All Episodes

Disciplined Investing: Embracing Error for Rational Decision-Making

Embrace being wrong to master investing. Develop a rational framework for navigating uncertainty and gain an edge by fostering deep insight and constructive disagreement.

View Episode Notes →

Venture Capital: Distinguishing Skill from Speculation Amidst Hype

Distinguish true venture capital skill from luck by analyzing GP discipline through recent market data, especially during inflated valuations and challenging founder support periods.

View Episode Notes →

Embracing Illiquidity and Thematic Bets for Outperformance

Embrace illiquidity and concentrated bets in private markets to unlock significant alpha, as public markets offer a discounted return for their inherent luxury.

View Episode Notes →

Integrated Design Creates Durable Hedge Fund Competitive Advantage

Build a multi-strategy fund from first principles to gain an immense competitive advantage. This integrated, ground-up design unlocks resilience, scalability, and long-term payoffs, bypassing the inefficiencies of organic growth.

View Episode Notes →

Private Equity's Structural Crisis: Exit Bottleneck Drives Industry Transformation

Private equity faces a structural crisis as too many companies are owned and too few buyers exist, breaking the industry's growth model and forcing a fundamental transformation.

View Episode Notes →

Total Portfolio Approach Replaces Pro-Cyclical Strategic Asset Allocation

Discover how the Total Portfolio Approach stabilizes risk appetite and clarifies accountability, moving beyond traditional asset allocation's pro-cyclical pitfalls for sustained institutional success.

View Episode Notes →

Leveraging Endowments to Drive Differentiated Investment Strategy

Uncover how to weaponize your unique structural advantages, like long horizons and operational independence, to build a differentiated investment approach that transcends market cycles.

View Episode Notes →

Future Fund's Systemic Approach to Long-Term Capital Resilience

Build enduring wealth by embracing delayed payoffs and structural resilience. Discover how systemic thinking and a long-term horizon unlock opportunities others miss.

View Episode Notes →

Australian Alpha Generation Through Specialized Origination Capability

Discover how Australia's unique market structure and a deliberate strategy of building specialized capabilities create significant alpha opportunities, revealing hidden inefficiencies in seemingly "safe" markets.

View Episode Notes →

Credit Investing: Navigating Microcycles Through Technological Disruption

Credit investors must map industry debt against technological change, not just macro trends, to find hidden opportunities and avoid risks in volatile markets.

View Episode Notes →

Diameter Capital's All-Weather Strategy: Harnessing Volatility Through Deep Research

Turn market downturns into opportunities with an "all-weather" credit strategy that prioritizes deep research, liquidity, and flexibility. Discover how to harness volatility for enduring competitive advantage.

View Episode Notes →

Identifying Durable Edge and Structural Alpha in Investment Management

Identify managers with a durable edge beyond track records to capture market inefficiencies. Investing directly requires world-class teams or risks "tourist investor" status.

View Episode Notes →

Emerging Markets Investing Requires Multi-Asset Class, Horizontal Approach

Emerging markets demand a global, multi-asset approach; siloed strategies fail due to deal flow and volatility, making diversified firms essential for survival and growth.

View Episode Notes →

Apollo's Strategic Evolution: Integrated Alternatives Platform and Owner's Mindset

Apollo thrives by generating excess returns per unit of risk, transforming origination into its primary growth constraint and capitalizing on market dislocations with an owner's mindset.

View Episode Notes →

Total Portfolio Approach Requires Organizational Shift and AI Integration

Adopt a Total Portfolio Approach to integrate goals, risk, and liquidity, leveraging AI for predictive insights and personalized guidance beyond traditional asset allocation.

View Episode Notes →

Investor Identity Drives Returns Through Technology and Governance

Investor identity--capital, people, process, information--drives returns by dictating asset allocation, not the other way around. Understand your core capabilities to succeed.

View Episode Notes →

Transforming Finance: Empowering Asset Owners and Disrupting Rent-Seeking

The financial services industry captures 40% of after-tax profits, distorting incentives and hindering growth. Explore models that empower asset owners and redirect capital toward real economic productivity.

View Episode Notes →

Capital Group's Private Ownership Drives Long-Term Client Success

Capital Group thrives by prioritizing long-term client outcomes over quarterly pressures, fostering sustained investment and market share gains through a unique, privately held structure and collaborative "best ideas" investment system.

View Episode Notes →

Private Credit's Shift: Fairly Priced Market Requires Discipline

Private credit's shift from undiscovered to fairly priced demands disciplined credit standards, as obscured losses and "extend and pretend" strategies risk investor underestimation during downturns.

View Episode Notes →

Private Equity Capital Aggregation and Strategic Adaptation Imperatives

Private equity faces unprecedented capital concentration, forcing firms to build robust organizations and demonstrate genuine alpha to survive and thrive in a shifting market.

View Episode Notes →

Enduring Partnerships and Operational Expertise Drive Private Market Success

Private equity's success hinges on operational value creation and proactive deal sourcing, not just financial engineering, demanding deep industry expertise in a crowded market.

View Episode Notes →

Private Markets Face Liquidity Crisis Driven by Fear and Structural Shifts

Private markets face a liquidity crisis not from lack of capital, but from fear-driven stagnation, creating industry consolidation and impacting venture capital exits.

