Identifying S-Curve Companies With Underappreciated Earnings Power

In a landscape often dominated by immediate gratification and short-term gains, Alex Sacerdote, founder of Whale Rock Capital, offers a compelling counter-narrative through his investment framework. This conversation reveals the hidden consequences of conventional thinking, particularly in technology investing, highlighting how a deep understanding of "S-curves," competitive advantages, and underappreciated earnings power can unlock significant, long-term value. Those who grasp these dynamics will gain a crucial edge by identifying companies poised for exponential growth, even when they appear expensive by traditional metrics. This framework is essential for investors seeking to navigate the complexities of technological innovation and build durable wealth, moving beyond the noise of quarterly reports to focus on the fundamental drivers of multi-decade success.

The S-Curve Inflection: Riding the Wave of Adoption

The core of Sacerdote's investment philosophy lies in identifying and capitalizing on technological "S-curves." These are periods of rapid adoption and growth that follow initial barriers to entry. He emphasizes that understanding this curve is not just about spotting a trend, but about mapping its trajectory and duration. The real advantage, he argues, comes from investing early in this inflection point, where exponential unit growth often leads to exponential earnings growth that the market struggles to comprehend.

"This S-curve framework gives you insight into how big the market can be where it might be in four or five years. It's like a map into the future."

This perspective challenges the common investor tendency to focus on predictable, linear growth. Instead, Sacerdote advocates for a forward-looking approach that anticipates the non-linear acceleration of successful technologies. For instance, he saw the potential in cloud computing not just as a server in a warehouse, but as a comprehensive ecosystem encompassing networking, storage, and software. By sizing the market at $300 billion (initially factoring in deflationary aspects) and then realizing it was closer to $600 billion with sustained growth, Whale Rock was able to position itself for a multi-year, exponential payoff. This requires a deep dive into the total addressable market and a willingness to project growth far beyond the current year's earnings.

Competitive Moats in the Digital Age: Why Some Companies Win Big

Beyond identifying the right trend, Sacerdote stresses the critical importance of a powerful competitive advantage. In the digital world, these advantages can be particularly potent and accrue rapidly. He points to network effects, where a platform becomes more valuable as more users join (like LinkedIn), or the dominance of an operating system. For Whale Rock, identifying these "moats" is paramount.

"The thing about the digital world is some of these competitive advantages can be much stronger than in the offline world and accrue faster."

Consider the example of AI infrastructure. Sacerdote's team recognized that regardless of which foundational AI models ultimately win, the demand for underlying infrastructure -- compute, GPUs, networking -- would be immense. This provided a clear, albeit complex, pathway to identifying winners. Companies like NVIDIA, with their critical intellectual property in GPUs, exemplify this. By investing in NVIDIA right after the ChatGPT launch, at what he describes as "four times what we're going to do this year," Whale Rock capitalized on the understanding that the infrastructure layer would be essential, no matter the eventual application winners. This foresight, driven by a deep understanding of technological dependencies, creates a durable advantage.

