Venture Capital Bifurcation and Capital-Intensive Innovation Shifts

TL;DR

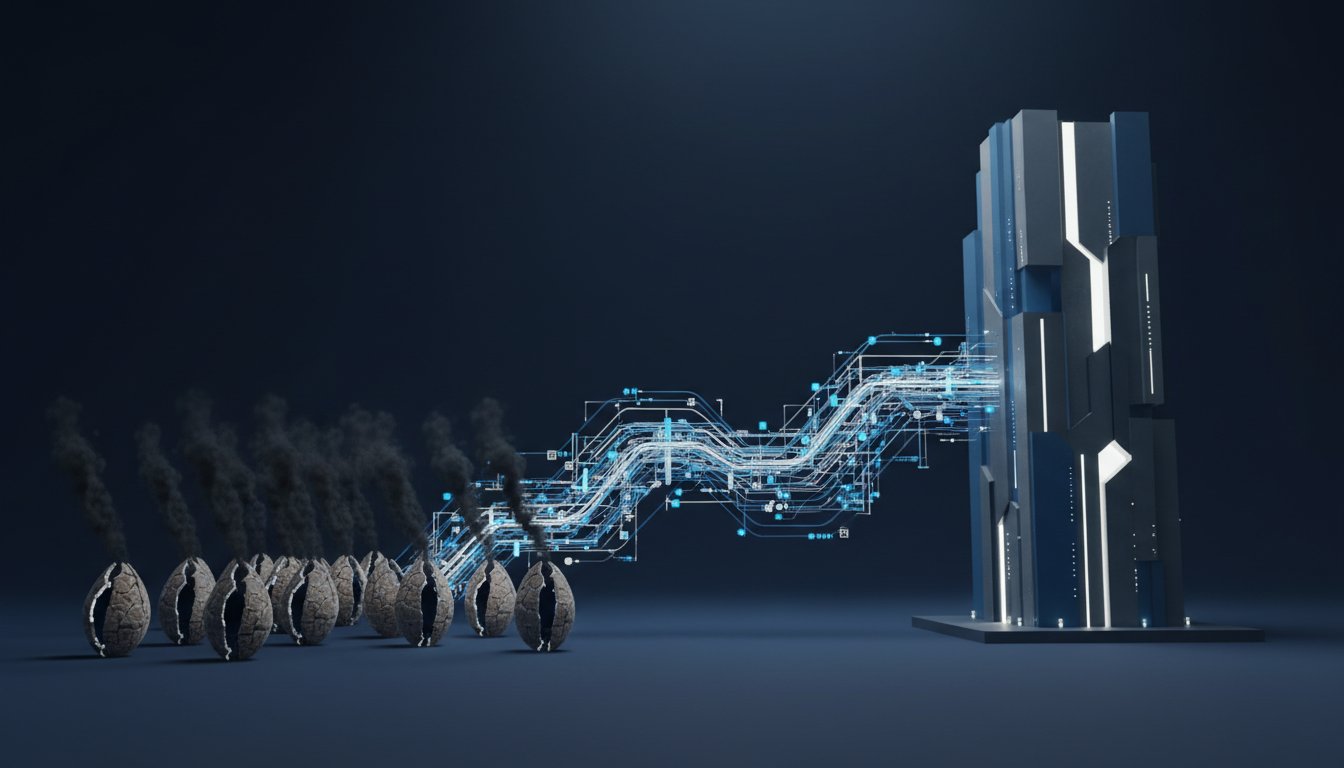

- Subscale venture funds face a 90% extinction rate due to insufficient reserves and over-investment, leading to down rounds and broken syndicates as follow-on capital dries up.

- Large venture capital firms are evolving into diversified asset managers, mirroring private equity giants by acquiring other firms and entering wealth management to build franchise value.

- The shift towards capital-intensive "venture real assets" like semiconductors and defense requires new funding models, challenging the traditional software-centric venture approach.

