Federal Reserve Policy Divergence and Streaming Industry Consolidation

TL;DR

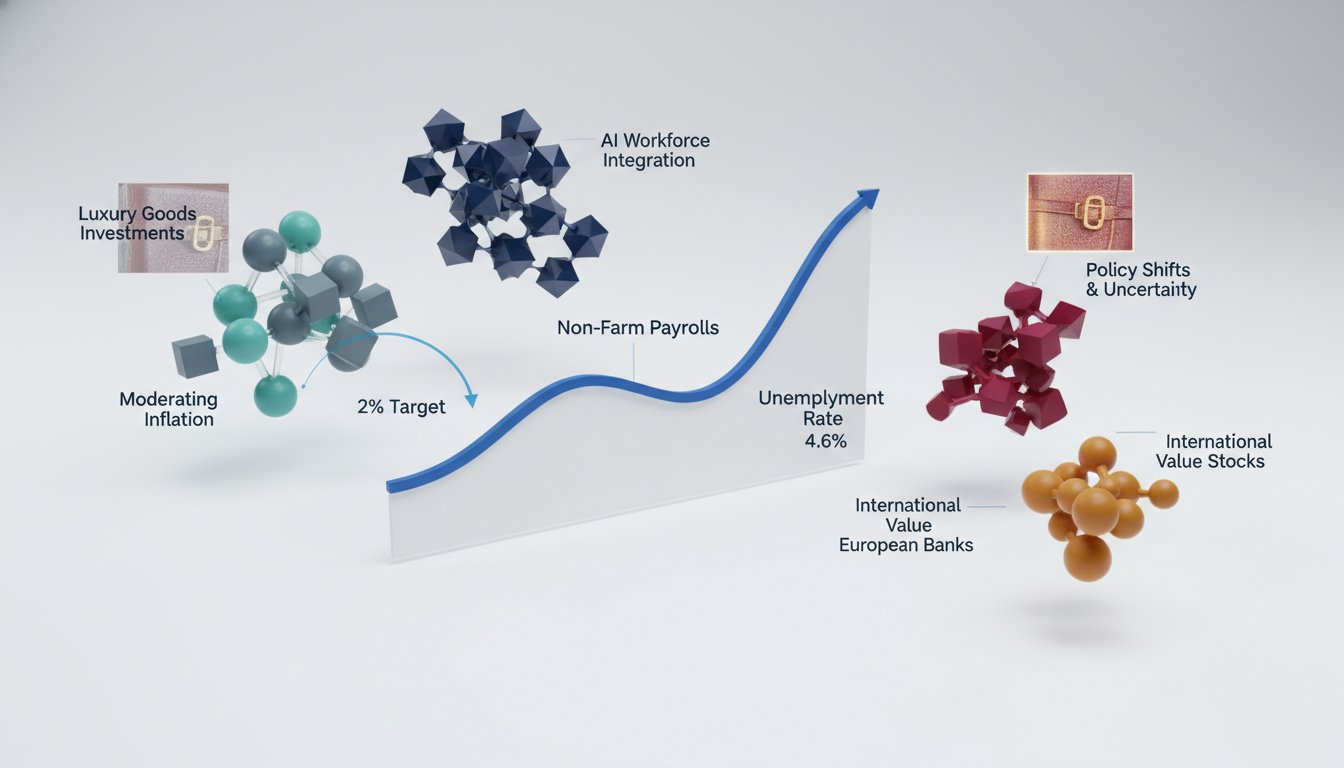

- The Federal Reserve's decision to cut interest rates despite 55 months of inflation above target and historically tight unemployment suggests a deviation from normalizing policy, prompting questions about the rationale behind such a move.

- The Employment Cost Index (ECI) indicates that while high wage and benefit gains post-COVID are decreasing, they have not yet returned to normal levels, potentially influencing future economic ideas.

- The streaming industry's subscale players like Paramount, Skydance, and Warner Bros. Discovery are natural partners for consolidation, aiming to achieve global scale and accelerate growth for platforms like Paramount+.

- Active ETFs offer a strategy to potentially outperform benchmarks, contrasting with passive ETFs that merely track them, suggesting a benefit for investors seeking stronger portfolio performance.

- For merchant acquiring businesses, buyer demand for virtual card payments presents a high-growth opportunity, addressable with Mastercard's adaptive B2B acceptance solutions to enhance infrastructure and deepen merchant relationships.

- Cisco Duo provides end-to-end phishing resistance through passwordless authentication and session theft protection, aiming to reduce costs associated with traditional multi-factor authentication solutions.

