US Energy Dominance, AI Demand, and Market Resilience Strategies

TL;DR

- Increased energy supply is crucial for US energy dominance, enabling allies to buy from friendly nations and counter adversaries funding wars, while also powering AI's intelligence generation demand.

- Cutting red tape and fostering innovation in the oil and gas industry, such as longer lateral drilling, reduces production costs, making drilling viable even at $60 WTI.

- Blocking natural gas pipelines into regions like New England, due to state policies, creates price disparities and hinders the ability to supply energy-intensive AI factories.

- Consumers are increasingly price-conscious, comparison shopping online and in-store, indicating a need for businesses and policymakers to acknowledge later-cycle consumer fatigue.

- A lack of US government fiscal discipline, across administrations, is a significant concern, potentially leading to higher bond yields and diminishing returns from credit assets.

- Rethinking portfolio construction beyond traditional 60/40 benchmarks is necessary, focusing on outcomes like growth, income, and uncorrelated returns to navigate market complexities.

- The market's low fear level may stem from expectations of continued Fed rate cuts and the intricate timing of potential Fed Chair appointments, influencing policy direction.

Deep Dive

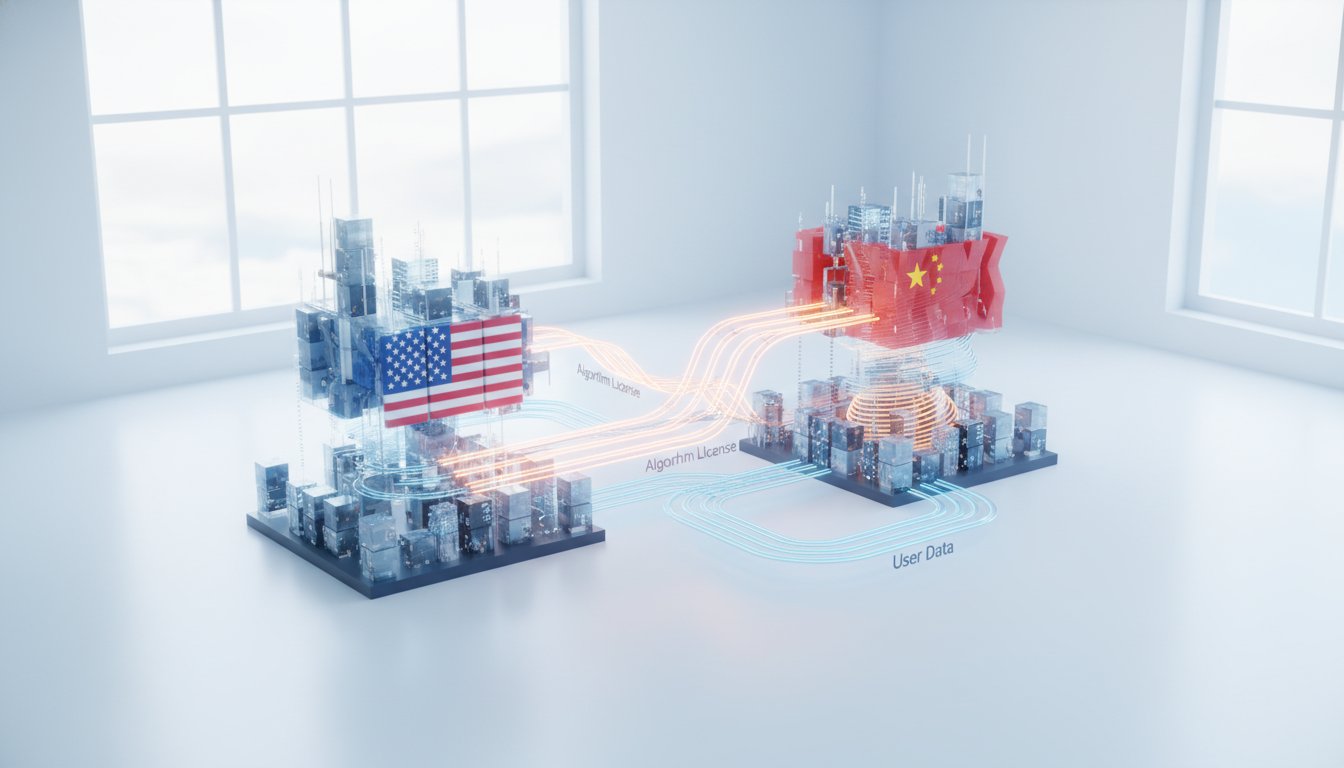

The US energy policy is undergoing a strategic shift towards "energy dominance," aiming to leverage domestic production to secure allies and counter adversaries. This policy is intrinsically linked to the burgeoning demand for artificial intelligence, which converts electricity into intelligence, creating an unprecedented and growing need for energy. While current oil prices are low, the administration believes that reducing regulatory burdens and fostering industry innovation, such as advanced shale drilling techniques, will enable companies to maintain profitability and increase production. However, this strategy faces challenges, particularly in natural gas markets, where infrastructure limitations and state-level policies impede supply, leading to higher domestic prices and complicating export capabilities.

The increasing demand for electricity driven by AI initiatives is creating localized price hikes, especially near data centers. The administration attributes these increases not to AI demand itself, but to state-level policies that favor intermittent and subsidized energy sources over reliable, cost-effective power generation. This policy divergence is expected to channel significant AI investment into states with pro-energy policies, potentially exacerbating economic disparities.

In financial markets, a cautious outlook prevails, with a preference for large-cap equities and gold over long-duration bonds. This strategy is driven by the belief that the Federal Reserve will not aggressively cut rates, and that small companies, which often rely on lower rates for sustained rallies and improved fundamentals, will struggle. The market's current optimism, particularly regarding a broadening rally beyond tech and communications sectors, is viewed with skepticism, as the economy is perceived to be later in its cycle. While deregulation is seen as a positive tailwind, particularly for banks, persistent trade policy uncertainties and the ongoing impact of higher prices on consumer costs suggest inflation may be more persistent than anticipated.