Underappreciated Earnings Power: The Exponential Payoff

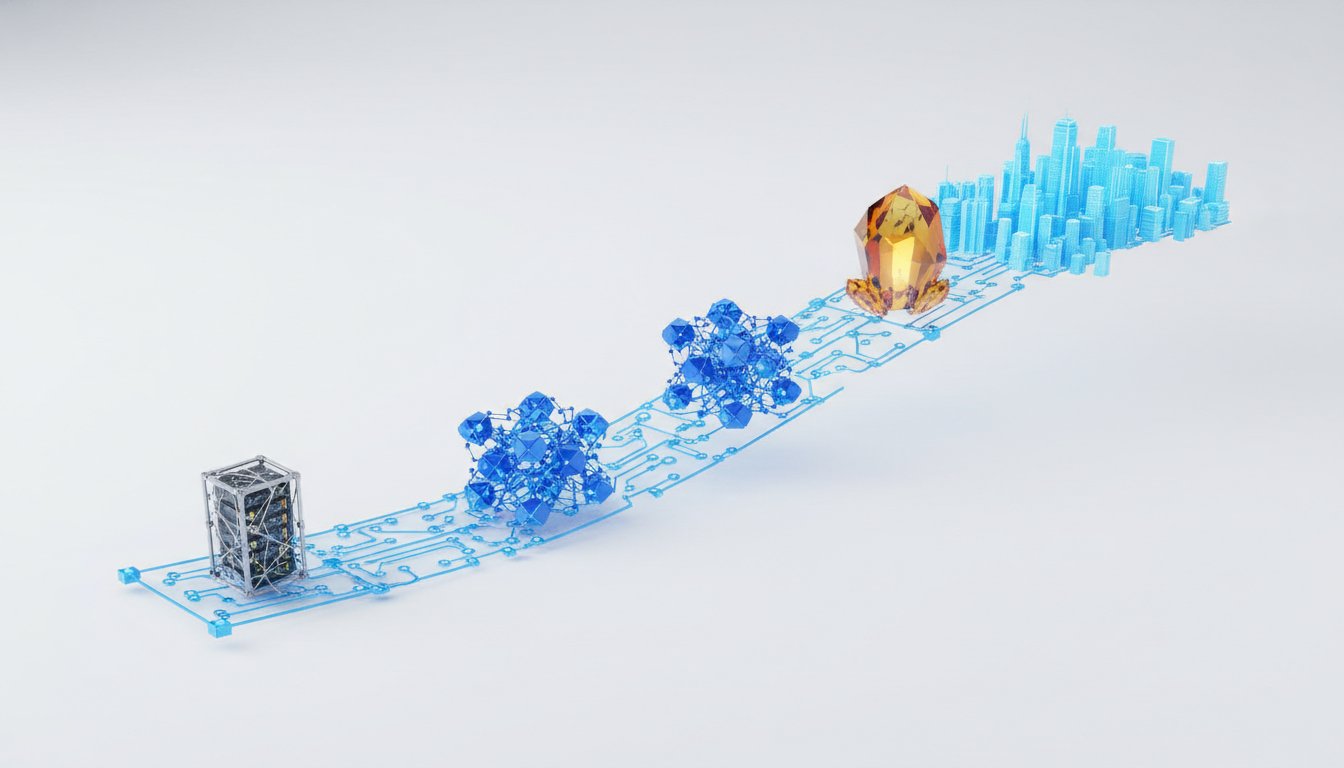

The confluence of a strong S-curve and a robust competitive advantage leads to what Sacerdote terms "underappreciated earnings power." This is where companies experience earnings growth that is not linear but exponential, often catching the market off guard. Traditional valuation metrics, focused on current or near-term earnings, can therefore appear deceptively high for these companies.

"If you can get those two things right, very often you can buy amazing companies at extremely low multiples."

Tesla serves as a prime example. By investing in late 2019 and 2020, as the electric vehicle (EV) S-curve took off, Whale Rock saw the potential for significant unit growth and margin expansion. They calculated that Tesla could achieve substantial earnings at a cost structure that was well-understood, leading them to buy at a multiple that was "literally four times the earnings they did three years later." This highlights a crucial insight: what appears expensive on a P/E ratio today can be incredibly cheap when viewed through the lens of future exponential earnings growth, especially when that growth is underpinned by a strong competitive advantage and a massive addressable market. This requires investors to develop the mental models to think exponentially, a skill that is difficult but rewarding.

Navigating the AI Stack: Infrastructure as the Safest Bet

The current AI revolution presents a complex ecosystem, but Sacerdote's framework provides a clear lens through which to view it. He breaks down the AI stack into infrastructure, cloud delivery, foundational models, and applications. His thesis prioritizes the infrastructure layer, arguing it's the first to inflect and the safest bet because it's independent of which specific AI models or applications ultimately dominate.

"Our thesis was invest in the infrastructure layer first because that's always the first to inflect on the S curve. It also, no matter who wins above, we know we're going to need tremendous amounts of AI infrastructure."

This strategic positioning is crucial. While the application layer is exciting, it's also highly speculative, akin to the early days of the internet with numerous search engines vying for dominance. By focusing on the foundational compute and networking required for AI, Whale Rock can benefit from the overall growth of the AI S-curve, regardless of the specific end-user applications. Furthermore, Sacerdote notes that the infrastructure layer is more "analyzable" in terms of identifying potential winners, especially given the known demand for GPUs and networking. He also points to the evolving nature of AI, particularly the increasing complexity of inference (where models "think" and "reason"), as a further tailwind for the infrastructure providers, suggesting the AI capex boom is far from over.

Actionable Takeaways

- Embrace the S-Curve Mentality: Actively seek out and analyze emerging technological trends that exhibit the characteristics of an S-curve, focusing on the inflection point of rapid adoption. (Immediate & Ongoing)

- Identify Durable Competitive Advantages: Prioritize companies with strong, defensible moats, such as network effects, proprietary technology, or significant scale, that can withstand competitive pressures. (Immediate & Ongoing)

- Think Exponentially About Earnings: Look beyond current P/E ratios and forecast future earnings growth based on the combination of S-curve adoption and competitive advantage. Be comfortable investing in companies that appear expensive on traditional metrics but are poised for exponential earnings expansion. (Ongoing Investment Process)

- Prioritize Infrastructure in Emerging Tech: For transformative technologies like AI, focus on the foundational infrastructure layer, which is likely to benefit regardless of which specific applications or models ultimately succeed. (Next 6-12 Months)

- Develop a "Learning Machine": Implement a rigorous, primary research-driven approach, involving extensive meetings with management teams, suppliers, and customers, to continuously refine your understanding of evolving technological landscapes. (Ongoing Investment Process)

- Consider Late-Stage Private Investments: Given that companies are staying private longer, develop the capability to analyze and invest in late-stage private companies that would have historically gone public earlier, using the same S-curve framework. (Next 12-18 Months)

- Maintain Humility Through Volatility: Recognize that technology investing involves inherent volatility. Stick to your well-researched process and maintain humility during both market highs and lows to avoid emotional decision-making. (Ongoing)