Private Markets Face Liquidity Crisis Driven by Fear and Structural Shifts

The "Oven's Not On": Unpacking the Private Markets Freeze and the Hidden Costs of Conventional Wisdom

This conversation reveals a critical disconnect in the private markets: abundant capital and transactional opportunities are being stymied by a pervasive fear and a structural inertia, creating a liquidity crunch that's far more complex than simple dry powder availability. The core thesis is that while the ingredients for a thriving private market exist, the "oven" -- the willingness to transact and accept current market realities -- is not on. This analysis is crucial for institutional investors, fund managers, and anyone navigating the complexities of alternative assets, offering a strategic advantage by highlighting the non-obvious downstream effects of current market dynamics and the delayed payoffs that create durable competitive moats.

The Frozen Oven: Why Capital Isn't Flowing

The most prominent theme emerging from this year's review is the persistent issue of liquidity in private markets. Ted Seides, CEO of Capital Allocators, frames this not as a lack of capital or companies willing to transact, but as a fundamental breakdown in the transaction mechanism itself. The analogy of making a pizza, where all ingredients are present but the oven is off, vividly illustrates the situation. This isn't just a temporary blip; it's a symptom of deeper behavioral economics at play, driven by fear on both sides of the transaction.

General Partners (GPs) are hesitant to sell because they fear realizing returns that might not meet Limited Partner (LP) expectations, potentially jeopardizing future fundraises. They're holding onto assets longer, hoping for continued business growth to reach target multiples. LPs, on the other hand, are wary of over-allocating to illiquid assets, a lesson learned from the aftermath of 2008. This creates a bid-ask spread where neither buyers nor sellers are willing to compromise, effectively freezing the market.

"All investment either happens or doesn't happen because of greed and fear that's basic behavior you could say that private equity is frozen because of fear on the gp side of if they sell the returns aren't what their lps would have thought they're afraid they're not going to be able to raise their next fund."

-- Ted Seides

This dynamic has persisted, with expectations for exit activity consistently proving overly optimistic. The "deliberation day" impact on strategic buyers and ongoing economic uncertainty further dampen transaction volumes. The implication is that this liquidity issue will persist for several years, requiring a significant narrowing of the bid-ask spread that simply hasn't materialized yet. The pressure is on GPs, not just for performance, but for the survival of their business model -- raising the next fund and retaining talent.

The Shifting Sands of Allocation: Middle Market Contraction and Mega-Manager Dominance

Beyond liquidity, the structural evolution of the industry is reshaping the landscape, particularly for middle-market players. Institutions have significantly increased their private market allocations over the past two decades, often exceeding their target percentages. This means the market share for private equity in institutional portfolios is unlikely to grow further; instead, institutions are looking to trim these allocations back to target levels.

This creates a dual challenge for GPs. Firstly, the sheer number of private equity firms means many may have raised their last fund. Secondly, the growth in capital for the largest managers, fueled by sovereign wealth funds and the burgeoning private wealth channel, concentrates resources at the top. These mega-firms are better positioned to absorb the middle market's contraction, purchasing assets from smaller, growing sponsors.

"The private wealth channel is a whole different distribution mechanism. What those two things have in common is they benefit the largest firms; they don't benefit the middle market player. So the middle market, you have contraction, and then you have the expansion of the already large managers."

-- Ted Seides

This trend suggests a future where the middle market faces significant contraction, while the dominant players become even larger. The question for investors becomes whether median returns will compress to a point where they no longer meet expectations, leading to a scenario where LPs, while still appreciative of their specific managers, may sour on the asset class as a whole. The common refrain that "everyone playing is playing for the top quartile" underscores the intense competition and the high bar for success.