Investor sentiment remains largely unconcerned, partly due to expectations of further Fed rate cuts and the perceived political insulation of the Federal Reserve. However, questions linger about the potential influence of political loyalty on Fed policy, especially concerning inflation. While current PCE data suggests a moderation in inflation, the impact of potential government stimulus measures, such as direct payments, could complicate the Fed's efforts to manage price stability. The confluence of potential easing policies, consumer strain, and robust M&A activity raises concerns about market froth.

The current investment landscape deviates significantly from traditional portfolio allocations, with an emphasis on outcome-based strategies rather than static benchmarks like the 60/40 portfolio. This involves constructing portfolios that generate growth, income, and uncorrelated returns, with a strategic underweight in credit due to tight spreads and a preference for hedging equity exposure with gold amidst concerns about US fiscal discipline. The massive issuance in credit markets, driven by AI infrastructure and M&A, is prompting research into the capacity of the credit market to absorb this supply without significant increases in defaults or a decline in risk-adjusted returns compared to equities.

Action Items

- Audit energy infrastructure: Identify 3-5 critical points of failure in US energy supply chains that could impact AI development or consumer prices.

- Measure consumer spending impact: Track the correlation between proposed government stimulus (e.g., $2,000 checks) and inflation metrics for 3-5 key consumer goods categories.

- Analyze policy-driven price discrepancies: Quantify the difference in electricity costs between states with pro-energy policies and those with restrictive policies over a 12-month period.

- Evaluate credit market risk: Assess the impact of projected AI and M&A financing needs on corporate bond spreads for the top 10 issuing sectors.

- Develop portfolio resilience framework: Define 3-5 key factors for constructing outcome-based investment portfolios that balance growth, income, and uncorrelated returns.

Key Quotes

"The security plan mentions energy 23 times -- there's an entire section about energy dominance and folks should think about energy dominance as the ability for the US to sell energy to our friends and allies so they don't have to buy it from adversaries particularly those adversaries that are either funding terrorism or are funding, you know, wars, actively funding war machines."

US Secretary of the Interior Doug Burgum explains that energy dominance is a core component of the national security strategy. Burgum argues that by selling energy to allies, the US can reduce their reliance on adversarial nations that fund conflict. This strategy is presented as crucial for both global peace and US prosperity.

