago during the dot com bubble where we saw valuations expand quite dramatically as investors tried to look forward and guess at the productivity gains and the economic benefits today investors are saying we saw what happened that time it's too hard and so what we're really going to focus on is the earnings today"

Ben Snider describes the market's current approach to AI, noting that while a significant productivity boost is expected, identifying who will benefit remains unclear. Snider contrasts this with the dot-com bubble, explaining that today's investors are prioritizing near-term earnings from sectors like semiconductors and hyper-scalers over speculative bets on future productivity gains, a more cautious strategy.

"I think the sentiment surveys have been getting less and less useful for predicting activity and that's true for the consumer sentiment surveys and the university of michigan in particular has been quite far out of line with what we've seen but it's actually true more broadly if you think back to 10 years ago 20 years ago just the importance of the ism print for markets and the importance now it's just nowhere close we still look at the business service and the consumer service because they have interesting detail they're very up to date but they just don't work as well as they used to or certainly were believed to so i would really focus more on the hard data the hard data would say that the consumer is doing okay consumer spending is certainly not super rapid maybe we'll get to you know 2 or so next year but i think consumer spending and real terms is likely to lag the overall economy"

Jan Hatzius points out that traditional sentiment surveys, like the University of Michigan's consumer sentiment index, are becoming less reliable indicators of economic activity. Hatzius advises focusing on "hard data" such as consumer spending, which, while not rapid, indicates the consumer is "doing okay" and is expected to lag overall economic growth.

"I view valuations through a physics lens as a measure of potential energy they tell you a lot about how much the market can move if there's a catalyst but they're not the catalyst themselves"

Ben Snider uses a physics analogy to describe market valuations, comparing them to potential energy. Snider explains that high valuations indicate the market's capacity for movement when a catalyst appears but do not themselves cause market shifts.

Resources

External Resources

Books

- "Larry Ellison, Not Elon Musk, Was The Tech Titan Who Defined 2025" - Mentioned as a linked article discussing tech titans.

Articles & Papers

- "Why 2026 Is Poised to Be Another Rocky Year for Global Trade" (Bloomberg) - Discussed as a linked article concerning global trade.

People

- Jan Hatzius - Chief Economist and Head of Research at Goldman Sachs, guest on the podcast.

- Ben Snider - Chief US Equity Strategist at Goldman Sachs, guest on the podcast.

Organizations & Institutions

- Goldman Sachs - Mentioned as the employer of the podcast guests.

- Bloomberg - Mentioned as the source of the podcast and linked articles.

Websites & Online Resources

- discord.gg/oddlots - Mentioned as a platform for conversation.

- omnystudio.com/listener - Mentioned for privacy information.

- bloomberg.com/subscriptions/oddlots - Mentioned for Odd Lots newsletter subscription.

- stello.com - Mentioned as the website for a glucose biosensor.

- discovercart.com - Mentioned as a resource for information on CAR T-cell therapy.

- lenovo.com - Mentioned as the source for deals on gaming computers.

- odoo.com - Mentioned as the website for an integrated business software platform.

- ibm.com - Mentioned in relation to AI and data access.

- duo.com - Mentioned as a resource for fishing resistance solutions.

Other Resources

- AI (Artificial Intelligence) - Discussed as a driver of economic growth, productivity, and market trends.

- CPI (Consumer Price Index) - Mentioned in relation to economic data and forecasts.

- S&P 500 - Referenced as a benchmark for stock market performance and earnings.

- Nasdaq - Mentioned as an outperforming stock market index.

- USMCA (United States-Mexico-Canada Agreement) - Mentioned in the context of global trade and tariffs.

- VAT (Value Added Tax) - Referenced as an example of tax increases impacting inflation.

- CAR T-cell therapy - Discussed as a personalized treatment for multiple myeloma.

- Multiple Myeloma - Mentioned as a diagnosis for which CAR T-cell therapy is an option.

- Glucose Biosensor - Discussed as a tool for tracking glucose levels.

- Fed (Federal Reserve) - Referenced in discussions about monetary policy and interest rates.

- ISM (Institute for Supply Management) - Mentioned as an economic indicator.

- GOP1 drugs - Mentioned as an example of a narrative used to justify stock investments.

- Rare Earths - Discussed in relation to China's control over supply.

- Zoler (omalizumab) - Mentioned as a prescription medication for food allergies.

- Genentech and Novartis - Mentioned as the companies behind the advertisement for Zoler.

- Abercrombie & Fitch - Mentioned for holiday clothing options.

- Palantir - Mentioned as a company building AI to assist workers.

- Lenovo Legion Tower 5 Gen 10 Gaming Desktop - Mentioned as a specific gaming computer.

- Lenovo LOQ Gaming Laptop - Mentioned as a specific gaming laptop.

- Repatha (evolocumab) - Mentioned as a medication to lower LDL cholesterol and reduce heart attack risk.

- Cisco Duo - Mentioned as a solution for fishing resistance.