View Episode Notes →

Hedge Fund Tools Applied to Long-Only Equities for Scarce Asset Identification

Identify overlooked, high-value assets by applying sophisticated hedge fund tools to long-only equities, creating opportunities from market inefficiency.

View Episode Notes →

Identifying S-Curve Companies With Underappreciated Earnings Power

Invest in companies on the AI S-curve, leveraging competitive advantages to capture exponential earnings growth the market often misses.

View Episode Notes →

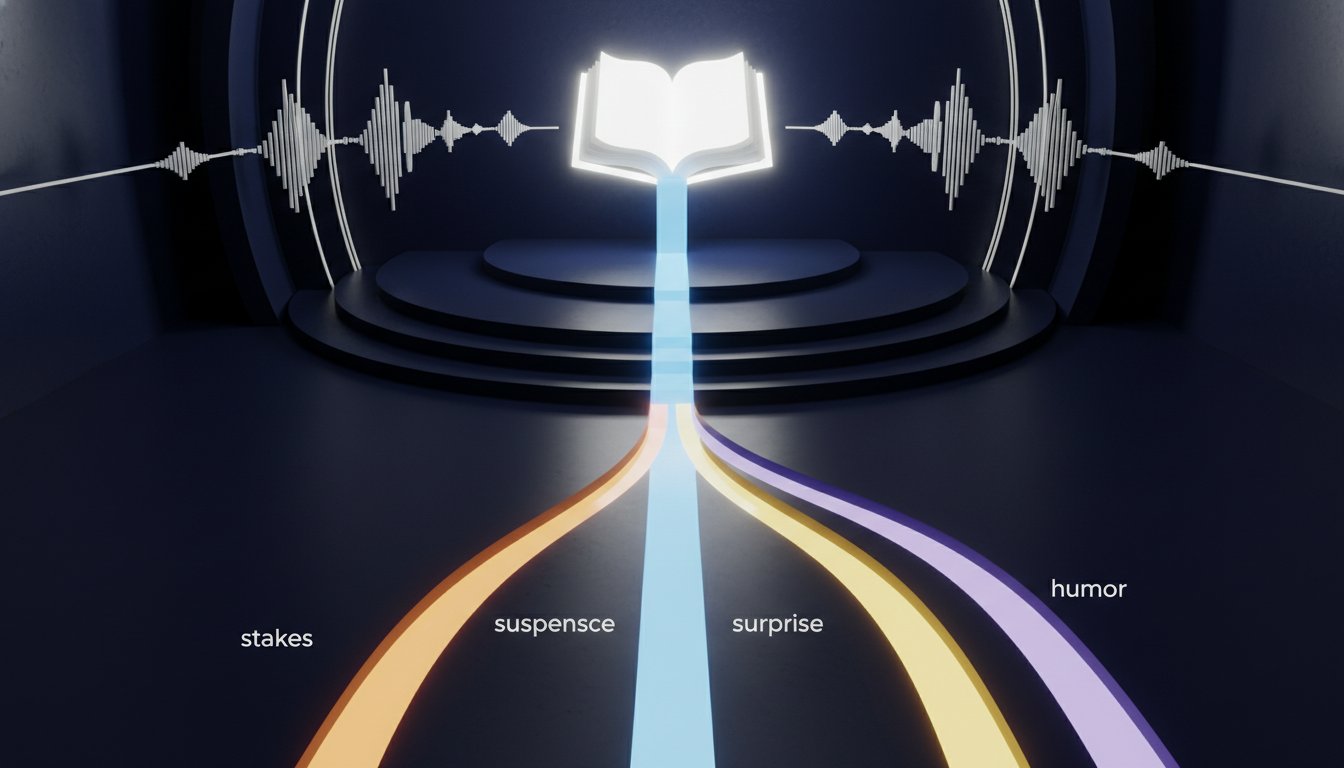

Mastering Storytelling for Impactful Business Performance

Transform dry topics into emotionally resonant experiences by shifting from presentation to performance, demanding preparation and audience engagement for deeper connection.

View Episode Notes →

Venture Capital Bifurcation and Capital-Intensive Innovation Shifts

Venture capital is bifurcating: subscale funds face extinction, while mega-funds become diversified asset managers, shifting focus from software to capital-intensive real assets and defense.

View Episode Notes →

Lux Capital's Contrarian Edge: Beyond Capital to Strategic Value

Venture capital thrives on contrarian theses and neglected areas, offering entrepreneurs strategic advantages beyond capital to anticipate inevitable technological shifts.

View Episode Notes →

Multifamily Real Estate: Long-Term Holds, Tax Advantages, and Predictable Income

Real estate offers superior after-tax returns through depreciation and income growth, outperforming liquid investments. This strategy prioritizes fixed-rate financing and landlord-friendly markets for predictable, tax-advantaged income.

View Episode Notes →

Exploiting Public Real Estate Valuation Asymmetry With Long-Term Horizon

Exploit market volatility to profit from disconnects between real estate stock prices and intrinsic value, especially in sectors facing temporary supply gluts.

View Episode Notes →

Democratizing Alternatives: Building Distribution and Proprietary Strategies

Individual investors gain institutional-grade access to alternative investments, leveling the playing field with fair fees and sophisticated structures.

View Episode Notes →

MDT's Transparent Decision Trees Drive All-Weather Quantitative Returns

Uncover MDT's "glass box" decision tree framework, blending machine learning with transparency to understand model drivers and achieve all-weather portfolio returns.

View Episode Notes →