"We think that, you know, one of the early targets we had was cut 10% of the cost away from those producers just by cutting red tape. So if you think about, you know, $60 today might be what $67 was a year ago because of the, the, our ability to take cost out for those producers."

Secretary Burgum highlights the impact of deregulation on the energy sector. He suggests that reducing red tape has significantly lowered production costs for US oil and gas companies. Burgum posits that these cost savings make current lower oil prices more economically viable for producers compared to higher prices in the past.

"The key is it's supply and it's infrastructure. We have places in the US right now where, again, there's not one price for gas in America as you know. I mean, even though we've got the markets and we've got, you know, Henry Hub, but we've got, we've got widely ranging prices."

Secretary Burgum identifies supply and infrastructure as critical factors influencing natural gas prices. He points out that regional price disparities exist within the US due to insufficient pipeline infrastructure. Burgum suggests that this lack of infrastructure, rather than market forces alone, contributes to price volatility and accessibility issues.

"We are kind of later in the cycle. We are at a point where you can pick and choose whatever economic data you want to just to fit the narrative you want to tell about the overall macro and what policy might do to respond to that macro. And I think you have to be very anchored to fundamentals and where we have visibility into fundamentals."

Kate Moore, Chief Investment Officer at Citi Wealth, expresses a cautious outlook on the current market cycle. Moore advises investors to focus on company fundamentals and earnings visibility. She suggests that in a late-cycle environment, economic data can be selectively interpreted to support various narratives, making a grounded approach essential.

"I think the markets are betting on the fact that the Supreme Court will punt the decision to after, uh, February and therefore Lisa Cook will remain in place. Right? That's really critical because if you have, uh, a threshold of five or four governors, they can, uh, overrule the president's terms."

Constance Hunter, Chief Economist at Economist Intelligence, discusses market expectations regarding the Federal Reserve's composition. Hunter explains that markets are anticipating a specific outcome related to a Supreme Court decision and the tenure of Fed governors. She highlights the importance of the number of governors on the Federal Reserve board for maintaining its independence from political pressure.

"We're asking ourselves, you know, how much juice is there left in the credit market? We know spreads on the IG and the high yield side are close to the 15-year tights. There's it's great if you're a company that's issuing, it's not so great if you're looking for like a great total return from that asset class."

Kate Moore discusses the current state of the credit market, noting that investment-grade (IG) and high-yield (HY) spreads are near historic lows. Moore suggests that while this environment is favorable for companies issuing debt, it presents challenges for investors seeking significant total returns from credit assets. She indicates a need to re-evaluate the risk-adjusted returns available in this market.

Resources

External Resources

Books

- "The One Big Beautiful Bill Act" - Mentioned as a piece of legislation that could impact economic growth and inflation.

- "The Tcja" - Mentioned as legislation that Kevin Hassett was influential in crafting.

- "The Cares Act" - Mentioned as legislation that Kevin Hassett was influential in crafting.

Articles & Papers

- "National Security Plan" - Mentioned as a plan released by the White House that includes a section on energy dominance.

- "Work from before he joined the first Trump administration" (Kevin Hassett) - Mentioned as centering on the importance of keeping inflation low.

People

- Doug Burgam - US Secretary of the Interior, discussed in relation to increasing US energy supplies and energy dominance.

- Kate Moore - Chief Investment Officer at Citi Wealth, discussed in relation to market outlook, equity preferences, and inflation concerns.

- Constance Hunter - Chief Economist at Economist Intelligence, discussed in relation to market reactions to potential Fed appointments and inflation data.

- Lisa Abramowicz - Co-host of Bloomberg Surveillance, mentioned as asking questions to guests.

- Amaryllis Horter - Co-host of Bloomberg Surveillance, mentioned as asking questions to guests.

- Jonathan Ferro - Host of Bloomberg Surveillance, mentioned as introducing guests and topics.

- Kevin Hassett - Discussed in relation to his potential role at the Fed and his past work on inflation and tax policy.

- Donald Trump - Mentioned in relation to deregulation efforts and potential policy changes.

