Bank Consolidation, Credit Caps, and Europe's Geopolitical Autonomy

TL;DR

- Bank consolidation has reduced the number of institutions from 18,000 to 4,300, leading to increased efficiency, better profitability, and higher capital levels across the industry.

- A proposed 10% credit card rate cap would significantly impact bank profitability and lead to credit origination cessation for lower-FICO score customers, forcing them to higher-cost alternatives.

- Europe's geopolitical autonomy is challenged by an "imperial vision" from the US, requiring a reinvention of international relations beyond old norms to avoid a "law of the jungle" scenario.

- Loan growth for the banking industry has accelerated from 0-1% to 5-6% year-over-year, indicating improved economic activity and potential for increased competition for deposits by next year.

- Citi's transition from a turnaround to a growth story hinges on expanding its undersized US consumer and global wealth management businesses, which are significantly behind competitors like Bank of America and JPMorgan.

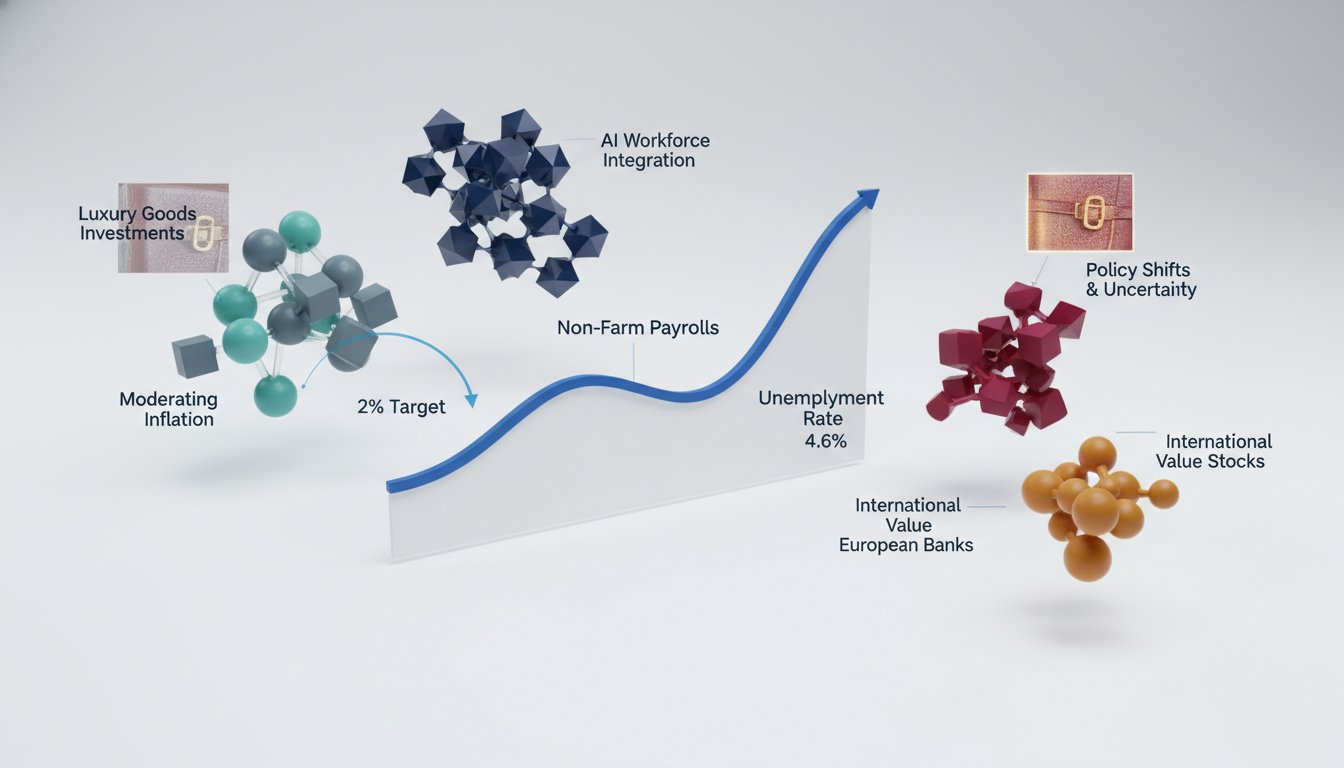

- The US economy is experiencing GDP growth driven by increased investment and total factor productivity, rather than employment gains, resembling a 19th-century economic model.

- The consumer remains resilient, comprising 65-70% of the economy, but is unlikely to be the primary driver of disproportionate future growth despite past resilience through COVID and higher interest rates.