- Geopolitical risks, including counter-terrorism, nuclear proliferation, and AI in warfare, are acute, necessitating sustained investment in defense technology to maintain a competitive advantage.

- The "apex of absurdity" in AI spending, driven by massive hardware investment for training and inference, is unsustainable and will likely be disrupted by on-device processing and Google's competitive strategy.

- The future of scientific discovery lies in cloud-operated, robot-driven labs, decoupling researchers from physical constraints and accelerating knowledge generation in biology and materials.

- Second-order insights in venture involve identifying scarce datasets and complex systems, such as in biology and robotics, where innovation is less susceptible to capital floods.

- The increasing cost of missile defense systems, where a multi-million dollar interceptor counters a much cheaper projectile, highlights a critical technological arms race.

Deep Dive

The venture capital landscape is bifurcating into two distinct tiers: subscale "minnow" funds likely to face involuntary exits due to under-reserving and over-investment, and "mega" funds increasingly adopting public market strategies with vast AUM and diversified offerings. This shift, coupled with a move from internet-centric software to capital-intensive "real assets" like semiconductors and defense technology, creates a challenging environment where traditional venture returns become harder to achieve, incentivizing GPs to focus on AUM growth over founder-centric returns.

This dynamic has profound implications for both investors and founders. For Limited Partners (LPs), the increasing fund sizes mean that the "enemy of returns" is size itself, requiring massive aggregate market value to generate venture-typical cash-on-cash returns. This pressures mega-funds to play a different game, potentially leading some to go public or acquire other asset managers, fundamentally altering their alignment with early-stage investing. Founders seeking long-term partners may find it harder to engage with these larger funds, which are less able to scale with them from inception. Lux Capital, recognizing this, aims to be the first institutional investor, positioning themselves to benefit from the abundance of later-stage capital by de-risking companies before larger investors enter at lower costs of capital and higher valuations.

The nature of innovation is also evolving, moving beyond purely software-based businesses to more capital-intensive sectors. Josh Wolfe highlights the "apex of absurdity" in AI capital expenditure, where the cost of training massive models outpaces revenue growth, suggesting potential market corrections driven by on-device inference and the competitive threat from tech giants like Google and Apple offering integrated AI solutions. Brett McGurk, drawing from his public service background, emphasizes that geopolitical risks, from counter-terrorism to nuclear proliferation and AI's military applications, are acute and necessitate continuous investment in defense technology. Both see "directional arrows of progress" in areas like maintenance, advanced energy, and brain-computer interfaces, but also recognize the increasing complexity of global threats and the need for technological parity. The core lesson is that the venture ecosystem is shifting, demanding new strategies for sourcing, investing, and adding value, particularly in sectors requiring significant capital and navigating complex global dynamics.

Action Items

- Audit AI capex: Analyze the ratio of capital expenditure to revenue for 3-5 leading AI models to identify unsustainable spending trends.

- Track directional arrows of progress: Identify 3-5 emerging technology sectors with high capital inflow and assess potential for future capital collapse.

- Evaluate geopolitical risk impact: For 3-5 portfolio companies, assess exposure to geopolitical risks (e.g., counter-terrorism, nuclear proliferation, AI military applications) and develop mitigation strategies.

- Measure venture fund bifurcation: Analyze the AUM growth and strategy shifts of 5-10 large venture capital firms to understand their transition towards asset gathering.

- Assess on-device inference potential: For 3-5 AI applications, evaluate the feasibility of running inference locally on edge devices to reduce cloud dependency.

Key Quotes

"funds that are subscale i have predicted that you would see a 50 involuntary exit or extinction rate they're under reserved they've overinvested they have too many portfolio companies those companies are going to have to come back to the well and raise money and they're not going to be able to find investors there's going to be a lot of down rounds broken fund raises broken syndicates and those guys are going to go out of business and that large lp looked at me and laughed and said josh that's ridiculous it's not going to be 50 it's going to be 90"

Josh Wolfe predicts a significant number of smaller venture capital funds will fail. He attributes this to being undercapitalized, overextended with too many companies, and unable to raise subsequent funding rounds. Wolfe highlights that these "minnows" will face down rounds and broken syndicates, leading to their demise.