Deep Dive

Frances Donald of RBC Capital Markets argues that the Federal Reserve's decision to cut interest rates is counterintuitive given current economic data, which suggests a neutral or hawkish stance would be more appropriate. This disconnect implies a potential misinterpretation of economic signals or a deliberate policy choice to prioritize other objectives over immediate inflation control and labor market normalization. The second-order implication is that continued inflation or persistent labor market tightness could force a more aggressive policy response later, creating greater market volatility.

Robert Fishman of Moffett Nathanson identifies a strategic imperative for consolidation within the media industry, specifically highlighting Paramount, Skydance, and Warner Brothers Discovery as natural partners. These entities are described as "subscale" in streaming, meaning their individual efforts to achieve global reach and profitability in streaming are inefficient. The implication is that without mergers or acquisitions, these companies will struggle to compete effectively against larger players, leading to continued financial underperformance and a potential decline in content diversity and quality as they prioritize survival over innovation. This consolidation trend suggests a future media landscape dominated by fewer, larger entities, altering the competitive dynamics and potentially concentrating market power.

Action Items

- Audit inflation data: Analyze 55 months of above-target inflation and tight unemployment data to identify root causes for potential interest rate cuts (ref: Frances Donald, RBC Capital Markets).

- Measure wage and benefit trends: Track year-over-year Employment Cost Index (ECI) data to assess if gains are normalizing and their impact on economic policy.

- Evaluate streaming market consolidation: Analyze the subscale nature of Paramount, Skydance, and Warner Bros. Discovery in streaming to predict necessary combinations for scale.

- Compare active vs. passive ETFs: Assess the cost-benefit of active ETFs aiming to beat benchmarks versus passive ETFs that merely track them for portfolio strength.

Key Quotes

"if i woke up this morning and i'd been in a coma and all i had was the data i would think well this federal reserve must be neutral or hawkish heading into this period they are in an environment where inflation has been above target for 55 months the unemployment rate is extraordinarily tight in fact there's only two times in history going back to the 1970s when the unemployment rate has been this tight what happened to the concept of normalizing and growth is fine so what i want to hear from chair powell today is why are you cutting"

Frances Donald of RBC Capital Markets questions the Federal Reserve's rationale for considering interest rate cuts. Donald points to persistent inflation above the target and an exceptionally tight labor market as indicators that suggest a neutral or hawkish stance would be more appropriate. She expresses a desire to understand the reasoning behind potential rate reductions given these economic conditions.

"i really lean on this it's the employment cost index and it's a blended study of wages and benefits it's different than all the other wage series some people believe in it some people don't i look at the year over year the view from 60 000 feet and the answer is from the high wage and benefit gains that we saw out of covid we're coming down but we're not back down yet to normal you really wonder if wages and benefits get down how that would change some of the ideas like we just heard from ms donald"

Robert Fishman highlights the importance of the Employment Cost Index (ECI) as a key economic indicator. Fishman explains that the ECI, which tracks both wages and benefits, provides a comprehensive view of labor costs. He notes that while there has been a decrease from the high gains seen post-COVID, the ECI has not yet returned to normal levels, suggesting continued inflationary pressures.

"when you think about who the natural dance partners are it was comcast and it and it still is paramount skydance now after the skydance deal and warner brothers discovery that those three are the most natural players because they're all subscale in streaming so when thinking about how to solve that streaming scale issue from a global basis it's just natural to think that you need to see some combination of those players and so that's essentially what's playing out in front of us"

Robert Fishman identifies Comcast, Paramount/Skydance, and Warner Brothers Discovery as natural partners in the streaming industry. Fishman explains that these companies are all considered "subscale" in streaming, meaning they lack the necessary size to compete effectively on a global level. He suggests that a combination of these entities is a logical step to address the challenge of achieving sufficient scale in the streaming market.

"paramount skydance needs these assets in order to accelerate the timing to reach the scale that they're desiring on a global scale basis for paramount plus so yes we very much think that the combination with paramount skydance is a must have"

Robert Fishman asserts that a combination involving Paramount/Skydance is essential for achieving desired global scale for Paramount+. Fishman explains that Paramount+ requires these assets to expedite its growth trajectory and reach its target scale internationally. He concludes that such a combination is a necessary strategic move for the platform.