Organizations & Institutions

- J.P. Morgan Asset Management - Mentioned for their active fixed income ETFs and their brand name.

- Mastercard - Mentioned for their adaptive approach to B2B acceptance and solutions for merchant acquiring businesses.

- Public.com - Mentioned as an investing platform offering stocks, bonds, options, crypto, and a high yield cash account.

- JPMorgan Chase & Co. - Mentioned as the parent company of J.P. Morgan Asset Management.

- Finra - Mentioned as an affiliate of J.P. Morgan Distribution Services Inc.

- Sipc - Mentioned in relation to Public Investing Inc.

- Zero Hash - Mentioned as providing crypto trading services.

- Chase Sapphire Reserve for Business - Mentioned as a business credit card with premium benefits.

- JPMorgan Chase Bank, N.A. - Mentioned as the issuer of Chase cards.

- Adobe Acrobat Studio - Mentioned as a tool with AI-powered PDF features.

- Citi Wealth - Mentioned as the employer of Kate Moore.

- Economist Intelligence - Mentioned as the employer of Constance Hunter.

- The White House - Mentioned in relation to the National Security Plan and energy policy.

- The Fed (Federal Reserve) - Discussed extensively regarding potential policy changes, interest rates, and inflation.

- Supreme Court - Mentioned in relation to a potential decision impacting Fed appointments.

- EPA (Environmental Protection Agency) - Mentioned in relation to cutting red tape for oil producers.

- Department of Energy - Mentioned in relation to reducing costs for energy producers.

- Department of the Interior - Mentioned in relation to reducing costs for energy producers.

- Baker Hughes - Mentioned in relation to drilling reactivities.

- Netflix - Mentioned in relation to a potential tie-up with Warner Brothers and its use of cash.

- Warner Brothers - Mentioned in relation to a potential tie-up with Netflix.

- 4imprint - Mentioned as a provider of customizable promotional products.

- MyPolicyAdvocate - Mentioned as a platform that reads and explains insurance policies.

Websites & Online Resources

- omnystudio.com/listener - Mentioned for privacy information.

- jpmorgan.com/getactive - Mentioned for information on J.P. Morgan Asset Management's active fixed income ETFs.

- mastercard.com/commercialacceptance - Mentioned for information on Mastercard's B2B acceptance solutions.

- public.com/market - Mentioned for information on the Public investing platform and a bonus offer.

- public.com/disclosures - Mentioned for complete disclosures related to Public investing.

- chase.com/reservebusiness - Mentioned for learning more about the Chase Sapphire Reserve for Business card.

- adobe.com/dothatwithacrobat - Mentioned for learning more about Adobe Acrobat Studio.

- 4imprint.com - Mentioned for exploring gifting options.

- mypolicyadvocate.com - Mentioned for transparency on insurance policies.

Other Resources

- Fixed income ETFs - Mentioned as capturing only a portion of the US public bond market.

- B2B card payment landscape - Discussed as an evolving area for large corporations and merchant acquiring businesses.

- Virtual card payments - Mentioned as a demand from buyers for paying invoices.

- High value payments - Mentioned in the context of Mastercard's B2B solutions.

- Supplier lifecycle - Mentioned in relation to Mastercard's support.

- Multi-asset portfolio - Mentioned as something that can be put together on the Public investing platform.

- High yield cash account - Mentioned as an offering from Public.com.

- Brokerage services - Mentioned as offered by Public Investing Inc. for securities, options, and bonds.

- Crypto trading - Mentioned as provided by Zero Hash.

- Premium benefits - Mentioned in relation to the Chase Sapphire Reserve for Business card.

- Annual partnership credits - Mentioned as a benefit of the Chase Sapphire Reserve for Business card.

- Airport lounges - Mentioned as an access benefit for Chase Sapphire Reserve for Business cardholders.

- AI-powered PDF spaces - Mentioned as a feature of Adobe Acrobat Studio.

- Market research - Mentioned in the context of AI turning pages into insights.

- Sales proposal templates - Mentioned as a feature of Adobe Acrobat Studio.

- AI specialist - Mentioned in relation to tailoring the tone of market reports.

