Tariffs Drive Hawkish Fed Policy Amid Assertive Geopolitics

The subtle, compounding impact of tariffs and shifting geopolitical priorities reveals a complex interplay between economic policy and global strategy, often masked by immediate concerns. This conversation unpacks how seemingly localized economic decisions, like tariff implementation, ripple outward to influence inflation and central bank policy, while simultaneously, a less visible but equally potent force is reshaping international relations, prioritizing regional preeminence over previous assumptions of restraint. Leaders and strategists who grasp these interconnected, long-term consequences will gain a critical advantage in navigating an increasingly unpredictable global landscape, moving beyond the surface-level noise to understand the deeper currents shaping our world.

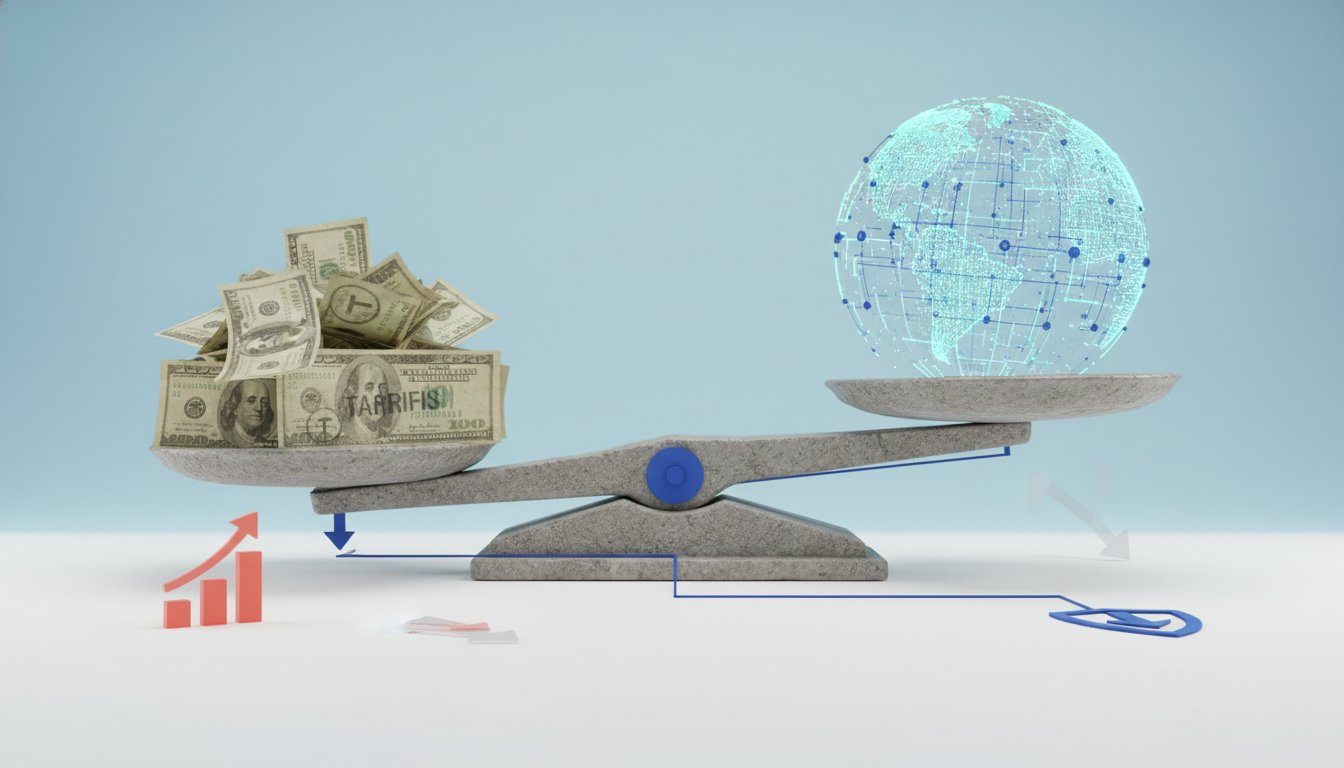

The Rolling Impact of Tariffs: More Than Just Sticker Shock

The common understanding of tariffs is a direct increase in the price of imported goods. However, the conversation with Lauren Goodwin of New York Life suggests a more nuanced, systemic effect: tariffs act as a catalyst for "rolling price impacts," a phenomenon that extends beyond immediate consumer costs to influence broader economic trends and central bank policy. This isn't a one-time price hike; it's a persistent pressure that can contribute to sustained inflation, compelling a more hawkish stance from monetary authorities.

