2026 Credit Cycle: Stimulus, AI Fueling Issuance Before Burnout

TL;DR

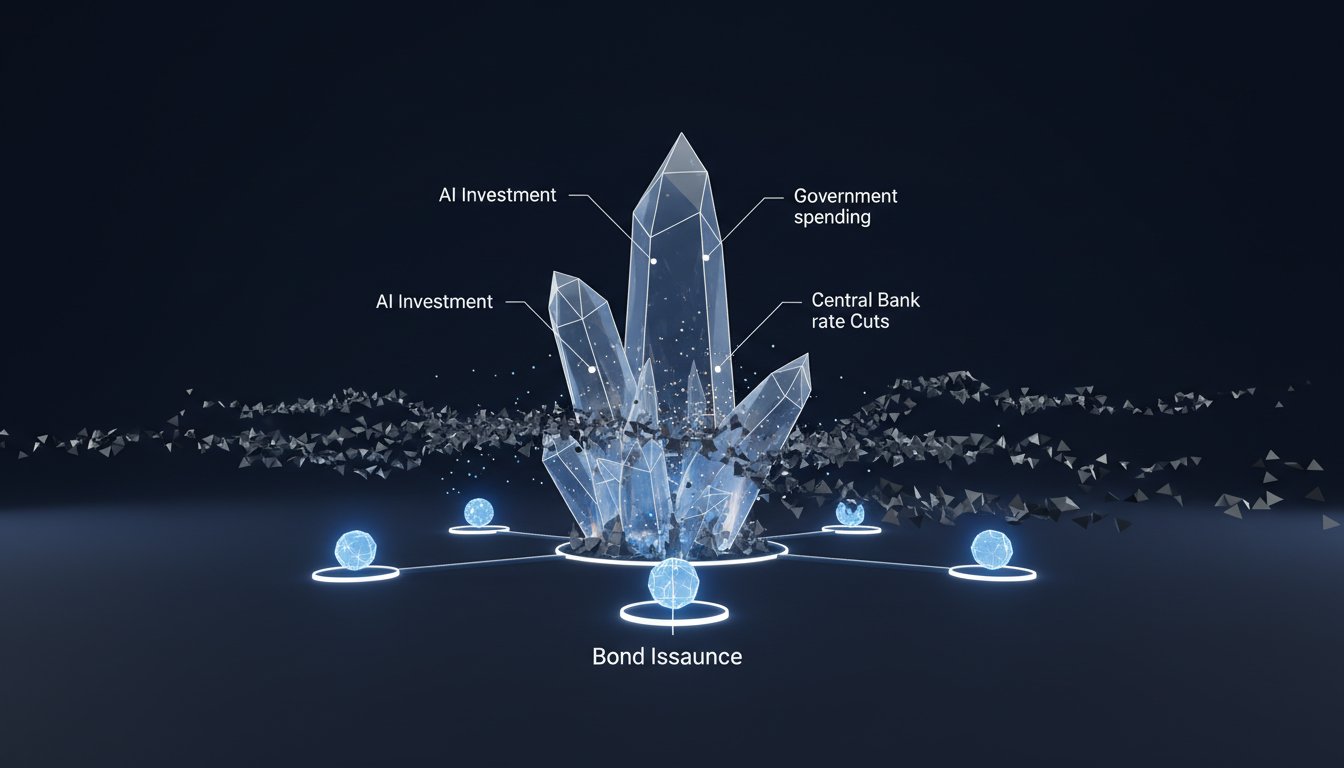

- A stimulative backdrop of central bank rate cuts, government spending, and AI investment will spur corporate risk-taking, causing the credit cycle to burn hotter before it burns out in 2026.

- Significant US investment-grade corporate bond issuance, projected to exceed $1 trillion, will necessitate wider spreads to absorb supply, even with healthy underlying demand.

- European and Asian investment-grade credit, along with global high yield, are forecast to outperform US investment grade due to relatively lower issuance levels.

- Positioning on the maturity curve, particularly in five- to 10-year corporate bonds in the US and Europe, offers the best risk-reward due to steepening credit curves.

- Single name and sector dispersion will remain critical themes, requiring granular analysis to navigate opportunities and risks within the credit market.

- A recession poses the most significant risk, which would widen spreads and invalidate the expectation of high yield outperforming investment grade.

Deep Dive

Morgan Stanley anticipates a credit cycle in 2026 that will intensify before resolving, driven by a confluence of stimulative economic policies and a significant AI-fueled investment cycle. This environment is expected to encourage greater corporate risk-taking, leading to aggressive issuance and capital expenditures that will test market capacity. The core implication is that credit investors must prepare for a period of heightened activity and potential spread widening, particularly in the U.S. investment-grade market, which will likely face the brunt of this supply surge.

The outlook for 2026 draws parallels to periods like 2005 and 1997-1998, characterized by substantial capital expenditure, merger activity, and specific interest rate and unemployment levels. These historical comparisons suggest two potential narratives: one where consumer struggles are offset by broad market support from forces like AI spending, and another where a transformative technology like AI accelerates market confidence and activity. Central to this dynamic is corporate bond issuance, projected to rise significantly, especially in U.S. investment grade, exceeding $1 trillion. This surge in supply, driven by AI investment, broader capital expenditures, and M&A, necessitates wider spreads for market adjustment, even with underlying credit demand remaining robust due to high yields and a resilient economy.