- Inflation - Discussed as a key economic factor influencing markets and policy.

- Rate cut expectations - Mentioned as a driver of market movements.

- Earnings - Discussed as a factor for company performance and investment strategy.

- Free cash - Mentioned as a factor for investment strategy.

- Economic data - Discussed in relation to interpreting market narratives.

- Fundamentals - Emphasized as a key anchor for investment decisions.

- Policy headwind - Mentioned as a potential challenge for companies.

- Tech and comms - Mentioned as sectors that have performed well.

- Deregulation - Discussed as a positive tailwind for parts of the market and economy.

- Trade policy uncertainty - Mentioned as a factor that has largely been resolved but with some remaining concerns.

- Tariffs - Discussed in relation to trade policy and their impact on prices.

- Consumer spending - Analyzed in relation to value consciousness and online shopping trends.

- Fiscal discipline - Discussed as a concern regarding US government spending.

- Bond yields - Mentioned in relation to inflation and fiscal discipline.

- Credit market - Discussed in relation to issuance, spreads, and potential fatigue.

- IG (Investment Grade) and High Yield spreads - Mentioned as being close to 15-year tights.

- Total return - Discussed as a consideration for asset allocation.

- Risk-adjusted basis - Mentioned in relation to evaluating returns from credit.

- Portfolio allocation - Discussed in the context of rethinking traditional models like 60/40.

- Outcomes-based portfolios - Mentioned as a new approach to portfolio construction.

- Growth, income, and uncorrelated returns - Mentioned as components of portfolio needs.

- Traditional asset classes and factor exposures - Mentioned as fitting into portfolio construction.

- Energy supplies - Discussed as crucial for meeting demand, particularly from AI.

- Energy dominance - Defined as the ability for the US to sell energy to allies.

- Adversaries - Mentioned in the context of energy sales to avoid reliance on certain countries.

- Kilowatt of electricity into intelligence - A concept related to the demand for AI.

- Oil producer - Mentioned in relation to the US being the largest in the world.

- LNG exporter - Mentioned in relation to the US being the largest in the world.

- Drilling wells - Discussed in the context of oil and gas company operations and pricing.

- Red tape - Mentioned as something the Trump administration aimed to cut to reduce producer costs.

- Productivity - Discussed in relation to the energy industry's gains.

- Shale revolution - Attributed to innovation in the energy industry.

- Well pad - Mentioned in relation to land management and energy production.

- Drilling reactivities - Mentioned in relation to changes since the Trump administration.

- Well count - Discussed in relation to drilling activity.

- Miles of lateral productive rock - Mentioned as an indicator of increased production.

- Natural gas - Discussed in relation to price increases and export capacity.

- Natural gas pipelines - Mentioned as a factor in regional price differences.

- AI factories - A metaphor for places where intelligence is created and manufactured.

- Electricity prices - Discussed as a factor in where AI plants might be located.

- Pro-energy policies - Mentioned as a driver of lower prices.

- Data centers - Discussed in relation to energy costs and demand.

- Off the grid / behind the meter - Mentioned in relation to how some AI data centers operate.

- Unreliable, intermittent, and highly subsidized projects - Described as policies from the last five years.

- Offshore wind - Mentioned as an example of a project with high cost for intermittent power.

- Assured 7 by 24 hour power - Contrasted with intermittent energy sources.

- Climate extremists - Mentioned in relation to policy choices driving up prices.

- Nord for bales report - Mentioned as a delayed economic data report.

- September PCE report - Mentioned as an upcoming inflation data report.

- Headline PCE - Mentioned as a component of the PCE report.

- Core PCE - Mentioned as a component of the PCE report.

- Wage and income data - Mentioned as a signal in the PCE report regarding the labor market.

- Wage data - Discussed in relation to softness and labor market strength.

- Tcja - Mentioned as legislation crafted by Kevin Hassett.

- Care Act - Mentioned as legislation influenced by Kevin Hassett.

- Board members and presidents - Mentioned in relation to the Fed's voting structure.

- Policy direction - Discussed as something Kevin Hassett would need to convince others on.

- Framework - Mentioned in relation to policy thinking.

- **One big beautiful bill act