"you have this bifurcation that i call the minnows and the megas what i mean by that are a very long tail of subscale funds funds that are basically call it 500 million or under normally that was the fabric size for a venture fund but you have a lot of people that have been tourists in venture they benefited from an environment with low rates and an abundant amount of follow on capital"

Josh Wolfe describes a bifurcation in the venture capital industry between small, subscale funds ("minnows") and very large funds ("megas"). He notes that many smaller funds were populated by "tourists" who benefited from a low-interest-rate environment and readily available follow-on capital. Wolfe suggests these smaller funds are now vulnerable.

"the megas are very large funds andreessen horowitz lightspeed insight these are all funds run by great people but they're playing a different game now the fund size is increasing the total aum is approaching 80 to 100 billion under management they will take a page from the playbook of apollo blackstone carlyle tpg kkr all of whom when public during the 2009 to 2014 period"

Josh Wolfe observes that large venture capital firms, referred to as "megas," are increasing their fund sizes and adopting strategies similar to private equity firms like Apollo and Blackstone. He suggests these mega funds are moving towards becoming publicly traded entities, mirroring a trend seen in the private equity sector between 2009 and 2014. Wolfe believes this shift indicates a fundamental change in how these large venture firms operate.

"the defense space takes a lot of capital and andrele has raised several billion dollars now there are few companies that are competing with them there's a long tail of want to be next gen defense tech companies but andrele is the 800 pound gorilla in next gen prime you do need capital historically if you take rule of thumb of asset management sizes the enemy of performance firms get big they live off their management fees not their incentive fees"

Josh Wolfe points out that defense technology companies require substantial capital, citing Anduril as a prime example that has raised billions. He identifies Anduril as the dominant player in next-generation defense technology, with limited competition. Wolfe also touches on the historical challenge for large asset management firms, where growth can lead to a focus on management fees over performance-based incentive fees.

"we have companies today that are approaching trillion dollars if you're a realist about this fund size increasing is the enemy of returns the incentives for the founders who want to have great investors that can be early stage because i can scale with them over time that's harder to do when you have a much bigger fund"

Josh Wolfe argues that increasing fund size is detrimental to venture capital returns, especially as some companies approach trillion-dollar valuations. He explains that larger funds make it more challenging to provide early-stage support and scale with founders over time, which is a key incentive for founders seeking long-term investors. Wolfe suggests that the focus shifts away from optimal returns when funds become excessively large.

"the other way to think about it is about 30 year companies might be 10x a third might break even and then a third are basically total losers and you end up with a 3x cash on cash more capital intensive on average harder return capital there are exceptions and that's what everybody is trying to do is find the outlier exceptions where they can still use capital as a moat generate deca billions of enterprise value based on billions of revenue but few and far between companies that can do it"

Josh Wolfe outlines a typical venture capital portfolio return profile, where approximately one-third of companies yield a 10x return, another third break even, and the final third are complete losses, resulting in an overall 3x cash-on-cash return. He notes that these capital-intensive ventures make achieving high returns more difficult, and finding "outlier exceptions" that can generate massive enterprise value is rare. Wolfe emphasizes that the industry is constantly seeking these exceptional opportunities.

"the difference in this ecosystem between those minnows and the megas we like the megas we want them to be in the cap table we always say we're contrarian and we want people to agree with us later we want these funds to come in later at a lower cost of capital and higher valuation where we've assumed some risk we've killed those risks product people finance technology market and therefore created value and a later investor should come in and demand a lower quantum of return that is the way that we think about it"

Josh Wolfe explains Lux Capital's strategy in navigating the "minnows and megas" landscape by welcoming larger funds onto their cap tables. He states their contrarian approach is to have these larger investors join later, at a lower cost of capital and higher valuation, after Lux has de-risked the investment. Wolfe believes later-stage investors should expect lower returns due to the reduced risk they are undertaking.