Deep Dive

The financial industry has consolidated significantly, leading to increased efficiency and profitability, with banks now holding higher capital levels than in previous decades. This consolidation, driven by national interstate banking legislation, has resulted in fewer but larger and more efficient institutions, positioning the industry for record profitability. Concurrently, loan growth is accelerating, shifting from a near-stagnant 0-1% year-over-year at the start of 2025 to a projected 5-6% by early 2026, indicating a stronger demand for credit.

The banking sector's profitability is robust, but proposed credit card rate caps, such as a potential 10% annual cap, pose a significant risk. Such caps would disproportionately harm the ability of banks to lend to lower-credit-score customers, as the cost of funding and expected credit losses would outstrip revenue, potentially forcing these customers to seek higher-cost alternatives. This would not only impact bank profitability but also stifle consumer spending and broader economic activity by restricting access to credit for those who need it most.

Meanwhile, Europe faces a critical juncture, with its foreign policy posture described as one of consistent submission, particularly in its interactions with an assertive United States under a Trump administration. This dynamic, characterized by what is termed an "imperial vision" from the U.S., risks reinforcing a colonial dynamic if Europe merely accommodates rather than strategically engages. The professor argues that the old world order has ended, and Europe must reinvent its approach to power, moving beyond a mere "survival of the fittest" model to one constrained by laws and institutions, though the existing frameworks of the past are no longer sufficient. The capacity for Europe to assert its interests, such as in the case of Greenland, hinges on developing a stronger backbone, which requires acknowledging the shift in global dynamics and mentally preparing for a new era of international relations, potentially supported by material conditions that are currently underutilized.

The economic outlook suggests continued GDP growth driven by investment and total factor productivity, rather than increased employment, leading to a declining labor share of income. While the consumer remains resilient and a significant portion of the economy, their contribution to marginal growth is expected to diminish. The Federal Reserve's approach to interest rates is increasingly influenced by political considerations rather than solely economic fundamentals, with potential future rate cuts contingent on shifts in Fed leadership and political pressures. Furthermore, the skilled trades sector faces a critical shortage of mechanics, prompting companies like Ford to offer incentives such as free tools and merchandise to attract and retain talent, highlighting a growing demand for vocational skills.

Action Items

- Audit European geopolitical strategy: Analyze 3 key instances of "submission" to identify systemic drivers of perceived weakness.

- Evaluate US bank consolidation trends: Track asset growth and market share for the top 5 largest banks over the last 20 years.

- Measure consumer spending resilience: Calculate correlation between interest rate changes and retail sales for 3-5 economic sectors.

- Develop framework for assessing geopolitical autonomy: Define 5 measurable criteria for evaluating European self-reliance in foreign policy.

- Analyze credit card rate cap impact: Model potential profit reduction for top 3 credit card issuers under a 10% annual cap.

Key Quotes

"So the consolidation that was brought on by national interstate banking under the Clinton administration when they signed that law has really led to the consolidation. As a result, what has happened is that the banks have become more efficient, which has led to much better profitability, while at the same time their capital levels are meaningfully higher than they were 20, 30 years ago and, of course, since the financial crisis."

Gerard Cassidy explains that the banking industry has undergone significant consolidation due to legislation like national interstate banking. This consolidation, according to Cassidy, has resulted in banks becoming more efficient and profitable, while also strengthening their capital reserves compared to previous decades.

"Profitability would be impacted significantly if rates came down for 10% for a year, especially for the credit card lenders, because when you think about it, let's assume the cost of funding is 3 to 4%. Credit losses for the higher-risk credit customers, those are the lower FICO score, they run anywhere from 5 to 7%. So you're losing money without even talking about operating expenses."

Gerard Cassidy argues that a proposed 10% credit card rate cap would negatively impact bank profitability. Cassidy details that with funding costs and credit losses for riskier customers, banks would be operating at a loss, especially credit card lenders.

"The turnaround story that she has orchestrated has gone very well, and she should be congratulated for it, and the stock has reacted accordingly. Now they're going to be finished once Mexico's consumer banking business is spun off into an IPO sometime early this year. They're going to go from a turnaround story to a growth story."

Gerard Cassidy praises Jane Fraser's leadership at Citigroup, stating her turnaround efforts have been successful and reflected in the stock performance. Cassidy anticipates that after the Mexico consumer banking business IPO, Citi will transition from a turnaround narrative to a growth-focused strategy.

"Well, I think that if by normal we mean the old world, the sooner we smell the coffee, the better it is. The old world has gone. The question is whether the new world has to necessarily be one in which it is only the survival of the fittest, only the law of the jungle, or whether perhaps indeed there will inevitably and always has been and always will be an exercise of power, but that exercise of power can somehow be constrained by laws and rules and institutions."