"the kind of phishing hacks do online is a lot like this kind of fishing they cast their lines bogus emails fake websites deceptive login screens hoping you'll take the bait with online phishing there's no calm no peace well until now with cisco duo fishing season is over duo goes beyond multi factor authentication delivering end to end phishing resistance built on passwordless authentication session theft protection and help desk verification all at half the cost of traditional solutions so when fishers cast their lines they come back with nothing at all that's why attackers hate us and users love us"

The speaker draws an analogy between online phishing and actual fishing to explain the concept. They describe phishing attacks as casting lines with deceptive tactics like fake emails and websites to trick users into providing information. Cisco Duo is presented as a solution that ends this "fishing season" by offering end-to-end phishing resistance through passwordless authentication and other security measures.

Resources

External Resources

Books

- "Single Best Idea" by Tom Keene - Mentioned as the title of a recurring segment featuring guests.

Articles & Papers

- "ECI (Employment Cost Index)" - Discussed as a blended study of wages and benefits used to assess economic trends.

People

- Frances Donald - Mentioned as a guest from RBC Capital Markets who provided analysis on interest rates and economic data.

- Robert Fishman - Mentioned as a guest from Moffett Nathanson who discussed the streaming industry and potential mergers.

- Tom Keene - Mentioned as the host of Bloomberg Surveillance Radio and the "Single Best Idea" segment.

Organizations & Institutions

- Bloomberg - Mentioned as the source of the podcast "Bloomberg Surveillance" and "Bloomberg Surveillance Radio."

- J.P. Morgan Asset Management - Mentioned as a global leader in active fixed income ETFs.

- J.P. Morgan Chase & Co. - Mentioned as the parent company for J.P. Morgan Asset Management.

- J.P. Morgan Distribution Services, Inc. - Mentioned as the issuer of a communication related to J.P. Morgan Asset Management.

- RBC Capital Markets - Mentioned as the affiliation of guest Frances Donald.

- Moffett Nathanson - Mentioned as the affiliation of guest Robert Fishman.

- Comcast - Mentioned as a potential partner in the streaming industry.

- Paramount - Mentioned in the context of streaming scale and potential mergers.

- Skydance - Mentioned in the context of potential mergers with Paramount.

- Warner Brothers Discovery - Mentioned as a natural player in the streaming industry.

- Federal Reserve - Mentioned in relation to an upcoming meeting and interest rate decisions.

- CVS Caremark - Mentioned for its prescription savings programs.

- CVS - Mentioned as a community pharmacy and retailer.

- Mint Mobile - Mentioned for its wireless phone plans.

- Cisco Duo - Mentioned as a provider of phishing-resistant authentication solutions.

Websites & Online Resources

- jpmorgan.com/getactive - Mentioned as a website to learn more about J.P. Morgan Asset Management's active ETFs.

- adobe.com/dothatwithacrobat - Mentioned as a website to learn more about Adobe Acrobat Studio.

- chase.com/business - Mentioned as a website for Chase for Business resources.

- omnystudio.com/listener - Mentioned for privacy information related to podcasts.

- public.com/market - Mentioned as a website to learn more about Public's investment platform and generated assets.

- mastercard.com/commercialacceptance - Mentioned as a website to discover Mastercard's solutions for B2B payments.

- cmk.co/stories - Mentioned as a website to learn how CVS Caremark helps members save on medication.

- mintmobile.com - Mentioned as a website to learn more about Mint Mobile's plans.

- duo.com/cisco - Mentioned as a website to learn more about Cisco Duo's phishing resistance solutions.

Podcasts & Audio

- Bloomberg Surveillance - Mentioned as the name of the podcast.

- Bloomberg Surveillance Radio - Mentioned as the radio program from which the "Single Best Idea" segment is derived.

- Health Discovered - Mentioned as a podcast that discusses Multiple Sclerosis (MS).

- iHeart - Mentioned as the network hosting the "Health Discovered" podcast.

Other Resources

- Passive Investing - Mentioned as a strategy that may be more costly than perceived.

- Active ETFs - Mentioned as an alternative to passive ETFs that aim to beat benchmarks.

- AI-powered PDF Spaces - Mentioned as a feature of the new Adobe Acrobat Studio.

- Generated Assets - Mentioned as a feature on Public that allows users to create investable indexes based on prompts.

- B2B Card Payment Landscape - Mentioned as an evolving area where buyers demand virtual card payments.

- Multiple Sclerosis (MS) - Mentioned as a medical condition discussed on the "Health Discovered" podcast.

- Online Phishing - Mentioned as a cybersecurity threat.

- Multi-Factor Authentication - Mentioned as a security measure that Cisco Duo goes beyond.

- Passwordless Authentication - Mentioned as a component of Cisco Duo's phishing resistance.

- Session Theft Protection - Mentioned as a component of Cisco Duo's phishing resistance.

- Help Desk Verification - Mentioned as a component of Cisco Duo's phishing resistance.