"the other thing we're doing is hiring a young bench of investors who i'm 47 years old my youngest partner is 24 our youngest is lan jane she's a killer amazing network of young bright brilliant math olympiad winners in high school that have gone on to computer science at stanford and mit went to work at open ai at 19 years old and then at 22 years old are leaving and starting a company and our goal is to be the founding investor in those companies that is what has changed is go earlier benefit from this ecosystem where there's an abundance of later stage capital they're in many ways indexing across the venture landscape but it benefits you if you can be an early"

Josh Wolfe highlights Lux Capital's strategy of hiring young, talented investors and aiming to be the founding investor in companies started by emerging entrepreneurs. He notes the firm's commitment to going earlier in the investment cycle, leveraging the abundance of later-stage capital available. Wolfe believes this approach benefits from the venture landscape's overall growth and Lux's ability to identify promising early-stage opportunities.

"we are relatively small 40 plus people 10 on the investment team everybody has

Resources

External Resources

Books

- "The Memo: How the Allies Lost the Cold War, and How We Can Win It Back" by Josh Bolton - Mentioned as context for advice given to Brett McGurk on briefing President Bush.

Articles & Papers

- "Paper on large language models on small devices using flash memory" - Mentioned as the source of insight for the belief that inference will be on-device.

People

- Josh Wolfe - Partner at Lux Capital, co-founder, repeat guest, discussed venture industry state, directional arrows of progress, and AI.

- Brett McGurk - Partner at Lux Capital, former public servant, advised four U.S. presidents, discussed national security strategy, geopolitical risks, and the Middle East.

- Scott Besson - Mentioned in relation to guidance on the Treasury.

- Werner von Braun - Mentioned in relation to a commissioned study for JFK's moonshot speech.

- Alex Reeves - Mentioned as a founder backed by Josh Wolfe in a biotech company, later pursued computer science and AI at Meta.

- Mark - Mentioned in relation to acquiring Evolutionary Scale for Nobel Prize pursuit.

- Palmer Luckey - Mentioned as founder of Anduril, who started the company after selling Oculus to Meta.

- Howard Hughes - Mentioned as an example of a visionary individual who built major companies.

- Dennis Jacobs - Mentioned as a former law clerk for whom Brett McGurk clerked.

- Josh Bolton - Mentioned as Chief of Staff in 2006, giving advice to Brett McGurk.

- JFK - Mentioned in relation to his 1962 moonshot speech.

- Dan Kahneman - Mentioned as a friend and his views on belief formation.

- Elon Musk - Mentioned in relation to XAI.

Organizations & Institutions

- Lux Capital - Venture capital firm specializing in emerging science and technology, where Josh Wolfe and Brett McGurk are partners.

- Softbank - Mentioned as a firm that previously provided follow-on capital.

- Tiger - Mentioned as a firm that previously provided follow-on capital.

- Andreessen Horowitz - Mentioned as a large venture capital fund.

- Lightspeed - Mentioned as a large venture capital fund.

- Insight - Mentioned as a large venture capital fund.

- Apollo - Mentioned as a firm that went public during 2009-2014.

- Blackstone - Mentioned as a firm that went public during 2009-2014.

- Carlyle - Mentioned as a firm that went public during 2009-2014.

- TPG - Mentioned as a firm that went public during 2009-2014.

- General Atlantic - Mentioned as a firm that may go public.

- General Catalyst - Mentioned as a firm that may go public.

- Fidelity - Mentioned as an example of a firm that large venture capital funds are becoming like.

- Snowflake - Mentioned as a successful software business that raised billions.

- Datadog - Mentioned as a successful software business that raised billions.

- Databricks - Mentioned as a successful software business that raised billions.

- Anduril - Mentioned as a company Lux Capital invested in early, and as an example of a defense tech company.

- Nvidia - Mentioned in relation to chips used for AI training and inference.

- SK Hynix - Mentioned as a memory chip manufacturer.