Consequently, regional differences in issuance levels are expected to create performance disparities. European and Asian investment grade, along with global high yield, are forecast to outperform U.S. investment grade, collectively targeting total returns of 4-6%, which would lag U.S. equities but outpace cash. Within these markets, selectivity will be crucial, with single-name and sector dispersion remaining key themes. Positioning on the yield curve, specifically in the five- to 10-year maturity range for U.S. and European corporate bonds, is identified as offering the best risk-reward. The primary risk remains a recession, which would lead to wider spreads and invalidate the expectation of high-yield outperformance. A milder risk involves even stronger corporate aggression and supply, creating conditions akin to late 1998-1999, where U.S. investment-grade spreads were significantly wider despite a strong economy and rising equity markets.

The critical takeaway is that the credit cycle's dynamics in 2026 will be shaped by an unusual combination of monetary easing, fiscal spending, and a transformative technological investment wave. This will drive a substantial increase in corporate bond supply, particularly in the U.S., necessitating spread adjustments and creating opportunities for outperformance in less issuance-heavy regions and specific maturity segments. Investors must navigate these supply pressures and potential economic risks, recognizing that historical parallels suggest a period of intense activity before the cycle eventually burns out.

Action Items

- Analyze 2026 credit cycle: Identify 3-5 key drivers (e.g., AI spending, CapEx, government stimulus) to forecast potential "hotter burn" before burnout.

- Measure US investment grade issuance: Track projected $1 trillion net issuance against historical data to assess spread widening impact.

- Evaluate regional credit performance: Compare forecasted 4-6% total returns for European/Asian IG and global HY against US IG to inform portfolio allocation.

- Assess maturity curve impact: Analyze carry and roll down opportunities for corporate bonds between 5-10 year maturities in US and Europe.

- Model recessionary risk: Quantify potential spread widening and yield impact under a recessionary scenario for global credit markets.

Key Quotes

"Surely, it can't go on like this." That phrase is probably coming up a lot as global credit investors sit down and plan for 2026. Credit spreads are sitting at 25-year highs in the US and Asia. Issuance and corporate activity are increasingly aggressive. Corporate CapEx is surging. Signs of pressure are clear in the lowest-rated parts of the market. And credit investors are trained to worry. Aren't all of these and more signs that a credit cycle is starting to crack under its own weight?

Andrew Sheets highlights that despite current market conditions, including tight credit spreads and aggressive corporate activity, many investors are questioning the sustainability of the situation. Sheets notes that credit investors are conditioned to anticipate problems, and the current environment presents numerous indicators that typically signal an impending credit cycle downturn.

"Not quite yet, according to our views here at Morgan Stanley. Instead, we think that 2026 brings a credit cycle that burns hotter before it burns out. The reason is partly due to an unusually stimulative backdrop. Central banks are cutting interest rates, governments are spending more money, and regulatory policy is easing. All of that, alongside maybe the largest investment cycle in a generation around artificial intelligence, should spur more risk-taking from the corporate sector that has the capacity to do so."

Andrew Sheets explains Morgan Stanley's contrarian view that the credit cycle is not yet cracking. Sheets attributes this to a confluence of stimulative factors, including central bank rate cuts, government spending, and easing regulations. Sheets also points to the significant investment cycle driven by artificial intelligence as a catalyst for increased corporate risk-taking.

"In turn, we think the playbook for credit is going to look a lot like 2005 or 1997-1998. Both periods saw levels of capital expenditure, merger activity, interest rates, and an unemployment rate that are pretty similar to what Morgan Stanley expects next year."

Andrew Sheets draws parallels between the projected 2026 credit market environment and historical periods like 2005 and 1997-1998. Sheets notes that these past periods shared similar economic indicators, such as capital expenditure, merger activity, interest rates, and unemployment rates, to those anticipated for the upcoming year. This comparison suggests a potential for similar market dynamics and investor strategies.

"Corporate bond issuance, we think, will be central to how this resolves itself. This is a strong regional theme and a key driver of our views across US, European, and Asia credit. We forecast net issuance to rise significantly in US investment grade, up over 60 percent versus 2025, to a total of around $1 trillion. That rise is powered by a continued increase in technology spending to fund AI, as well as a broader increase in capital expenditure and merger activity."

Andrew Sheets emphasizes the critical role of corporate bond issuance in shaping the credit market's trajectory. Sheets forecasts a substantial increase in US investment-grade issuance, projecting it to exceed 60% compared to 2025 and reach approximately $1 trillion. Sheets attributes this surge to increased technology spending for AI, alongside broader capital expenditures and merger activities.

"We think this story is a bit better in other areas and regions that have less relative issuance, including European and Asian investment grade and global high yield. They all out-perform US investment grade on our forecast. In total returns, we think that all of these markets produce a return of around 4 to 6%."

Andrew Sheets suggests that certain credit markets may offer more favorable prospects due to lower relative issuance levels. Sheets specifically highlights European and Asian investment grade, as well as global high yield, predicting they will outperform US investment grade. Sheets forecasts total returns for these markets to be in the range of 4% to 6%.

"The most significant risk for global credit remains recession, which we think would argue for wider spreads on both economic grounds, but also through weaker demand, as yields would fall. It wouldn't mean that our spread forecasts are too optimistic and that our expectation that high yield out-performs investment grade would be wrong."

Andrew Sheets identifies recession as the primary risk to the global credit market. Sheets explains that a recession would likely lead to wider credit spreads due to economic weakness and reduced demand, causing yields to decline. Sheets further notes that such a scenario would invalidate the current forecasts for spreads and the expectation of high yield outperforming investment grade.

Resources

External Resources

Podcasts & Audio

- Thoughts on the Market - Discussed as the platform for an outlook on global credit markets in 2026.

People

- Andrew Sheets - Head of Corporate Credit Research at Morgan Stanley, featured speaker on credit cycle outlook.

Organizations & Institutions

- Morgan Stanley - Mentioned as the source of research and outlook on global credit markets.