Nathalie Tocci asserts that the "old world" order in international relations is over and a new paradigm is emerging. Tocci questions whether this new world will be solely based on power dynamics or if it can incorporate constraints through laws and institutions.

"Well, this is a really odd kind of situation here, because Europeans, starting with the Danes themselves and the Greenlanders, are more than happy to talk substance. So does the United States want a greater security presence in Greenland? No problem. Does the United States want greater access to Greenland's natural resources? No problem. But if it is not substance, if it is simply a question of territorial expansion, then that's kind of a conversation killer, right?"

Nathalie Tocci describes the situation regarding Greenland as unusual, noting that Europeans are open to discussing practical matters like security and resource access. Tocci points out that the conversation becomes difficult if the U.S. interest is perceived as territorial expansion rather than substantive cooperation.

"It certainly looks like that right now. Now, we certainly don't think that this is going to continue like this for the next quarter or half century as it did back then. So we're not poised for another period of absolutely exceptional growth like we had a century and a half ago. But certainly right now, I mean, looking back at the past nine months or so, it has been upside surprise after upside surprise."

David Seif observes that current economic conditions, characterized by GDP growth without significant employment increases, resemble a past era. However, Seif does not expect this trend of exceptional growth to persist for as long as it did historically, despite recent positive economic surprises.

Resources

External Resources

Books

- "Diplomacy" by Henry Kissinger - Referenced as a comprehensive work on diplomacy that was read cover-to-cover.

Articles & Papers

- "Europe has reflexively and consistently adopted a posture of submission" (Foreign Affairs) - Quoted to describe Europe's reaction to certain foreign policy visions.

People

- Gerard Cassidy - Head of US Bank Strategy for RBC Capital Markets, discussed in relation to bank industry analysis and Portland fires.

- Jane Fraser - CEO of Citigroup, discussed for her turnaround strategy and future growth challenges.

- John Stewart - Host of The Daily Show, discussed for his commentary on Fed Chair Jerome Powell.

- J.D. Vance - Senator, mentioned in relation to crunch talks about Greenland.

- Marco Rubio - Senator, mentioned in relation to crunch talks about Greenland.

- Natalie Tanchi - Professor of Practice at Johns Hopkins, discussed for her expertise on Europe and US foreign policy.

- Paul Sweeney - Co-host of Bloomberg Intelligence podcast, mentioned in relation to John Stewart's commentary.

- President Trump - Mentioned in relation to a proposed credit card rate cap and US control of Greenland.

- Robert Solow - Emeritus professor, mentioned as a notable figure in undergraduate economics education at MIT.

- Jerome Powell - Fed Chair, discussed regarding his recorded message and public appearances.

Organizations & Institutions

- Bloomberg Audio Studios - Producer of the Bloomberg Surveillance podcast.

- Bloomberg Intelligence - Source of deep dives into companies moving markets.

- Bloomberg Surveillance - Podcast discussed for its content and guests.

- Chase for Business - Sponsor offering guidance and digital tools for small businesses.

- Citigroup - Bank discussed for its turnaround story and future growth strategy.

- Federal Reserve - Institution whose data on loan growth is analyzed.

- Ford - Company mentioned for its partnership with Carhartt to attract mechanics.

- Johns Hopkins - University where Natalie Tanchi is a Professor of Practice.

- JPMorgan Chase Bank, N.A. - Bank mentioned as a sponsor and for its business services.

- MIT - University where David C. attended as an undergraduate.

- Nomura - Financial services company where David C. is Chief Economist for Developed Markets.

- Okta - Company discussed for its role in securing AI agent identities.

- Open to the Public Investing Inc. - Brokerage services provider.

- Public - Platform for building multi-asset portfolios, mentioned as a sponsor.

- RBC Capital Markets - Firm where Gerard Cassidy is Head of US Bank Strategy.

- The Daily Show - Program where John Stewart commented on Fed Chair Jerome Powell.

- The Wall Street Journal - Publication mentioned for an article on improving onboard behavior through appropriate dress.

Podcasts & Audio

- Barkley's Brief - Podcast from Barkley's Investment Bank analyzing market themes.

- Bloomberg Intelligence Podcast - Podcast featuring deep dives into companies.

- Bloomberg Surveillance Podcast - Podcast covering market news and analysis.

Other Resources

- Generated Assets - Feature on the Public platform allowing users to create investable indexes with AI.

- H8 Data - Federal Reserve data released on Fridays concerning loan growth.

- Total Factor Productivity - Economic metric discussed in relation to GDP growth and investment.