- Samsung - Mentioned as a memory chip manufacturer.

- Micron - Mentioned as a memory chip manufacturer.

- OpenAI - Mentioned in relation to large language models and revenue growth.

- Google - Mentioned in relation to Gemini, its AI model, and its potential to undercut paid AI services.

- Microsoft - Mentioned in relation to its role in the OpenAI revenue structure.

- Meta - Mentioned in relation to its products and potential for AI integration.

- Apple - Mentioned in relation to its ecosystem and potential AI integration.

- Amazon - Mentioned as a cloud provider and a company that inspires trust.

- Anthropic - Mentioned in relation to its AI model Claude and revenue growth.

- Evolutionary Scale - Mentioned as a company Alex Reeves spun out, focused on AI and biology.

- DeepMind - Mentioned in relation to protein structure prediction and competition with Evolutionary Scale.

- Broad Institute - Mentioned in relation to Eric Lander.

- CZI - Mentioned as acquiring Evolutionary Scale.

- Kerrion - Mentioned as a successful company focused on nuclear waste.

- Control Labs - Mentioned as an investment that was acquired by Meta.

- Spacex - Mentioned as a company where a founder of Reflect Orbital previously worked.

- Blue Origin - Mentioned in relation to competition in space.

- Darpa - Mentioned as a source of advanced technology development.

- Pentagon - Mentioned as a source of advanced technology development.

- General Dynamics - Mentioned as an example of a company that could be built by a visionary.

- General Atomics - Mentioned as an example of a company that could be built by a visionary.

- WCM Investment Management - Mentioned as a sponsor of the podcast.

- Old Dwell Labs - Mentioned as a provider of software for allocators.

Tools & Software

- Grok - Mentioned as a large language model.

- Gemini - Mentioned as a large language model.

- Perplexity - Mentioned as a large language model.

- Chat GPT - Mentioned as a large language model.

- Claude - Mentioned as a large language model.

- Fireflies - Mentioned as a tool for recording Zoom calls.

- Granola - Mentioned as a tool for recording.

- Otter - Mentioned as a tool for recording.

- Garageband - Mentioned as music production software.

- Pro Tools - Mentioned as music production software.

- Logic - Mentioned as music production software.

- Amazon Web Services (AWS) - Mentioned as a cloud computing provider.

- Azure - Mentioned as a cloud computing provider.

- Google Cloud - Mentioned as a cloud computing provider.

- Owl - Mentioned as software for allocators.

Podcasts & Audio

- Capital Allocators - The podcast where this conversation took place.

Other Resources

- Venture Capital - Discussed as an industry undergoing significant shifts.

- AI (Artificial Intelligence) - Discussed as a major area of investment and progress.

- Sci Tech Diplomacy - Mentioned as a concept for diplomatic vectors involving technology.

- Counter Terrorism - Mentioned as a geopolitical risk.

- Nuclear Risk - Mentioned as a geopolitical risk.

- Military Applications of AI - Mentioned as a national security agenda item.

- IMEC (India-Middle East-Europe Corridor) - Mentioned as an initiative for trade and technology transport.

- Space - Discussed as a domain of geopolitical contestation and opportunity.

- Directional Arrows of Progress - A framework used by Josh Wolfe to identify inevitable trends.

- Maintenance - Discussed as a growing area of demand in capital allocation.

- Nuclear Waste - Mentioned as an unsolved problem with nuclear energy.

- Brain Machine Interfaces - Mentioned as a directional arrow of progress.

- Automated Labs - Mentioned as the future of scientific research.

- Sci-Fi - Mentioned as an inspiration for innovation.

- Subterranean Warfare - Mentioned as a domain of future focus.

- Private Credit - Mentioned as a potentially overdone area in capital markets.

- Secondaries - Mentioned as a potentially strong area in capital markets.

- Horseshoe Theory - Mentioned in relation to domestic political polarization.

- Information Vector - Discussed in relation to the weaponization of information.

- Tiramisu - Mentioned as a culinary mystery.