The initial assumption might be that tariffs, like those discussed in relation to a specific email from Robert Sinshew, would have a clear and immediate effect. Yet, Goodwin's analysis points to a more gradual, yet significant, inflationary pressure that has been building over "a couple of years." This suggests that the economic system absorbs these costs in stages, leading to a persistent upward bias in prices. The implication is that the "disinflation" narrative, while appealing, might be overlooking these underlying tariff-driven price pressures. This creates a challenging environment for policymakers who are trying to balance inflation control with economic growth. The system, in this instance, doesn't just react; it adapts by incorporating these new costs, making the path to stable prices more arduous.

"We believe that yes, tariffs are likely to impact prices, actually likely a little more this year relative to last year. It's one of the reasons why we've come in a little hawkish relative to consensus on the Fed over the course of all of last year."

-- Lauren Goodwin

This perspective challenges the conventional wisdom that inflation is solely a function of demand-side pressures or supply chain disruptions. Instead, it highlights how deliberate policy choices, like imposing tariffs, can embed themselves into the economic fabric, creating a persistent inflationary tailwind. The "rolling price impacts" are not just a series of isolated events but a continuous adjustment of the economic system to new cost structures. This requires a longer-term view, recognizing that the delayed payoff of tariffs--in terms of economic adjustment--is also their hidden cost, potentially leading to prolonged periods of higher interest rates.

Geopolitical Reorientation: The Unforeseen Pivot to Regional Power

Leslie Vinjamuri's insights introduce a critical geopolitical dimension, revealing a significant shift in international relations that deviates sharply from initial expectations. The prevailing assumption about a particular leader might have been one of restraint or even neo-isolationism. However, the reality has unfolded as a drive for "preeminence in the Western Hemisphere," characterized by a willingness to push territorial borders and exert influence through threats and force. This represents a profound recalibration of global priorities, with significant downstream consequences for international stability and alliances.

The initial understanding of the geopolitical landscape might have been shaped by a focus on broad, global issues. However, Vinjamuri's analysis points to a more localized, yet intensely competitive, focus on regional dominance. This shift is not merely about rhetoric; it involves tangible actions like "pushing territorial borders" and "taking leaders out." The implication is that the international system is not static; it is actively being reshaped by actors pursuing specific, often aggressive, agendas. This dynamic creates a feedback loop where perceived weakness or a lack of clear regional strategy can invite further assertiveness from rivals.

"We thought this would be a president who might be, you know, neo-isolationist, who might be, you know, inclined towards restraint. That is just not what we're seeing right now."

-- Leslie Vinjamuri

This focus on regional preeminence is a strategic choice that requires significant investment and a willingness to engage in prolonged contests for influence. It diverges from a more globally interconnected approach, suggesting a fragmentation of international relations into spheres of influence. The delayed payoff for such a strategy lies in establishing a secure and dominant regional position, but the immediate cost is increased instability and the potential for conflict. Conventional wisdom, which might have predicted a more inward-looking stance, fails to account for this active pursuit of power projection within a defined geographic area. The Chicago Council on Global Affairs, as Vinjamuri represents, is positioned to analyze these shifts, offering a critical lens on how these regional power plays will reshape global dynamics.

Actionable Takeaways for Navigating Complexity

- Immediate Action: Re-evaluate the inflationary impact of existing tariffs. Consider how these "rolling price impacts" might necessitate a more hawkish outlook on monetary policy than currently priced in by consensus.

- Immediate Action: For businesses with significant import/export operations, model the cumulative effect of tariffs over the next 12-18 months, not just immediate cost increases.

- Longer-Term Investment (6-12 months): Develop scenario plans for increased geopolitical tension and regional power struggles, particularly in the Western Hemisphere, and assess their potential impact on supply chains and market access.

- Requires Discomfort Now for Advantage Later: Shift analytical focus from immediate economic indicators to the slower-moving, but more impactful, trends in geopolitical realignment and their long-term consequences.

- Longer-Term Investment (18-24 months): Build resilience in supply chains by exploring diversification strategies that account for potential regionalization of trade blocs driven by geopolitical shifts.

- Immediate Action: Engage with analysis that explicitly maps the downstream effects of policy decisions, rather than focusing solely on intended immediate outcomes.

- Requires Discomfort Now for Advantage Later: Prioritize understanding the "why" behind observed economic and geopolitical phenomena, rather than just reacting to surface-level events. This delayed understanding creates a durable competitive advantage.