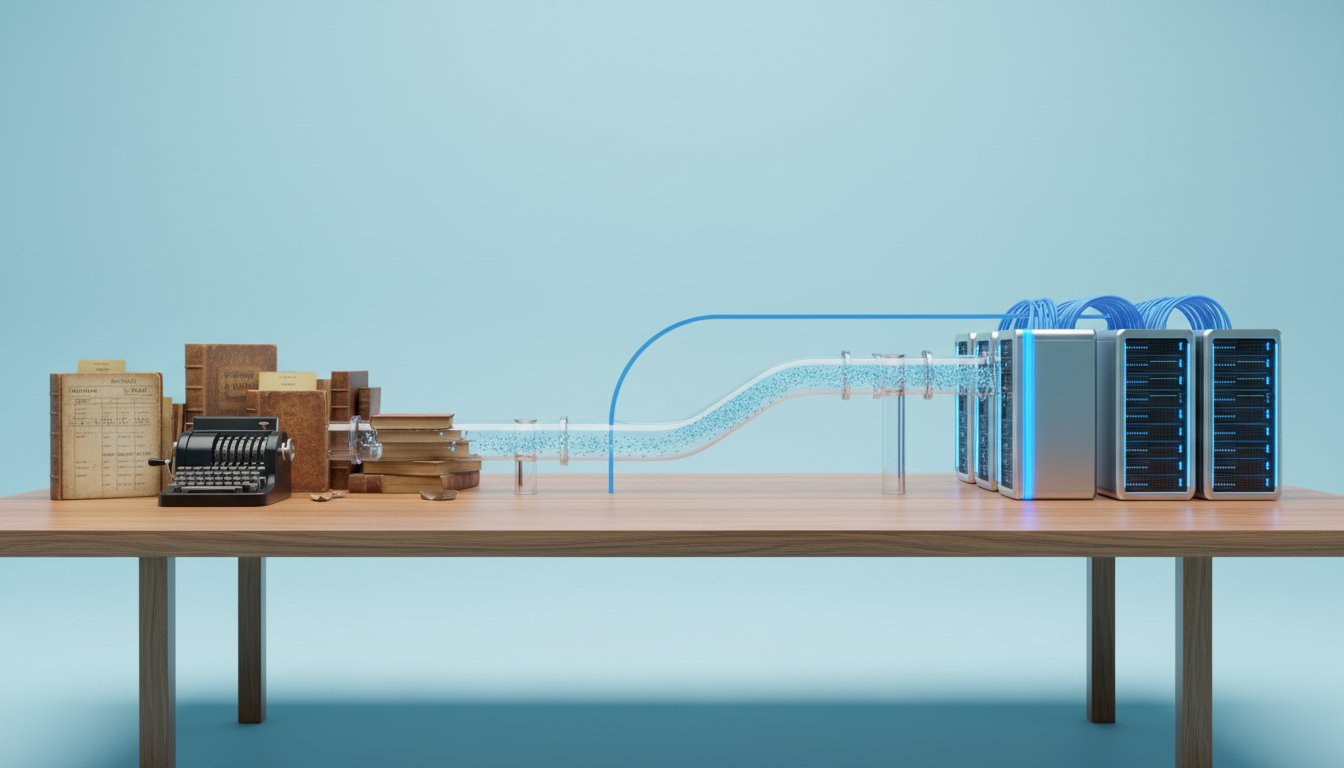

Venture Capital's Perpetual Private Status and the Growth Equity Conundrum

Venture capital, once primarily focused on early-stage investments, has expanded its scope to include growth equity. A significant structural shift is occurring where successful venture-backed companies are staying private for much longer. These companies, often highly profitable, can access capital and liquidity through private credit and secondary markets, bypassing traditional IPO exits.

This creates a substantial bucket of growth equity within institutional portfolios that is increasingly illiquid. While these are often great businesses, the inability to exit them through public markets or even robust secondary markets changes the dynamics for allocators. It means that new capital deployment into venture is constrained, as a larger portion of the portfolio is tied up in these long-duration, illiquid growth equity stakes. Allocations to top-tier early-stage venture managers remain highly sought after, but the overall picture for venture capital is one of increasing illiquidity and a need for new thinking around portfolio construction and exit strategies.

Actionable Takeaways

-

Immediate Action (Now - 3 Months):

- Re-evaluate LP Commitments: Review your private market commitments. If your target allocation is already met or exceeded, consider pausing new commitments until current positions begin to show distributions.

- Strengthen GP Relationships: Proactively engage with your General Partners. Understand their strategies for navigating the current liquidity crunch and their plans for future fundraises.

- Analyze Portfolio Construction: Assess the liquidity profile of your private market portfolio. Identify any significant concentrations in illiquid growth equity or buyout assets that may hinder future capital deployment.

-

Short-Term Investment (3 - 12 Months):

- Explore Secondary Markets: Investigate opportunities in the secondary market for private equity. This can provide liquidity for existing positions and potentially offer attractive entry points into mature funds.

- Develop "True Self" Assessment Frameworks: For allocators, refine your due diligence processes to move beyond a manager's "best self" and uncover their "true self" -- their operational realities and resilience. This requires deeper probing and relationship building.

- Enhance Data Analytics for Total Portfolio Approach: Invest in data infrastructure to better understand your total portfolio's risk and return drivers, moving beyond simple asset class betas to more nuanced risk management.

-

Long-Term Investment (12 - 18 Months+):

- Diversify Beyond Traditional PE: Consider the role of private credit and other alternative strategies that offer different liquidity profiles and return characteristics, particularly for wealth channels. However, be mindful of spread compression and anchor expectations to realistic returns.

- Prepare for Public Market Outperformance: As private markets eventually unlock, anticipate a wave of capital returning to public markets. Position your public equity strategies to capitalize on potential outperformance from active managers, as traditional asset class betas may not suffice for spending needs.

- Build Foundational Infrastructure: For managers and allocators alike, focus on building robust operational and team foundations. This "hard work" phase, often with delayed visible payoffs, creates durable competitive advantages and the capacity to adapt to future market shifts.